The music is stopping in Europe

Italy's banks are teetering.

Shares in Italy’s third-largest lender, Banca Monte dei Paschi di Siena, are down about 75 percent this year and trading at one-tenth of book value. A ban on short-selling the bank’s stock was imposed on Wednesday. Monte dei Paschi is only one of a group of Italian banks beset with 360 billion euros ($398 billion) of nonperforming loans; that’s some 20 percent of Italy's gross domestic product.

The Italian government has already engaged in modest bank bailouts, but that has failed to stem the crisis.

Now there are concerns of contagion.

Italy’s banking crisis could spread to the rest of Europe, and rules limiting state aid to lenders should be reconsidered to prevent greater upheaval, Societe Generale SA Chairman Lorenzo Bini Smaghi said.

“The whole banking market is under pressure,” the former European Central Bank executive board member said in an interview with Bloomberg Television on Wednesday. “We adopted rules on public money; these rules must be assessed in a market that has a potential crisis to decide whether some suspension needs to be applied.”

You might think that Italy would be humbled and begging for help. You might think that Europe would be developing a plan to contain the crisis.

You might even think that the center of this crisis was in Italy.

You would be wrong with all three assumptions.

For starters, check out what Italian Prime Minister Matteo Renzi had to say.

The difficulties facing Italian banks over their bad loans are miniscule by comparison with the problems some European banks face over their derivatives, Italian Prime Minister Matteo Renzi said on Wednesday....

"If this non-performing loan problem is worth one, the question of derivatives at other banks, at big banks, is worth one hundred. This is the ratio: one to one hundred," Renzi said.

What is Renzi talking about? Specifically he was referring to Germany's largest bank (and Europe's largest derivative bank) - Deutsche Bank.

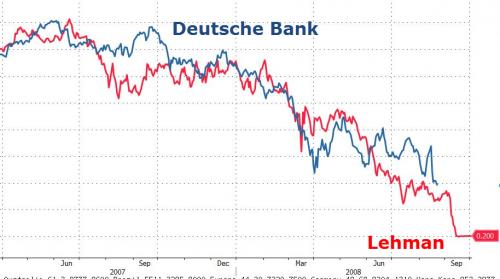

Deutsche Bank – “the most important net contributor to systemic risks,” as the IMF put it last week after a lag of several years – is having a rough time. Shares dropped 4.2% today to close at a new three-decade low of €11.63, down 48% since July 31 last year, lower even than the low during the doom-and-gloom days of the euro debt crisis and the Global Financial Crisis.

It’s not the only European bank in trouble. Credit Suisse dropped 1.7% today to CHF 9.92, another multi-decade low, down 63% since July 31. Other European banks are getting mauled too. The European Stoxx 600 banking index dropped 3% today to 117.69, approaching the Financial Crisis low of March 2009.

The swelling banking crisis in Europe has caused 7 commercial real estate funds in London to lock out clients.

If you thought Europe's politicians were going to save the day, think again.

The day after polls showing the anti-Euro party, Five Star Movement, surging into the lead in Italian polls, the EU Commission decided to enforce austerity on southern Europe.

“A government collapse is more than just a possibility, it is a scenario that we are looking at very closely,” said Federico Santi, an analyst at the Eurasia Group consultancy. “The trend has been clearly bad for the ruling party and favourable to the Five Star Movement, driven by issues — like migration, the banking troubles and corruption scandals — that are not going to go away. It’s hard to see what it could take for Renzi and the PD to make a comeback at this point.”

Italy will have a constitutional referendum in October. The failure of which would probably trigger an election, which could bring Five Star into power. By this time next year, Europe's fourth-largest economy could be leaving the Euro.

The music is stopping in Europe. It's time to grab a chair.

Comments

Countries need to be able to

Countries need to be able to manage themselves according to the public interest, not be run as trading blocs intended to make extra-huge fortunes for the relative few. Seems that whenever financial self-interests run everything, it all crashes and burns, doesn't it?

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Nah.

