Does this make any sense?

During the two and a half months that followed the February 11th lows, the stock market took a near vertical escalator upward, adding trillions of dollars in paper wealth and coming within 3% of the all-time highs.

You would think that everyone was bullish on the economy and the companies that issue these equities, but you would be wrong.

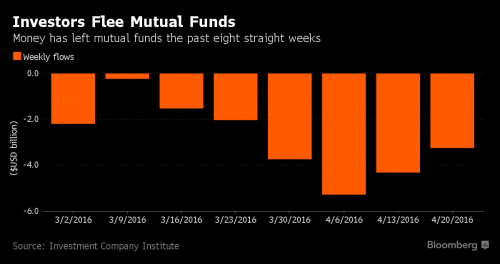

Here’s what happened during the rebound in equities that added nearly $3 trillion to U.S. share values in 10 weeks: mutual funds hoarded cash, short sellers tightened their grip on bearish bets and individuals bailed out of the market.

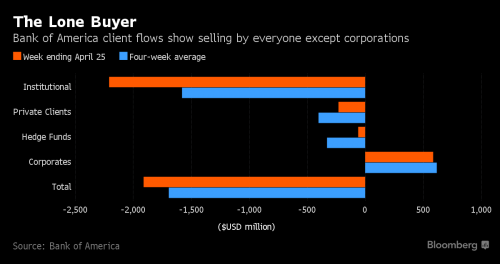

Mutual funds mean small investors, and that generally means "dumb money". Wall Street makes their livings betting against them. However, retail investors aren't the only ones selling.

In normal times, corporate buyers are the smart buyers. But is that true this time?

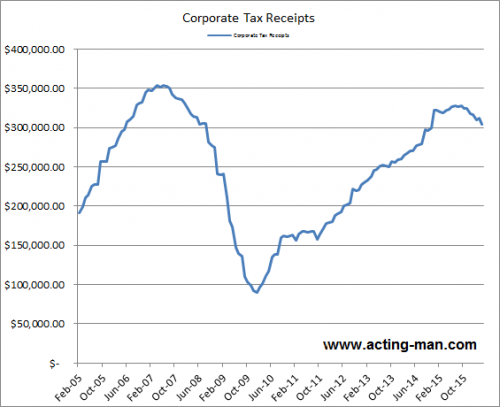

Based on the 55% of companies in the S&P 500 index that had already reported results Thursday morning, Thomson Reuters expects overall earnings to decline by 6.1% in the first quarter compared with a year earlier. ...

This would mark the S&P 500’s third consecutive quarter of declining earnings—the longest streak since the financial crisis. Revenues will have declined for five quarters in a row, outstripping even the four-quarter slide in 2008 and 2009.

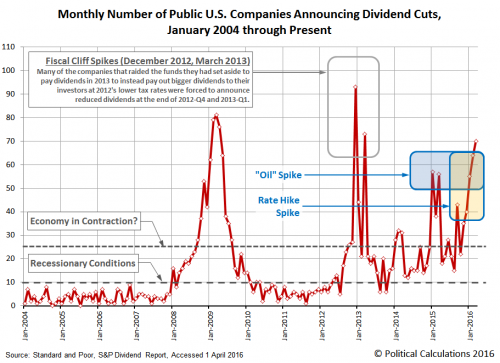

Falling earnings are not a positive in any financial universe, but that isn't the worst of it.

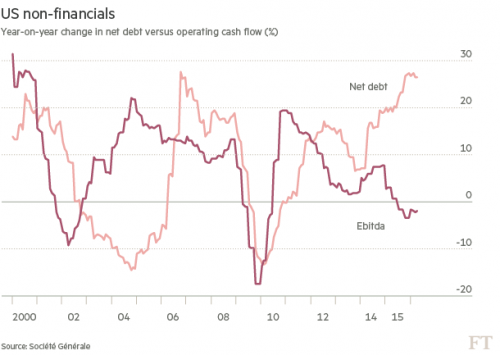

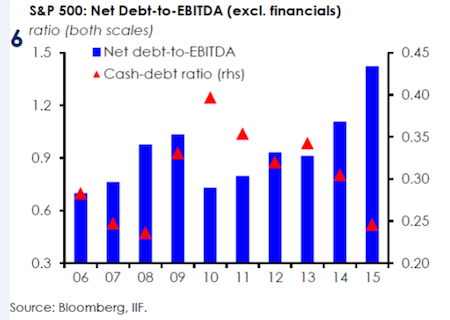

According to Andrew Lapthorne of Société Générale, the reality is that “US corporates appear to be spending way too much (over 35 per cent more than their gross operating cash flow, the biggest deficit in over 20 years of data) and are using debt issuance to make up the difference”....

