How is this not a bubble?

Sometimes a bubble is hard to recognize until after it has burst.

Sometimes it is easy to see.

In 1637 a single tulip bulb in the Netherlands was traded for a 12 acre farm, or 10 times the annual income of a skilled tradesman.

That's clearly a bubble.

So is this.

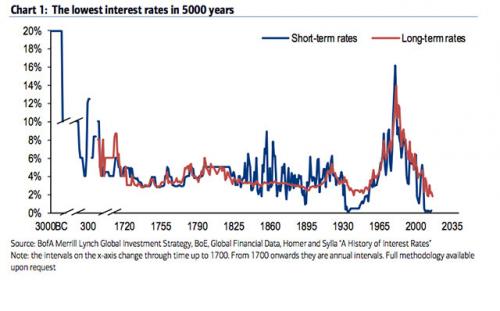

Interest rates today are the lowest they’ve been at least since Stonehenge was under construction and the pharaohs of the First Dynasty ruled Egypt, Bank of America Merrill Lynch (BAML) said in a report this week.

In fact, according to another new report, this one from the Bank of Montreal, interest rates have fallen so far that some governments can actually make money by borrowing it — essentially destroying any argument for spending cuts.

“In this bizarre circumstance, let’s just say that the argument for spending restraint — let alone austerity — pretty much collapses,” Bank of Montreal chief economist Doug Porter wrote in a report Friday. “Public sector borrowing becomes a revenue-generating activity.”

Anytime you are using the expression "5,000 year high/low" it is a bubble by definition.

Anyone who says otherwise is either "talking their book" or a fool.

Ultra-low interest rates in Japan have completely wiped out the entire money market fund industry.

Persistently ultra-low interest rates will implode the global pension industry. Like money market funds, pension funds aren't built to survive zero interest rates for extended periods.

Need more proof? How about this.

The yield on Germany’s 10-year government bund, Europe’s benchmark security, fell below zero for the first time on record, as investors’ seemingly insatiable demand for haven assets created another bond-market milestone.

The nation joined Japan and Switzerland in having 10-year bond yields of less than zero.

Some of you may not understand the significance of one of the most important nations in the world going negative (NIRP).

Fortunately there is a precedent for this, and I have a chart that will make it more clear.

To put it more simply, the last time interest rates in Germany went to zero, it was followed by this:

Does that mean hyperinflation is coming? No. In fact I think deflation is much more likely. At least that is what the markets believe.

According to BAML’s “Longest Pictures” report, this is happening because of central banks all over the world that have been pushing down interest rates for years in order to fight the threat of deflation — a persistent decline in prices....

Central banks are battling that trend by lowering rates, which is supposed to spur more borrowing and spending, and therefore higher prices. But after nearly a decade of low and lower interest rates, and the threat of deflation still stalking developed economies, some are wondering whether the policy works at all.

It may have just caused the world to take on way too much debt.

Guess what happens to an economy with way too much debt? Debt deflation and eventually defaults and bankruptcies.

The Bank for International Settlements (BIS), a sort of “central bank of central banks,” has been warning for some time that the borrowing numbers aren’t adding up — the world has gone and borrowed too much.

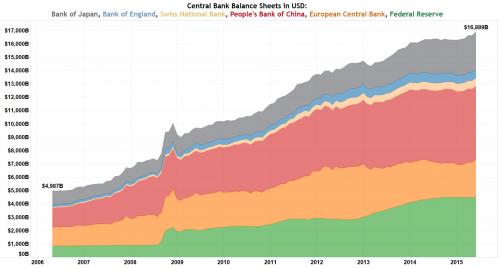

This is the doing's of the global central banks, who have managed to convince the markets that "bad economic data is good news for markets" through the mechanism of massive financial asset purchases.

Those massive financial asset purchase programs, aka QE, have pushed interest yields on bonds to previously unthinkable lows.

Negative-yielding government debt has risen above $10tn for the first time, enveloping an increasingly large part of the financial markets after being fuelled by central bank stimulus and a voracious investor appetite for sovereign paper.

...

