What happens when the banks own everything?

What happens when the banks literally own everything?

No, I'm not asking this as a theoretical exercise. Nor am I being excessively pessimistic.

I'm speaking of a scenario that will happen if current trends continues.

The chart above shows how just three central banks printed money out of thin air to buy nearly $14 Trillion in financial assets.

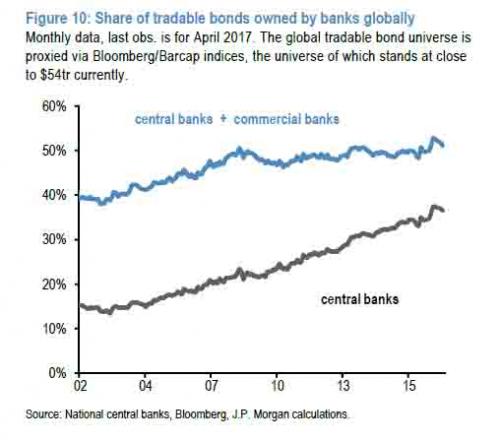

Globally, central banks own roughly $18 Trillion in bonds - over 1/3rd of all the bonds on the planet.

When you include private banks, banks own half of the global bond market.

Leading the charge is the Bank of Japan.

The bank's total assets stood at 498.15 trillion yen as of May 20. By the time the month ended Wednesday, its holdings of Japanese government bonds had increased by another 2.24 trillion yen. Assuming that the BOJ had not significantly reduced its non-JGB assets, its balance sheet almost certainly crossed over the 500 trillion yen mark into uncharted territory.

At around 93%, the scale of the Japanese central bank's assets in proportion to GDP has no close match.

Central banks have always been market movers, but now they own the markets.

Don't think for a second that all this money printing/asset buying is limited to just bonds.

The Bank of Japan has stepped up purchases of exchange-traded funds as part of its monetary easing policy, with the balance surging to 15.93 trillion yen ($144 billion) as of March 31.

Don't think for a second that all this money printing/asset buying doesn't slosh over borders.

According to its last filing with the Securities and Exchange Commission, the Swiss National Bank owned more than $63 billion worth of stock — most of it in US companies...

The latest filing included more than 15 million shares of Apple, 13 million Intel, 25 million General Electric, 6.6 million Facebook, 10 million Ford, 13 million Intel and on and on and…

In fact, a printed list of all the stocks is 66 pages long.

There is no telling how much stocks central banks own.

For years now central banks have been warning that they would start selling their portfolio. Not only does that day keep getting pushed back, but when you own everything who are you going to sell too?

It doesn't take a genius to know that the group that owns everything will call the shots.

It also doesn't take a genius to know that when the next financial crisis hits, the politicians will obediently bail out the bankers again, even if it means they will leave nothing left for the 99% but debt and poverty.

The next financial crisis will mark a global crisis for democracy, and won't be settled without violence.

Comments

The ultimate foreclosure.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

When the banks own everything,

it will be game over for the rest of us.

We come from dust. We will return to dust.

That's why I don't dust. It my be someone I know.

Naw, If they own everything

they actually own nothing, and that would become immediately obvious.

"Obama promised transparency, but Assange is the one who brought it."

I'm hoping to pay off my house.

Barring that, I own 17 acres I can pitch a tent on. Raggedy Andy assures me we would have ample time to dismantle the house and re-mantle it across the fence. We'll see. We can at least to that with the metal out-buildings.

edited for infernal typos!

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

@Raggedy Ann until the ad valorum tax

until the ad valorum tax bill comes.

It is my property tax bill I cannot pay if I stop working.

I simply must work until I die.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

Oh, I'm so sorry, otc.

Our taxes are cheap. I'm in New Mexico. I pay less than $1,200/yr for a house and 21 acres. We're lucky in an unlucky sort of way.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

i'm paying

$14,500 for a 1br condo and a parking space.

On to Biden since 1973

YIKES!

Now I understand why we are such a poor state.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Yikes!

I meant $1450. Though if my condo were reappraised it would go up to over #6000 (count the 0s… got it right this time.)

On to Biden since 1973

In parts of Michigan

property taxes are 6% and higher, it's essentially like paying rent to the state.

"Obama promised transparency, but Assange is the one who brought it."

In NY two tax bills, one for schools and one for county + town

Also 21 acres, $6K/year combined. And going up yearly. For comparison.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

I'm in Washington state

.

