China's stock market crash

All eyes have been on Greece this week, but the real action is on the other side of Asia.

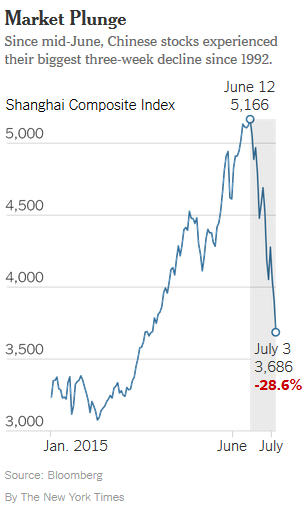

About $2.7 trillion in value has evaporated since the Chinese stock market peaked on June 12. That is six times Greece’s entire foreign debt, or 11 years of Greece’s economic output.

The really interesting, and potentially most scary thing about this crash, is the involvement of the Chinese government.

How we got here

Just to give you an idea of the size of the Chinese stock bubble.

In just 12 months the Chinese stock market rose $6.5trn, even while the overall Chinese economy slowed.

That’s the equivalent of around 70 per cent of China’s GDP in 2013, or about 40 per cent of the total value of the New York Stock Exchange – or enough to pay off Greece’s debt 20 times over.

So who were these brilliant stock market traders? How many PHD's in business did they hold? Pretty much zero.

The villagers first started investing their savings in stocks after hearing about the market craze on a visit to a nearby town. As the excitement spread, a small informal stock market center was set up in the village where residents could monitor their investments by the minute.

The farmers now only tend their fields outside of market hours, Liu noted.

When farmers prefer day trading over farming you have a problem. But it is even worse than that.

More than two thirds of new equity investors exited the education system by middle school — which in China means around the age of 15. More than 30 percent exited at age 12 or below.

So poor, uneducated people are piling into the stock market. A responsible government would do something about that.

As it turns out the Chinese government did do something about it - they encouraged it.

And then the bubble burst

Stock markets don't go to the moon. Everyone should know that by now.

Yet the Chinese government still showed enough arrogance to think that they could stop the bubble from popping.

People's Bank of China Governor Zhou Xiaochuan cut the benchmark lending rate by 25 basis points to a record low of 4.85 percent, slashed the deposit rate to 2 percent and reduced required reserve ratios for some lenders. As stocks plunged anyway, China's securities regulators tried to cheer traders by announcing they would consider suspending initial public offerings in order to increase demand for existing shares. The sell orders still accelerated. Next, government officials assured the record numbers of individual investors entering the market that the risks from margin trading are controllable. Selling ensued regardless.

When China's government couldn't talk the market into stabilizing, they took more drastic steps.

China is suspending initial public offerings, creating a market stabilization fund and telling investors not to panic in an effort to shore up its stock market, which has had the largest three-week drop since 1992.

Because there is nothing that will calm a person down more than when their government tells them not to panic.

Amazingly, the stock selling continued.

The Chinese government has changed the rules to allow the national pension fund to buy stocks.

The selling continued.

It announced plans to investigate short-sellers, those who have placed bets that the market will fall.

The selling continued.

Today, they changed the rules again.

Financial magazine Caijing reported on Monday that the National Social Security Fund had told its external fund managers they could buy stocks but were not permitted to sell them.

Looks like your Social Security is in the stock market and can't be withdrawn.

The selling continues. Oops.

And if a "market stabilization fund" sound familiar, well, it should. America did the exact same thing in 1929.

The selling continues.

So the China brought in the big guns.

On Sunday, the government brought in the central bank, the People’s Bank of China, and an investment arm of the country’s sovereign wealth fund to support the effort.

China, the second largest economy in the world, is risking their national pension fund and their central bank...on a stock market bet.

Sweet.

The stock market is falling so fast that poor Chinese can't even sell their shares because after a 10% fall trading of those shares are automatically suspended for the day.

The really big problem

Well, how far can it fall, right?

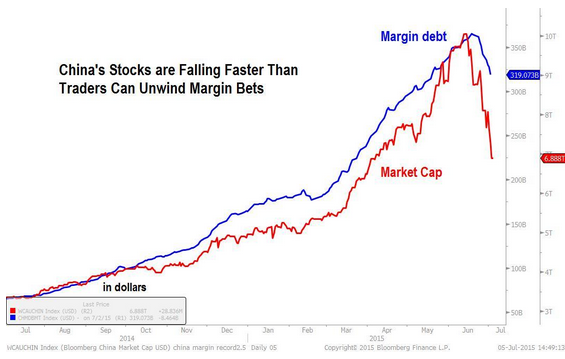

If everyone was buying stocks in cash then this crash would be over soon.

The problem is that most of these stocks weren't bought with cash.

OK. So there is a lot of borrowed money here. So what? They'll just borrow money faster, right?

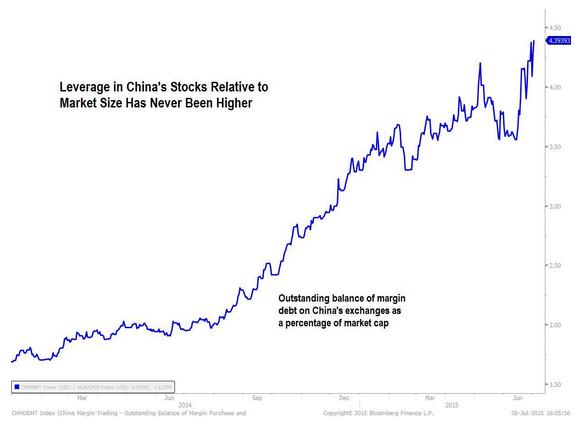

Leveraged bets on Chinese stocks have increased to a record versus the size of the market as prices fall faster than margin traders cut positions.

Margin traders are jumping ship even though securities regulator eased margin-trading rules last week.

The government of China messed up twice here.

First they ignored a huge bubble. That's a bad mistake but forgivable.

Then they decided to put their own credibility on the line in re-inflating this bubble, and so far it isn't working. That's not forgivable.

Now they appear to be going "all in" on this bet. That's inexcusable.

Comments

Tell me again...

why we need TPP to counter China?

lol - you guys are so smart... n.t

"Religion is what keeps the poor from murdering the rich."--Napoleon

This sums it up

link

You don't do this unless you've lost your faith.

Chinese government takes the next step

link

All trading on NYSE halted: "technical difficulties"

http://wtnh.com/2015/07/08/trading-halted-on-new-york-stock-exchange/

What's with that?