The Fast Approaching False Narrative About Entitlements

For once the Democrats weren't lying. The Republicans really are coming for your Social Security and Medicare, and they aren't shy about it.

House Republicans have started to weigh a series of legislative proposals targeting Social Security, Medicare and other entitlement programs, part of a broader campaign to slash federal spending that could force the new majority to grapple with some of the most difficult and delicate issues in American politics.

...

In recent days, a group of GOP lawmakers has called for the creation of special panels that might recommend changes to Social Security and Medicare, which face genuine solvency issues that could result in benefit cuts within the next decade. Others in the party have resurfaced more detailed plans to cut costs, including by raising the Social Security retirement age to 70, targeting younger Americans who have yet to obtain federal benefits.“We have no choice but to make hard decisions,” said Rep. Kevin Hern (R-Okla.), the leader of the Republican Study Committee, a bloc of more than 160 conservative lawmakers that endorsed raising the retirement age and other changes last year. “Everybody has to look at everything.”

That's a HUGE lie. "Everybody" has absolutely no intention of looking at "everything".

For starters, the GOP has absolutely no intention of making major cuts in defense spending. This is despite the fact that the military budget is at an all-time high, even though the Pentagon has never passed on audit. If they were sincerely concerned about waste then they would start with the department that can't pass an audit.

Then there is the issue of paying taxes.

The top statutory tax rate on investment income is just 23.8%, but it’s 43.4% on income from work. Put another way, the tax code penalizes poor people who work, while rewarding lazy, rich people who don't work.

The 400 wealthiest U.S. families paid an average income tax rate of just 8.2 percent from 2010 to 2018.

Between 2014 and 2018, the 25 wealthiest Americans collectively earned $401bn, but paid just $13.6bn – about 3.4%.

The average billionaire pays a lower income tax rate than you do. Does that seem fair?

At least 55 of the largest corporations in America paid no federal corporate income taxes.

Will the new Congress raise income taxes on the wealthy? Hell no! There is zero chance of that happening.

But none of this will save Social Security and Medicare, amirite? Well, there is a problem. Social Security will only be able to pay 76% of promised benefits by 2033 if nothing changes.

However, the solution is really easy and obvious.

Here’s how the system works. To help pay for Social Security, a tax of 12.4% is split between employees and employers; a worker is subject to a 6.2% tax assessed on earnings up to a certain amount — $160,200 in 2023.

...An easier solution would be to eliminate the earnings cap while leaving benefits as is. The extra revenue would solve the financial gap for 35 years, according to a report by the Congressional Research Service.About 180 million Americans contributed a total of $943 billion to Social Security in 2021. Ending the cap for the 5% of US workers who earn more than $160,200 would increase revenue by more than $150 billion.

It's that simple. You solve the Social Security problem by turning the regressive payroll tax into a flat tax. Even West Virginia Democratic senator Joe Manchin supports this option. Will Congress consider this option? Not likely.

How about Medicare? Well, you raise the payroll tax cap for Medicare too, but you also take another badly needed step - Medicare-For-All. Congress found that expanding Medicare to everyone would actually save money.

Modeling the cost of a single-payer program is relatively straightforward. You begin with the status quo health care system and then make educated guesses about the following questions:How many more units of health care services will be demanded and supplied when price barriers are removed?

How much more efficient will health insurance administration be after the enrollment and payment systems are radically simplified?

How much money will be saved by reducing the payments rates for health care providers and drug companies?

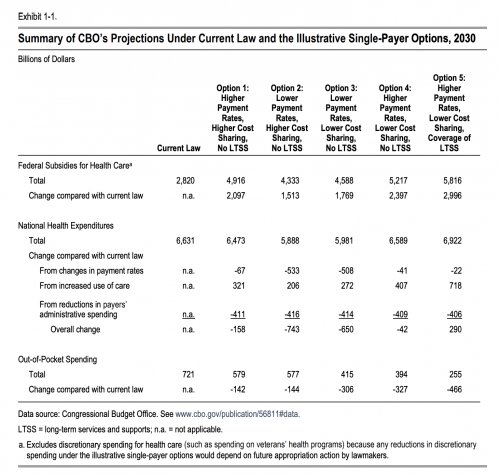

The CBO answered these questions for four different single-payer designs and found that a single-payer system would save $42 billion to $743 billion in 2030 alone.

