Who's buying the Trump Rally? You could probably guess

The 'Trump Rally' in the stock market is hitting multi-decade records.

This is from last week.

The stock market is having its best performance in the first month of a rookie president's term since the 1960s.

The S&P 500 has gone up 3.8% since Trump took office.

That's the biggest increase for a new Republican president since the blue chip index that eventually became the S&P 500 debuted in 1923, according to S&P DJ Indices.

And this is from yesterday.

The red-hot Dow closed at an all-time high yet again on Monday, its 12th consecutive record day.

That's only happened two other times in the 120-year history of the Dow. There has never been a 13-day streak of records, though that could change on Tuesday.

The euphoria of investors in a new presidency is something to behold. I've never seen this in my lifetime.

It begs the question, "who are these people?"

Bloomberg has an answer.

After years of snubbing the asset class in favor of fixed income, retail investors are showing pent-up demand for stocks amid an escalation in risk-taking and projections for economic growth since the November election.

From the $86 billion plowed into equity exchange-trade funds so far this year, Panigirtzoglou and team calculate that 2017 as a whole may see equity funds absorb a net $442 billion of new retail-driven money if the year-to-date pace is sustained. That would be almost six times larger than last year’s volume, according to JP Morgan.

On the other hand, institutional investors from risk-parity to mutual fund managers have decreased their exposure to the equities, the team concludes from assessing various active managers’ returns -- another sign that the flows to passive strategies are likely dominated by retail investors.

In other words, professionals are selling stocks while amateurs are buying them.

Normally that would be enough information, but this isn't normal times.

I can get more specific than that.

When it comes to confidence in the U.S. economy, the partisan divide is the widest ever on record. Democrats are expecting an outright recession, whereas Republicans are expecting the exact opposite–and getting ready to let the boom times roll.

The latest figures released by the University of Michigan Surveys of Consumers on Friday show sentiment among Republicans was 120.1, in line with expectations for robust economic growth, whereas it was only 55.5 for Democrats – a number predicting recession. The gap between the two is the widest on record, since the study started in 1945, according to Richard Curtin, who compiles the survey.

Since people who are "expecting an outright recession" don't normally buy lots of stocks when the market is at an all-time high, the answer for "Who's buying the Trump Rally?" is "Trump Fans".

It really is as simple as that. Which gives a whole new definition of "Dumb Money".

Let's not stop there, because stocks aren't the only thing hitting all-time highs.

Home prices are above the housing bubble peak price, with home sales at their highest levels since February 2007.

So who is buying these homes at nosebleed prices?

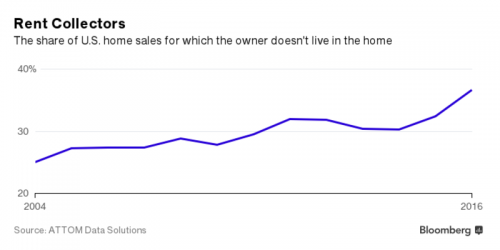

Last year, 37 percent of homes sold were acquired by buyers who didn’t live in them, according to tax-assessment data compiled in a new report published by Attom Data Solutions and ClearCapital.com Inc.

In the years following the foreclosure crisis, Wall Street drove a rise in the share of homes purchased by landlords, as private equity firms bought thousands of cheap homes. In 2012, institutional investors accounted for 7.8 percent of home sales, according to the report.

Rising home prices led big investors to curtail their purchases, and the share of homes acquired by institutional investors fell to 2.9 percent last year. But as Wall Street backed off, smaller investors picked up the slack, aided by tools developed to help big investors find, finance, and manage rental properties.

Once again, the professional investor is not buying, but the amateur is buying at all-time high prices.

Once again, normally that would be enough information, but this isn't normal times.

I can get more specific.

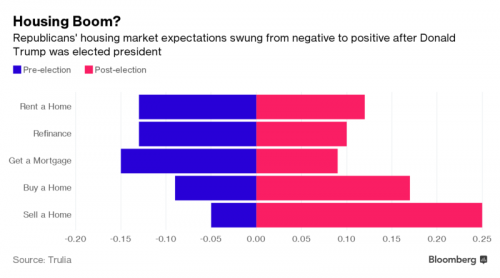

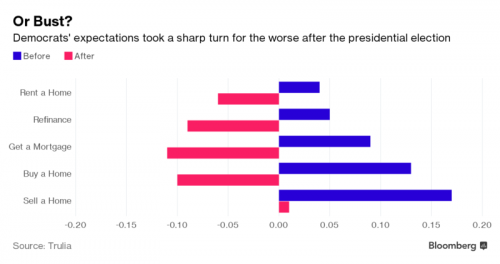

During the last week of October, when Hillary Clinton was ahead in the polls, Trulia commissioned surveys of 2,000 Americans. Respondents who identified themselves as Republicans said that 2017 would be worse than 2016 for selling a home, buying a home, getting a mortgage, or finding rental housing. Democrats thought that 2017 would be better in each of those categories. After Donald Trump’s surprise electoral college win, outlooks for Republican and Democratic respondents flipped—in every category.

