Recession: The other danger to Hillary's campaign

It's not a controversial statement to say that in an election year where the public overwhelmingly believes the country is on the wrong path, and the government is corrupt, it's a risky strategy to nominate a candidate under criminal investigation by the FBI for ‘wrongdoing’.

I'm sure I'm not the only one to have noticed this.

But there is another potential risk that has been largely overlooked.

"I’ll defend President Obama’s accomplishments and build upon them."

- HillaryClinton.com

Hillary has essentially declared herself the defender of Obama's legacy.

That'll play well with fellow Democrats, where Obama is popular, but its a much more risky strategy with Independents, who don't particularly like the president. Hillary was already despised by independents, so it appears she has given up on gaining their favor.

This looks especially dangerous when you factor in Hillary's failure to energize the Democratic base to turnout and vote in the primaries.

Some people may not be so enchanted with Obama's record

In 2008, during the deepest recession in 75 years, 13.2% of Americans lived below the government’s official poverty line. The Great Recession officially ended in June 2009, but in 2014, after five years of economic expansion, 14.8% of Americans were still in poverty.

.

The hidden danger of running on Obama's record is what happens if the economy turns down between now and November?

Promising "more of the same" won't go over well with voters. Not. At. All.

Most Americans are one paycheck away from the street.

Is this a hypothetical question? You tell me.

On January 13, President Obama described the economy as "strong" and "durable".

Two weeks later CNN described the economy from the Q4 GDP report as "grinds to a near halt".

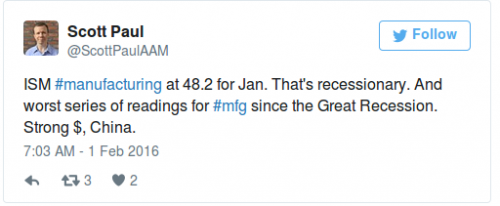

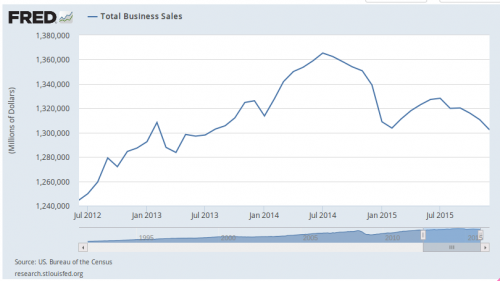

Consider manufacturing.

A key report on U.S. manufacturing in January showed the sector contracted for the fourth straight month but the pace of deterioration stabilized.

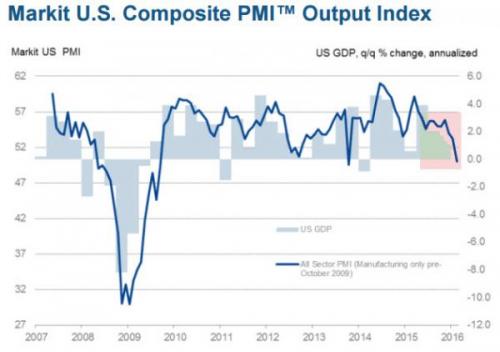

Fortunately, since our manufacturing sector has been gutted over the past generation, we are a service economy. Which makes this report alarming.

We just got the clearest sign yet that something is wrong with the US economy.

Markit Economics' monthly flash services purchasing manager's index, a preliminary reading on the sector, fell into contraction for the first time in over two years.

...

Wednesday's data shows "a significant risk of the US economy falling into contraction in the first quarter," according to Chris Williamson, chief economist at Markit.

According to Markit's release, business activity was slammed by scarce new-work opportunities, as clients lacked confidence in the economic outlook, and snowy weather on the East Coast.

Markit noted that service providers had the weakest business outlook in nearly six years.

"Slumping business confidence and an increased downturn in order book backlogs suggest there's worse to come," Williamson wrote.

Bloomberg on corporate earnings

While bulls cling to predictions that profit growth will resume for Standard & Poor’s 500 Index companies in 2016, analysts just reduced income estimates for the first quarter at a rate that more than doubled the average pace of deterioration in the last five years. Forecasts plunged by 9.6 percentage points in the last three months, with profits now seen dropping the most since the global financial crisis, data compiled by Bloomberg show.

Growing skepticism among analysts is another example of an economic truth, that once corporate income starts to fall across industries, it’s rarely temporary. Most of the downward revisions in projections came in January and February -- a clue as to why equities staged their worst selloff to start a year since 2009 and almost $3 trillion was wiped from share prices at the worst point.