Negative rates have not been confined to the sovereign debt market. Corporate bonds with a negative yield have climbed to $380bn, according to Tradeweb.

“You have central banks which have gone through the looking glass and gone through . . . zero that many people thought was unbreakable,” said Sameer Samana, a strategist with Wells Fargo Investment Institute.

Central banks have been at DefCon1 for eight years now.

The balance sheet assets of the world's six major central banks hit a new all-time record, increasing to $16.9 trillion from $4.9 trillion 10 years ago, a 239 percent increase.

The balance sheet asset of the Fed, which has been leading the monetary policies of America, the world's largest economy, reached $4.495 trillion, equal to 25.41 percent of the country's combined GDP. This proportion was 6.17 percent in 2006.

So what? What's to stop them from continuing this forever?

Once again, Japan is the note of caution.

The total assets of the Bank of Japan (BOJ) reached 70 percent of the country's GDP in 2015 with $2.834 trillion, compared to 24.27 percent in 2006.

Japan's central bank has bought up so many of its bonds that liquidity in their bond market has dried up. It's a major reason why NIRP in Japan is a bigger disaster than anywhere else.

Secondly, like a snake swallowing its own tail, the amount of bonds that the Bank of Japan can even buy is shrinking.

Japan is not alone.

German lender Commerzbank AG estimates that almost two-thirds of all German sovereign debt outstanding now yields below minus-0.4%, which makes it ineligible for central-bank purchases.

Thus QE, like falling interest rates, has both diminishing returns and an upper limit.

Economists believed for at least five centuries, since the creation of modern economics, that negative interest rates were not possible.

You don't throw out the rule book without some amount of care.

Unlike 2007, this bubble isn't being led by the United States (although we're getting a lot of the excess cash/credit/debt).

Europe and Japan are leading the charge into unsustainable low interest rates, while China is leading the charge in excessive corporate debt and housing bubbles.

Comments

Crap!

A lot of my clients incomes are based on pensions. If they go, I'll have little to no work. Time to diversify my employment, I guess.

Great.

Ya got to be a Spirit, cain't be no Ghost. . .

Explain Bldg #7. . . still waiting. . .

If you’ve ever wondered whether you would have complied in 1930’s Germany,

Now you know. . .

sign at protest march

Your concern

for your clients is touching.

The more people I meet, the more I love my cats.

Uh, I HOPE that is snark

as you DO NOT know how I bust my ass to keep their costs down, how sometimes I don't even bill them for work performed? How I'm trying to set up an alternate income stream for them at their request. This being No Hum, maybe you can guess what that may be? How a 72 yr. old Union worker with cancer has to try and make his shit work to survive after 35 yrs. in a union job? When pensions are under assault from vulture capitalists? I'm gonna stop before I say something untoward to you.

peace

Ya got to be a Spirit, cain't be no Ghost. . .

Explain Bldg #7. . . still waiting. . .

If you’ve ever wondered whether you would have complied in 1930’s Germany,

Now you know. . .

sign at protest march

If what you are saying

is true, then applaud you and wish you well. But please, just read again what you wrote in your comment:

Not knowing anything about you, that sounds like someone lamenting "poor, poor me," whilst lacking any empathy for their clients.

I'll take you at your word that this is not true. I doubt C99 would attract someone like that. But man, it didn't sound good.

The more people I meet, the more I love my cats.

Agree.

I had the same visceral reaction to the original comment by TBaU.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Late night,

dog on deaths threshold, no sleep, depressed. So yeah, it was 'poor me' I guess. Still, your reply struck me as a little harsh. And my original post was unnecessarily brief. Did I mention tired? Try exhausted. Again,

peace.

Ya got to be a Spirit, cain't be no Ghost. . .

Explain Bldg #7. . . still waiting. . .

If you’ve ever wondered whether you would have complied in 1930’s Germany,

Now you know. . .

sign at protest march

My reply

was a little harsh. For that, I apologize. It... has been pointed out to me at times that I'm a bit to... direct?... in my interactions with folks. And I'm the one who advocates for taking time to respond when on the webs.

