Are we headed for a recession? Yes

Deutsche Bank released a study that lays it out in no uncertain terms: we have almost no chance of escaping a recession in the next 12 months.

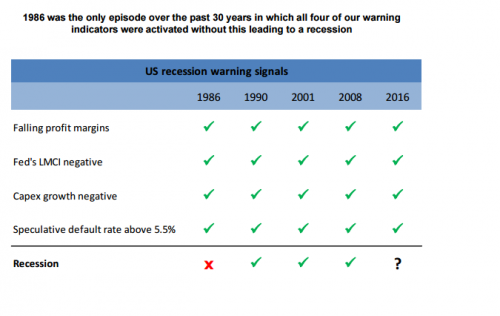

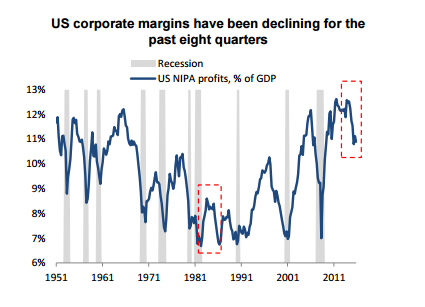

a) 1986 was the only episode over the past 60 years in which U.S. corporate margins declined (from 8.6 percent in the second quarter of 1984 to 6.7 percent in in the fourth quarter of 1986) without this leading to a recession

b) it was the only episode over the past 40 years during which capex growth turned negative (driven by falling energy investments) without this leading to a recession

c) it was the only episode over the past 30 years in which speculative default rates rose meaningfully above 5 percent without this leading to a recession.

Amazingly investors are betting on a repeat of 1986, despite the fact that a) the credit cycle was only four years old in 1986 (it's seven years old today), and b) the Fed cut rates by 550bps and the US dollar dropped by 40% after the Plaza Accord, boosting export growth. in 1986 (with rates near zero that can't happen today).

The Federal Reserve's Labor Market Condition Index (LMCI), which gives a broad view of the momentum of the jobs market, turned negative in August compared with the year earlier, and in five of the seven occasions that's happened over the past 40 years such a decline has coincided with the onset of a recession.

Comments

So, what does it mean?

We will find no jobs anymore, everything gets much more expensive, the dollar is nothing worse and we can't get a loan, can't get to school, can't pay medical bills?

Nice outlooks.

https://www.euronews.com/live

The business cycle

I thought the business cycle was supposed to give us a chance to recover from the last recession before hitting us with the next one. Not anymore, apparently.

"We've done the impossible, and that makes us mighty."

All gains in worker productivity have gone to the 1% - none

for wage earners for the past 20 years.

With consumers financially strapped, don't look for the majority to help spend out of a recession: We can't.

Henry Ford in the depths of the Great Depression: "Actually times are pretty good if you've got money." I gather from that, that the 1% won't do anything to help those struggling with food and shelter.

TINA: There Is No Alternative refers to the idea pushed by brokers and big capital that stocks, particularly dividend paying stocks are the only place for your money. I don't want to be in stocks when the big recessions takes hold. The S&P is valued over 19 when average is 14.5 - stocks are over valued at present.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

"All your productivity gains...

...are belong to us!"

I want my two dollars!

There was no recovery

We never really recovered from the last recession. Hell, we never really recovered from the 2002 recession. The books have been cooked for years with phony numbers trying to instill confidence. The fundamentals have never improved, we're just trying to ride from one bubble to the next, a giant depressing game of musical chairs. In 2002 we needed something to replace the dotcom bubble, so we got the housing bubble. After that fell apart we now have the auto and student loan bubble, in addition to home prices inflating back to unaffordable levels.

The US economy is sick, but nobody has the will to fix it. If we keep pretending everything is OK, it will be. For some people anyway.

http://www.zerohedge.com/news/2016-09-07/one-trillion-dollar-consumer-au...

So how is the economy?

Today they interviewed two people where I work for a low-paid, entry-level IT support position.

One person had a bachelors of science degree.

The other had a masters of science degree.

Those interviewed are symptomatic of the Obama economy

failing to provide decent paying jobs for recent graduates and those about to graduate.

