Yes Virginia, it's a Bubble

A couple weeks ago I asked a question - How is this not a bubble? - after reading this.

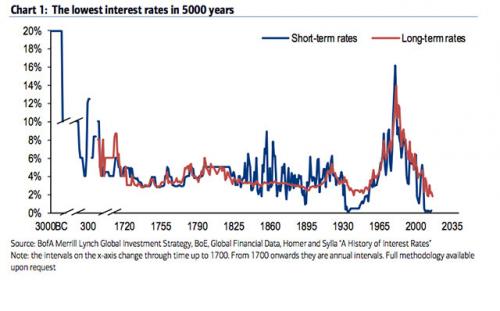

Interest rates today are the lowest they’ve been at least since Stonehenge was under construction and the pharaohs of the First Dynasty ruled Egypt, Bank of America Merrill Lynch (BAML) said in a report this week.

In fact, according to another new report, this one from the Bank of Montreal, interest rates have fallen so far that some governments can actually make money by borrowing it — essentially destroying any argument for spending cuts.

Then today I ran across this article on the ultra-bullish Yahoo financial site.

"We're in an epic bubble of colossal proportions," Peter Boockvar, managing director and chief market analyst at The Lindsey Group, said Tuesday on CNBC 's " Futures Now " in reference to the fixed income market....

Ultimately, Boockvar warned of the fallout that could occur if multiple nations opt to end what he referred to as a "negative deposit rate regime."

"Even if they put it back to zero, imagine the carnage, at least in the short-term bond markets," concluded Boockvar.

OK. It's one person's opinion. It doesn't mean much more than that, amirite?

Actually, no.

How can I be so certain? Because of this.

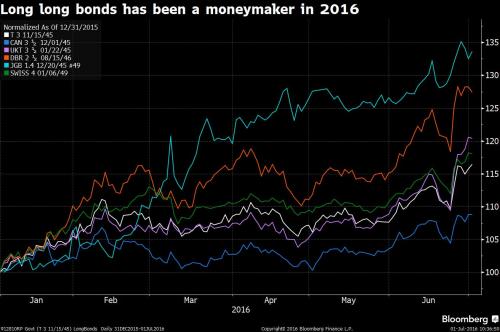

The downward march of long-term bond yields in 2016, which have sent the entire Swiss yield curve into negative territory, has been a wonder to behold.

For investors who bet on super-low yields to go even lower this year, the returns in the first half of the year have been stunning...

The standout performer, the Japanese long-term bond, has rallied by more than 30 percent year-to-date.

By contrast, an investment in the S&P 500 at the start of 2016 would have garnered a total return of roughly 4 percent at the end of the first half.

To sum this up:

one of the best performing investments you could have made this year is to PAY SOMEONE TO BORROW MONEY FROM YOU.

Wait..What?

Let me put this another way.

Bond prices and interest rates are directly inversely correlated. So the lower interest rates go, the higher the price of the bond. It still applies when interest rates go negative.

So current bond holders will celebrate at negative rates (NIRP)...However, negative rates will gradually eat into those profits of recent buyers. Therefore rates have to go more negative at a faster rate to make up the difference, which of course, eat into those profits even more.

Does that somewhat Ponzi-ish?

The Ponzi in this case are the central banks, and like any good Ponzi scheme, someone has to loose money.

Let me correct that: investors aren’t buying the JGBs anyway. The only entity that is buying on a net basis is the BOJ. Everyone else is selling. And when these investors slow down their selling just one notch, even as the BOJ continues mopping up every JGB that isn’t nailed down, yields fall further.

What does this mean for investors that bought bonds with long maturities years ago? For example the German 4.75% Bund, issued in 2008 and due in July 2040 trades at 202.3 cents on the euro, having doubled its value over the past eight years. The sellers of those bonds are the true beneficiaries of Draghi’s monetary policies, and they can sell them right to the ECB.

But long-term investors, like insurance companies and pension funds, hold bonds to maturity to create predictable income streams to pay for predictable benefits decades down the road. They’re going to get face value for these bonds when they’re redeemed. And 30-year bonds that these insurance companies and pension funds are now buying have a yield of 0.32%. Next to nothing!