I'm really sorry about your dog. I lost two cats not long ago and it still chokes me up to think about it - even though I have three more sweeties in my life. I suffer from major depression, which can prompt me to lash out, even when I take my meds. So yeah, I understand your position and where you're coming from. Thanks for continuing to talk with me, rather than just telling me to fuck off. I'm happy to start getting to know you.

As-salamu alaykum to you, as well!

The more people I meet, the more I love my cats.

Me too,

as for 'being direct', usually people just refer to me as 'asshole' and for the most part they'd be correct. However, 'I AM trying, I'm trying real HARD to be my brothers' keeper'. Most times successfully, sometimes not.

Thanks for keeping me straight.

Ya got to be a Spirit, cain't be no Ghost. . .

Explain Bldg #7. . . still waiting. . .

If you’ve ever wondered whether you would have complied in 1930’s Germany,

Now you know. . .

sign at protest march

Damn

I can't even think about what happens if China's economy implodes. That would be really, really bad.

More like a black hole than a bubble

Keynes must be spinning in his grave.

One thing makes sense, deficit spending.

The political revolution continues

It's a historic achievement

The Cuban Missile Crisis. WWII. The Great Depression. The French Revolution. The Black Plague. The Fall of Rome. The Punic Wars. The Peloponnesian War. The Fall of Babylonia. The Great Flood.

None of those things managed to push interest rates negative.

it's global hoarding, IMHO

The point about "safe havens" is key. There's less and less money actually circulating as global fiscal monstrosities suck every fraction of every penny from every single exchange of money, whether it's usurious consumer credit card interest rates, corporations paying no taxes (or negative taxes), or labor's worldwide race to the bottom. I hope my upcoming pension (beginning July 1) survives as long as I do!

"Fear is the mind-killer" - Frank Herbert, Dune

Yeah, but it will trickle down in

3, 2, 1.....

Lemme try that again

3, 2, 1.....

Something's not right here.....

Hey, elites--you do understand the economy will crash if the rest of us can't buy enough to keep the machine running, right?

Hello?

Ruh roh, this could get ugly

Dig within. There lies the wellspring of all good. Ever dig and it will ever flow

Marcus Aurelius

and our ReThug congress refuses to put people to work

doing needed infrastructure maintenance so it is left to the Fed try to compensate the weak economy with low interest rates. Same deal in Europe with "austerity".

Another bubble & burst coming?

Time magazine's Rana Foroohar, author of "Makers and Takers", discusses the possibility of another bubble:

"It is perhaps the ultimate irony that large, rich companies like Apple are most involved with financial markets at times when they don’t need any financing. Top-tier U.S. businesses have never enjoyed greater financial resources. They have a record $2 trillion in cash on their balance sheets—enough money combined to make them the 10th largest economy in the world. Yet in the bizarre order that finance has created, they are also taking on record amounts of debt to buy back their own stock, creating what may be the next debt bubble to burst."

http://time.com/4327419/american-capitalisms-great-crisis/

When Time discusses the failure of market capitalism, it has already arrived. Incidentally, it was illegal until 1982 for a company to buy back it's own stock. Since interest rates are so low and companies want to keep their profits abroad to avoid paying U.S. taxes, they have contributed to the over-financialization of the economy. The Time article discusses the failure of economic policies over the last 40 years.

The issue is that Apple has vast sums of money . . .

parked overseas as part of its elaborate tax avoidance schemes. However, if it brings the money back, they'll get hit with a big tax bill. So instead of bringing the money back to inflate their stock price and drive up executive compensation, they borrower domestically at low interest rates and get another short-term tax benefit for their trouble.

What a bunch of big corporations are waiting for is another "tax repatriation" holiday like the one that we had in the mid-2000s. The next president and Congress will probably give it to them -- Clinton voted for the last give away in 2005. They'll call it a "jobs" bill, but really it's just a give away to shareholders.

The real welfare queens

There is nothing which I dread so much as a division of the republic into two great parties.. This...is to be dreaded as the greatest political evil under our Constitution.--John Adams

This strikes me

as another in the author's pieces about disaster which perma bears have been writing since 2009.

Eventually they will be right.

But not based on any of the reasons they site.