Corporate America is not healthy. And if it isn't healthy it won't hire people.

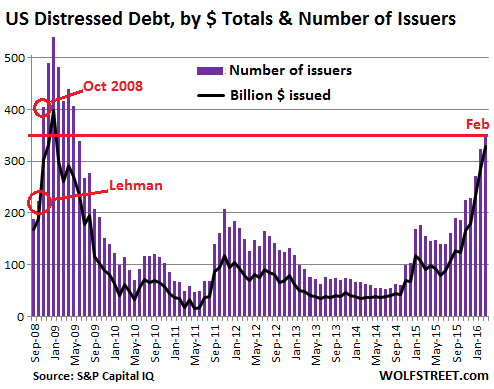

A Moody’s Investors Service tally of the least-creditworthy companies rose by 10 to 274 this month, pushing it nearer to April 2009’s record 291. The list comprises companies rated at least six notches into junk territory with a negative outlook–which suggests a further downgrade could come soon.

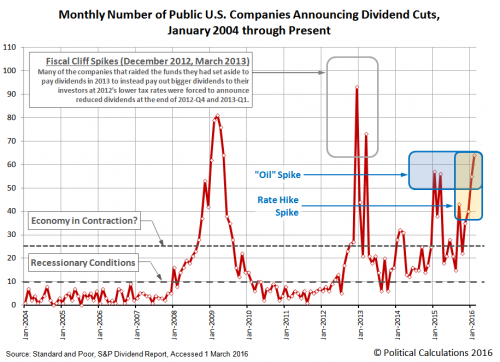

What does this have to do with the chances of recession? Everything.

Since corporate profits turned negative in mid-2015, Wall Street has pondered whether it's just a passing phase or a signal of something worse. History strongly suggests the latter.

Recessions have followed consecutive quarters of earnings declines 81 percent of the time, according to an analysis from JPMorgan Chase strategists, who said they combed through 115 years of records for their findings.

The news gets worse: Of the remaining 19 percent of the time, recession was only avoided through either monetary or fiscal stimulus. With the Federal Reserve holding limited easing options and a deeply dysfunctional Washington thwarting a fiscal boost, the prospects for help are not good.

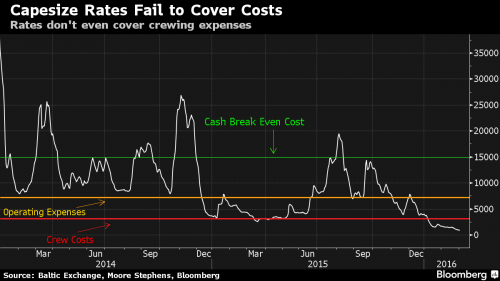

Dry bulk shipper Golden Ocean Group CEO, Herman Billung, to an industry conference on Thursday:* "In the coming months there will be a lot of bankruptcies, counterparty risk will be on everybody's lips.

* "The market has never been this bad before in modern history. We haven't seen a market this bad since the Viking age. This is not sustainable for anybody and will lead to dramatic changes.

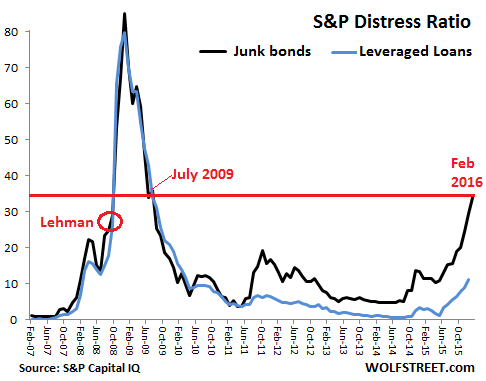

Junk bonds are signaling a warning

The junk-bond market is indicating a 44 percent chance of a recession in the U.S. within one year, according to Martin Fridson, a money manager at Lehmann, Livian, Fridson Advisors LLC.

“I am not an economic forecaster -- this is what the market is saying," said Fridson, who started his career as a corporate-debt trader in 1976. "There are lots and lots of caveats, but if you accept all of the assumptions, it’s a pretty startling comment."

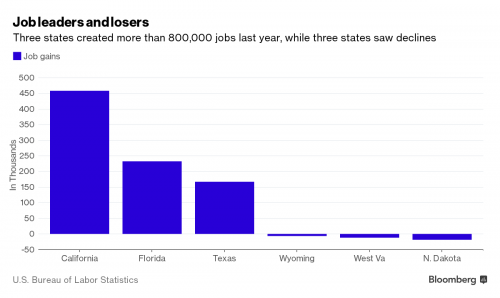

In energy producing states the energy bust means recession.