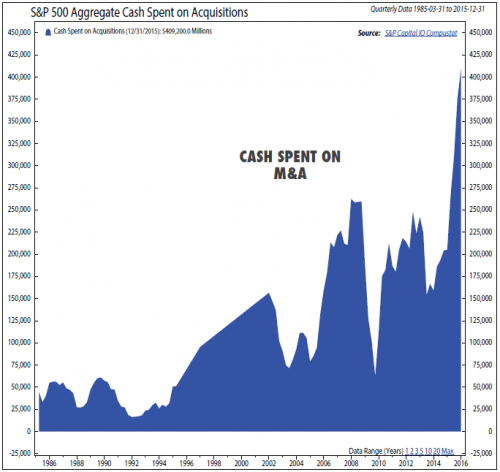

Cash-funded mergers and acquisitions are at a record. In the four quarters to the end of last September, according to Ned Davis Research, S&P 500 companies spent $376bn on acquisitions, 43 per cent above the prior high in 2007, ahead of the credit crisis.

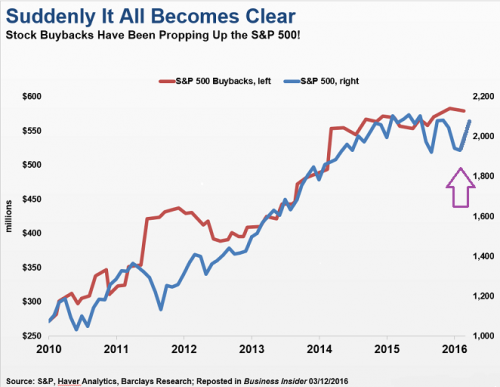

Literally, the only reason stocks went up is because companies borrowed money to buy their own stocks.

Standard & Poor's 500 Index constituents acquired roughly $182 billion of stock in the first quarter of 2016 alone.

And borrow money they've done, in record amounts.

Referring to the US, the IIF said companies were borrowing as if there was no tomorrow even though their profits began to decline in 2014. It said the ratio of net debt to earnings (EBITDA) for companies was at 1.4. This had doubled since the 2007 subprime bubble, according to The Telegraph.

"For the most part, this very significant amount of debt has been used to pay dividends, buy back shares and fund M&A transactions, rather than financing capital spending, which has been on a declining trend since 2012 (and fell 3.5pc in the first quarter on 2016)," the IIF explained.

On junk bonds, a high-yielding high-risk security, typically issued by a company seeking to raise capital quickly, Europe and the US put together are reported to have issued them at double the pace when compared to the pre-Lehman period. "Of particular concern is that since US high-yield companies have increased their debt relative to assets, the recovery rate on defaulted bonds has declined sharply," the IIF said. It added that corporate defaults were at the highest levels since the financial crisis and it was "not restricted to the energy sector."

Well, heh. Maybe they know something about the economy in general. Maybe the economy is turning around. Or not.

Gross domestic product increased at a 0.5 percent annual rate, the slowest since the first quarter of 2014, the Labor Department said on Thursday in its advance estimate...

Almost all sectors of the economy weakened in the first quarter, with the housing market the lone star.

Underlying indicators are no better.

US industrial production (manufacturing, mining and utilities) declined at an annual rate of -2.2 percent this past quarter, after having declined -3.3 percent the preceding quarter. Industrial production has fallen six of the last seven months. US industrial capacity is now at its lowest point since 2010.

Business investment is another trouble spot. Investment in business structures fell by -10.7 percent and investment in new equipment by -8.6 percent, the latter the biggest drop since the 2007-09 recession.

Profit problems are especially pronounced in the financial centers.

Virtually every major bank in every major country reported Q1 earnings ranging from disappointing to catastrophic. To take just one representative example, Deutsche Bank’s profit fell by 58%, and it is now shedding 35,000 workers in 10 countries while eliminating half its investment banking customers.

It’s like that everywhere. Even Goldman Sachs, whose former (and future) execs hold decision-making roles in virtually every Treasury and central bank, is hurting..

Why is that? Ironically, banks are hurting because of the methods used to save them.

First, QE and negative interest rates turned out to have unintended consequences, one of which is a drying up of bond trading. If governments buy up all the high-grade bonds then obviously there aren’t many left to trade. And if the yield on new bonds is negative, holders of existing positive-coupon bonds have no incentive to sell them. Hence, eerily silent trading desks around the world.

Second, the financialization of the global economy has created a vast sea of hot money that flows mindlessly from one location and asset class to another on a scale that exceeds traders’ ability to predict and/or manipulate. Put another way, in a world where it’s impossible to know what’s going to boom or crash next, it’s irrationally dangerous to place big bets on anything.

Eight years of emergency monetary policy, even experimental monetary policy, is choking the financial markets. Stock and bonds move in ways completely divorced from their underlying fundamentals, and that isn't healthy.