Thank you for adding nothing to the discussion

Maybe next time you could address just one of the points I made.

wow. touchy. someone can't just have an opinion

'they must now be deemed' as adding to the conversation.

Wonder what the criteria are for that…no wait, please don't list anything...

We're fucked. The powers that be don't give a damn. They're looking out for themselves and will feed on the people as long as they need to in order to maintain their station and power.

Those in power will turn around and blame 'the people' for forcing them to punish everyone else and then those in power will smirk to each other and wax poetic about how this is just the world we all live in' as they tell people to vote for them and send them campaign contributions.

And, if not deemed worthy of adding to the discussion:

What is a "perma bear", exactly?

I didn't get the reference....

Dunno

Don't care either.

The poster coulkda just said woof, and all the OP had to do was ignore it and move on, but oh noes, this didn't add to the conversation…blah f-n blah

- whatever.

On a different note - speaking of bears - I still get annoyed with this commercial from a few years back…

[video:https://www.youtube.com/watch?v=ua8jF1ZPaAU width:500 height:400]

Baby Bears have died… - the obvious stabs at manipulating people in this commercial make me laugh still, but wow.

Oh yeah - Woof!

[video:https://www.youtube.com/watch?v=DMlhBq4xb-A width:500 height:400]

It sounded snide

at the very least, in the context it was used. I've never seen/heard the term.

The writer was specific, so he/she seemed to care....just wondered.

Perma bear

Never heard the term, but I'll venture a guess. Since this is an economics discussion, it probably relates to the "bulls and bears", i.e. stock market investors. Bears are pessimists and act on the market (and stocks) going down. I guess "perma bears" are investors who perpetually trade as if a stock will go down and sell short.

Calling someone a Perma Bear is a bit insulting

…and similar to calling them a "doom 'n gloomer."

They are not necessarily traders. More often they write or report on market behavior and market fundamentals. There are some who look at a chart or two, in a limited context, and announce, "We're all gonna die."

Other Perma Bears look at the charts in great context, seeing trends in leading and lagging indicators that show no reason for markets to rise based on sales, profits, and debt, which suggests that stocks are oversold. They also look back through time and find that the current pattern matches patterns that historically end with a market rout. They put out a warning to investors. Perma Bears rarely send "buy" signals; they generally pipe up only when they believe the market cannot be supported.

Sometime around the doc com crash in 1999, market fundamentals stopped correlating with historic outcomes that economists had relied on for centuries. Suddenly, companies that underproduced in certain sectors went up in value instead of down. Companies that take on more debt were suddenly more valuable instead of less. The entire market entered "opposite world" due largely to changes in geopolitical money flows and manipulation by central banks. Also in 1999, the Forex could be traded publicly for the first time. It's the largest exchange in the world and sets global currency values.

Markets are now guided by invisible forces that, frankly, suggest that its smarter to bet with the "House" and forget about the economic fundamentals. The "House" can move the market up, continuously if it wants to — and it does. It can also asset-strip one class of investors and not others.

From this more cynical marketplace, Ultra Perna Bears emerged. They assure people that, yes, the fundamentals really do look like a recession or worse. They write newsletters for investors who can't make the leap to a rigged market, telling them how to protect their wealth. They appear on Business oriented TV shows. But bears no longer have much of a voice on Wall Street. The are regarded as equivalent to concern trolls or teabaggers.

The author is far too nuanced to fall into any of these categories.

Thanks for the explanation. : )

Perma bear

A perma bear is someone who is permanently bearish (negative) about the stock market and thinks it will fall. I have read several articles suggesting that the current stock market is overvalued. Time will tell.

I was replying to a personal jab

If he had an opinion about the essay then I wouldn't have been "touchy".

I may live in a ranch house, like,

a cute bunk house with some amenities, but it is paid for from the day I finished building it. And it can be moved, if I want off the acreage, which is also paid for.

What works for me is cheap goods.

Too bad world banks depend on slave laborers buying ever more expensive shit.

Stonehenge, indeed.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

Stock buy backs are not all bad

Some industries need to do some serious stock buy backs, in an effort to reduce the shock from the decline of those industries.

