Damn Furriners might thwart Trump's agenda, and why this isn't something to celebrate

The failure of the Republicans to kill Obamacare, and eliminate health insurance for tens of millions of poor Trump supporters, is going to cause some serious problems for Republican plans to make massive tax cuts for the wealthy.

However, that might not be the primary obstacle to Trump's agenda.

I'm not talking about the Democrats, or the Freedom Caucus. I'm talking about China.

Signs are growing that the United States' nearly $20 trillion national debt is becoming unsustainable -- at exactly the worst time for President Donald Trump's plans to slash taxes and boost government spending.

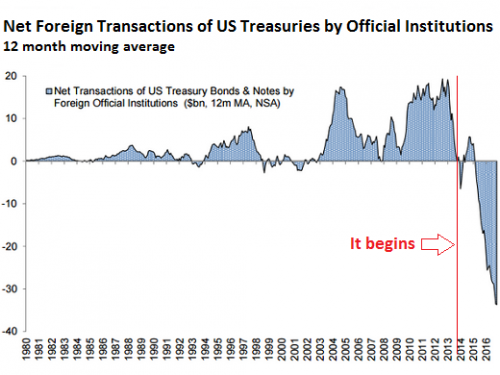

Foreign governments and investors have sold a combined $361 billion of long-term U.S. Treasury bonds since June, data show....

It's the rule that Americans have forgotten exists: You pay for your spending through taxes, or you borrow it. And if you borrow it, someone has to buy that debt.

Foreigners still hold $5.94 trillion, or roughly 43 percent of the U.S. government debt .

"There's all these grandiose plans for what Republicans are going to do now that they're in office, but somebody's got to buy this deficit that they're building," Bove said. "In the past, it's always been foreigners, but they don't want to do it anymore."

..Yet the Tax Policy Center, a nonpartisan think tank in Washington, estimated in October that Trump's budget plan would add $7.2 trillion to the national debt over the first decade.

According to the report, publicly held national debt will climb to a new record of 107% of gross domestic product in 15-25 years. The previous record of 106% was set in 1946, following a giant surge in military spending during World War II.

It isn't just China that is selling.

Japanese were net sellers of U.S. sovereign debt for three straight months through January, the longest stretch since 2013. Since Trump’s election, they’ve sold 4.28 trillion yen ($38.5 billion), Japanese Finance Ministry data show.

Foreigners have sold U.S. Treasuries for a 10th straight months.

China has sold Treasuries in seven of the last eight months, while Japan has sold fourth consecutive months.

So far all this selling has caused only a modest increase in interest rates, but Trump and the Republicans could change that.

The president has singled out Japan and China, the two biggest overseas creditors, as well as Germany, for devaluing their currencies to gain an unfair advantage in trade.

The primary method of devaluing your currency is by buying another nation's debt.

Which means if Trump gets what he wants, there will be a lot more selling of our Treasuries.

It isn't just foreigners that are a danger of selling lots of Treasuries due to Republican policies.

U.S. commercial banks now hold $2.4 trillion in government debt and agency securities, more than double the total from nine years ago, according to the St. Louis Fed.

But House Republicans — with the support of the administration — are pushing to roll back parts of the Dodd-Frank regulations that were put in place after the 2008 financial crisis. That means banks could get a reprieve from those capital level requirements, and they could reduce their Treasury holdings as a result.

..Banks have already been slowly selling off the debt, which causes yields to rise.

While some of this is a reaction to Trump, most of it is simply the culmination of long-term trends.

In fact, a significant portion of the reasons for all this Treasury selling has nothing to do with anything going on within our borders.

It started with a whimper a couple of years ago and has turned into a roar: foreign governments are dumping US Treasuries...