People before Profits will resonate with many people when and/or if someone can pick up and run with the torch Sanders discarded.

It will also appeal to those unemployed for more than six months who are finding it close to impossible to secure employment.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

it may be local ...

Seems like tech employment is turning up again in the BOS area. Signs are that some of the ridiculous requirements are gone, and reasonable salaries are no longer out of the question.

Please do not relocate here, however. We have much, much too much traffic at rush hour as it is.

No H1-B's available?

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

maybe that's saturated, too ...

there were limits on H1Bs.

This could all be very temporary, too. Interesting it's more or less happening in the 3rd quarter, though. If calendar year businesses expected poor results, they definitely wouldn't be hiring right now.

I know, that's why TPP (or TTIP?) was going to remove the limits

on H1-B visa. And people wonder how people can vote for "that awful Donald Trump".

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Lovely. And here I was wondering when the next crash was going

hit due to Wall Street's shenanigans. They've never stopped doing a single thing they were told not to do. And they figured out a way to make their gambling debts ours to pay off in advance.

***

The Bail-In: How You and Your Money Will Be Parted During the Next Banking Crisis

http://sandiegofreepress.org/2015/01/the-bail-in-how-you-and-your-money-...

***

Now it's talk about a Recession? Wonderful. Just what we need in a time of impossible student loan and car loan debt (there's quite a trade in bundled car loans btw), a low paying job market, rising costs of shelter and necessities, and an overwhelming lack of savings by the 'middle/lower middle' class, not to mention they won't remain 'lower middle/middle' class in another recession. Job losses (which in truth are happening all around us already) were unprecedented during the "great recession" that just ended a couple years ago. What would another recession do to our 'recovered' job market? (That last sentence was kind of a joke, son. Kind of a joke.)

It almost seems like we're screwed no matter what happens in November.

I'm tired of this back-slapping "Isn't humanity neat?" bullshit. We're a virus with shoes, okay? That's all we are. - Bill Hicks

Politics is the entertainment branch of industry. - Frank Zappa

It just occurred to me that the 99% has an untapped

revenue stream--human organs! One of us has Dick Cheney's next heart. /s-- or is it?

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

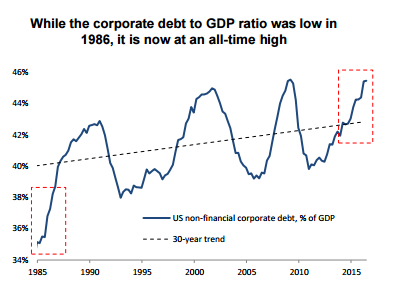

Corporate Debt to GDP Graph

Looking at the Corporate Debt to GDP graph, the highest points seem to coincide with past financial turmoil like (1) the late 1980's savings and loan debacle; (2) 2000 tech bubble burst; and (3) 2008 Great Recession. The problem with the next financial mess is that interest rates are near zero and quantitative easing has been overused. Guess it's time to tax the corporations and super rich for revenue. However, it's unlikely this solution to the problem will be proposed.

Karl, you ARE a master of understatement. Unlikely. **chuckle**

I saw what you did there, as they say.

I'm tired of this back-slapping "Isn't humanity neat?" bullshit. We're a virus with shoes, okay? That's all we are. - Bill Hicks

Politics is the entertainment branch of industry. - Frank Zappa

Tax the super rich to balance inflationary

pressures is a very good idea. Also to prevent them from buying our politicians, our education, etc....

But, as head of the fed, Ruml wrote in 1946, taxes for revenue are obsolete since we went off the gold standard and stopped issuing dollars against our gold holdings thanks to FDR.

"Taxes for Revenue are Obsolete":

http://neweconomicperspectives.org/2010/04/fed-chairman-ruml-got-it-righ...

Now dollars are just accounting marks on a spread sheet, some of which get turned into paper dollar bills. The government has infinite ability to create accounting marks and doesn't need to collect tax before it can make more.

And treasury bonds are just a savings account at our central bank. They too are not necessary for revenue purposes.

QE has been many things.

