The End Of The Great Bond Bull Market

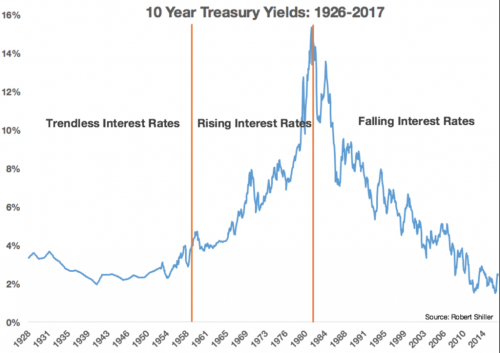

Interest rates have fallen for 36 year.

Let's put that into perspective.

We’re currently living through the second longest bond bull market in recorded history, and the longest since the 16th century, according to a new research paper from the Bank of England.

...“The average length of bond bull markets stands at 25.8 years, and the range falls between 61 years (1451-1511) and 12 years (1718-1729). Our present real rate bond bull market, at 34 years, is already the second longest ever recorded,” Schmelzing writes.

Interest rates have fallen for so long that last year they reached their lowest levels in 5,000 years of recorded civilization.

When you have to go back to the ice age to find lower interest rates, you know that they can't fall much further. At some point the charts will show that an absolute bottom has been reached.

They have.

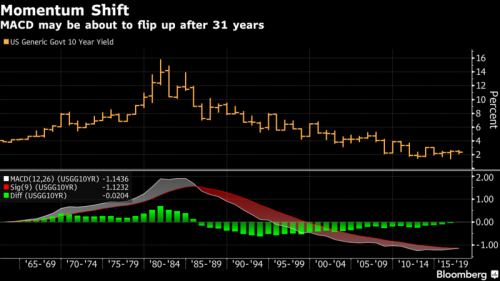

The yearly MACD chart -- moving average convergence and divergence -- for 10-year Treasury yields is getting very close to crossing the nine-year signal line. The two have met just once before, back in 1986 when the MACD’s slide below the signal indicated momentum was there for the sort of declines in yield that the current long-term bond rally has delivered. If the two cross in the other direction it would indicate the potential for sustained increases in yields.

Treasuries traders may need to get ready for the Halley’s Comet of chart points to appear. If it comes, it may be signal the end of the market as they and their forbears have known it.

And then there is this one.

“While everyone is watching the stock markets looking for a bubble to burst, or stressing about Europe, the real risk is probably complete mayhem in bond markets,” Blain said (see chart below).

The moment of truth has arrived for secular bond bull market! Need to start rallying effective immediately or obituaries need to be written.

— Jeffrey Gundlach (@TruthGundlach) October 24, 2017

Why does this matter?

For starters, interest rates have fallen for longer than a career on Wall Street.

There is no one left working on Wall Street that even knows how to trade a bond market in which interest rates are rising.

I think this is a very underappreciated dynamic.

Secondly, once-in-the-life-of-a-civilization low interest rates tends to encourage people to borrow money.

A loan at 2% interest may not make sense at 5%.

You can see the problem here.

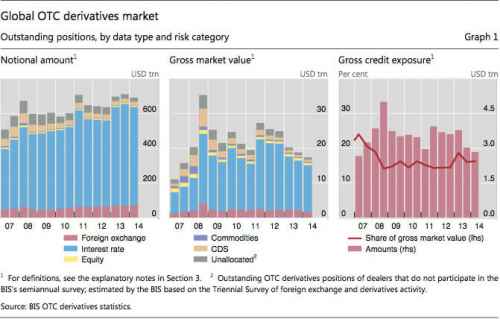

Finally, there is something I've ranted about before - interest rate swaps.

What most people don't realize is that the interest rate swap market is far larger than the credit default swap market that scared so many people in 2008.

the global notional market for interest rate swaps was about $560 Trillion in 2014.

While using notional values dramatically overstates the actual amount of money at risk (unless there are systemic defaults), even a small fraction of that mountain of money dwarfs of the GDP's of the world.

What this means is that if interest rates were to rise, and rise quickly, it would trigger these interest rate swap contracts (i.e. someone would have to pay).

When interest rates rise, they rise across the board for an entire nation, and they may indeed help trigger interest-rate increases in other nations as well. Issuers have entered into trillions of dollars of contracts with Wall Street and other financial firms to cover their risk if interest rates increase. And if interest rates do increase substantially – they increase for the nation as a whole, in every state, for every borrower, and for every category.

So there is close to 100% correlation – the simultaneous losses being incurred could be likened to one firestorm spreading over the entire country.

And the reserves that were established to cover statistical assumptions of uncorrelated losses quickly disappear when it is correlated losses on a national basis that happen instead.

Wall Street and the banking industry remain as highly over-leveraged as ever. Just where are these hidden reserves of many trillions of dollars worth of capital to honor all of the derivatives contracts?

...

Do Wall Street and the other providers of interest-rate derivatives actually have the capital tucked away somewhere to cover the many trillions of dollars in increased interest payments for the entire nation (and the entire world), year after year, if rates were to rise by 5% or 10% or even more?

In practice, we know that Wall Street wasn't good for their promises on a little more than $1 trillion in subprime mortgage derivatives. There are more than 400 times as many interest-rate derivatives currently outstanding as there were subprime mortgage derivatives in 2008. There's no possible way. It would be an annihilation scenario, short of even greater levels of government interventions.

