Central bankers have gone bonkers

The picture above is from Santander Consumer Bank AG in Germany. According to their web site, they want you to take out a loan at "-1.0% financing for 24 months".

In case that isn't clear, negative 1.0% interest rates means they pay you to borrow money.

(Before you try calling them, you have to be German to qualify.)

I know what you are thinking. It must be a mistake. No one would ever pay for the right to loan money, right? That's just bizarre.

Yet, there is this (via Google Translate).

Getting paid to borrow money for your house. It seems too good to be true, but for some clients of BNP Paribas and ING is not a dream but reality. The interest rate on their home loan is dropped below zero and so they get money from the bank.

Who in 2012 concluded a mortgage loan variable rate at BNP Paribas Fortis or ING has very lucky. Due to a decline in interest rates, the interest rate on their home loan has also fallen below zero. In other words, the banks pay their customers rather than collect interest. This writes the newspaper De Tijd.

Better ask Alice for directions, because we have gone through the looking glass.

To be fair, Denmark was first with negative interest mortgages, and then came Spain.

Here's how it works. Mortgage interest in Europe is often pegged to interbank lending rates known as Libor or Euribor. Short-term rates on a Swiss franc version of Libor are now approaching minus 1.0%.

Spain's Bankinter, which sold mortgages pegged to Swiss Libor, told CNN it couldn't pay interest on a loan (go figure!) so instead reduced the principal for some of its customers.

"It's not healthy, it's not sustainable, it's mad."

- José María Roldán, head of the Spanish Banking Association

Bankers paying borrowers to take their money is turning 1,000 years of capitalist fundamentals on it's head.

Let's be clear on something: negative interest rates are not supposed to happen. Period. The entire discussion of NIRP has been the domain of theoretical economics for generations.

The reason is obvious. Why loan money to someone at a negative interest rate when holding cash instead makes more sense?

Even during the deep deflation of the Great Depression, interest rates never went below zero.

It doesn't take a financial wizard to see that this makes absolutely no sense at all, and is destined for tears.

Actually, let me rephrase that.

Being a financial wizard appears to be a hindrance to recognizing just how stupid this is.

Sub-zero interest rates in Europe and Japan are “net positives” for the global economy, International Monetary Fund chief Christine Lagarde said Tuesday

Yes, you can be so over-educated that it makes you a moron. (see Economists/2008/Subprime)

Of course Lagarde also recently said, "When the world goes downhill, we thrive," so take it for what it's worth.

Fortunately, not all the bankers are so disabled.

The chairman of France's second-biggest retail bank is more worried about Europe's banking sector now, in some ways, than when he took the reins at BPCE bank during the depths of the global financial crisis in 2009.

Francois Perol said on the sidelines of an economic conference in Italy on Saturday that negative interest rates in the euro zone were a major problem, squeezing interest margins in a way that was unsustainable over the longer term.

"I am much more worried than I was in 2009 in certain respects."

So paying people to borrow money is unsustainable? You don't say.

Morgan Stanley called NIRP a “dangerous experiment’ that will erode bank profits 5%-10%.

The European Central Bank (ECB) lowered its deposit rate below zero, after all, and also buys bonds en masse to push market interest rates down.

Negative interest rates are an enormous part of the market now.

More than $26 trillion of government bonds now trade at yields of below 1%, with around $7 trillion currently yielding less than 0%. Government bonds in Germany with a maturity of seven years are trading at negative yields, while Swiss and Japanese government bonds out to 10 years trade at negative yields.

More than 46 percent of all non-U.S. sovereign bonds now yield less than zero.

Even Italy is selling bonds with negative interest rates. A serial defaulter like Italy. That's like paying Charlie Sheen to watch your stash of coke.

Even corporations are issuing negative rate bonds.

So besides squeezing bankers profits, what are the negative side effects?

For a good example of how badly things can go wrong I give you Japan, where the BoJ just recently adopted NIRP.