This is capitalism y'know. "Accumulate, accumulate! This is Moses and the prophets." -Karl Marx

"You exclude the poor, not necessarily by disenfranchising them, but by giving them nothing to vote for. By giving them two candidates who are both members of the oligarchy." -- Michael Parenti

Not to worry.

After all, american currency carries "In god we trust".

Funny that all religions are tax exempt here.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Brexit knock on effect.

The European banks are so fragile that any systemic shock is likely to have an outsized effect.

Bloomberg estimates Brexit cost the banks $165 billion.

In normal times that is survivable, but these are not normal times. In our ridiculously leveraged system a loss of that magnitude is compounded at least 20x, and with the weakest banks already on Central Bank life support, a hit like that is bound to be fatal to at least some of them.

Then of course there is the potential for a cascade of bank defaults that takes down the whole rotten financial system.

The next phase is just beginning.

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

unavoidable at this point, yes?

Don't you think the forces already set in motion cannot be stopped--that a collapse that makes tulip mania look like a hiccup is inevitable globally? The Ponzi scheme of creatively bundled debt behind the bank bailouts has grown by orders of magnitude to swamp the world's GDP. The question marks seem to be when the collapse will be widely recognized and what will arise to replace current economic and government systems. These are precisely the unstable times in which authoritarian forms and figures win or seize power.

"It is no measure of health to be well adjusted to a profoundly sick society." --Jiddu Krishnamurti

Yes.

Don't forget that bad loans are just the tip of the iceberg for the banks. There are over 100x that amount floating around in derivatives bets based on those loans.

The financial system is a Jenga puzzle with not many pieces left to pull before it all tumbles down.

Just a matter of when.

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

Notional value of CDS in 2015 was 15 trillion

http://www.bis.org/publ/otc_hy1511.pdf

This source places the notional value of the worlds derivatives markets 1200 trillion.

http://www.investopedia.com/ask/answers/052715/how-big-derivatives-marke...

FDR 9-23-33, "If we cannot do this one way, we will do it another way. But do it we will.

At a certain point...

the numbers get too big to matter.

It's like counting nuclear weapons. Long before all the missiles are fired, everything gets wiped out. After that, anything more is merely redundant.

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

your link to bis.org

.... is useful in many ways. The document's Glossary is helpful at any time derivatives are being discussed.

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

hmmmm

Is this a moment of clarity or a sign of my ignorance? It suddenly occurred to me a possible reason the ECB, German, and French banks haven't been willing to be reasonable in dealing with the financial crises in Greece, Italy, Cypress, and Spain is because they are insolvent themselves and have to continue running the scam or it all collapses. A ponzi scheme only crashes when you don't have the cash to keep paying the suckers or the suckers catch on and pull their assets. I don't know if this is an alternative idea or part of the larger scam but are they hoovering up as many liquid assets and real property as possible in an anticipation of a collapse. The only way to survive a financial system crash is to have real assets and hard currency to take advantage of the chaos. It seems to me the banksters know they're fucked and are looking for a way to remain on top and not simply survive. Any thoughts?

"Ah, but I was so much older then, I'm younger than that now..."

Ponzi scheme is right.

Analysis spot on. Fucking corporatist house of cards comes crashing down. Brett pulled one of the supporting props out of the scam. Down. One slight missing factor is the Eurozone financial regulations require investors, shareholders and other stakeholders to absorb most of the blow before government bailouts will be triggered. Fuck them all. Obama, you smart A, you tried to prop up the Euro by railing against Brexit. See how they disrespected you? Thank you, Barack--now go home and stop meddling in our politics. Okay, so let's see what happens to the American house of cards--and I don't mean the TV series. Bernie Sanders was the wake up call--but you're still not listening. WTF will it take you to get out of your elitist bubble? Keep pushing Clinton and see much more disrespect you garner. BTW, I would advise you, Mr. Prez, consult Marvel Comics when you seek to get your "Library" built. Your "legacy" will be the destruction of the American economy--a truly bipartisan effort initiated by Saint Ronnie, ably assisted by Slick Willie. Bitter, am I? Bitter are you 99ers? Bernie or Bust because Fuck This Shit.

