News Dump Thursday: Visualizing a rigged market edition

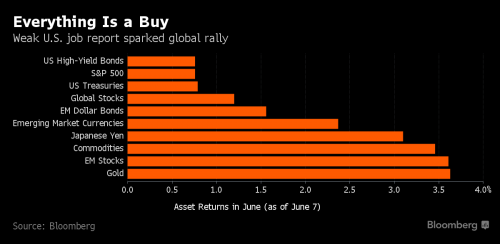

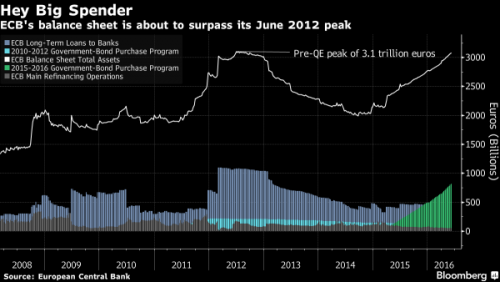

“Everything is being driven by high liquidity that ultimately is being provided by central banks,” Simon Quijano-Evans, chief emerging-market strategist at Commerzbank AG, Germany’s second-largest lender, said in London. “It’s an unusual situation that’s a spill over from the 2008-09 crisis. Fund managers just have cash to put to work.”

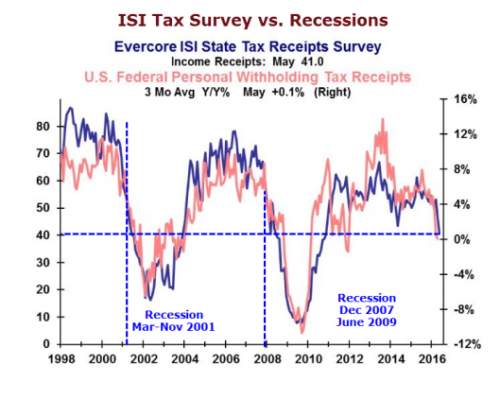

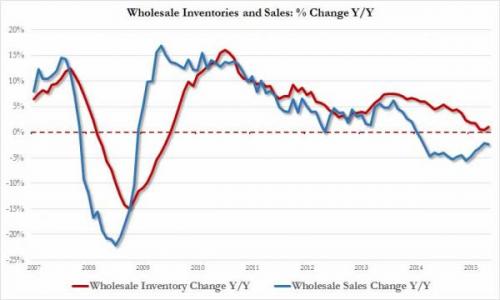

For much of the time since the financial meltdown eight years ago, investors have been in the mindset that bad economic data is good news for markets. The near-zero interest-rate policies by major central banks -- and negative borrowing costs in Japan and some European nations -- have pushed traders to grab anything that offers yield. And every indication that the liquidity punch bowl will stay in place is greeted by markets with a cheer.

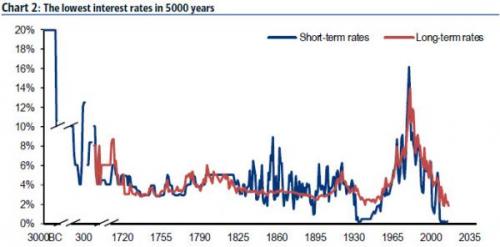

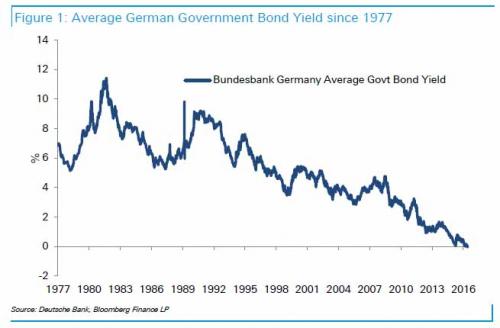

Yields on the 10-year government debt of Germany and the U.K. fell to all-time lows, a stark demonstration of the modern era of scant inflation, weak growth and outsize monetary policy.

The yield on 10-year German bunds closed at 0.049% on Tuesday and continued to fall on Wednesday, hitting 0.036% in early European trade, according to data from Tradeweb. The 10-year U.K. gilt yield slipped to 1.263% at Tuesday’s close and traded down to 1.256% early Wednesday. Both yields are lower than previous troughs in the first half of last year. A different measure of the U.K. yield from data provider FactSet stood at 1.267% Tuesday. Yields fall as prices rise.