As economists size up the chances of the first nationwide slump since 2009, pockets of the country are already contracting. Four states -- Alaska, North Dakota, West Virginia and Wyoming -- are in a recession, and three others are at risk of prolonged declines, according to indexes of state economic performance tracked by Moody’s Analytics...

Louisiana, New Mexico and Oklahoma are all at risk of recession, according to Moody’s. Wyoming and North Dakota’s economies have declined for at least the past 10 months, according to the Philadelphia Fed.

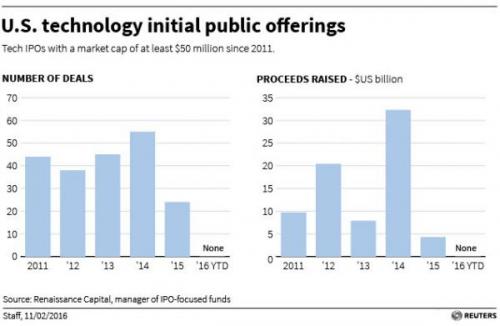

In Silicon Valley, venture capital funding is drying up while the Tech IPO bubble has completely burst.

The Tech Bubble has been compared to the Titanic right after hitting the iceberg, but before the ship began sinking.

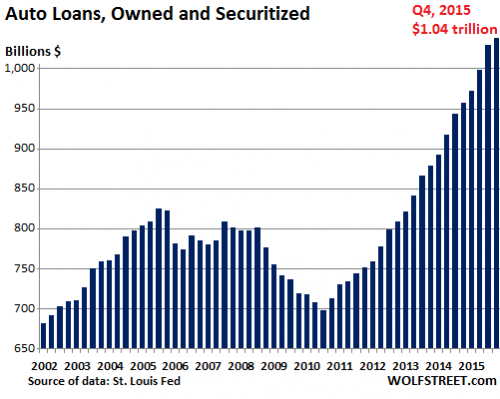

There is one other bubble in the economy that doesn't get noticed as much, but it most resembles the subprime bubble of 2008 - subprime auto loans.

“What is happening in this space today reminds me of what happened in mortgage-backed securities in the run-up to the crisis,” U.S. Comptroller of the Currency Thomas Curry warned in October about the auto loan bubble.

And his warning is now becoming reality.

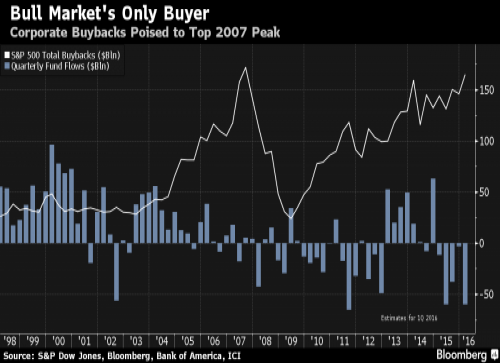

Of course the stock market is still roaring. So how's that working out?

The companies losing money on these bets are down a collective $126 billion over the past three years, a decline of 15 percent.

Many corporations would have been better off investing that cash in an index fund instead of their own stock. The overall market rose 39 percent over the same period.

We may barely escape a recession, or we may not.

But Hillary made a political decision that could gain her the nomination, while badly wounding her chances in the general election.

Comments

I'll drop this on GOS tomorrow morning

For those of you new to C99P I sort of use this blog as a "sandbox" (in the IT sense).

Almost all of these charts I've posted here before in bits and pieces.

I appreciate your "sandbox" posts here,

because I'm not and never have been a

DKos member/lurker/whatever, which

means your c99p posts are the only

chance I have to read your work - work

that I really appreciate. Thanks!

Only connect. - E.M. Forster

So glad to see you here

there are three or four diarists that I follow consistently and you are one. I always learn something from your work which is why I originally started hanging out at DK.

gjohnsit is my

main source of what the fuck is going on. He interprets and reports real information and not drivel or spin. I'm so glad he graces caucus99percent with is ever loving charts and all real news that's fit to read. Thanks gjohnsit, your a wealth of information and a real Mensch ( a great human being).

I appreciate your posting here first

While I do not always post on your articles here, I read them first and often come back to the here before posting any comments over at gos.