Scrapping corporate, for-profit health care and creating a government-sponsored medical system would boost the economy, help workers, and increase longevity. But that's not something that you will hear in Washington, nor in the corporate media.

Instead of creating a more fair tax system that rewards work instead of speculation, that cuts waste instead of badly needed programs that people have paid into their whole lives, you will hear that working people are lazy and spoiled, while the super-wealthy will lead us to a dystopian Promised Land and that's the best we can hope for.

Comments

I cannot remember a time when the was GOP ever shy

about wanting to cut entitlements. And if one buys the first premise of their budget argument, they are right that "we" can't afford it. If taxes can only go down and never up, spending will will have to be cut or financed by funny money "borrowed" by the Treasury. Wave after wave of absurd tax cuts are accomplishing their intended effect as schemed by Grover Norquist to "starve the beast" of government.

Cockamamie "defense' spending would logically be subject to this logic, but it is not -- due to the existence of Putin and China and the corruption of the Democratic Party.

Welcome to the Restaurant at the End of America.

The Clinton-Obama-Biden Democratic Party has been reaching across the aisle for three decades now, and the tax cut chickens are coming home to roost. If Adam Schiff, my Congressman, throws down and really fights this final round of the Norquist Scheme, I'll vote for him in 2024.

Does aytbody expect that to happen?

I cried when I wrote this song. Sue me if I play too long.

the tax cut chickens are coming home to roost

no wonder there is an egg shortage

Zionism is a social disease

And Joe Biden stared talking about cutting entitlments when?

1977? 1975? 1973? Once he stopped talking about how bad "forced busing" was? Pressure from working class retirees MIGHT scare off the GOP, but not Biden, despite what he thinks he just read off his teleprompter.

On to Biden since 1973

scare off the GOP

fear is a non-concept to a delirious puppet

Zionism is a social disease

"Saving money"

But the point of Congress is to command the printing of money so it can be handed to the already-rich. So as regards any policy proposal, one must ask: how does that help the purchasers of Congress? As for "they're coming for your Social Security"...

"... so they can give it to their criminal friends on Wall Street..."

Or here's a fun one! Dylan Riley and Robert Brenner:

And of course there's that paid-for Supreme Court:

"It hasn't been okay to be smart in the United States for centuries" -- Frank Zappa

Trump said earlier this month...

“Under no circumstances should Republicans vote to cut a single penny from Medicare or Social Security,” Trump said in a video message. From Politico.

Cutting SS is a typical Republican idea, the worry is not Manchin but Biden and Schumer. How many Democrats would be willing to toss up their hands and say "there was nothing we could do" All it would take is almost all Rs and a few Ds.

While I support a government health program to provide for all citizens, I don't think Medicare is the perfect way to go about it. For one thing Medicare takes a monthly payment for much of it's services. Also it doesn't eliminate the for profit part.

Hospital groups, pharma, docs, all make tons of profit off Medicare, and we pay way more for health care than we should.

But getting back to the budget, raise taxes. Instead of insulating the upper middle class from paying more that is exactly the place to go, that's where the money is. I always read things like "no one who makes $200K or less" will take a hit. Heck $100 thousand is much more than many people could ever dream of making in this life. The least they could do is raise it starting at the median income and exponentially from there. I know it wouldn't hurt our budget to pay a lot more.

Agree with the tax scheme you propose

start at the mean income and raise it exponentially from there

those making more should be able to pay more

thanks!

Zionism is a social disease

How many decades

has this been coming up? Probably since Tip O'Neil, Ronnie Reagan and Lucifer Greenspan raised taxes on little people, supposedly to extend the solvency of SS and medicare. Instead it was a pool of $$$ for both parties to raid for tax cuts for the 1% and the military. Look for another "Grand Bargain" from Ol' Joe. The military needs new equipment, after all since we're sending stuff to Ukraine. If that don't work, look for some republican group to bring up the constitutionality of SS, Medicare and O'bummer care. Time to stock up on cat food futures.