Also Tuesday, the U.K. sold a 30-year bond with a yield of 2.095%, the lowest average auction yield ever for that maturity. A similar bond auctioned in April yielded 2.345%. And Switzerland announced it will be issuing 13-year bonds with a 0% coupon, the lowest on record.

A fully charged program of central-bank bond buying in the eurozone, along with negative interest rates, has pulled down the bund’s yield. The decline in British yields is remarkable, since the Bank of England hasn’t moved interest rates since 2009 nor changed its bond-buying program since 2012....

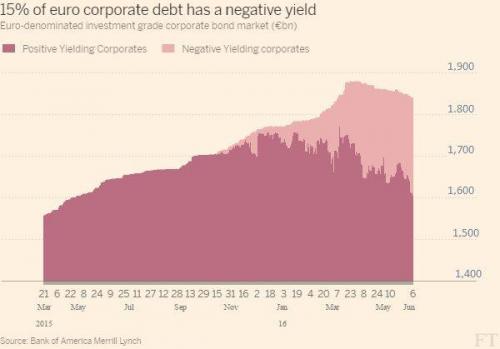

Tumbling German bond yields this year have a more straightforward cause: the European Central Bank’s move to progressively deeper negative rates and its continued buying of government bonds. The ECB’s stimulus has driven yields down on swaths of German government bonds: German debt all the way up to nine years has negative yields. The amount of global sovereign debt with negative yields surpassed $10 trillion for the first time in May, according to Fitch Ratings.

German lender Commerzbank AG estimates that almost two-thirds of all German sovereign debt outstanding now yields below minus-0.4%, which makes it ineligible for central-bank purchases.

The bank’s entry into the corporate bond market on Wednesday was no exception: buying bonds with junk ratings. The second day didn’t disappoint either, with purchases of notes from troubled German carmaker Volkswagen AG.

By casting his net as wide as the program allows, Draghi ensured that the first day of corporate bond purchases made an impact. While the ECB has said it would buy bonds from companies with a single investment-grade rating, investors expected the central bank to start with the region’s highest-rated securities...

Purchases on the first day included notes from Telecom Italia SpA, according to people familiar with the matter, who aren’t authorized to speak about it and asked not to be identified. Italy’s biggest phone company has speculative-grade ratings at both Moody’s Investors Service and S&P Global Ratings. The company’s bonds only qualify for the central bank’s purchase program because Fitch Ratings ranks it at investment grade

literally no one knows who owns your mortgage

In a filing unsealed on June 3, 2016, the Department of Justice (DOJ) confirms what many of us have known for years. Nobody, not even the U.S. Government, with massive resources, can determine who owns your loan and has the right to collect on your mortgage.

The information comes from case files unsealed on June 3, 2016 by federal Judge Yvonne Gonzalez Rogers of the Northern District of California in the case of the United States v. Discovery Sales, Inc. The case involves some 325 fraudulent loans originated by Discovery Sales, Inc. (DSI) between 2006 and 2008, many of which were then sold to Wells Fargo Bank and JP Morgan Chase to securitize.

The Discovery Sentencing document on page 9 states:The originating lenders who made loans to purchase DSI properties, including Wells Fargo and J.P. Morgan Chase, generally would not keep the mortgages and thus did not end up losing money as a result of the DSI fraud scheme. Instead, they would sell the mortgages to other banks who would package them in securities that were sold to other investors. These securities failed when the underlying mortgages went into default. It was impossible to trace the majority of the mortgage loans on the over 300 homes sold by DSI that were the subject of the FBI investigation; it would have been harder yet to identify individual victims of the fraud given that the mortgages were securitized and traded.

Hillary Clinton is wasting no time trying to woo Republicans turned off by Donald Trump now that she’s the presumptive Democratic nominee, as her campaign has launched a new website aimed at courting disaffected GOP voters.

The website, republicansagainsttrump.org, was registered on May 27 and launched on June 2, according to domain registration records. The Clinton campaign only appears to have begun buying ads to promote the site more recently.

The ads promise potential supporters a “free ‘Republicans Against Trump’ sticker” if you pledge to oppose Trump in the fall.

The small print, if a visitor scrolls to the bottom of the page, reads: “Paid for by Hillary for America.”