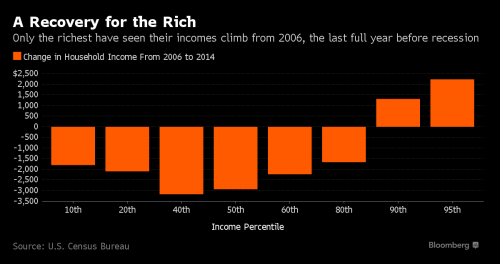

We have seen a lot of these charts before, but when they are put together in a single post, they paint a very scary picture of an economy teetering on the edge once again. A country based upon a service economy cannot sustain a middle class, imho. It is not the number of jobs created if those jobs are all part time or low wage jobs where people are barely treading water. The chart that blows me away is the change in household income. The middle income classes are the one that are bleeding the most (40th, 50th, and 60th percentiles).

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

Yup, Job numbers

are all but meaningless and easy to fudge(which is exactly why they are used). A much better number would be the total amount paid out in wages/salaries/benefits

“To learn who rules over you, simply find out who you are not allowed to criticize.” -Voltaire

And what about the cost of living?

on the verge in northern California. fixed income = die faster thank you!

Why Sonoma County Workers Can’t Afford the Rent

Much more at the link, I selected the following quotes because I think homelessness in CA is perpetuated by the Democratic party here and I'm pissed at the lobbyists ruining everything. Disaster capitalism is big business for industrial-sized, dare I say "global" charities now serving a nation of 47 millions poor. Every yuman is a potential contract in the eyes of corporate politicians it is their version of "opportunity".

"That's the system" says Jerry Brown.

Honor Labor

Peace

Just as bad

at the other end of the Bay -- average workers and those on fixed incomes are being priced out, forcing either long commutes (bad for families and the environment) or crowding into sub-standard conditions.

Goldman Sachs: a name you can trust

I just read this morning that Goldman Sachs says this is the best time in two decades for retail investors to buy stocks.

They wouldn't lie to you.

BTW, I just put this up on GOS.

Real median household income

Real median household income still hasn't reached its pre-crash level, or even the level President Obama saw at his inauguration. If that's the best our roaring Democratic recovery can do before a downturn, Hillary's going to have a tough case to make. A recession will give us Il Duce in November, unless Hillary faceplants and Bernie steals the nomination.

Please help support caucus99percent!

A recession is looking likely

We can still avoid it, but the odds are going up.

Most Americans are one paycheck away from the street.

How do you think they will vote if they suddenly lose their job? A status quo candidate? I don't think so.

I don't think a status quo candidate has a good chance

... even without a recession. If we fall into an economic hole, we're screwed if Hillary is the nominee. I don't think she'd win anyway.

Please help support caucus99percent!

What is interesting is just how little discussion

these economic trends have gotten outside of econogeek blogs.

There is a chance that we could already be in recession. Does anyone care?

You wouldn't know it from DKos.

You wouldn't know it from the Dem debates.

You wouldn't know it from the evening news.

Yet if it happens, it'll change everything.

I think Bernie is addressing it....

He discusses it in terms of people just not really recovering from the last recession. The income inequality. People that are outside the 1% have been in recession for 35 years(or more). Wages have not gone up, inflation is not flat, it is just disguised. The Fed is out of ammunition. Companies should be swimming in cash but they aren't since they used it to make their performance look better than it actually has been. We are in a world of hurt and there is no solution in the mix except what Bernie is proposing. We have to cut the military and invest in infrastructure and education. We are out of options.

Bernie is talking about the inequality

and the rigged system.

I was just talking specifically about the recent economic trends.

You wanna see some people go ballistic? Check out the responses to this essay on GOS tomorrow.

Some will get downright nasty and personal.

You are just pointing out trends which will be apparent to all

Based on what you have laid out. A good question for the candidates would be there plan to handle the next downturn because it is not an if but a when. The boom/bust cycles are a feature of our capitalist system not a bug.

Bring out the bubble machine

and crank it up again. Yeah that's the ticket. The housing market is cranking up this round features Shanghai investors and scum bag developers building high end slums of the future because growth is green and wrecking your city/town/ state is actually progressive. Too bad if the rents too high loser.

Hey nobody who supports

some more please wants to see the reality they are oblivious to, the one that is ongoing right before their lying eyes. What are you gjohnsit some kind of doomsday downer spouting RW talking points? HRC, Obama and the Third Way (formerly known as the DLC) neoliberal Dems. saved us all from going off the cliffs of fiscal mass destruction that they helped create and now are the way forward. Goldman Sachs rules the world and that is an inevitable irrevocable fact. Get over your obsession with reality, and get pragmatic. Praise the Lord for 'victory for compromise' these compromises allow the austerity to continue forevermore and will save our asses from Dr. commie rats who want free stuff.

plus, who names their kid "gjohn"?

