The economy suddenly gets scary

Submitted by gjohnsit on Mon, 03/10/2025 - 7:50pm

Today was a bad day on Wall Street.

Tech stocks tumbled by the most since 2022, sending the Nasdaq 100 Index diving nearly 4%. Crypto prices slid. Corporate bond sales were scrapped. Wall Street’s fear gauge and a key measure of credit risk surged. And Treasuries rallied, pulling yields down steeply, as they took on the role as haven of last resort.

It isn't just stocks and bonds. The dollar is sinking too.

Trump and MAGA are blaming Biden, which is ironic since only weeks ago Trump was taking credit for the stocks market.

It doesn't make sense that stocks went up because Trump was going to be president, but going down because Biden is no longer president. Of course facts have never mattered less in America.

Probably 30% of Americans will blame Biden no matter what, while 30% will never believe anything he says.

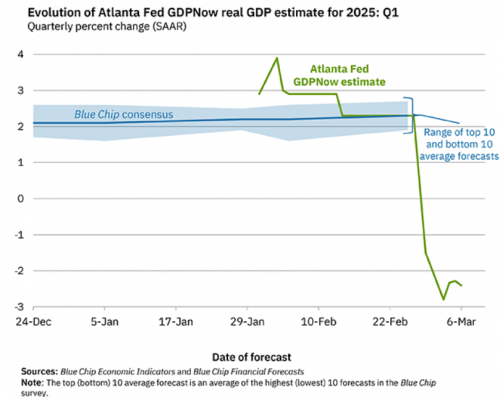

The reality is that the economy was/is in a massive bubble under Biden. The bubble was eventually going to burst, but Trump's chaos was the bubble's pin.

Comments

Yeah, I felt that.

.

Like the swoop in a fast elevator.

All the random stories fell into place like deja vu.

This is 'merica

It's always a good day on Wall Street....for the 1%.

If I remember correctly, after Clinton NAFT'd the U.S. and people fretted that we didn't make anything, economists stated that we didn't need to manufacture anything. Finance and stocks were our new industry. So in Casino America all we have to do is add new and fun games to the floor, out with the slots, in with credit default swaps, and now crypto. Oh Joy! Government backed poker chips.

about the stock market as a measure of economic performance

The Dow Jones Industrial average lost almost 1,000 points over the last five days to its current ominous level this morning at about 41,000. For perspective, the Dow was at 19,173 as of March 20,2020 at the bottom of the seven-week pre-covid crash that saw a loss of 9,000 points. Once the pandemic shutdowns took effect, the Dow actually rallied over the next four months to gain all that loss back and reach a new all-time high of 35,000 in August, 2020, damned close to doubling during the sharpest decline of economic activity in history.

What a good indicator! It tells you what investors think The Market is going to do.

With the current Dow number at 41,000, it is double what it was when the real-life economic downturn started to put people out of work and having to sleep on the pavement. Looks like investors saw that the markets would be protected by fiat money during the Depression that is so troublesome to mere citizens of this Brave New World.

.

1,000 points down, and Trump sucks. So what else is new?

Link: https://mailchi.mp/workersstrikeback/wa-democrats-brutal-budget?e=7c5aca...

That was scary.

I cried when I wrote this song. Sue me if I play too long.

Oh My! Trump's ego is having a tantrum. What could possibly

go wrong?

The Kobeissi Letter @KobeissiLetter

Nothing to see here!

https://www.cnbc.com/2025/03/10/stock-market-today-live-updates.html

It's better than "FIRE AND FURY"...

...and that actually worked out relatively well!

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

The Onion nails it again

gold

This seems to happen a lot...

...and yet, there never seems to be any reliably observable causal relationship between it and anything actually changing.

If only to prove I'm not impossible to satisfy, needless mass-ruination caused by Lockdown would be a good counterexample of a major economic event that DID have directly-observable and lasting effects.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

yeah, if I recall correctly

.

.

they even warned us about licking an envelope

the propaganda penetration was almost complete

fortunately, didn't buy into the vaxx solution

but do see the effects on those who succumbed

(and continue to "be safe") Try Ashwagandha instead..

Ancient Indian remedy for anxiety.

Thought is the wind, knowledge the sail, and mankind the vessel.

-- August Hare