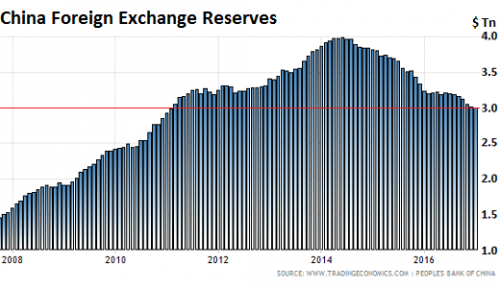

Some, like China and Saudi Arabia, are unloading their foreign exchange reserves to counteract capital flight, prop up their own currencies, or defend a currency peg.

China is selling Treasuries to prop up their currency, because its wealthy citizens are desperately sneaking their money out of the country by the trillions before China's historic credit bubble pops.

Saudi Arabia is selling Treasuries to pay for an unwise, stalemated war in Yemen, while oil prices are too low.

Both of these examples deserve their own essays. Both of these examples are beyond the control of Trump.

With Puerto Rico straining the muni bond market, subprime auto loans straining the ABS market, and Italy's banks straining Europe's banking sector, a liquidity event in Treasuries could cause a global crisis.

Those unfamiliar with how money works may think that we can simply print our way out of this mess.

But more recent data showing outright sales of U.S. securities by China suggests a less cavalier attitude would be in order. It isn't the end of the world, just a portent of what can happen when the biggest buyer of America's biggest export -- its IOUs denominated in dollars -- stops buying.

That would leave the Federal Reserve as lender of last resort to the U.S. government to fill the gap left by its biggest creditor. Think this Zimbabwe style of central-bank monetization of an unsustainable government debt can't happen in one of the world's major industrialized democracies? Well, it may be starting in Japan.

The situation in Japan has been coming since 1990, and also deserves its own essay.

Nevertheless, you can only print your way out of debt once. After you do that, no foreigner will want to buy your debt again. Not without collateral.

If the selling pressure increases then the bond prices will drop and interest rates will rise.

This doesn't just mean that much more of the budget will have to be set aside for interest on the national debt.

This doesn't just mean that Trump's massive giveaway to the rich will be impossible without blowing up the budget.

This doesn't just mean that mortgages will be difficult to obtain.

It means that we've had eight years of Fed-induced artificially low interest rates, which has encouraged everyone to borrow too much (both corporate and consumer). Rising interest rates will make affordable monthly payments suddenly unaffordable, leading to rising defaults and another financial crisis.

Comments

Governments CAN and DO run out of money!

Oh, you mean like the beLIEvers in Modern Money Theory?

Which is incorrect. As you state:

Attempting to print one's way out of debt always results in hyperinflation. The most famous example is that of the Weimar German Republic in 1921 - 1924. You cited the example of the Zimbabwe dollar, and the Hungarian pengo are other examples.

The linked article on the German hyperinflation closes with this cautionary passage:

And we're heading in the same direction, and for the same basic causes. The German situation had its roots in military overspending under Kaiser Wilhelm II, just like our current situation today.

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Uhh...not so much...

Uhh...no. The Weimar hyperinflation was propelled by the war reparations demands of Britain and France, who insisted that the billions they were owed must be paid in gold or an acceptable hard currency that was not a German Mark.

Since they did not have the gold or hard currency required and payments were due, the Weimar government was forced to simply buy up whatever gold/hard currency they could obtain at whatever price might be demanded in the international exchanges, printing whatever Marks were demanded by the sellers of gold/etc.

Though these Marks were then being held primarily by foreigners (banks, mostly), who could not spend the Marks in their own country nor lend them to domestic buyers, they were then ultimately lent to German banks/borrowers on extremely favorable terms to those German borrowers, who then spent those Marks in Germany.

That is the indirect method by which the 'printing press' Marks were introduced to the German economy. Once the inflation began to get pretty bad, the borrower/spenders of those Marks understood that they needed to spend them right away, before they lost value over time and would end up buying less.

The hyperinflation had almost nothing to do with the money that the Kaiser's government had borrowed & spent on The Great War.

