The End Of The Great Bond Bull Market

Submitted by gjohnsit on Mon, 11/06/2017 - 10:02pm

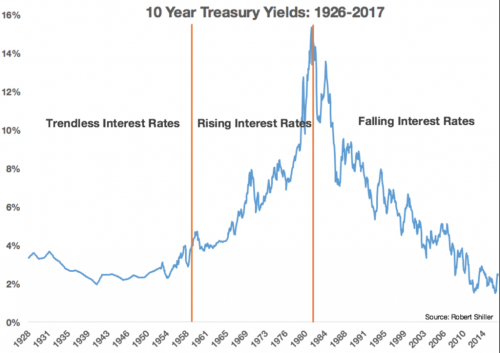

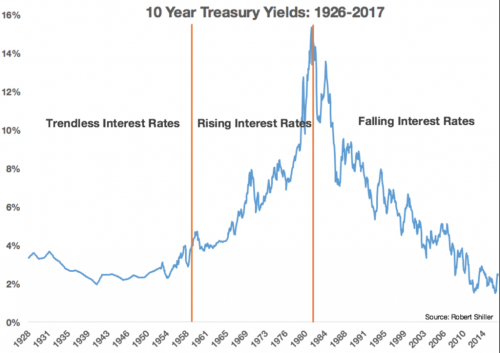

Interest rates have fallen for 36 year.

Let's put that into perspective.

Interest rates have fallen for 36 year.

Let's put that into perspective.

The failure of the Republicans to kill Obamacare, and eliminate health insurance for tens of millions of poor Trump supporters, is going to cause some serious problems for Republican plans to make massive tax cuts for the wealthy.

However, that might not be the primary obstacle to Trump's agenda.

The stock market absolutely loves the idea of a Trump presidency.

The stock market gets all the financial news headlines, but it's the credit markets that hold the real power. Or to put it a more colorful way:

“I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.”

- James Carville

A couple weeks ago I asked a question - How is this not a bubble? - after reading this.

The next spike in corporate defaults will be a doozy.

Imagine for a moment that some salesman offered you a deal.

They are willing to let you loan them money, and would only charge you a nominal fee plus a small rate of interest for the transaction.

In a sane world your answer would either be either, "Uh, no" or you would laugh in their face, depending on your mood at the time.

Pay to loan money?!? That's insane. Not just insane, illogical.

In a press conference last week, Fed Chair Janet Yellen was asked about negative interest rates. Yellen dismissed the possibility, but also said if "we found ourselves with a weak economy that needed additional stimulus, we would look at all of our available tools, and [a negative rate] would be something that we would evaluate in that kind of context."

All eyes are on Greece this weekend.