They’re completely screwed. Or rather, the regular folks who are supposed to get these payouts in the future are completely screwed.

Well, just wait, because you haven't seen the craziest part yet.

The price of junk-rated Ohio tobacco debt that may never be paid in full has climbed 14 percent since the start of the year. New York City’s Albert Einstein College of Medicine sold $175 million of unrated securities in January at par for a yield of 5.5 percent. Now, they’re worth 122 cents on the dollar and yield 2.8 percent, according to data compiled by Bloomberg. Even those issued by Puerto Rico, which has been defaulting on a growing share of its debt, have returned 8.4 percent.

The same Puerto Rico that just defaulted on $2 Billion in debt.

The same Puerto Rico that just got it's credit rating cut by Fitch to 'D'.

Note that a rating of 'D' is BELOW junk.

If you loaned money to this dead-beat, your return on investment would have been DOUBLE the stock market this year.

Wait a sec. Making money by loaning money to broke dead-beats.

Where have I heard this before? I seem to remember something about this from a decade ago.

Everyone seems to be ignoring that fact that ultra-low interest rates and flat yield curves have almost always been the sign of an economy in real trouble.

The spread between the yield on 10-year and two-year U.S. Treasury notes narrowed in the immediate aftermath of the June 23rd referendum, widened briefly, and is now shrinking again as investors continue to flock to the perceived safety of U.S. government debt. A model maintained by Deutsche Bank AG's Steven Zeng, who adjusts the spread for historically low short-term interest rates, suggests the yield curve is now signaling a 60 percent chance of a U.S. recession in the next 12 months — up from a 55 percent probability as of mid-June, and the highest implied odds since August 2008.

"This relentless flattening of the curve is worrisome," Deutsche analysts led by Dominic Konstam said in their note on the model. "Given the historical tendency of a very flat or inverted yield curve to precede a U.S. recession, the odds of the next economic downturn are rising."

If you need help understanding this, and I don't blame you if you do, watch this video below.

Comments

The only great pyramid scheme

was done by the ancient Egyptians.

Wealth is nothing but power. There is no real value except the control of others.

Regardless of the path in life I chose, I realize it's always forward, never straight.

I don't understand this, but it seems like we need to somehow

stop divorcing the behavior of the stock market from reality. I don't know if it's a bubble, but it certainly seems unreal.

Please check out Pet Vet Help, consider joining us to help pets, and follow me @ElenaCarlena on Twitter! Thank you.

What is unreal here is the bubble contention

I am a full time securities trader - I do not claim to have a monopoly on knowledge but I do know a thing or two about this subject. gj is claiming the bond market is in a bubble. A bubble is when certain assets reach irrationally high valuations. A bubble ends when everyone who could possibly buy has bought, like low wage workers buying mansions in 2007. Bonds are valued inversely to interest rates - rates down, bonds up. That's all that's happening here. We don't see the proverbial man in the street hocking everything to get into bonds, taxi drivers imparting the latest hot bond tips, etc.

Interest rates are pathologically low because austerity idiots in the EU, and Repukes in the US, refuse to allow governments to spend money to put people to work, so the bankers are doing what they can to try to take up the slack.

Could you add more?

I'd be interested in hearing more of your views on this subject, wilderness voice. Your vantage point certainly would add to the discussion. Perhaps an essay?

I don't have much to add

except to say stock valuations are high because yields are so low. The market is not going to decline until the fed does some major raising of interest rates, which does not appear imminent.

All that's happening

All that's happening is that interest rates are at a 5,000 year low. Which makes bond prices at a 5,000 year high.

And what's going to change that?

- a pickup in economic activity

Why stop at 5,000? Those Neandertals were no slouches - you wouldn't find them giving out none o' them lily livered interest free loans. Fer sure this has gotta be the lowest interest rates in 200,000 years, minimum.

Thank you for this information! I am not familiar with all the

ins and outs, but I do believe in austerity idiots. They make no sense. They know spending on the MIC improves the economy where defense plants are located. Why wouldn't spending for any purpose improve the economy wherever the spending takes place? Of course it would. There's nothing magical about war spending.