James Kroeger

the Weimar hyperinflation

Which reparations came from the fact that Germany escalated a war that wasn't theirs to begin with.

I don't deny that the war reparations were key to the Weimar hyperinflation. I just think that if Germany had stayed out of the War -- or allowed the peace feelers from Austro-Hungarian Emperor Karl to take root rather than quashing them and, in fact, threatening to make war on Austria and Hungary if they continued -- the reparations would have been left at levels Germany could manage. Instead, Wilhelm II extended the War for nearly two years almost single-handedly. Those were significant factors in setting the reparation amounts in 1919. Even though Austria-Hungary had started the War, Germany under Wilhelm II insisted on prolonging it. And Britain, France, Russia/USSR, and the USA neither forgot nor forgave. Reparations were set in amounts and terms deliberately calculated to cripple Germany, with the result that not only was Weimar indeed crippled, but the Peace of Versailles of 1919 was in reality only a truce, broken twenty years later by Hitler who preferred prolonged war to peace at the Versailles cost.

Or, as the Wikipedia article put it:

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Interesting thread of reasoning...

Well, there's no doubt that if Germany had not committed itself to joining Austria's expected war with Russia, the German people would have been able to avoid the hyperinflation as well as the deaths of 2 million Germans. But the decision to go to war was equally stupid for just about all of the belligerents.

Britain had no good reason to join the fight that justified the deaths and maimings of so many of their people (the excuse about Belgian neutrality was revealed to be so much hypocrisy after they stomped all over Greece's neutrality). The Russian autocracy would certainly never have committed itself to Serbia if they had know that the price would be the deaths of millions of Russians and the end of the Romanov dynasty.

Perhaps the least justified of all the participants was the United States. WWI was clearly the least justified war America has ever participated in. How important was the sinking of American ships that defied Germany's blockade as a reason to go to war? Our government could easily have said to America's merchant fleet: Look, they've told you that they're at war with Britain and that they'll sink you if you try to make money off the situation, so STAY AWAY from that war zone. You know, like how we did it at the beginning of WWII, when precisely the same situation was faced.

(Head shaking)

James Kroeger

where the rubber hits the road

Here, of course, is where the rubber hits the road. All wars are stupid, of course; but WWI was the single stupidest war fought since the end of the Western Roman Empire. With the exception of the bullying of Serbia by Austria, all other entry into that hideous War was "you declared war on my friend, so I'll declare war on you!". This includes the USA, by the way. The use of the excuse of the sinking of ships with loss of American lives was entirely for domestic consumption, largely to keep German-Americans and Austro-Hungarian-Americans from deserting Woodrow Wilson, whom they had voted for in predominantly large numbers in 1912.

It all was pretty effing stupid. (As you are well aware.)

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Wars are not stupid for

all the players. Wars throughout history have made fantastic profits for a select few - especially for those that finance them.

@thanatokephaloides I disagree with you, but

I disagree with you, but the fact is we shouldn't be in this damned position anyway, no matter which monetary theory you subscribe to. Obama managed to kick the can down the road; now it's going to explode in Trump's face (b/c the govt won't endorse MMT even if its tenets ARE true; they couldn't afford for anyone to believe those tenets; it breaks the justification for more than half of the lousy shit they do.

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

MMT

CSTS, you apparently subscribe to Modern Money Theory:

The principal flaw in MMT is this: No matter who one might be, whether an individual or some sort of "currency sovereign", one cannot simultaneously dictate the number of currency units in existence and the value of each of them. No one in history has ever done both at the same time, ever. The more currency units in existence, the less each one of them is worth in absolute terms, i.e., the ability of each unit to purchase real things.

As every example of hyperinflation in history demonstrates, again and again, this is a law of nature. It is exactly as subject to the demands of human power as is the law of gravity.

Conversely, I could ask you for an example -- any example -- of a nation successfully expanding the number of currency units while maintaining the value of each one of them. Again, none such exists because none such can exist.