It would be better if it wasn't heavily debt fueled, but at current interest rates, I can't hardly blame them for taking that route. Stock buy backs, will help to maintain the price of a stock even as the business that stock is issued by shrinks. The oil industry needs todo this soon, Apple has reached peek phone profits and it will be down hill from here, so buy backs will maintain the per share price even as the market cap of the company declines.

Their will be further encouragement for this share buy back behavior as retire's start withdrawing their 401K's in larger numbers. This is going to be a huge factor in our future economy.

Companies will be spending more on buybacks, and less on new investment, even to the extent to reducing their workforce to pay for it.

I expect that increased use of electric cars will keep oil prices down for the next 20 years, and keep shipping costs from getting prohibitive, so outsourcing will likely continue without some real change in national policy.

For awhile i thought that the retirement boom would lead to lower unemployment figures, but I really am coming to think that wont be the case. Their will be some positions that involve legacy knowledge that come up(mainframe programming for example (jpl,rex,fortran,cobol)), but i more see a future of not rehiring the positions of retired workers.

Stock Buy Backs

I came across this article regarding stock buy backs. It appears the activity has been abused. There has to be a reason it was illegal until 1982, when the SEC under Reagan made some changes. The removal of financial regulation over decades has created this crappy economy for so many people. Shipping so many jobs out of the country was/is another problem. Now with the global economy, we are more vulnerable. But look what the U.S. economy did to the economies of other countries when it crashed in Sept. 2008.

http://www.theatlantic.com/politics/archive/2015/02/kill-stock-buyback-t...

"So what’s changed? Before 1982, when John Shad, a former Wall Street CEO in charge of the Securities and Exchange Commission loosened regulations that define stock manipulation, corporate managers avoided stock buybacks out of fear of prosecution. That rule change, combined with a shift toward stock-based compensation for top executives, has essentially created a gigantic game of financial “keep away,” with CEOs and shareholders tossing a $700-billion ball back and forth over the heads of American workers, whose wages as a share of GDP have fallen in almost exact proportion to profit’s rise.

To be clear: I’ve done stock buybacks too. We all do it. In this era of short-term-focused activist investors, it is nearly impossible to avoid. So at least part of the solution to our current epidemic of business disinvestment must be to discourage this sort of stock manipulation by going back to the pre-1982 rules."

I can see...

That a company who makes a profit may want to buy back their stock as a way maintaining some liquidity. If you need some quick cash - you can sell the stock in order to invest. That does mean that flooding the market with your stock will have an adverse affect on the price and when money is so cheap to borrow, it is probably not the best financial move. If interest rate were high - it would make sense to do this. But, as the diary points out, interest rates are below zero - so why not borrow money to pay for your own stock?

Democrats, we tried to warn you. How is that guilt and shame working out?

Yes, we are still in a liquidity trap

As noted above the only known way out is to deficit spend.

FDR 9-23-33, "If we cannot do this one way, we will do it another way. But do it we will.

That's a good analysis.

I've suspected for some time that things may full through soon. It's really remarkable just how stupid many of us become. Every day the economy gets a little worse. The people in charge always seem to make the same decision despite the fact that they didn't work the last time. Austerity obviously doesn't work. Yet we just keep going.

The biggest reason that things continue this way is that so few people feel any responsibility for the world around them. They don't feel they need to understand anything. If you bring up economics they just tune you out. The only way to fix is that is with an economic collapse. I think that they will get that, in time.

Tuning Out Economics

You are correct about many people's attitudes toward economics. Years ago, people paid closer attention as to what was happening. Economics was a popular subject in public high school years ago. (My mother took it in the late 1930's.) In all fairness to people, trying to understand these "fancy financial products" is a challenge and one can get lost in the weeds. The financiers want to disguise what they are doing so only a few people know.

Just watching the Oscar nominated movie "The Big Short" would be a good start. Time magazine and other publications are for the layman. An economic system is a major component of a society and it's disheartening that people don't pay much attention to it. Still they know something is very wrong with the system.