If you’re a fake bomb-maker for the FBI or one of those informants who poses as an ISIS recruiter online, business is definitely booming, as continued pushes for more “terror” arrests have dramatically escalated the problem, with the FBI admitting “hundreds” of such sting operation are now ongoing.

Increasingly, reports of detained “ISIS suspects” involve arrested Americans with literally no ties to ISIS, who were approached by FBI informants as likely to be susceptible, and then ultimately arrested for their involvement in an FBI-manufactured “plot.” The NY Times is reporting about two in three terror prosecutions in the US are such FBI-made fake plots.

Comments

I know next to nothing about economics but

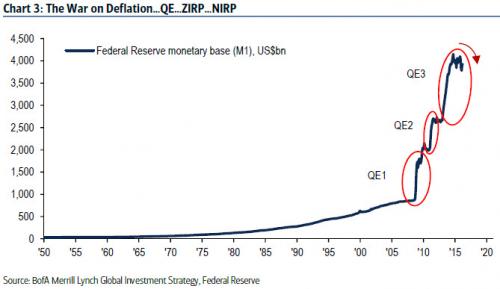

what the hell is ZIRP and NIRP, in the title on the last graph? Are those really economic acronyms? It sounds like the noise made when one is mired in a cesspool...

Think off-center.

George Carlin

Terms

ZIRP = zero interest rate policy

NIRP = negative interest rate policy

So they're not...

...things Mork from Ork would have said?

I want my two dollars!

2 in 3 terror plots are FBI entrapment?

I'm surprised. I would have thought it closer to 9 in 10. Or perhaps they count DHS or DOD or local police entrapment cases separately.

Our local law enforcement's "drug task force"

(they get such a boner when they get to call themselves the "drug task force") takes the same ounce of marijuana and has the same snitches sell it to each other.

"Just call me Hillbilly Dem(exit)."

-H/T to Wavey Davey

"entrapment" should be illegal

It is my opinion that law enforcement is doing themselves and the public a disservice. Instead of "protect and serve", we have devolved into the worst imagined by Orwell in "1984".

Look up at the stars and not down at your feet. Try to make sense of what you see, and wonder about what makes the universe exist. Be curious. Stephen Hawking

Is this a black hole

and not a bubble?

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

It feels like a black hole to me. eom

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Then I suppose that many of us

will get much closer (to broke).

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

It's a struggle every day.

I have $22 in the bank until tomorrow, when RAndy gets paid. I hold my breath every week. It's insufferable and no relief in sight.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

I have about $100 in mine until end of month

and promised ca $3500. oh my.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

YIKES!

This is what infuriates me! Look at how much we're struggling! I'm 63 and it shouldn't be this hard! When my parents retired at 62 - they were set until they died, 23 years later!

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Please keep writing!

Now that Krugman is getting senile, I love your contrarian economic posts.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

I was once a loyal believer, back in the bushit days.

Mr. Krugman is no longer on my reading list.

Look up at the stars and not down at your feet. Try to make sense of what you see, and wonder about what makes the universe exist. Be curious. Stephen Hawking

That M1 number is surreal

Pity the private sector can't do anything useful with all that liquidity...

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

Republicans for Hillary

because the RW radio-listening and TV-watching Republican base has been waiting for 25 years now just for the chance to vote for Hillary.

It's this very sort of mind-boggling D/R cross-pollination that makes it abundantly clear that both parties and their candidates are nothing more, or less, than hired help for the 0.01%.

Only connect. - E.M. Forster

ZIRP will chase money into the stock market...

Pension funds have no where else to go if they want returns on their funds. I guess you could assume deflation and say "please give me back at least what I put into this" or even "less than I put in" (Assuming NIRP). Even if pension funds can't save the market the printing of money from the FED can out spend all the "sellers" of this market combined. It seems like "save the market" at all costs is the meme of the day - and they can do it, for an extended time if need be. So look for new market highs to suck in the last amount of money they can to keep this rigged market buoyant until the elections...

Peace

FN

"Democracy is technique and the ability of power not to be understood as oppressor. Capitalism is the boss and democracy is its spokesperson." Peace - FN

Not a pretty picture, good evening gjohnsit

Do you think Brexit, if passed, could damage the EU and the world financial system?

Will we see a repeat in Europe of "too big to fail"?

Look up at the stars and not down at your feet. Try to make sense of what you see, and wonder about what makes the universe exist. Be curious. Stephen Hawking