People aren't buying this stock rally because there is no financial logic behind it (unless you are expecting QE4), except for chasing the momentum. And that is a game for insiders, not long-term investors.

Comments

I'm gonna clean this up some more tomorrow

but this should be most of what I'm trying to say.

The velocity of money

The net effect of inequality is a loss of velocity creating a feedback loop and continuing loss of velocity.

The individual has always had to struggle to keep from being overwhelmed by the tribe. If you try it, you will be lonely often, and sometimes frightened. But no price is too high to pay for the privilege of owning yourself. - Friedrich Nietzsche -

It's a good thing to keep an eye on.

Awhile ago somebody asked me about the markets and why I was so down on them. I tried to come up with a way to describe what I thought of it that wouldn't frighten people off who don't understand the stock market. Here is what I came up with.

"Lets say that a bunch of guys rob a bank and almost get away, but they have a flat tire. So the cops round them up and the cash. They arrest them, but while they are waiting for a trial, they are allowed to stay in their homes rather than the jail."

"They have a whole team of dedicated lawyers and they tie the prosecutor up in knots. Still, its hard to beat a conviction when you have witnesses and an enraged public. So after a whole lot of yelling, they are found guilty. They are required to pay a fine which represents about 10% as much of the cash as they stole. They can keep the rest."

"Do you figure that the bank will be robbed again?"

That's basically the situation. Even in the incrediblely rare circumstance that a corporation is found liable for this sort of thing, the fines usually represent far less than the profit, and nobody goes to jail. Not even during the trial. So really, under those circumstances, why not rob the bank? What is there to be afraid of?

The way I see it, we are due for another bubble soon.

Negative Interest rates have reached the consumer

I know someone who got a new credit card that pays 2% back on all purchases. She is replacing the card that only gave 1%. Since she never carries a balance over the month end, it is a pretty good deal. Now absolutely everything goes on the card. I guess Visa may lose some money on each transaction, but they hope to make it up on volume

They collect a fee from the merchants.

They are making a profit, even at 2% cash back. IIRC, the usual fee is 3%, and as high as 6% for small merchants.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

You nailed it

in the first paragraph.

No wealth was created. But it sure sounds good being it's on paper.

It would be worth much more written on hemp.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Just remember that $75.000 of that "worthless money" buys

a decent engineer for a year, 4 times that 300,000 buys the talents of a really exceptional one, and the boss owns the intellectual property developed lock, stock and barrel.

The execs and their friends are in the position to be able to loan themselves ridiculous amounts of money at near zero interest rates, to buy the labor of others. That is why it is called "leverage" Your labor gives the money value.

Precisely. And the charts show a growing concentration

…of asset ownership and monopolization among just a few at the top. Corporate failures are on the rise, vacuumed up through the merger and acquisition activity of the remaining big fish. Really big fish.

Seems to me that the gamble is "the appreciation of real assets and intellectual property against the devaluation of the currency that their loans are denominated in" — allowing them to pay off their loans with cheap money. Would that be the Dollar?

Stocks prices move up with these real asset acquisitions. Dividends dry up but Honey Badger institutional investors don't care. They're skimming off the top and it's not their money, anyway.

Personally, I think the world is holding its collective breath, watching the Petrodollar die as the world cashes out.

I'm impressed that the Plutocrats managed to fashion a "carry trade" to see them through a dollar collapse. The more they cannibalize their profits and take on debt, the more money they make. It's a sure thing.

I read somewhere

That Apple had

700800 engineers working on just the camera module of the iPhone." In the beginning, the universe was created. This has made a lot of people very angry, and is generally considered to have been a bad move. -- Douglas Adams, The Hitch Hiker's Guide to the Galaxy "

Wealth hasn't been created for quite awhile in our society.

Michael Hudson explains what has happened in a very good interview in a Counterpunch article. He lays it out this way: "FIRE is an acronym for Finance, Insurance and Real Estate. Basically that sector is about assets, not production and consumption." So if no one makes anything tangible, there are no jobs and nothing to buy. The modern world doesn't work the way we think it does or should. Of course, this is a gross simplification of his ideas or the interview. For that reason, here is the link:

http://www.counterpunch.org/2016/05/02/wall-street-has-taken-over-the-ec...

It is worth reading. I can't recommend Michael Hudson's work and writing too highly. He explains so that non-economists can understand. No calculus, complicated graphs, or double-talk. If one pays attention, the explanation is clear and persuasive. Try it. You'll like it.

-Greed is not a virtue.

-Socialism: the radical idea of sharing.

-Those who make peaceful revolution impossible will make violent revolution inevitable.

John F. Kennedy, In a speech at the White House, 1962

You might not like it

But at least you'll understand it.

prog - weirdo | dog - woof

Education is an intangible. Think about that for a minute.

I love Michael Hudson's work. What little I have had time to read, so I don't think

is exactly what he meant.

