Trump's Golden Era Of Stupid

Submitted by gjohnsit on Thu, 04/10/2025 - 2:22pm

Today was a bad day on Wall Street.

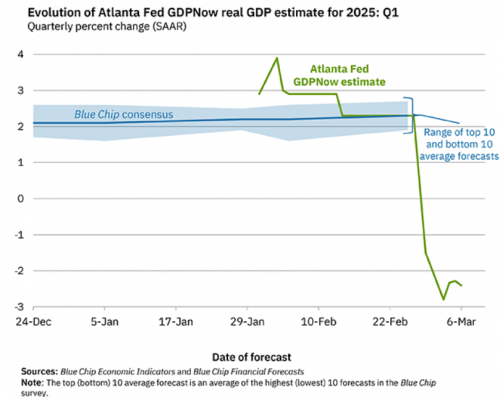

Another news filled week. The European Chihuahuas came to seek the favor of their master. One snaps at the hand that feeds him, and all four leave with their tail between their legs. EU style democracy doesn't look so good. Calin Georgescu, the populist frontrunner in Romania's annulled 2024 presidential election, was arrested while en route to register his candidacy for the upcoming May election. Perhaps Trump will finally stop all shipments of weapons and money to Ukraine. Sadly that isn't the case with Israel which is now occupying parts of Lebanon and Syria as they continue their expansion in the West Bank. US hypocrisy is on display, J. D. Vance criticizes the EU for their suppression of speech as the DOJ and FBI target pro-Palestine speech. The economy is probably in a recession which looks to deepen. Those stories and more below the fold.

So here's a theory: they're doing this, raising interest rates and such, because they want to plow all of that money they were gifted from Congress into real estate, and the real estate prices are too high at this time:

The stock market just had its best month is almost two years. Now we all know that the stock market hasn't reflected the real economy for many years, but what's going on now is nothing short of "bad news is good news".

A couple of articles showed up in this morning's headlines regarding the government's efforts

to downplay recession fears. Because politics.

A traditional definition of economic recession:

Two straight quarters of economic contraction is typically viewed as a recession.

The GDP report is scheduled for release on Thursday and, following first-quarter contraction at an annual rate of 1.6%, the latest data may confirm that the economy is shrinking.

Just a few months ago it appeared that COVID and vaccine mandates were going to be the biggest issues for the November 2022 elections.

It now appears that this perspective will seem quaint.

Just how bad will it get?

Symbolically, this is a good indication.

Since the 2008 crash the economy has been propped up with artificially ultra-low interest rates.

There is no doubt that the economy is slowing.

The leading economic index fell in December, marking the fourth decline in five months.