Orwell: Where's the omelette?

Whoa, Shaz!

We all know that gjonhsit is Mr. Doom and Gloom. He cannot be right even with all of his data and charts...well, just because.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

GOS?? Ahh think I got it ...

Great Orange Satan == DK!

There are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns – the ones we don't know we don't know.

Well done...I was wracking my brain to come up with something!

“Those who can make you believe absurdities, can make you commit atrocities.” Voltaire

Yep! (n/t)

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

Beginning to get the impression that

is the management's preferred style of communication on the GOS.

“To learn who rules over you, simply find out who you are not allowed to criticize.” -Voltaire

Help -GOS

New here, learning - what is GOS ( a slang for DKos) or another place to learn.

BTW - learn more from your posts than anywhere else - wish there was some way to break thru the MSM to cover at least the summary of what you see.

DUH: Great Orange Satan

Forget my question...:)

Great Orange Satan

Yes slang for dkos. Honestly, I hope that after a few weeks of the kos bashing, that we can move on.

I'm sure we will

Before last week there was very little DKos bashing here. It'll go back to normal after a while.

Actually courtesy of Atrios I believe

He gave DK the "Great Orange Satan" moniker as counterpart to his own site's "Baby Blue Cherub" for some reason.

Seems a bit more apropos these days.

will have your back tomorrow at GOS, gjohnsit

tx for what you are doing. All this is particulary relevant to me as I am negotiating a renewed lease with my office landlord for my very small business which is definitely feeling the impact of hard times. He wanted five years, I got him down to three, but I think I am going to bargain for two. Don't want to get stuck in an expensive lease if another recession hits...Still haven't figured out whether or not I should go for a two year lease or a three year lease.... wish I could see into the future.

Sea Turtle

Because it isn't a trend for

Because it isn't a trend for most people, it's the new normal. The only movement that makes it not a recession is the upper 10% money flying around. Chop that off and look at the lower chunk of the economy and it is bleak.

The majority of us have been treading water since 2007 and before.

Thom Hartman has been saying

I listen to Thom regularly and he keeps reminding his listeners that we are facing a recession... ( not the buy gold commercial).

Doom and gloom because you hate Hillary.

Sorry, thought since you like to dry run things here before DKos, I'd add some authenticity.

Seriously, though, I've been surprised that the connection between economy and election at a time I can't see one good indicator anywhere, and lots of bad ones, isn't something screamingly obvious to pretty much anyone talking about these things.

Just want to thank you for bringing up actually meaningful things to think about. At DKos I think we should remember it's not about the people writing there, but the many times larger number of visitor/lurker eyeballs. One might get 20 recs and comments but be read by hundreds and thousands.

Orwell: Where's the omelette?

Wasn't she all about "it's the economy, stupid" in '92?

“Those who can make you believe absurdities, can make you commit atrocities.” Voltaire

Here we go again!!

I always enjoy your depressing posts! They are always a clear look into the future. Looks like the history not learned in 2007 is about to repeat itself.

“Our enemies are innovative and resourceful, and so are we. They never stop thinking about new ways to harm our country and our people, and neither do we.”

George W. Bush

It'll be different this time...sort of

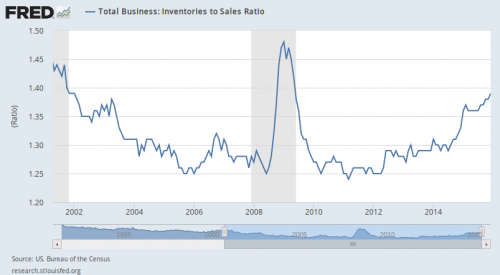

This won't be a financial sector-led recession. It'll be a more traditional, inventory-led recession.

OTOH, the Fed will have almost no ammo to use, and with a real deflation risk.

The recovery has been Meh, for the middle/working/poor class....

My hubs has a small business. He sells oil paintings that he imports from China. Since the crash his income has stayed about 40% below where it had been. His clientele are middle class/working class people. These are not expensive paintings, but they are a luxury. Working folks can't afford luxuries anymore. His income has just started to go up a bit over the last 9 months, I can't imagine what it will do to us if the economy crashes again. We've condensed all we can.

Will any of MSM dare use the r (recession) word?

This echoes 2007-2008? Will any candidates dare use that word?

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Good Question

Maybe it's time for Senator Sanders to bring it up at perhaps the town hall tonight, or the next debate? "You know, it's highly possible that we are already entering a recession." Thank you for the diary gjohnsit. I'm a reader of your work from DKos too.