The only reason precious-metal hard currency holds its value is that the materials from which it is made have an inherent cost; this tends to prohibit this currency (specie) from dropping in value below that cost. Also, the supply of hard currency is directly controlled by the available supplies of the materials from which it is made, which also causes it to retain its value.

It is only when national governments can create currency without having to spend some currency first, i.e., through fractional reserve banking, that the problem of number of currency units in existence versus the absolute value of any one of them arises.

And it always arises at that point.

That's how governments, even "currency sovereigns", run out of money. And it really does happen.

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

@thanatokephaloides You want to debate

You want to debate the relative merits of MMT; I don't have any interest in doing that any more than I have an interest in debating which methods would be best to save the remaining coral in the Great Barrier Reef, and for similar reasons. No one in power cares whether MMT is true or not. MMT could be the kind of bedrock truth that is expressed in the law of gravity or the speed of light and the government still wouldn't derive policy from it, because polices that arose from MMT assumptions would not support the oligarchy. There's no point in talking about MMT--or any alternative theory of money--unless we intend to build a separate economy with, probably, a new kind of currency. So I guess I might as well just say "Yes, of course, you're right--of course MMT is shit, and conventional theories of money and finance are gospel truth!" because they might as well be gospel truth, because nobody in power is going to use any other assumptions to generate policy (why should they? from their point of view, things are going swimmingly).

"More for Gore or the son of a drug lord--None of the above, fuck it, cut the cord."

--Zack de la Rocha

"I tell you I'll have nothing to do with the place...The roof of that hall is made of bones."

-- Fiver

Please explain.

If China presently holds US debt at 1% interest and sells it on the open market at a loss in anticipation of buying US debt at 4%, how is that anything other than rational behavior? It doesn't mean newly created US debt will be unsellable. It doesn't mean the US won't be able to finance its spending spree.

I'm not sure I understand your question

Of course China is acting rationally.

China's main problem/concern is internal. They've blown one of the most massive credit bubbles in history.

It's explosion will be so large you'll be able to see and hear it from California.

That's why China's government keeps locking down capital controls - to keep the rich from escaping with their stolen wealth. That's why bitcoin in yuan is at records.

This is a big essay in itself.

Bursting Bubbles in our economy

subprime auto loans

27% of student loans in default

what that does to housing

commercial real estate: the bubble no one is looking at

The picture is not complete without the detonator

…of the Dollar catastrophe the US is facing: the current Petrodollar albatross. Just last week, Saudi Defense Minister and Deputy Crown Prince Mohammed bin Salman, and his entourage showed up at the White House to instruct the President. As a result, President Donald Trump has opted for a policy of appeasement to Saudi Arabia — despite his tough campaign rhetoric — which includes a $200 billion investment into the Saudi economy amidst sweeping cuts to U.S. foreign aid.

And, of course, President Trump was forced to participate in multiple Saudi-led war crimes, resulting in a massive humanitarian crisis that claims the lives of an estimated 1,000 children every week. In supporting the Yemen genocide, the US has “assisted” the Saudi campaign with airstrikes and massive arms sales to honor the decades-old U.S.-Saudi arrangement of security-for-oil. The Petrodollar is the only thing that is now propping up the US Dollar, internationally. It is little wonder that Trump recently dropped more bombs on Yemen in one week than Obama did in an entire year.

This information may not have been analyzed for Americans by US news sources.

Ahhh. Thanks.

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

I think I finally get petrodollars now

Thanks for the summaries.

One question: were we to succeed in weaning the world off the ICE in favor of simpler, cheaper, electric cars, that could crash the oil markets. It seems that this would in turn radically reduce demand for dollars and change exchange rates dramatically. Does that make sense?

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

There are many moving parts

…to that scenario. Plus a disruptive technology with a fast execution.

