You blinked and missed one of the biggest bubbles in history

China has seen some pretty dramatic bubbles in recent years, many of which have yet to pop, such as real estate.

The Chinese stock market bubble that peaked and crashed last summer comes to mind.

However, the craziness has only gotten more and more extreme. This time it was the commodities market that went bonkers.

From the Dutch tulip craze of 1637 to America’s dot-com bubble at the turn of the century, history is littered with speculative frenzies that ended badly for investors.

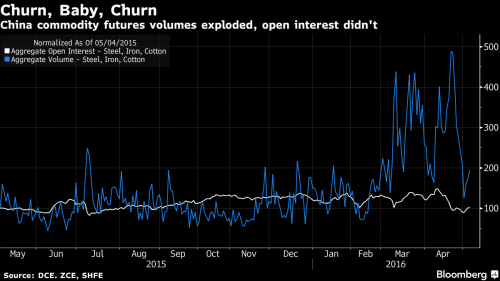

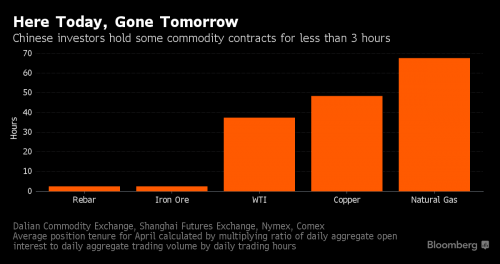

But rarely has a mania escalated so rapidly, and spurred such fevered trading, as the great China commodities boom of 2016. Over the span of just two wild months, daily turnover on the nation’s futures markets has jumped by the equivalent of $183 billion, outpacing the headiest days of last year’s Chinese stock bubble and making volumes on the Nasdaq exchange in 2000 look tame.

What started as a logical bet -- that China’s economic stimulus and industrial reforms would lead to shortages of construction materials -- quickly morphed into a full-blown commodities frenzy with little bearing on reality. As the nation’s army of individual investors piled in, they traded enough cotton in a single day last month to make one pair of jeans for everyone on Earth and shuffled around enough soybeans for 56 billion servings of tofu.

"I’m pretty bored at work, so I trade commodities futures for some excitement."

- Jeremy He

Chinese authorities cracked down and commodities trading collapsed as quickly as it had started, but that's hardly comforting because it doesn't address the underlying problem - too much easy credit.

“You have far too much credit, money sloshing about, money looking for higher returns,” said Fraser Howie, the co-author of “Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise.” “Even in commodities where you could have argued there is some reason for prices to rise, that gets quickly swamped by a nascent bull market and becomes an uncontrollable bubble.”

In many ways, China’s financial landscape was ripe for another mania. New credit soared to a record in the first quarter, giving individuals and businesses plenty of cash to invest at a time when several of the country’s traditional sources of return looked unattractive.

Some of you might ask, so why does this matter? To answer that question, I would like to refer to yesterday's market action.

The Hang Seng China Enterprises Index tracking some of the nation’s biggest companies tumbled from an advance of 1 percent to a loss of 1.5 percent in about two minutes, before rebounding to a gain.

Flash crashes are not healthy. They tend to scare long-term investors away, while keeping speculators around.

Credit is just another word for debt, and people are waking up to the fact that there is far too much debt in China.

According to the Economist magazine, China's total debt has gone from 155 percent the size of its economy in 2008 to 260 percent by the end of 2015. And that, in turn, has created three big problems. The first is that most of this money has poured into just a few sectors of the economy — in particular, steel, cement and housing. The result has been a glut that has pushed down prices so much that companies can't afford to sell at them. But they can't afford not to either, because they need some money coming in to at least pay the interest on what they owe.

In a normal economy, the word for this kind of situation would be "bankruptcy." But China is far from being a normal economy. The government still controls a lot of banks and companies, so it can tell them when to lend, when to borrow, and when to restructure or roll over debt all in the name of social stability rather than making money...

That brings us to problem No. 2. It's hard to lend out so much money so fast without a lot of it going to people who won't be able to pay you back. In China's case, the consultancy Oxford Economics thinks this could add up to nonperforming loans equal to 14 percent of gross domestic product...

The biggest problem, though, is that Beijing hasn't done anything about this. Well, other than make it worse.

The Chinese economy is slowing down, and slowing down fast. Bad debt can be grown out of at 10% growth, but maybe not at 5%.

It's a Ponzi scenario, where the investment scheme blows up when the number of new investors begin to fall off.

What's more, almost everyone knows that this game is coming to an end. Which is why the Chinese are looking to get their paper profits out of China and into real investments in any way they can.

One of their favorite ways is American real estate.

Chinese nationals have become the largest foreign buyers of US property after pouring billions into the market in search of safe offshore assets, according to a study.