Including buying treasury bonds in order to keep interest rates low. The fed can do so indefinitely.

QE for the People would be a good idea, however its' structured - either by having the fed buy t-bonds and consider them retired, having the fed directly mark up the bank accounts of the little folk, etc....

Or just letting treasury do its' job via Congress doing its' job, and increase the governments' deficits and thus the private sectors' net financial assets while providing risk free savings accounts at our central bank.

Does the Fed have any more latitude

... to act more than they already have without Congressional mandate? I'm not sure they do.

One day, we're all going to have to have the universal income discussion, and I hope it happens before a whole lot of people are dislocated.

Yes, it has latitude. All it needs is the current

laws on the books, apparently.

My understanding is that the law allows the fed to buy pretty much whatever it wants.

as always, it seriously annoys me when you assert that

something or other is "just accounting marks". no, they are not "just" accounting marks, they are accounting marks that are expected by the mass of society to signify something real -- in particular, an obligation of one party to supply real goods and/or services to another. whether the government signifies that obligation with printed bills or complex patterns of magnetically oriented atoms on a spinning platter somewhere, whenever the government permits the creation of debt, it is permitting the creation of a claim on society as a whole, with the guarantee that we will in fact pony up the goods and services should the debt-holder demand them. one reason "taxing for revenue" still matters, Ruml notwithstanding, is because we desire that our government account for its expenditures by making explicit the nature and magnitude of its confiscation of society's productive capacity and the consequent obligation that it is creating for all of us. Taxing the rich is not just a "good idea", it's a necessary measure, without which the MMT mantra of sovereign currency is a non sequitur.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

You lost me with what debt you are talking about, and who holds

the debt?

If you are talking about government debt, then you are talking about savings accounts at our central bank.

So, for instance, China has two accounts at our central bank, a reserve (checking) account and a savings (securities) account.

When they sell us stuff, they earn dollars and are paid in full at point of sale. Those dollars are placed in their checking account at our central bank.

If they want to save those dollars at our central bank and earn a higher rate of interest than they do on their checking account, then they invest in a treasury bond. Once they do, their checking account is marked down and their savings account is marked up.

The dollars have not disappeared into some vault at the treasury. The treasury does not have a vault filled with accounting marks.

The dollars are still in Chinas' savings account, tied up in a time deposit earning interest.

When their bond matures, their savings account is marked down and their checking account is marked up.

What can China do with their dollars? They can buy any dollar denominated asset: Oil, American real estate, etc... they can open a savings account at our central bank, they can exchange their dollars on the foreign exchange market for other currencies, etc....

If American own treasury bonds, then they, through their bank, have a savings account at our central bank.

When their bond matures, they get their dollars back.

What can they do with their dollars? Buy any dollar denominated asset, exchange their dollars for foreign currency, or pay their taxes.

The only thing government owes you in return for its' IOU is tax relief.

Sorry, but this is just how it works.

As far as backing: The dollar is backed by the full faith and credit of the entire US economy and social cohesion.

I'm not sure I've answered your question, but would be happy to clarify.

The holder of treasury bonds can demand only one thing:

That the dollars they hold in a savings account are returned to their checking account when the bond matures, plus interest.

They can not demand that their bonds are converted into any goods or services - they can not demand any such "ponying up".

Dollars will have value as long as their are dollar denominated goods and services you wish to buy and as long as you must satisfy a tax obligation to the US government.

I think you are confusing money with real wealth. Money is useful to the extent that there's stuff of value to buy with it. True.

But the government does not promise to convert either dollars or bonds into any commodity.

Confiscation of productive capacity????????

Government buys stuff from the private sector in the course of issuing dollars. This is the "confiscation".

I'm not sure if you're claiming that taxes are a confiscation or bonds are. I think you're saying taxes are.

But the money you use to pay taxes comes from government spending.

Government must first issue dollars to the private sector before the private sector has dollars with which it can pay its' taxes.

Do most people pay too high a tax for the government services we get? I think so.

But I think the way to change things is to realize that taxes do not fund those services.

Rather taxes regulate inflationary pressures by removing excess dollars from circulation. Taxes destroy dollars, just like how private bank credit is destroyed when the loan is repayed.