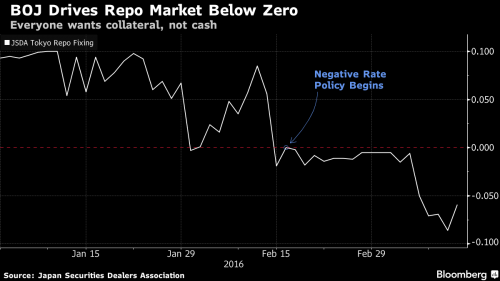

There's a free Snickers bar for the first person who can guess the moment in this chart where negative interest rates started.

Two months after the BOJ said it would start charging interest on some lenders’ reserves, the outstanding balance in the interbank call market tumbled to a record low 2.97 trillion yen ($27 billion) on March 31, according to Tanshi Kyokai data going back to 1988. While the brokers association and the Japan Securities Depository Center said two weeks ago they had upgraded systems to settle transactions at sub-zero yields, traders say more than technical issues are preventing a revival.

“Among central banks, the BOJ is the one that destroys functioning markets the most,” said Izuru Kato, the president of Totan Research Co. in Tokyo. “Companies will slash staff and scale back operations where activity is grinding to a halt, exposing markets to spikes in rates when the time comes for normalization.”

NIRP isn't just breaking Japan's interbank lending.

Japan's bond market is breaking as well.

Signs of stress are multiplying in Japan’s government bond market, which is crumbling under pressure from the central bank’s unprecedented asset-purchase program and negative interest rates.

Bank of Japan Governor Haruhiko Kuroda has repeatedly said his policies are having the desired effect on markets, including suppressing JGB yields. His success is driving frenzied demand for longer-dated notes as investors avoid the negative yields offered on maturities up to 10 years. And as buyers hang on to debt offering interest returns, the BOJ is finding it harder to press on with bond purchases of as much as 12 trillion yen ($106 billion) a month, sparking sudden price swings leading to yield curve inversions that have nothing to do with economic fundamentals.

Even before the BoJ broke the bond market with NIRP, they completely destroyed money markets fund in Japan.

All 11 companies running money-market funds stopped accepting new investments, citing the BOJ stimulus. They plan to return money to investors, the Nikkei newspaper reported, and money from the funds is moving to deposits, according to analysts at Deutsche Bank.

While the BOJ’s monetary easing policies are meant to stimulate lending and encourage borrowing, lending growth slowed slightly in February while deposits rose -- the exact opposite of what the bank was aiming for.

Nowhere has NIRP been a bigger failure than in Japan. If it continues for long Japan's economy will collapse. And yet no one in a position of authority has pointed out that the Emperor has no clothes.

"Let's be clear: Negative interest rates are terrible."

- BlackRock CEO Larry Fink

Other side effects of NIRP are as equally unsurprising.

Moody's Investors Service concluded that three countries with NIRP, Sweden, Switzerland, and Denmark (the originators of negative rate mortgages) "the unintended consequences of the ultra-loose monetary policy are becoming increasingly apparent -- in the form of rapidly rising house prices and persistently strong growth in mortgage credit."

Imagine that. When you pay people to take out mortgages you create housing bubbles.

NIRP also means punishing savers for saving money.

The response in Germany was predictable.

The European Central Bank's negative interest rates are sparking demand for safe deposit boxes, where bank customers can store cash to avoid the prospect of paying the bank interest on their accounts, German bankers said.

In Japan there was a run on home safes for the same reason - to store cash.

It isn't just retail customers.

German reinsurer Munich Re is boosting its gold and cash reserves in the face of the punishing negative interest rates from the European Central Bank, it said on Wednesday.

This dash for cash has prompted some economists and bankers to propose banning cash, thus eliminating the ability of people to protect themselves from NIRP.

There is one other side effect to NIRP that should have been obvious, but for some reason central bankers are still refusing to acknowledge.