But now interest rates are scraping rock bottom. They have to go up, short of dangerous monetary experimentation or disastrous global deflation.

That means that probably sooner rather than later, interest rates will go up, and if they go up quickly (like, for instance, because of widespread defaults) then that mountain of derivative contracts will be triggered. A mountain that simply can't be paid.

Comments

The logical and elegant

solution (as in 2008) is the voiding of all derivative and related instruments coupled with across the board debt created from credit forgiveness.

But could the finance community get itself to see the need; or rather will they let their inclinations for greed lead them, and us all, blindly over that cliff right in front of us?

Orwell: Where's the omelette?

Quickly voiding interest rate swaps

would cause rates to spike.

It's easier to not make this mountain than it is to level the mountain.

the mountain

Then lock the rates down via regulation. "Behave, or no more access to the Fed for any of you!"

This mountain must be leveled -- or civilization will be.

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Issuers have entered into

Could you explain this more.

So... interest rates are low so people go borrow more because of that phenomenon. If they were to go up that would be an increase in the amount needed to pay back. But... also these issuers have contracts to cover their risk? What risk? Will financial firms pay that interest rate increase or?

That is kind of the muddy part for me here. I kind of got lost here.

Sorry about that

That's it

An interest rate swap is an insurance policy against the risk of interest rates rising.

Wall Street banks sell those swaps.

@gjohnsit So insurance policy. So

So insurance policy. So basically a bet. I guess I'm just trying to understand the details.

1) If interest rates go up, Wall Street lost the bet essentially and have to pony up due to the insurance policy for all the issuers.

Or

2) If interest rates go up, Wall Street has to be the one to pay for the increased payments due to the interest rates going up.

Or more likely, they claim that they can't pay it...

As always, and demand a bailout from the federal government to cover their bet.

After they've secured all of the cash they can in off-shore accounts of course.

/cynicism

I do not pretend I know what I do not know.

Thank you for all your highly informative posts. n/t

Betty Clermont

The problem is that zero is a floor

And even that can be overcome with creative financing, that is, negative interest rate. The FED is still trying to stimulate a moribund economy. As the 1% take all of the growth in GDP that leaves no growth for the consumer sector, 70% of the US economy. So the cycle closes with debt. The consumer increases spending by borrowing money, essentially, from the amassed wealth of the 1%, although much of it now comes directly from Uncle Sam.

Low interest rates make a statement. If I can borrow money at near Zero interest then I can invest it and make a fortune. The fact this is not happening, other then investments as gambling, indicates how the US economy is dead. If I could borrow money at 4%,and build a business that returned 10% then that would be irresistible and the economy would be growing leaps and bounds. The fact that this is not happening in a large scale tells you something. the bottom line is that money as capital is worthless today, that is, its value is near zero and therefor its return (interest rate) is near zero.

As gjohnsit points out this low interest rate economic state has no realistic exit strategy. As one example, low interest rate have pumped up the housing market. Exit from this is extremely painful. A falling housing market would mark the loss of enormous wealth, and would make selling houses that are underwater very difficult. The solution is to walk away from your mortgage, resulting in bank collapse or yet another bail-out.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

Banks were able to borrow with

ZIRP(Zero Interest Rate Policy)....for the rest of us we still pay way more

for the right to borrow money.

But what makes ZIRP so felonious is ordinary people don't get

interest on savings, CD's, Bond's etc.etc. forcing them into

buy stocks and houses, at least that's how the FED proposed it

would work to us peons, while knowing all along the money would go

to the 1%, PE, Hedge Funds, IB's to buy stocks, housing, and whatever

toys they might want.

IOW's we've been robbed to high heaven, people forget markit's can

crash up, see Zimbabwe.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

I can't complain.

The low interest rates allowed me to refinance my mortgage at a savings of $400 per month and roll some high interest credit card debt into a 0% until May 2019 balance transfer offer. I'm saving a bundle on interest payments and finally see a bit of light at the end of the tunnel after several bad years brought on by the Bush Recession.

...That means that probably

.

Considering how impoverished most of the nation is, is it possible that banks 'legally' (thanks, Obama!) grabbing depositor's money - even if they get everyone's rent/mortgage payment and grab their houses because they'd already stolen the mortgage payments - might not be enough? In that case, could these all-important giant financial institutions survive even where the citizens don't? Please tell me that the equally-all-important US PTB War On The World And Its People effort wouldn't have to be curtailed to cover this with public funds as well?

I'm deeply concerned that Those Who Matter continue to enrich and empower themselves at everyone else's expense... they must have a plan for this offshored somewhere, if only we knew. Only I gather that New Zealand is shutting down that isolated-bunker-craze escape route for the very rich, which would spare TPTB from having the inconvenience of being forced to drive over the starved bodies of Americans in the streets. Or through a solid wall of pitchforks.

Would they bleed red or greenbacks, I wonder?

Edit to add something that just came on in a mix, by a woman who does great music... and does crazy a little too well:

https://www.youtube.com/watch?v=TM2m371xLxw&list=PLXctIVhQimRLZmjYvWnq-o...

Seems to fit, somehow...

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.