So the question we should be asking is: Who should shoulder the burden of regulating inflationary pressures?

WHAT are we taxing? Are we taxing labor and industry -- which produce real wealth? Or are we taxing unearned incomes?

What areas of social life do we wish to value in ways not related to market logic? Whatever they are, society can always afford to pay for them using the governments' ability to create dollars out of thin air.

The essential problem is that you refuse to acknowledge that

accounting is, in fact, accounting. Your standard catchphrases such as "Taxes destroy dollars" is in straightforward denial of the mechanisms by which governments -- including the federal government -- actually do their accounting. I've told you this before. Directly contrary to your assertion, many (if not all) collected federal tax dollars are deposited into one of many (?) federal bank accounts that operate in exactly the same fashion as your bank account and my bank account. In its internal accounting structures, the federal government doesn't simply record that some dollars were paid against an assessed tax obligation, cancel that obligation in the relevant records, and *poof* the dollars have been destroyed; rather, the federal government maintains bank accounts into which those dollars are deposited, and the federal government subsequently issues cheques and other instruments of payment out of those bank accounts in exactly the same fashion as you or I would.

I don't know why you think they don't do this, or even whether you sincerely believe that they don't do this, but IT IS WHAT THEY DO.

Over and over and over again you assert that taxes do not fund services, but this assertion is an epistemological sleight-of-hand. Again, as a society, we insist that the government account for its spending, either by creating additional debt (repayment of which is guaranteed by, um, us, repayment meaning we will produce something for someone so as to gather dollars to ourselves which we will then pay into the government as taxes), or by collecting taxes, depositing those tax receipts into bank accounts, and then spending those tax receipts back out into the world. Tax revenues absolutely do fund government spending because, the MMT line notwithstanding, the government generally operates as if creating new dollars is the worst possible way to "balance the books" (not to be confused with balancing the budget ...); and generally, I agree with that sentiment. It is almost always "better" to balance the books by collecting taxes than by issuing new dollars "out of thin air", as you so like to say.

The "confiscation" to which I referred is most often the immediate demand of the government for goods and/or services, to be provided either by government employees or by private-sector individuals. When the government employs someone to, for example, perform data processing at the NSA, the government is confiscating that individual's productive capacity from society at large. Society at large senses this confiscation in the subsequent consumption by that individual of goods and services; and society at large demands that the confiscation be accounted for by exactly the same mechanisms society demands that ALL consumption be accounted for.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Good lord.

Here's ex Treasury official Frank Newman - sorry, but he disagrees with you regarding national accounting and how it works:

Short piece: http://neweconomicperspectives.org/tag/frank-newman

Here's a longer talk:

Bank of England disagrees with you:

Here's an article with links to The Bank of Englands' papers relating to these issues:

https://www.theguardian.com/commentisfree/2014/mar/18/truth-money-iou-ba...

My problem with you is your tone: "I've told you this before".

Fine. You disagree with folks like the bank of england, treasury officials, etc....

I happen to agree with them rather than you.

Why?

Because it makes logical sense once you give up the notion that money is material.

Alan Greenspan:

In a country that creates its' own currency, taxes do not fund the federal government. He tries explaining this to Paul Ryan.

For some reason you choose to agree with Paul Ryan rather than folks like Frank Newman.

Economist Paul Samualson on the role of the myth that

governments should balance their budgets - "it acts as old time religion":

The epistemological slight of hand is your insistence that

the government has a vault large enough to contain infinity or something, as you are insisting that money is a material object, or that it must be accounted for using the logic of material objects even if it isn't.

No.

Money is numbers, numbers are abstract, no matter how much anxiety that might cause us.

Yes, when government hires people, those people are no longer available to be hired by the private sector.

As long as they produce things we value, so what?

I have never said that money is material.