It suddenly occurred to me a

(My knowledge of EU economics is limited so take this accordingly, but ... )

My understanding is that insolvency is probably still a major concern for European Banks (at least on a whole): so yes they need to keep the "scam" going in that defaults could take the entire system down like dominoes.

BUT I don't think that is the sole cause of the problem: the Eurozone has structural problems (ex. a single monetary policy) that make it harder for "weaker" members to recover because they can't do what's in their own best interest if it's in conflict with more powerful members. In the US the big banks only did what was "reasonable" because they were basically forced to by the government and the Fed. The EU and the ECB can't (or won't) exert that sort of pressure for the sake of weaker member states. (TL;DR: if it's not good for Germany then you're SOL).

Since the global monetary system is interwoven,

all of that has to mean bad news for US economy. But I don't understand it well enough to guess about what might happen.

Life is strong. I'm weak, but Life is strong.

Former Greek Finance, Yanis Varoufakis . . .

had a good discussion with Noam Chomsky a couple months ago about structural and political defects with the EU. It doesn't directly deal with the issue of Italy Banks, but the broader context is helpful for understanding why these problems continue to persist and are likely to be unresolved anytime soon.

https://www.youtube.com/watch?v=szIGZVrSAyc

Zero Hedge says that Germany's banks are in trouble

because of shipping loans.

http://www.zerohedge.com/news/2016-07-07/europes-bank-crisis-arrives-ger...

The recipients of shipping loans are having trouble paying back the capital funding to the banks because of world-wide decline in trade.

A Marxist would say that such a decline is inevitable in a world where the elite vacuum up all the profits and the rest of the world, the paying customers, cannot buy the offered goods. You have to have customers that can pay for your products or services and if too many people are increasingly poor, they will have less and less ability to buy stuff.

In other words, the crisis is the natural result of increasing income inequality throughout the world.

The actual problems may be more complex than this explanation, but that doesn't mean that this view is incorrect as far as it goes.

Life is strong. I'm weak, but Life is strong.

Predators will naturally overfeed

until prey becomes so scarce or well-adapted, that the predators' population crashes.

Seems to me it is very much like that jenga

analogy in The Big Short, but they were only talking about the stupidity of the banks in that scene. By taking out the bottom due to unemployment/underemployment and low wages, they've chipped away at the foundation, and the only thing left is the ultimate collapse of the "top tiers" or in essence, the entire corrupt system.

This whole thing smacks of Ponzi to me too - keeping interest rates too low to juice the returns on Capital artificially when only true Demand would have any real effect at all. It will collapse alright. They've been staving off that collapse for a while now, but it'll happen.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

Ciao Italia, ci vediamo

But Renzi is fighting back;

A Furious Italian Prime Minister Slams Deutsche Bank As Europe's Most Insolvent Bank

The political revolution continues

Check out The Wolf of Wall Street

http://wolfstreet.com/2016/07/04/investor-fears-spike-italy-europe-inch-...

And July 6th

http://wolfstreet.com/2016/07/06/deutsche-bank-crisis-coco-bonds-shares-...

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

Actually, this is kind of serious...

I think I have this right, and am willing to be corrected. The Germans more or less "run" the EU, and their insistence on following "rules" in general, coupled with the dopey EU deficit-limit rules (I think the target is always 2% GDP) limits the Italians from creating a "bad bank" and putting Monte dei Paschi's non-performing loans into it. Italy would go over their debt limit. Such a move would make Monte dei Paschi "whole", stockholders (whose shares are now worth little would be wiped out, a new Board would be set, and the new "good bank" is sold. Meanwhile, the government capitalizes and "unwinds" the "bad bank". That's what would happen in the US, most likely, but EU laws forbid it, except in extremely dire cases, which this is, but nobody in the EU will admit that their "bail-in" law is idiotic. The Bail-in Law, which I think they did in Cyprus, is that DEPOSITORS in the bank give up their money to pay bond-holders...in return, they get "stock" in their bank, and how they price that I do not know. It's crazy.