"Not nearly enough attention has been paid to the toll these low rates — and now negative rates — are taking on the ability of investors to save and plan for the future."

"This reality has profound implications for economic growth: consumers saving for retirement need to reduce spending... A monetary policy intended to spark growth, then, in fact, risks reducing consumer spending."

Finally, there is the fact that negative interest rates encourages investment in excess capacity, which in turn drives down prices for goods and services. This creates a deflationary feedback loop in a time of very low inflation.

Most economies with negative rates are caught in a credit trap. Credit demand is weak and credit supply is constrained. Policy measures such as negative rate and additional QE are increasingly ineffective.

In essence, central bankers are treating a global demand problem (i.e. the consumers are broke and in debt) as a supply problem (i.e. the consumers need more loans).

Stephen Roach calls this misdiagnosis "the greatest failure of modern central banking."

Why does this matter to me?

The question above requires a multi-part answer.

First of all, take a look at this chart.

Notice that every time a recession hit, the Fed dropped interest rates to combat the slow-down.

Also notice that interest rates are near zero, so knowing that NIRP doesn't work, in the event of the next recession, further cuts will have no real positive effect (this chart is similar to the rest of the developed world).

35 years of falling interest rates are over. An era has ended. Monetary policy can no longer cover up for fiscal failure.

I seriously doubt the global political and financial establishment has come to terms with this fact.

But they will, when the next crisis hits.

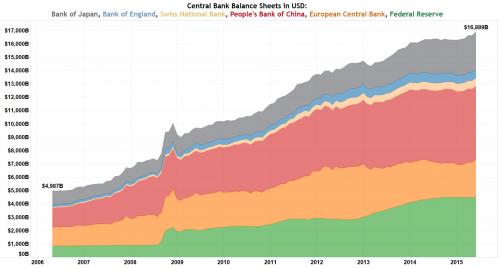

Central banks have another tool - an enforcement tool - called quantitative easing (QE), the buying of financial assets in order to influence interest rates.

It's only supposed to be used in case of emergency.

Central banks have been at DefCon1 for eight years now.

The balance sheet assets of the world's six major central banks hit a new all-time record, increasing to $16.9 trillion from $4.9 trillion 10 years ago, a 239 percent increase.

The balance sheet asset of the Fed, which has been leading the monetary policies of America, the world's largest economy, reached $4.495 trillion, equal to 25.41 percent of the country's combined GDP. This proportion was 6.17 percent in 2006.

So what? What's to stop them from continuing this forever?

Once again, Japan is the note of caution.

The total assets of the Bank of Japan (BOJ) reached 70 percent of the country's GDP in 2015 with $2.834 trillion, compared to 24.27 percent in 2006.

Japan's central bank has bought up so many of its bonds that liquidity in their bond market has dried up. It's a major reason why NIRP in Japan is a bigger disaster than anywhere else.

Thus QE, like falling interest rates, has both diminishing returns and an upper limit.

Also, this unprecedented and massive purchase of bonds by central banks has distorted (and was meant to distort) asset prices. Any attempt at "normalization" will have dramatic and negative effects on prices (and profits).

Once again, I don't believe politicians and economists understand what has happened here.

As more and more people recognize the failure of NIRP you might think that they would step back and re-evaluate their actions.

But you would be wrong. Instead they are preparing for the biggest and most dangerous experiment of them all.

Faced with political intransigence, central bankers are openly talking about the previously unthinkable: "helicopter money".

A catch-all term, helicopter drops describe the process by which central banks can create money to transfer to the public or private sector to stimulate economic activity and spending.

Long considered one of the last policymaking taboos, debate around the merits of helicopter money has gained traction in recent weeks.

ECB chief Mario Draghi has refused to rule out the prospect, saying only that the bank had not yet “discussed” such matters due to their legal and accounting complexity. This week, his chief economist Peter Praet went further in hinting that helicopter drops were part of the ECB's toolbox.

Germany's finance minister has threatened to sue the ECB if they do use "helicopter money".