Please check out Pet Vet Help, consider joining us to help pets, and follow me @ElenaCarlena on Twitter! Thank you.

don't see it

... that is the 'proverbial man in the street' ever buying bonds ... don't see that ever happening. But then again tulips might make a comeback but, IMHO, normalized interest rates will not return until we're back on a sound monetary system. The grand world wide fiat system reckoning may be at hand ... history doesn't have any records of soft landings from such pinnacles of monetary madness.

And speaking locally

Wassup?

http://wolfstreet.com/2016/07/07/foreign-investors-chinese-pull-back-fro...

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

Over at Naked Capitalism

And

http://www.nakedcapitalism.com/2016/07/political-and-financial-contagion...

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

They're doing it again.

We didn't bust them the first time, now they're making a habit of it.

Funny, I do not recall ever hearing that Stonehenge

was financed. I assumed on first read that this was snark.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

BAML did not claim that Stonehenge was financed.

Bank of America Merrill Lynch mentioned the construction of Stonehenge and the First Dynasty in Egypt were mentioned to fix a point in time:

"Interest rates today are the lowest they’ve been at least since Stonehenge was under construction and the pharaohs of the First Dynasty ruled Egypt, Bank of America Merrill Lynch (BAML) said in a report this week."

It's just a more dramatic (or more pseudo-intellectual, depending on your point of view) way of saying that interest rates have not been this low in five thousand years.

I guess the Romans financed their causeways

off the backs of their citizens, too. Much like we finance MIC.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Too right they did

and they kept raising taxes as long as they could get away with it - until enough people decided that the barbarians on the border were less of a threat than the tax collector next door.

There is no justice. There can be no peace.

Don't worry! Hillary will tell them to "just cut it out"!

Of course, she's speaking about cutting out your retirement and your children's future.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

The market will indeed crash

I don't know when. Maybe tomorrow. Maybe 5 years from now.

What I do know with absolute certainty is it won't be for one of the reasons cited by people who have been saying the market is going to crash for the last 8 years.

Their financial advice, if you were unfortunate enough to follow it, was disastrous.

Really these people like the ones cited here.

Wolf Richter for example, cited here, has been the housing market was going to collapse since 2011.

And the housing market may indeed collapse. But saying it was going to happen 5 years ago is shit advice given what it has done since.

But there is a market for doom and gloom.

It's important

to not acknowledge ANYTHING I mentioned above.

Otherwise we might have a constructive debate.

End stage monopoly capitalism is marked by several things,

one of which is the financialization of the international economy. Another is secular stagnation (which is economist-talk for persistent slow growth and lack of areas where excess profits can be invested).

Summers and Stiglitz have both made official pronouncements on the stagnation of world economies but neither have been able to bring themselves to mention the economists who have gotten this correct because they don't exist for the purposes of the triumphalist capitalist model. Hint: 50 years ago Monopoly Capital by Baran and Sweezy was published and foretold the direction the concentration of wealth and political power was heading. Since then, many economists working in this tradition have made important contributions to the understanding of how this works and why it is unfolding as it is.

(Market timing is still for suckers though.)

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Worth remembering the 1990s . . .

1997 Asian financial crisis. 1998 collapse of the ironically named Long-Term Capital Management. Japan was mired in the first lost decade. Gasoline prices crashed to $18 per barrel. Yet the Dow Jones increased in value by nearly 70 percent in the span of three years from 1997 to 2000. It took two years to wipe out three years of gains, before the market rebounded and doubled in value, only to wipe out nearly a decade of gains before another huge run up in prices. At least based on that history, we may be in a bubble, but it could be another year or two before it pops. On the other hand, there's a lot of uncertainty in the global economy right now.

Thanks gjohnsit.

Edited because it originally contained "JtC" instead of "gjohnsit" due to auto fill and my inattention. Sorry.

-Greed is not a virtue.

-Socialism: the radical idea of sharing.

-Those who make peaceful revolution impossible will make violent revolution inevitable.

John F. Kennedy, In a speech at the White House, 1962