Love The Big Short

See my sig.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

The solution for the economy

8 years ago was Jubilee, debt forgiveness. The solution today is Jubilee. The solution next year is Jubilee. After that's done: no more money/debt creation except by Public Banks.

Orwell: Where's the omelette?

Yep

Writing off the debt, or simply admitting that it is unpayable, is the only solution.

And establishing the fact that...

...the debt was run up as a result of illegal activity on the part of the debt holders is key to making a Jubilee legal...

I want my two dollars!

Can't Hillary just

tell them to cut it out? Problem solved!!!

Another Refugee from the Great Orange Purity Troll

Been saying this for a while

Depression is coming. And the Neolibs have no one but themselves to blame.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

Are you kidding? They will do what they always do...

...and simultaneously blame Republican'ts and the Dirty Fucking Hippies (now personified by Bernie Sanders)...

I want my two dollars!

Let 'em!

I don't give a shit if they learn from it or not, it's still their own damn fault and they own it.

They won't, but that's their problem, not ours

The biggest issue is still a lack of aggregate demand.

Europe, the U.S. and Japan need to go on a public spending binge. There are plenty of things we could spend the money on that would provide a lasting benefit to generations to come (e.g. dealing with global warming for starters, through investments in green technologies, energy efficiency; infrastructure investments here in the U.S. -- all could provide a long-term economic benefit as well)

The problem is that too many countries are trying to stimulate growth through monetary policy, currency devaluation and trade flows.

Part of Japan's debt purchases are defensive -- they're a way of fighting back against Chinese currency devaluation efforts and also an attempt to keep the Yen from gaining too much strength relative to the dollar.

Lack of demand while in a liquidity trap

FDR 9-23-33, "If we cannot do this one way, we will do it another way. But do it we will.

The world's economy...

is ENTIRELY based on monetary policy. Governments spend on infrastructure, retirement, healthcare and policing. That's it. They spend very little on any investment - including education. All of the world's economies have totally outsourced economic growth to their central bank and private sector. It is the greatest wealth theft in the history of the world.

Democrats, we tried to warn you. How is that guilt and shame working out?

Sooo...

I should wait to buy a house?

MAGA

Morons

Are

Governing

America

Depends upon where you live

Buying a house is a good thing, since rents are increasing. However, it depends upon where you live and what you buy. After shopping around a lot, a median-priced house in an area with a decent economy is a safe bet. You could go cheaper if you know how to do home repairs & remodeling. You have to live somewhere. It's nice not to depend upon the landlord doing things too. Just my $.02.

Less than zero interest rates = depression ahead

Cheap money is an elixir. It is the antidote of choice to economic exhaustion. Sadly, we have become drunk on our dangerous elixir and will pass out and sleep until we awake, stupid with a hangover, not knowing how we got here, and not knowing how to get back home.

Be a Friend of the Earth, cherish it and protect it.

Two years until 65 when 2 annuities start.

Crap. Maybe should I jump the gun and demand they start now? Or begin moving little bits out of TIAA and get slammed for taxes, too?

And a jubilee would never be for us little folk, right? No debt removal for us, just the banks.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Just checked:

If I wait until 11/1/2016, my yearly draw on one goes from $14K to $19K, a significant difference. So I guess I hold my breath and commit to Nov 1.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

TIAA

TIAA survived the 1929 stock market crash & the Great Depression. I wouldn't worry too much. If you have some retirement in an annuity that is an insurance company, the state dept. of insurance where you reside probably insures it. When we had the Sept. 2008 crash, I had an annuity with an insurance company and my State Dept. of Insurance told me I was insured even though the company was in Texas. Annuities with insurance companies are regulated by states. You may want to call you state dept. of insurance and check so you feel more secure.

The rich spend more when rates are low

The rest of us spend more when our earnings go up.

To fix this problem, wealth inequality has to decrease. They wanted to "win" and they are now "winning" the way a cancer "wins".

For all his flaws, Ford understood this. His genius was not the production line but the understanding that by paying workers enough to be customers he expanded his market and his profits.

Dig within. There lies the wellspring of all good. Ever dig and it will ever flow

Marcus Aurelius

Excellent yet again - bubble will pop & ...