Since the negative effects are so obviously a failure, I guess success has been redefined to meaning "not causing a complete collapse". Sort of like how the GWOT has gone.

Comments

Phew!

That required a lot of work. Please let me know if this is clear.

It's pretty clear, I guess,

but it's a complicated subject. It takes some effort by the reader just to wrap their heads around the concept.

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

It's very clear, but hard to understand nevertheless,

thanks.

https://www.euronews.com/live

Jim Stanford: Negative Interest Rate Explained

[video:https://youtu.be/UN-d4dhYm4M]

ZIRP and banks

thanks, it's more the relation to bonds and

the idea that cash money can be banned, I don't get. Basically, when they ban cash payments, you have no way of not being enslaved in that system to the point you are paralyzed even if you have cash money.

https://www.euronews.com/live

your writing is very clear. But the subject is highly

complex. I've been trying to understand it so just purchased Randy Wray's book after reading some pamphlet's from Bank of England. It's very complicated subject and requires a deep knowledge of some terminology.

Don't believe everything you think.

I do have a degree in economics

But I think it's clear in laymen's terms that people in power in government and business are trying to run a one-legged race where it comes to the economy. The other leg-- fiscal policy-- has been ignored or disabled on purpose. I can't speak for Europe or Japan, but we know that in the U.S., fiscal policy has gone unused since the Great Recession largely because the Republicons don't want a whiff of a notion that government can do anything good for the economy. So we have had much slower growth than is necessary and a paucity of investments in the things we so need for the next phase of the economy: clean energy, high speed rail, new public works, education and basic scientific research.

For at least another hundred years we must pretend to ourselves and to everyone that fair is foul and foul is fair; for foul is useful and fair is not. Avarice and usury and precaution must be our gods for a little longer still.

John Maynard Keynes, 1930

I think you nailed it:

"I’m a human being, first and foremost, and as such I’m for whoever and whatever benefits humanity as a whole.” —Malcolm X

People don't need LOANS...

People need actual cash. If the Bankers had any brains, instead of trying to incentivize their already failed business model, they'd INVEST in companies with no strings attached.

Percentage of later profits maybe? You know, the whole actual INVESTING in a company instead of trying to profit off the risks of somebody else. You can't make money without risking something, at least that's how capitalism is SUPPOSED to work.

Bankers have eaten their cake and had it too for so long, they fail to realize that the people don't want to prop up their little pyramid scheme any more.

I do not pretend I know what I do not know.

Very clear gjohnsit

The world is awash with cash.

Oligarchs have gotten good at stashing it 'places'.

I want a Pony!

Very clear !

Have I mentioned I thoroughly grok your posts ? I'm a historian, poli sci / pub admin, and tech guy by training and passion, NOT a finance guy ! And your posts (even at TOP) have always been easy for me to comprehend...

The charts are very insightful !

-PubliusVergil

Phenomenal Assembly of Info

When money is worthless, capitalist economics is through. Absolutely done. So where does it go to find new value? In one of those burgeoning third world free market capitalist societies? Remind me where they are located, please.

Meanwhile, I just had to stop my bank from taking a maintenance fee out of my kindergartner's little savings account. It was a "mistake." Of course, of course.

Looks like taking out a loan

Looks like taking out a loan would give you a better return than putting your own money into a savings account.

They say that there's a broken light for every heart on Broadway

They say that life's a game and then they take the board away

They give you masks and costumes and an outline of the story

And leave you all to improvise their vicious cabaret-- A. Moore

In the longer run

it's bad for the financial system because if you have to pay to save your money at the bank, or you get nothing, you may as well stuff it into the mattress. Of course, you could buy other financial assets that might deliver a positive return, or buy precious metals.

For at least another hundred years we must pretend to ourselves and to everyone that fair is foul and foul is fair; for foul is useful and fair is not. Avarice and usury and precaution must be our gods for a little longer still.