There are a bunch of issues with the EU governance, but the economic problem is the lack of the ability of nations in Europe to manage their own economies, because they all use the EURO. The problem is a Greek EURO and an Italian EURO versus a German EURO is that, they have the same value, but shouldn't. Countries have given up currency sovereignty, so that can't "devalue" their EURO against other countries. That's a fundamental role of nation-states, which was given up in the currency "Union". That could be OK, if there was a European version of a "Central Bank" that lent freely, with penalty interest rates, in times of crisis--but Europe doesn't have that. They have the Germans in charge, and Germans think that austerity for everybody who owes money to bond-holders is the way to go. As the biggest exporter, everybody owes Germany money, but Germany can't be a net exporter without extending credit. And Germany doesn't. And they won't even look at Deutche Bank's

Modern Monetary Theory says that countries that print their own currencies cannot go broke, but yes, they can indeed make really bad inflation. Interest rates are now floating around zero...negative rates in some places, so inflation fears should be nominal. More important, if the EU is busting up. Brexit happened. Austria is re-doing it's election and the EU separatist party almost won, and might win in a re-election. Italy's separatist Five Star Party will (depending on this banking situation) win if Renzi can't fix the problem. Marie le Pen in France will likely improve her position in the next election, given France's immigration situation. Etc. It's a mess.

The issues to my mind are these: It takes 5-8 years to convert a currency. That's what it took everybody to get their ATM's and banking hardware and software to convert to the EURO. It would take the same amount of time, perhaps more, to change back to sovereign currencies. The easier solution, to my mind, is 1) to create a European version of the Treasury/Federal Reserve as a proper "lender of last resort"; 2) Relax the debt restrictions on European nations, to allow for more deficit spending as a Keynsian response to the situations in each country; 3) Find some kind of mechanism [I'm waving my hands here, because I have no idea what it would be] to somehow allow the value of the Euro to "float", based on source of origin--and the obvious answer is this won't work...the Euro didn't work...a floating currency for 8-10 years so Italy has Liras and Greece has Drachmas, and no matter what card you put into the ATM, the exchange rate works right.

Sorry for the long rant, but the Deutchebank derivative-contagion thing puts me to mind of 2008. It's why the Italians are worried. The financial Masters really don't know when a fuse is getting lit, until it's WAY too late to put it out.

"Guess Who" gets to pay the price!

-- Grateful Dead, "Throwing Stones" (Weir/Barlow)

see also my last comment

edited to correct lyrics

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Rant well expressed and quite fitting

The Wall Street geniuses did not foresee the dot.bomb bust in 2000. They did not perceived the Real Estate default crash in 2008. Maybe the only things these guys will understand is the repossession of their yachts and Bugattis plus an all-expense paid vacation in the Graybar Hotel.

Prep for bail-ins on Greek model already quietly enacted here

Following the Greek model, the US has already put in place the system for a bail-in. Under new law, depositors in US banks are now unsecured creditors of those banks. Once you put your money in a US bank, it’s no longer yours—it literally and legally belongs to the bank. So the next bailing of banks will be a direct one, via deposits and depositors. This change indicates that a “next one” is expected, and we’ve been set up to be robbed for it. (Thus far, I believe, this change does not apply to credit unions; if anyone knows otherwise, please correct me here.)

http://allnewspipeline.com/Surprise_Surprise_Did_You_Know.php

http://www.huffingtonpost.com/ellen-brown/banks-confiscation_b_2957937.html

https://ellenbrown.com/2014/12/01/new-rules-cyprus-style-bail-ins-to-hit...

"It is no measure of health to be well adjusted to a profoundly sick society." --Jiddu Krishnamurti

I don't think this is accurate.

In the U.S. both retail banks and credit unions have similar mechanisms for insuring depositor accounts, so I'm not really clear why one would be protected and the other wouldn't. Not all accounts are federally insured, but if the bank is listed as FDIC-insured and/or insured by the NCUISF (the Credit Union's equivalent), depositors are protected up to $250,000. Depositors may also have other forms of insurance outside of the federally guaranteed programs for money in excess of the limit.