Paying $3100 for a 3 bdr. tract home in suburbia. They will take our properties through excessive taxes.

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

There's a reason Alabama is dumb

If we doubled our property tax it would still be the lowest in the nation. We pay $500/year for 120 acres with house, barn, etc. The timber companies own our state and run the legislature - they pay $0.50/acre/year.

As to Azazello's comment - they already have negative interest rates in some European banks....that is you have to pay them to hold your money. Seems it would be time for a new mattress.

“Until justice rolls down like water and righteousness like a mighty stream.”

We burn everything down

And eat the rich.

" In the beginning, the universe was created. This has made a lot of people very angry, and is generally considered to have been a bad move. -- Douglas Adams, The Hitch Hiker's Guide to the Galaxy "

Way too much marbleling.

Definitely rancid.

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

Best solution, and

when you add in automation, is probably too kill off 70% or so of the 99% before they do something about the situation.

Orwell: Where's the omelette?

I know what happens.

I read this essay before dinner and it took me a couple hours to figure it out.

What happens when the banks own everything ?

They lower interest rates !!

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

Economic rent

The biggest scam of all is "economic rent". That's the key to income with no work, the specialty of banks. Buy buying all of these assets they have driven prices up, simulating a healthy economy. The problem now for them is that they need to continue to buy up assets or asset prices fall, and they have paid too much for these assets and there is no buyers market anywhere in the world to unload these assets in the quantities that they own. Meanwhile assets give them economic and political power and they get to set the rules. Be prepared for a new set of Draconian laws protecting the assets of banks, and screwing you to the wall. Hello wall, hello screw, uh oh!

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

They're just creating their own barbarians.

It's like how the US Military can't understand how they're losing to a bunch of guys in caves.

1. They don't depend on the same luxuries that you do in order to live.

2. They don't require the same support structure you do.

3. Their entire plan depends on destroying both 1 and 2.

When all the records are in the hands of the banks, and the internet is sufficiently censored and rarefied to be useless as a common...

You're gonna see a lot of banks that look like fortresses. A lot of mercenaries accompanied by the cops going out to claim property in the name of the banks. All legally of course, because they have a piece of paper that says they own it. Even if they don't.

The banks of course think they hold ALL the cards, and there is nothing we can do to stop them.

[video:https://www.youtube.com/watch?v=oYoLG_iP9Ec]

I do not pretend I know what I do not know.

According to Scheidel bloodshed

The Great Leveler looks at violence and wealth inequality since the stone age.

Every single time in history wealth inequality has reached this degree it is only changed by bloodshed. The degree of wealth leveling correlates very strongly with the body count.

First people societies had in built wealth leveling mechanisms - the Brehon laws in Ireland ensured that the excess concentration of wealth (ie land for grazing) an individual attained was then shared out amongst poorer relatives in the clan to maximise the number of Freemen. Similar customs existed in pre-Imperial China. Throw in that agriculture began tens or hundreds of thousands of years earlier than previously thought (13kya) once you consider the tending of Oak forests, lily fields of California (evidence of humans in San Jose 130kya) and Ireland by natives.

We made a deal at the end of the 19th century - our wealth leveling regulations of high marginal tax rates and estate taxes would peacefully resolve feudal wealth inequality. In the 1970s they reneged. This time it will be a one time asset tax of at least 50% to eliminate all public debt and fully fund public services, repair infrastructure. I'd prefer peacefully but it is obviously now a them or us situation and I pick us.

I abhor violence, but recognize that sometimes it is

the only way that we will end the threats of violence that hang over us daily.

Just the day before yesterday here in Portland, the pigs were supporting the Donald Trump Rallies, set up to directly insult "Pride" Month. Yep, that's right, the fascists are claiming that they get to have pride now.

Of course the pigs herded the counter demonstrators into the waiting arms of swat members who pepper sprayed, pepper bombed and hit protestors with batons. But only one side.

The PTB have picked their side, at least here in Portland. They're with the fascists.

I do not pretend I know what I do not know.

I'm with you on the violence, for moral, ethical and pragmatic

reasons. Looking at the current circumstances and the last 50 years it is clear the PTB are not interested in peaceful change, they want to win by any means necessary. Post 14th century black death western Europe saw labourers wages, rights increase and they defeated attempts at serfdom, in eastern Europe the aristocracy implemented serfdom successfully.

No more German bonds to buy?

ZH