What I have said (at least in so many words) is that money is not just numbers. Rather the numbers have a meaning that is not wholly abstract, but is related, by those of us who manage our day-to-day economic affairs via transactions that alter the numbers, to the real goods and services for which the numbers stand. If they were as utterly abstract as you continually make them out to be, there would be no functional difference to me or to you between $1 and $1,000,000; yet transparently there is. More particularly, ordinary folks wouldn't give a flying fuck about inflation, since hey, "they're just numbers". But of course, they are not just numbers -- they are intended to represent, to signify, something "real", whether concrete and material, or more ephemeral, which is to say, the non-material output of human labor (e.g., a musical performance). The function of money is to provide a mechanism for accounting (both the formal kind required by institutional systems and the casual kind embodied in everyday personal commerce), and it cannot do that if nobody is accounting for the coming and going of the money itself.

I don't give two hoots about the bullshit spewn by Alan Greenspan (Randian lunatic who was genuinely surprised when the world failed to conform to the ideology that he had mistaken for revealed knowledge) or Paul Samuelson (classicalist whose textbook I found laughably naive and/or deceptive 35 years ago, when I was 19).

And I note that despite my explicitly pointing out that I was not discussing "balancing the budget", but rather "balancing the books", which are two very different operations, you condescended to lecture me on budget balancing.

Similarly, you "take issue" with my remarks about government "confiscation":

... as if I were objecting to government spending. I was not, and I do not, though I must say, most governments these days have a viewpoint rather diverse from mine with respect to "things we value". The difference between you and me is that i believe in the value -- indeed, in the proper significance, rooted in real human goings-on -- of accounting for government spending. I am the big government tax-and-spend far-to-the-left-of-liberal who wants 95% marginal tax rates and an economy that runs at >50% public-sector (Including, most importantly, medicare for all and free post-secondary education). I will also suggest that if you asked the opinion of Frank Newman, Alan Greenspan or Paul Samuelson on that figure, they would all tell you that the economy can't handle a federal budget beyond 20% or so of GDP, and that the current overall figure of about 35% (for all levels of government) is at best just about right and at worst an unsupportable nightmare.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

I'm a spend and tax liberal.

I'm trying to figure out the core of our disagreement.

Are you saying that taxes DO fund the federal government -- our currency issuer?

Your point seems to be that inches are more than numbers.

When used to buy wood to build a house, they must signify precise lengths of wood, both to make house building easier and to make sense out of contracts where a precise number of dollars are exchanged for a precise amount of wood.

Yes, I'd agree.

But this does not mean that inches are any less of an abstraction than they in fact are. They are useful abstractions.

Money is a useful abstraction too.

Numbers are a useful abstraction.

My daughter was "forced" into student loan for grad school.

It's only about $5K so far, but the loan was sold in one day to a bundler bank. Happy days for some.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

A couple more charts

should we care so much about public debt in the aggregate?

Wouldn't an MMT'er say that public debt == private surplus? We can definitely argue about whose hands have that surplus, but I'm no longer automatically worried about rising debts.

Should I be for the foreseeable future?

No : ) Only worry about who owns that surplus

I was hoping you would show up, katie.

This is why I'm not quite so gloom and doom yet. I think we're going to get whacked at the end of the year when the Fed tries a one and done quarter point rise, but really the thing to look for is real inflation. When and if that starts up, that's when I'm going into two positions: cash, and fetal.

I don't see inflation as a problem

since fewer and fewer dollars gets into the hands of those who actually spend. However, since we no longer enforce antitrust we will get huge spikes in some things like life saving drugs.

I do see a huge demand for tumbrels coming soon.

glitterscale

Government "debt" is not like household debt

because households do not issue our national currency out of thin air.

Households must earn dollars in order to have dollars.

The government, being a monetary sovereign, merely issues the dollars we use.

The government is a currency issuer.

We are a currency user.

The government creates dollars out of thin air and can always create more.

Households can run out of dollars.

Dollars are our net financial assets. The only other source of our money supply is private bank credit/debt, which nets to 0.

Dollars are the private sectors' net savings (all dollars in existence that have not been taxed away).

Private bank credit is our debt. Too much private debt causes crashes.

Government created dollars causes private sector net incomes.

And Treasury Bonds are risk free savings accounts at our Central Bank. We only ever owe interest on those savings accounts.