The Petrodollar is only one aspect of the dollar's use for foreign trade. Its value is political clout for both the Saudis and the US. It lets the US impose sanctions and force their will on other nations, and it and forces the rest of the world to go along. If an oil-producing country doesn't go along (think Russia, Venezuela, Iran) they become the "axis of evil."

But the fact is, the Petrodollar is doomed already. Saddham and Gaddafi were killed because they tried to sell oil for gold, but now everyone is doing it, starting with ISIS and now Iran. China is buying it from Africa for Yuan and Russia sells it for gold or Rubles or whatever. The Saudis ruined the scam when they started over-producing with OPEC and crashed the price of oil a couple of years ago. International think tanks and bankers are already talking about the US defaulting on their global debt due to the demise of the PetroDollar, but most conclude (correctly) that the US would never do that. The US may suddenly find that their dollars might not be accepted in a trade negotiation, however, so it will be rough going for awhile for the US to cover trade deficits.

Personally, I think humans will suck every last drop of oil out of the ground and burn it. Even if everyone had electric cars, they would burn it to make electricity to charge those cars. 93 percent of all oil pumped is owned by the people (nationalized), which means the people rely on that income. Places like Norway, for example. The US is one of the few countries where the people do not own the oil, so the US oil corporations are the ones calling the shots, collecting the wealth, and designing the trade agreements.

If there was another robust way to make energy, like cold fusion for example, that would be a total game changer.

Anyway, beyond oil, the Dollar is also used for general trade between foreign nations. A weak dollar or a strong dollar won't change that because its relative when non-dollar nations are using it for trade. Generally, currencies trend together and upcoming trades are hedged when the deal is made so there are no surprises. However, if all foreign nations conspired to trade with each other, using something other than the Dollar, and allow their dollar reserves to dwindle, the US dream of ruling the global Empire would abruptly turn to ashes. The international murder-sprees would end. As many as 1,200 foreign military bases would close. Ultimately, that is the salvation of the American people. They could finally take their country back, reorganize their priorities, get out of debt, and build a promising future for everyone. That's what I am counting on.

[Edit typos]

Me too.

"I’m a human being, first and foremost, and as such I’m for whoever and whatever benefits humanity as a whole.” —Malcolm X

Alrighty then...

Uh, yeah...it can't happen because The Fed would not allow it to happen.

They are way too fearful of inflation to allow anything remotely like a Zimbabwe hyperinflation to happen. (Yes, it could happen theoretically, but if you don't know how opposed to inflation our central bankers are, you don't know anything. I think Wray is guilty here of over-hyping it to sway political minds.)

What would/will happen is The Fed will monetize the debt (buy the Treasuries others are selling) to keep interest rates and the dollar's strength around the targets it has set. BUT, if they perceive that an increase in government spending using borrowed money is starting to 'overheat' the economy, they will throw the economy into a recession, just as they always have when facing the same 'threat.'

Would that recession put the FIRE sector at risk of a serious meltdown? Yes, but nothing that another Fed bailout (and years of suffering for poor people) wouldn't be able to fix, IMO.

James Kroeger

I don't think you understand

Those are conflicting actions. The more debt that is monetized, the weaker the dollar gets.

The Fed is not all-powerful. If foreigners don't cooperate then the currency (and eventually interest rates) is out of the hands of the Fed.

Oh I understand...

There is not a direct causation here. If the PBC starts becoming a net seller of US debt (and does not spend the $$ on other U.S. assets), this would mean that it is accepting a higher XR for the Renminbi vs. the dollar. And that means a weaker dollar (vs. the Renminbi). Hell, one of the biggest reasons they had for buying so many US paper assets was to keep their currency weak.

This weakening of the dollar vs. the Renminbi would have nothing to do with The Fed deciding to buy Treasuries to finance the U.S. Treasury's debt issues but by the unilateral actions of the PBC, alone.

I know there are many in the finance industry who like to exaggerate the importance of the confidence, or lack thereof, of international investors in the U.S., but their actions can almost always be counter-acted by a knowledgeable central bank.