“It’s really not very intuitive,” said Ralph McLaughlin, chief economist at Trulia. The second survey, for instance, was conducted after mortgage rates spiked in response to the election results. “Even if your side wins, if mortgage rates go up, you might get pessimistic about your chances of buying a home.”

These are dramatic swings, and it’s tempting to attribute them to an emotional response following a result that caught most people by surprise.

Since people who think it's a bad time to buy a house don't normally buy houses when prices are at an all-time high, the answer for "Who's buying these houses?" is "Trump Fans".

Again.

Comments

Essays like this are gold

TOP would absolutely love info like this - where politics meet markets on a consumer level.

But TOP only wants sycophants, so c99p gets this essay while TOP gets 3 dozen diaries about Trump's skin color and hair.

In related news

I'm thinking about shorting the market.

Solid Gold

Nice job as always.

Listing my house tomorrow...

My condo right now is in bubble

territory regarding it's value, but then again, we've been in a bubble for over a year now here in WA. 4 units in my building sold last year at really high prices and all within a week or so. I don't really want to sell yet but its been tempting with what some got for these places. Its maybe 1200 square feet, nice building but not brand new, built 1998, nothing fancy, and these things are going at over $500K. I feel for the people who bought them as I just don't see that value holding through another crash. I am just glad not to be under water and glad I did a 20 year fixed at a decent rate. Scary times watching that stock market too. And my finance guy says I should buy in now, uh no thanks.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

And how does one "buy protectiion"?

shift IRA market funds to credit union IRAs? Store money in 'gift cards'?

@Creosote.

And gift cards buy police protection in the form of not being arrested for having them and simply having them seized because they can do that. There is no protection but in sane law... too bad TPTB of what they like people to term 'the greatest democracy of the world' allow neither democracy nor sane law.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Of course, when the crash comes...

...and it will come, they'll blame it all on Obama...

I want my two dollars!

@Ken in MN

Hey, Obama/Dems/their funders/TPTB set up for this. They should all bear their portions of the blame - although I expect that this would have anyway happened under the Clintons, assuming that the country/globe wouldn't have been nuclear-irradiated and global-dimmed into extinction by this point.

Goldman Sachs, et al, would be running the economy 6 feet under in either case, after all.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

I'm thinking mini-boom for up to a year then the drain will

be circled as the side effects of deregulation bite.

Same thoughts here

I believe a lot of this boom is fueled by anticipation of deregulation.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

What goes up

always comes down.

Sooner or later, reality returns. And the stock market and real estate market parted company with reality long ago. It will be a hard landing. And with most families still trying to recover from the last recession, and younger folks unable to get their feet under themselves thanks to poor-paying jobs and crippling college debt -- topped of by a government of, by and for the wealthy -- it's going to get very ugly.

It's not a question of if, but when.

Time to buy another thousand shares of Industrial Torches & Pitchforks.

Nicely done, gjohnsit.

"The real power is in the hands of small groups of people and I don't think they have titles. -- Bob Dylan"

Beware the Ides of March

We live in interesting times.

http://www.zerohedge.com/news/2017-02-26/stockman-after-march-15-everyth...

[video:https://www.youtube.com/embed/7xgNncFHAng]

Scary! and when it comes

who will get the blame from Trump?

To thine own self be true.

@CB

I dunno, I suspect that there will somehow be money for everything the billionaires, corporate interests and their political lackeys want, just nothing for the public.

And this could be where civil forces/emergency forces are dropped and (publicly paid?) private industry mercenaries brought in to maintain order in an emergency state demanding martial law. Just speculating, of course, just rather nervously.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Wait a minute, I thought the Trump fans were

ignorant hicks from St. Lick that couldn't buy a stock unless they sold their mama's china? Not wealthy stock market players. And I thought Trump's policies of "cleaning the swamp" was pissing off the rich people, not enriching them?

Oh ya, Russia.

A bit off topic.

Have you seen anything lately from bobswern, gjohnsit? Somehow, myself and the hubbyster are digging in with great caution in terms of the stock market and real estate. I look at this so-called "Recession" as what it actually is: a long-term Depression! Rec'd!!

Inner and Outer Space: the Final Frontiers.