Under the gold standard, dollars were issued against our gold holdings, while treasury bonds were not. That was the difference. Since T-Bonds are a time deposit, when the bonds mature and the dollar savings are returned to the "checking" account, those dollars could be converted into gold upon demand. In this way, T-Bonds represented borrowing against our gold holdings.

Now they don't. We could stop issuing bonds out of thin air tomorrow and still issue dollars out of thin air.

Government Spending = National Net Income - Taxes - Private Bank Debt - Foreign Trade

If too much government spending leads to too much inflation, then the government can increase taxes in order to remove excess inflation causing dollars.

Thank You! Too many people say we are like Greece, we're not!

Greece cannot create currency. They depend on German bankers to do that.

Illinois is like Greece, but the Federal Government is not.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

We're Expected To Prostitute Ourselves

If the global 0.01% gets their way with the elimination of national sovereignty and the ability to make and enforce laws, those without enough money to belong to the club will be expected to service those who do belong in some manner for the purpose of gaining sufficient sustenance to survive another day. Because we will be dealing with self-styled "entrepreneurs", they will expect us to come up with "business" proposals which interest them to sample. Should they like the sample, they will demand more until they are sated. IF they feel as if they were satisfied by our performance, they might toss us a coin or two.

If not, starve and die.

Vowing To Oppose Everything Trump Attempts.

The essay is pessimistic--please explain the following

to those of us who lack the acumen in economics to understand this essay after reading about superb income growth in 2015. This sounded fishy to me but I lack the knowledge to tell if this is B.S. (as I suspect) or something else.

I address that report

last week

Thanks for the reference to your prior essay

So, if I understand correctly, the reason the middle class had such a superb year was because some federal economic yo-yos are bundling inflated real-estate prices to the truly lessening wages. Well, well, well; I guess we can put Obama in the same class as Clinton--you can't believe anything that comes out of his mouth.

The word "recession" and its meaning prior to 2006

…Has no place or meaning in today's reality. As far as I can tell, it's an historical term that is used to distract and obscure.

One can exist in an economy that has satisfied the criteria of a technical recession (two quarters, etc….), but none of the historic effects follow. Indeed, now times are harder when the US is not in a recession. People are "out of the money" and selling apples on the street when the stock markets are doing great. The old guides don't work.

Part of this is due to the fact that QE is actually a process that exports US inflation, along with other specific monetary adversities, to the rest of the trading world. This elevates the Fed and its reserve fiat to a secure place above all other domestic fiat systems. Thus, the Fed can choose to support any particular sector where neoliberal investors decide to put their money in the US. That sector as a whole will perform astonishingly well. The banking monopoly is now essentially another branch of government, with the same socialized protections, while still sporting a private profit-making window. That's one less thing for everyone to worry about.

(Residential Real Estate, aside, of course, since a rapidly shrinking percentage of the hoi polloi still own homes, and can run amok if not constantly herded.)

Remember: Cycles are now kabuki. Don't let the word "recession" trip you up, and never bet against the house.

same class as Clinton

Dingdingdingdingding!! Give that gator a Marijuana!! (Remember, I live in Colorado!)

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

oops -- duped again!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

"investors are betting on a repeat of 1986" Hahaha.

Yes by all means repeat the 86 scenario. Oh wait, what followed was a huge stawk market crash in 1987.

But this time is different -- I'm hearing.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

And in 1986 the Reagan Administration...

...was making John Maynard Keynes look like a piker, deficit-spending money hand over first on its way to tripling the federal debt. There is no such government spending this time around to save the real economy (where the 99% exist) from Wall Street's hubris and belief in Supply Side economic mythology...

I want my two dollars!

One way to help fix the economy

might be to legalize cannabis. Take a lesson from Colorado, America.

I know I'm being simplistic. There are myriad ways to prevent recession and boost the economy - infrastructure jobs, fixing the healthcare system, heck - just look at Bernie's platform. Ain't gonna happen. I get it.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Exactly - the vote in November

(if we don't vote in Jill) will just be a new low in evil regardless of which of the two major parties gets in. (Jill herself will find nothing but blocks from both the gop and supposed dems, imo).

glitterscale