A huge surge in Chinese buying of both residential and commercial real estate last year took their five-year investment total to more than $110bn, according to the study from the Asia Society and Rosen Consulting Group.

Chinese investment in property has also helped to inflate prices in other developed countries, notably the UK and Australia in the wake of the dip in world stock markets in 2015

What this is translating into is a surplus of empty residential housing, in expensive coastal cities, being used as investments all over the world.

Comments

So they are buying "prime" real estate.

If they are expecting long term gain, this probably isn't a bad idea for the individual investor. However, if the total exodus of wealth from China is too great, that could be bad. Does anybody know what the state coffers look like?

ETA:

China as a nation is very defensive about being told that it has committed errors. They are already armed to the teeth and if their collective manhood is shaky this could lead to some real trouble.

Life is strong. I'm weak, but Life is strong.

And here I thought this was about astronomy

And how we detected a gravitational wave, which struck Gravity-based ears in Louisiana, and then a whole 10 miliseconds later, detectors in China.

My mistake. But in terms of the size of bubbles, and China, that black hole caused Gravity was a lot larger.

To be fair

The bubble in Japan is pretty big too. So it's safe to assume that when the ponzi scheme in China implodes that it will take Japan with it and those two black holes will feed on each other.

According to astronomical measurements

we are all very small and very temporary. And not very smart, either.

Life is strong. I'm weak, but Life is strong.

Very well done post.

Thanks.

thanks gjohnsit

interesting stuff.

chinese $$ is flooding the USA housing market

https://www.theguardian.com/business/2016/may/16/chinese-pour-110bn-into...

did 9 months in California prison, because Neoliberal Democrats and GOP maggots work together to profit off the drug war

not for much longer, looks like.....

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Mrs. Bollox was in China recently for work

One thing she told me about on her return was that the shops were either very high end, or very poor. There didn't seem to be much that catered for anyone in between..............indicating there weren't many 'in betweens - middle class'.

Gëzuar!!

from a reasonably stable genius.

Actually, there is one.

It's not all that large relative to the size of the population, but it exists. Mostly they shop at the high-end stores, in order to show off.

Self-exiled from DKos, ahead of the arrival of the Clinton Thought Police.

Markos' transition from gatecrasher to gate-polisher is now complete.

Thanks gjohnsit.

Another great post.

Real v Fake investment

In a given economy there is an opportunity for "real" investment, but it's very small. "Real" I define as investments that increase output of useful goods and services. It involves investing in science and technology and in the overall infrastructure and increase in extractive activity. All the rest of investments I categorize as "fake". They are mostly derivatives, betting on outcomes of anything in the economy. The problem with "real" investments is that they are difficult, have long time frames, and are risky. That new business may take 6 years to see if it succeeds. The successful economies generate far more capital than can be safely invested in "real" sectors. I would guess that the opportunity is somewhere between 3 and 15% of GDP, depending on the individual economy. As it becomes mature, that is, it is already using current technology and is built out, the opportunity becomes very small. So we end up with fake speculative economic activity dominating the capital sector. This is true for the UK, Europe, Japan and the US, and its starting to effect China. The really pernicious part of this is that fake investment drives out real investment. Try to get money from a bank a new business. Not possible without securing it with something else. Try to get money for your real estate speculation. Easy.

We have an old economy. I call it the Post WWII economy. As economies get older this problem gets worse. US growth is much better than most developed economies, but we are running at about 1.75% running average since the Great Recession.

There are two ways to fix this. the first is to have a Great Depression. You clear out current wealth and debt. You then start with a New Economy. The second is to actually fix the economy, in place of just bailing out private capital. You probably need to regulate markets, especially derivatives, and you need to forgive some debt, at the cost of lost capital. Essentially a soft reset, with controls in place to not immediately repeat the past mistakes. What astonished me is that we always concentrate on preserving wealth and rarely reducing debt. Stiglitz has talked about this.

China is learning the lessons of free market Capitalism. Fortunately for them, the bubbles seem to return to where they were before the bubble. They are still a developing economy so they have lots of opportunities for real investment. They need to learn about the hazards of "fake" investments now that they have the world's largest middle class and a big wealth class. I'm not surprised that their capital has flown the country to take advantage of "fake" investment opportunities in the West. Shame on them!

Who will be the first country to rationally tame Capitalism?

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

And Bill will be economy czar for Hillary

Article from Naked Capitalism

Here is link. Don't have time to summarize

After Distancing Herself From Bill Clinton’s Economic Policies, Hillary Wants Him as Mr. Economic Fix It

Great article. Thanks again and again.

With the derivatives markets in the hundreds of trillions of dollars, all the kings horses and all the king's men can't stop the collapse if it takes off