In theory, if someone had money in excess of $250,000 in an FDIC insured account, and no other insurance, and the Bank failed, the money could be at risk. The depositor would have have access to funds up to $250,000, but may have to wait on excess funds until after the Bank's assets are liquidated.

A lot of what they are talking about sounds more like investment Banks and uninsured accounts.

Please note

that small business accounts and trading as accounts are not protected by FDIC insurance.

"I can't understand why people are frightened of new ideas. I'm frightened of the old ones."

John Cage

business bank accounts

Not entirely true. All "deposit product" accounts in FDIC-insured banks are covered to the same limit of $250,000. The limit applies "per person or entity, per ownership class, per bank".

The reason you may have the impression that business accounts aren't covered is that times have changed since the early 1930s, and an amount of insured funds which was pretty damn vast even to most businesses back then is relatively insignificant to business accounts today. A serious incorporated small business is expected to pass several million dollars through its bank accounts every year in this day and age; $250,000 is only a small fraction of that.

FDIC Deposit Insurance At A Glance

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

FDIC insurance isn't the issue for credit unions

Credit unions are run as a form of cooperative business, and depositors are members. US law hasn't sweepingly changed that status from members to unsecured depositors, if I understand correctly.

Overall, credit unions don't have the level of exposure on CDOs. Their lending and investment practices don't pose the risks of the TBTF banks--they didn't gamble on a jaw-dropping scale and manage to privatize their profits and socialize their massive losses (and aren't still doing that).

Of course, due diligence is always advised. It's also helpful to understand that in times like these, non-material assets can become worthless overnight, as history has shown time and again. Now they're just digital pulses in a vast network that can be shut off with the flick of an electronic switch controlling ATMs and credit card systems.

"It is no measure of health to be well adjusted to a profoundly sick society." --Jiddu Krishnamurti

Correct, 2andfro.

I am a credit union member - the operative word being member. They have their own Federal insurance - NCUA - which insures deposits to $250,000. I don't belong to a bank - don't trust them. I suppose things could go south with a credit union, too. Anything is possible in this ever changing world!

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

credit unions

In practice, Glass-Steagall is still on the books for credit unions. And -- for the exact reasons you describe -- they like it that way, as that encourages credit union use.

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Part of the issue is also a lack of fiscal integration . . .

e.g. as has been pointed out elsewhere, the economic crisis in Spain was on par with the Savings & Loan crisis in the U.S. in the 1980s. However, because of fiscal integration and labor mobility, Texas didn't go into a massive economic depression. The state experienced a 2 percent spike in unemployment, and experienced a complete recovery within 4 years.

http://krugman.blogs.nytimes.com/2012/06/17/what-a-real-external-bank-ba...

Germany refuses to promote a higher inflation target in the core and it refuses to run the kind of budget deficits that would support and cushion the losses in the periphery of the EU. Part of the problem may be due to the fact that bureaucrats see this as a chance to rewrite the social contract in several nations -- destroy pension systems and other social safety nets in domestic economies in a way that wouldn't be possible otherwise politically. Of course, the net result is a risk of a complete economic and political meltdown and a return back to the situation that the EU was designed to prevent.

ashes, ashes.....

".... for it's all too clear we're on our own ....."

[video:https://youtu.be/WninWFtO0Gg width:480 height:360]

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Simple Solution

Stop tying out economies to the health of private banks and claw back all inappropriate profits to make these loans healthy

YES, REDISTRIBUTE THE WELTH FROM THE TOP TO THE BOTTOM, TRICKLE UP

All this should spark

the return of Postal Banking and the Mattress Savings and Loan.

"I can't understand why people are frightened of new ideas. I'm frightened of the old ones."

John Cage

Just a side note.

An article on The Kyifvpost (http://www.kyivpost.com/) that due to the rapcious theft of Ukrainian oligarchs, there are something like only 20 functioning banks in the country.