You can have a lot of jobs without producing anything other than ideas and methods. A better way to do things is valuable even though it is nothing but a construct.

I think what John is getting at is the that the market is being manipulated by the money of account that is being created and spent by those at the top while the lack of real earnings is because of Death of Demand that Marks predicted as the endpoint of capitalism, which wants to pay its workers as little as possible and thus runs out of customers, because the workers can't afford what they produce.

What Michael has been trying to do is aquatint people with the fact that we are not constrained by how much "money" we have.

We are actually constrained by the amount of arable land we have, the water to make it productive, our ability to grow corps from it, our natural resources, the numbers and skill of our labor force, our store of knowledge, and the ability to solve problems faster than they tear us apart.

"Money" is a utility to help deploy our assets, and as Volcker said should take up only about 7% of GDP, not the present 40% or so.

By the way, both laws that set up the extreame financialization were passed during the Clinton Administration. The CFMA was Written by Clinton's undersec of the Treasury .

I'm reading Hudson's latest book,

Killing the Host: How Financial Parasites and Debt Destroy the Global Economy, right now. I highly recommend it, if you can find a copy. It's full of good information and juicy quotes, like the epigrams he uses at the start of each chapter:

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

Rescued from “Wall Street on Parade” back in mid-March:

Was the first Obama election fixed? New book raises suspicions

Do read the whole thing.

If only to find out why these seasoned experts on the FIRE industry give a shout-out to Black Agenda Report and Counterpunch.

I think "fixed" in that it was not stolen.

Almost all the vote was counted in 2008, as it always should be.

Spend enough time with this guys blog https://richardcharnin.wordpress.com/ to know what he is labeling, and it looks like every election for the last 16 years BUT 2008 has had a heavy thumb on the scale in favor of the Rs.

Not fixed like a cat?

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Stock buybacks and M&A

Have, as their sole reason, the enrichment of upper management, principally the CEO, but often others too.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

This is a really good presentation, gjohnsit.

It's brilliantly organized and simple to follow. You make it look easy, but I know it cannot be. Thank you.

This is a new unsustainable economic pattern signifying something we have not yet experienced in the US. Otherwise we would recognize it. I'm keeping my fingers crossed.

I just dropped this on TOP

It'll be interesting to see if 1) anyone there cares about a serious issue, and 2) how many market apologists there will be.

Competing globally

All of this excellent data goes to the competitive health of the US economy. As we are entering a multi-polar world in many areas including economic, our ability to compete will determine our future as a country. Right now we are on an absolute disaster slide, as we get away from producing things of value and move to trading in speculative assets. Our strength globally is in finance, but I am 100% certain that the rest of the world will generate its own capital where it is needed for growth, independent of the US$.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

The Stawk Market is like a Heroin Addict now

7 years of ZIRP and QE money printing has re-inflated the Stawk bubble. But at some point the Addict has to get off the Methadone (ZIRP and QE). Fed tried to raise rates from ZIRP by a quarter point last december and the patient flat lined. IMO, they've screwed the pooch.

I've been wondering how the stawk bubble was re-inflating. Apparently companies can't resist borrowing when the Fed is handing out money at virtually 0% interest.

Nice analysis gjohnsit.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

Exactly

I should post some charts which match the S&P 500 to the QE's.

They match up almost exactly from 2009 to 2014.

What do the experts say?

Not a real stock market

I have been reading

for some time about a bond market bubble. I didn't know about the buy-backs.

I don't really understand it all, but it sounds bad. OTOH, if I really understood it, I'd probably be working for Goldman-Sachs.

If, and it's a big if, this country made a big investment in infrastructure, we might as a whole be able to ride it out.

Such work would result in value added, at any rate.

Life is strong. I'm weak, but Life is strong.

I have been reading

pieces like this one for about 7 years - approximately the time that Zerohedge came into existence.

The core of it is in this paragraph:

"Eight years of emergency monetary policy, even experimental monetary policy, is choking the financial markets. Stock and bonds move in ways completely divorced from their underlying fundamentals, and that isn't healthy. - See more at: http://caucus99percent.com/content/does-make-any-sense#new"

This is a repeat of the right wing mantra about QE2 - which is been proven rather completely wrong. QE2 did not cause inflation. QE2 is not "chocking the financial markets". To be sure, it is absurd we QE2 is being pursued in absence of fiscal stimulus. But very little that critics of QE2 have predicted has happened. This has not stopped them from asking why they were so wrong in 2010 or 2011 or ...

I have no idea whether the market will crash tomorrow or not. One can predict a recession in the next 18 months for the simple reason that we have gone too long without one. When that happens I expect financial markets to get hit hard.

But that has little to do with the reasons by permabears.

This essay is kinda-sorta something like something else

and that means the two are equal and thus you can dismiss the essay.

Have I summed up your point?