John Maynard Keynes, 1930

That's exactly what they want you to do.

There is no velocity of money with people saving. They WANT you to gamble it away. It's a really bad situation.

"Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies." - Groucho

I know just enough about NIRP

to understand I know absolutely nothing. I think I may have a lot of company as nobody understands where this is going absent a change of direction. But what? It looks like the central bankers and policy makers are down to reaching into the guts of a very complex machine and pulling out a handful of wires. Their only guiding principle seems to be whatever we do it has to not hurt us. Bollocks! The only way out is to hurt them and was the only real solution to the 2007-09 cluster fuck.

I don't have any ideas, just questions. Have we seen the upper bound to the wealth transfer from the many to the few of supply side economics? Has the plutocrats' greed finally strangled the golden goose? The golden goose I speak of is the average person. Our economies run on their spending so maybe we've discovered just how poor they have to be to starve the machine. I thought the first sign of real trouble might at hand when be saw your data from a couple weeks ago showing that the highly educated and skilled, hand maidens to the extremely rich, were seeing income reductions. They are those in the top 2-10% of income earners. They are able to save and invest but still spend a significant portion of their income which fuels the economy. I think we'll see pitchforks and torches when these folks begin to see they're the next in line to be shorn like the bottom 90%.

What is the alternative to civilization collapsing along with the economies of the world? How to stop that from happening? The few things I can think of all come under the general heading of converting all that money sitting on the sidelines in the hands of a very few individuals and huge corporations. The only solution looks to be on the demand side. What would work? Mandating significant wage increases for the average worker combined with reduced work hours? Large tax rates on high incomes of individuals and corporations to finance a national infrastructure rebuilding program? (Financed with negative interest rate TBTF bank loans? There's a privatization plan I could get behind.) An honest assault on tax evasion worldwide?

Hell, I don't know. I'm just throwing shit out there now. None of this makes sense except if the bankers' only concern is to maintain the scam and keep their ill gotten gains. Are there any ideas where this is going floating around out there in the world of economics?

"Ah, but I was so much older then, I'm younger than that now..."

Secular Stagnation

The world of late stage monopoly capital is in a state of too much productive capacity and not enough investment opportunities. It was predicted decades ago that a financialization of post-industrial countries would take place and that is what is happening. The capitalist maxim of "growth at all costs" has led to this, along with waste, corruption, disrupted lives, and widespread poverty in the global south.

This system which has brought misery and grotesque maldistribution of wealth needs to be replaced with an economic system where peoples' needs are met first. Prominent among these needs is a sustainable biosphere that will support human life and keep biodiversity. The new system has to reverse the factors that are causing climate change and causing an existential threat to living beings.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Growth at all costs

Is the philosophy of the cancer cell.

I meant to say that stupid people are generally Conservative. I believe that is so obviously and universally admitted a principle that I hardly think any gentleman will deny it."

John Stuart Mill (1806 - 1873)

Central Bonkers.

"I’m a human being, first and foremost, and as such I’m for whoever and whatever benefits humanity as a whole.” —Malcolm X

How soon will cashless society

Hit here and does that mean I can't pay for my food or gas with cash? I know that they are trying it out already in some countries in Europe, but I don't know the details of what it means.

I did have a hard time understanding what you wrote, gj.

Help?

The message echoes from Gaza back to the US. “Starving people is fine.”

Income redistribution

Negative interest rates are a strange form of income redistribution. Note that they are happening in fairly progressive countries where they understand that cash circulation is stimulative.

Also, making cash illegal will have no effect as people will simply switch to fungible commodities like gold. Once again, the incompletely educated banker types get fascinated by shiny computer bits while forgetting that real people eat atoms...

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

Clumsy

Still, as you explain, it is a hopelessly clumsy way to try to put savings to use. A much simpler way would be to tax the crap out of idle money and use it for infrastructure projects and public research.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

That's not simple

I agree that NIRP is doing wonders for gold, but there simply isn't enough of the shiny metal for people to shift to it without the price of gold shooting through the roof.