I don't know where bobswern went

but I know Bonddad is back on the GOS.

What do you think is going to happen March 15 when

we hit the debt ceiling of $20 trillion? Most of Trump's grandiose plans will take a hard knock.

Another factor is how long can stock prices remain disconnected from economic reality? The markets are up but the economy is fairly flat comparatively. Sooner or later people are going to realize all these stocks they are buying are not backed up with enough assets or earnings to rationalize their cost. In many cases, their only value is in the hope there will be another sucker to buy them for 10% more than they paid.

The debt ceiling isn't the big problem

The problem is the size of the debt and deficits, combined with China and Japan no longer buying our debt.

If Trump gets ANYTHING like what he wants in tax cuts, the deficit will explode, and that will push up interest rates, which will

1) explode the deficit higher

2) cause interest rates to shoot up, which will

2a) cause defaults to shoot up

2b) crush retail

2c) possibly trigger a majorderivatives event

An essay in itself

Legacy of Obama

I'm missing Hecate

Any info?

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

Bob Swern is around but doing other things

He runs a business and was trying to get a message to DK/TOP because they have such a large base.

He is out there somewhere.

I can get in touch if someone wants to track him down.

A few years ago he ran a lot of articles from Sheldon Wolin's "Democracy Inc.: Managed Democracy and the Specter of Inverted Totalitarianism" That was published in 2008 and since then it has happened.'

Also, Bob put in a lot from Naked Capitalism. It is now much broader than finance and has a good following.

In some ways, there have been so many new voices that most of us are in overload with great things. When Bob was burning rubber on TOP/DK, that was before The Intercept, and before The Young Turks took off, and before Common Dreams had so much of its own content, and many other sources. There has been so much that has happened in the last few years and we have learned so much e.g., the Clintions F**** the system and now the oligarchs are in the drivers seat.

Kate Arnoff is writing it seems several articles per week and this one about how to organize to fight Trump - basically, the land & environment & start local and build the base.

THE CLIMATE MOVEMENT GOES TO WAR WITH TRUMP But to save the planet, we need to remake the Democratic Party

the dem party has folded and may or may not be revived

and there is twitter. I follow 22 people on twitter and that is at the edge

I recall when Glenn Greenwald started on Twitter I would report in Joananleon's place about each new 10K people following Glenn. And early on DK/TOP had about 125K when Glenn was at 60, 70, 80K. I just checked and TOP has 251K and Glenn has 850K. And the quality of who follows their tweets is at a different level.

Bob Swern will show up some time. He knows we are here. In the mean time, lots to do

Good recap

The saga of the past year has been epic. As we come up on one year of moral dislocation, one can see just how far everyone has traveled. Many have branched off into alternate pilgrimages and people display so much more confidence and resolve that they did before.

Inverted totalitarianism has always worked as a model, but from a distance, the US is starting to look like a failed state. There's a narrative out there…. From the corner of the eye, the US starts to look like the North Korea of the Western Hemisphere.

There's talk that H.R. 1205, the American Sovereignty Restoration Act is being reconstituted, to end US participation in the UN and any organizations affiliated with them.

All this because the US is sharply criticized by Member Nations for continuing to deny Human Rights to US citizens. Naturally, a 2014 Gallup poll showed that a staggering 57 percent of Americans were opposed to the UN. Even among Democrats, half thought the UN was doing was doing a "bad job." Sigh.

It might be just Trump fans and Dumb Money,

but private prisons, for-profit K-12 chains and the armament industry look like smart plays to me.

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

Financials too

deregulating Wall Street is seen as an unquestionable good thing.

@gjohnsit

Yeah, we're hearing about "red tape" again, just like in the 1980s.

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

@Azazello

Yeah, the economy, people and environment are just too 'burdensome' for corporate interests to actually be prevented from killing them all off for a little more profit now.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

So when's the bubble going to burst?

I know someone's working on that to set us up for the next Big Short or worse.

Beware the bullshit factories.

Maybe the fed finally created some inflation.

After all both Venezuela and Zimbabwe stock markets boomed during their hyper inflations. Prolly just the blow off top to a nine year run. Caveat emptor. Many signs we are headed for a bonfire.

Thanks for the info, DonM!

I became a YUGE bobswern fan at TOP cos he explained the economic corporate robberies (TPP, NAFTA, etc.) in a language econ dummies like me could understand. I always watch for him even wandering back over there on occasion. Appreciate it. Thanks again.

Appreciate it. Thanks again.

Inner and Outer Space: the Final Frontiers.

... In other words,

Fee Fuck For fun, I smell the blood of a big crash come...

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.