Now it's true that there are many in finance circles who would like to believe that excessive government debts lead more or less directly to inflation, but there is no actual cause & effect relationship. If, for example, we were already in a severe depression and the Fed decided to finance a massive increase in govt. spending on infrastructure, there would be no hint of inflation involved.

Actually, they are as close to being all-powerful as one can imagine. Remember the 2007-8 crisis? The big pitch to Congress to put up $900 billion of taxpayers dollars to finance the bailout was never necessary in any economic sense. The Fed had the power to do it all on its own. The only reason Bernanke et al. did the "we all gotta work together" talk was to get Congress to put its own skin in the game, which put those who voted for it in a position to defend the Fed's actions (buying up worthless assets on bank ledgers with $$ created with a keystroke) when it covered all of AIG's worthless commitments.

Otherwise, there would have been widespread outrage over the way that the Fed took care of its own privileged family and that would have provoked talk of reforms.

James Kroeger

Think about that for a moment

If they were really that powerful then why do we have so many financial problems?

Why has no one discovered this "secret power" before now?

Secret power

There's nothing secret about it. They just don't volunteer any information that might be 'misunderstood' by the underclass. So it's not widely understood. It's not expounded on in textbooks. And whenever a sensitive question is raised, it is dismissed by "the smart ones" as being insignificant.

So I guess you could say there is a conspiracy of silence going on.

I still read articles by economists who insist that the Fed is a government entity, simply because it has the word 'Federal' in it and because the President is allowed to appoint seven members of the FR Board of Governors.

Even the BOG appointees the POTUS does nominate are strongly influenced by the banking industry both directly and through their constant lobbying efforts with members of Congress.

The actual truth about The Fed it is privately-owned (by commercial banks) and receives no funding from Congress. It is a creation of the commercial banking industry that serves the interests of the commercial banking industry.

You've heard of the shadow government? They are a significant part of it.

James Kroeger

The 20% border tax, how does the Trump admin think that

will help? US imports a lot of food from Canada and Mexico. From Canada forest products and water to name two commodities. These will cost more in the USA as a result. How is that going to help anyone? Do they expect the countries penalized by the 20% import tax will want to continue friendly trading policies with the USA?

To thine own self be true.

@MarilynW

The US has the world's largest military. At this stage, I do not want to bet that US corporate politicians would not start bombing Canadian cities 'back to the Stone Age' over trade disputes.

But on the plus side, being flattened would get us out of a lot of really bad 'trade deals' with no further worries, so I'd personally go for Fair Trade only or a faster death that that of being slowly drained and poisoned-for-profit by The Parasite Class...

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Finance is fascinating to me, but I lack enough knowledge

to understand wading in the weeds.

One thing many of us hoped and begged for at the beginning of Obama's first four years was a large infrastructure effort. The interest rates got so low that funding even a very large debt would amount to debt, but interest free.

Now what? If we still want those projects, and have the political will to go forward with them, don't they come at a higher price as each day passes?

Some smart person can set me straight.

Thank you for all the economic and finance essays. They always help and give more perspective than I get any where else.

You may choose to look the other way, but you can never say again you did not know. ~ William Wiberforce

If you can donate, please! POP Money is available for bank-to-bank transfers. Email JtC to make a monthly donation.

Depends which infrastructure you're spending on.

Roads and transportation increase the GDP by $2 or more for every dollar spent because it increases capacity and productivity over the long term. During economic downturns, the effects are even larger. During the 2009 American Recovery and Reinvestment Act (the stimulus), the infrastructure portions spent in 2009 and 2010 yielded four times larger economic growth than normal.

Devout conservatives say it doesn't create jobs or boost the economy because someone rich somewhere has to pay more taxes. Seriously. There's a case to be made that spending money "repairing" the existing infrastructure won't provide much bang for the buck. Once you build a highway, it costs 5 to 10 percent of the investment every year just to maintain it. If you neglect it for years and years, you're just building the same highway over again when it falls apart. You gain nothing but debt.