BTW, gold is doing great so far this year.

Hard to buy eggs & bacon with a gold bar

Would we be shaving it? So many grams?

People with savings accounts pay the bank to keep their money.

That isn't good. Who would keep their money in the bank? It would cause a run on the banks, would it not?

"Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies." - Groucho

We pay the banks for lots of other things right?

We pay 2-4% for the bank to move money from one account to the other when a Visa is swiped. If we pay to move something why not pay to store securely? If you have an RV that you store in the off season you would have to pay for that storage right?

I think it is less important that we clamor to find the stupidity in NIRP than it is understand what NIRP means as a harbinger of the future.

As in, it doesn't matter that NIRP is crazy and seemingly stupid. Banks simply act as brokers between those who have and those who need. A simple equation of supply and demand. Putting themselves as the go between and getting their slice of the pie. What does matter is that NIRP suggests that there is massive amounts of cash (or at least cash availability) that is sitting idle. When in reality a healthy economy needs that capital to be productive.

Mainstream media...

...sends this to the depths of the business section. They either don't want us to know about this, or think we're too dumb to understand. Thanks for bringing some attention to this.

"Then I read this: Atlas Shrugged by Ayn Rand. I read every word of that piece of sh*t and I'm never reading again !"- Officer Barbrady

I got this bag a gold on my back

I got this bag a gold on my back

Going from town to town

along this dusty track

I'll tell you brother

I'm nearly dead on feet

I got to find me

something to eat!

Every time I wonder

onto some place

I can't get no food

not even a taste

Everywhere I go I see these signs to behold

They say

Won't be selling no bacon and eggs for gold

the yokes worth more

than all the gold you hold

Don't ask again now

you been told

Won't be selling no bacon and eggs for gold

Well I tell you all

it's s sad state of affairs

I got the gold but no one cares

Guess I'll have to keep shuffling on down the road

I just can't get no bacon and eggs for gold.

PS: thanks sunspots. your post got me thinking

With their hearts they turned to each others heart for refuge

In troubled years that came before the deluge

*Jackson Browne, 1974, Before the Deluge https://www.youtube.com/watch?v=7SX-HFcSIoU

Excellent story, I almost understood it

Two things:

1. What the heck does GWOT mean? Damnable acronyms

2. Who is stupider: the central bankers who, despite accumulating evidence AND common sense, continue NIRP--or the public for seeing this idiocy for what it is and not rising up about it?

GWOT?

I am guessing Georges War on Terror?

Global War on Terror

But George's War on Terror works too.

Meddle not in the affairs of Dragons - For thou art crunchy and good with ketchup

I Don't Know Why

But this puts me in mind of a great piece published on TOS back in 2008.

It paralleled the circumstances leading up to the Great Depression to those leading up to the Great Recession... even though that term hadn't come into use yet.

I always read your essays, as well as those of others who know far more about this stuff than I. I don't always catch the nuance of terms and graphs, but I usually get the gist. Smell shit? Check your shoes and watch where you're walking.

Please continue to keep us posted because... sniff sniff

Meddle not in the affairs of Dragons - For thou art crunchy and good with ketchup

Panama Papers and War on Cash

interesting

Cashless society

lessons from Davos

How low is low?

They seem to be having trouble coming to terms with the fact

That Bernie is right and we need the Fed to start up construction jobs rebuilding the infrastructure. That's the form of "helicopter" money that really works in kickstarting an economy.

Also, I don't buy into the assertion that negative interest is poisonous. It and deflation are healthy corrections to an over inflated economy. Bringing down the price of goods and a defacto lowering of the cost of housing are both good things since both have been artificially inflated to begin with. It's not sustainable, but it is far more sustainable than the banksters would care to admit.

Bottom line is, the 1%ers stole too much and now the economy demands that they give some back.

Their loss, humanities gain.