Trump's plan during his rallies was to cut military spending and use that money to bring US infrastructure into the 21st century. But the Deep State Neocons got him early and bamboozled him into increasing Empire's war spending far beyond the Pentagons wildest dreams. That's more than half of all government revenues thrown down a black hole, never to be seen again. All we get out of it is a bunch of brain injured veterans, militarized police departments, tax cuts for the wealthy, and steep deficits which require deep cuts to social programs.

This is why we can't have nice things.

Not in 2017. Not until Empire collapses.

Either way, money has to be borrowed by selling Treasuries. I think it is helpful to look at US Treasuries as if it were a big bank. People from all over the world store their excess money in this bank for a specific amount of time, earning interest. But here's the thing — the US Constitution guarantees that foreigners will get all their money back, no matter what. It can tax the American people for this purpose. US citizens and institutions don't have the same guarantee, and could take a haircut.

Yet, even with a guarantee, the world has stopped depositing their money in US Treasuries.

Looking at the chart, I'd say the world started to sour on the US sometime between Edward Snowden's whistle blowing on the NSA and the US overthrow of the Ukraine's democratically elected government.

No more safe haven?

The Fed has no choice but to raise interest rates to compensate for the perceived risk in investing in the US.

Thank you. And if I read it right, it's the foreign investment

in our treasuries or their lack, that will stop investing in infrastructure improvement.

You may choose to look the other way, but you can never say again you did not know. ~ William Wiberforce

If you can donate, please! POP Money is available for bank-to-bank transfers. Email JtC to make a monthly donation.

There has to be a source for the money

...which is generally the sale of bonds. Modern money theory doesn't see it that way, but we're not there yet. Most of the rest of the world doesn't work like that, when it comes to infrastructure investment.

In a normal country, that possesses a supply of commodities and resources, the citizens own the nation's natural resources, collectively. The profits from the sale of those resources is typically used to nation build. Almost any country you can think of works like that.

The US has a plantation economy. The people don't own the nation's resources, or profit from them meaningfully. All the people have is their labor and their debt. For fifty years, between FDR and Kennedy, we built an advanced infrastructure from tax revenues, which were 93 percent at the top marginal rate. That's where the middle class came from, and the interstate highway system. Now, the US has just about the lowest overall tax rate in the world. (See Forbes Misery Index.) So, the American colonists are merely circling the drain. They've become the resource being exploited.

@Pluto's Republic

You always put things so beautifully, in showing their ugliness, as do so many other others here... thanks for being, and especially for being here where people like me can read your points.

And thank goodness and JtC (have I even got that right? The interior painting and other redecorating-for-sale here is scrambling my already-fried brain, lol) for this site!

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

You are too kind, Ellen.

I thank you for your words, but I am mindful that there are some madly brilliant "explainers" here. I've learned more in the past 18 months than I had in the previous years I've been blogging. I can name six topics I was a near blank on just a year and a half ago. I was certainly oblivious to the intricate function of political parties, and a lot weaker in history when I first got here. Lucky for me, this is a nest of willing teachers. Also, the curiosity factor is very high here. So many open and inquisitive people like you. You bring a lot of energy, which I appreciate. The quality of the thinking here… it doesn't get any better in my experience.

@Pluto's Republic

Well, you're definitely one of the brilliant crowd here, even if I often don't think to mention my appreciation to individuals for the level of illuminating discourse and information-sharing here, mostly on the grounds of this generally being so obvious and especially because of there being far too many examples to do so.

Gotta agree about the quality of the thinking on this site and add that the quality of the people here couldn't get any better, either.

Lol, and thanks for trying to say something nice about my sticking my often-insufficiently-informed nose in everywhere, even when I'm obviously in over my head and, properly speaking, my nose really shouldn't stretch that far. Still, it is mostly cartilage, you know.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.