Surprised to see this on the REC list at TOP/GOS or what ever we call it these days

Incredible to see the neo liberal comments from establishment dems that are in denial

In a comment to BNR I recommend people to to you diary and REC it over there

The establishment is in total denial about an economic collapse -- except those who are betting on it

Have you ever submitted your work to Naked Capitalism?

Interesting that election fraud is well covered here on C99% and at theprogressivewing.com but when people bring it up at TOP the piece gets zapped as quickly as possible

TOP is now a DNC site full time & it sounds like Kos has drunk Brock crap and after it passes through his system, he passes it out in another post

and the time bomb ticks...

not just economically but also in the physical world. We are at the beginning of a major climate change, we are starting to see those effects. IF we would throw all our efforts into dealing with this massive earth shaking change we might save ourselves and our economy. Think if we stopped fossil fuel extraction...a new economy would have to take place.

But it is all a dream. The US won't even admit climate is a problem....and on we go into oblivion. Economies rise and fall in the short term. Species come and go in the long term.

“Until justice rolls down like water and righteousness like a mighty stream.”

We got a timebomb - Na, na, na, na

[video:https://www.youtube.com/watch?v=AWtZ1TqMq4g width:500 height:400]

The US has a Zombie economy

The FED doesn't dare raise interest rates out of fear of triggering a depression. Same thing really for the EU. Neoliberal economics has destroyed the economies of the West. There is no out, we are trapped. The goal of low interest rates is to spur investment. The economy is so sick that it is not working. Instead the availability of capital is going to useless activities, like stock buy-back. The side effect is that retirement savings are not generating spending, since senior are earning nothing on their nest-egg. On top of that, we are trying to create a housing bubble to restore the value of house assets. It's working somewhat in the wealthier urban areas, but failing in general across the country. Again this is an economic bind, in order to restore housing prices we need to make them much higher than historic prices. There is no way out of this. The basic problem is income inequality. For the consumer to spend she needs income. We need two things, debt jubilee to wipe out excess debt and accumulated wealth. Then we need extremely progressive taxes, like during the Eisenhower administration, of 93% on the highest earners. I can't think of any other viable method, since the value of labor has crashed with automation and offshore cheap labor. I suspect that what we will get is a deflationary depression, like in 1930, wiping out debt and wealth and we will start again. There is no way that the oligarchs will agree to a Jubilee, after all that would be a moral hazard, as compared to bailing out the banks?

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

"ACA" killing disposable income

My health insurance premiums have gone up 37% in 2 years . My premium for health insurance is now more than my mortgage. Bye bye disposable income to go to local restaurants, retail spur of the moment purchases.

There is no sign of premiums stabilizing (brainwrap over at DK tries to spin how 15-20% premium increases are ok)..

15-20% premium increases could only be ok

if:

1. Coverage is getting better and deductibles getting lower not HIGHER

2. Wages are also increasing 15-20%

Otherwise, with wages stagnant and more out of pocket costs, there is simply no way for anyone to argue that continually increasing premiums are ok!

What we're going to end up with at this rate is an additional tax and no health coverage for people again. Because there comes a point where people's costs are so high to HAVE insurance that they'd rather pay the penalty.

Corporations need to stop firing their customers

and start paying them a real living wage. Otherwise, it's just a rat race to the bottom.

The real SparkyGump has passed. It was an honor being your human.

Who is going to stop them?

We have a Wal Mart economy. So look at Wal Mart. People who work there can't afford to shop there. Also, since they wiped out the small businesses in the area, other people can't shop there either. So the cut staff in order to cut costs and boost margin. Which in turn, removes more potential customers. So the store starts to look crappier, shopping experience becomes worse and the system starts to eat itself. Eventually, they close the Wal Mart and move to a more profitable area - having mined all of the wealth out of the area. Eventually, they run out of areas to mine - but that is OK because the Sam Walton brats have enough money to keep themselves and their infinite progeny in the fat for ever.

Democrats, we tried to warn you. How is that guilt and shame working out?

Appreciated gjohnsit

Could you conclude your articles with a "summary for financial dummies"?

So another bubble -- got that. Bubbles burst -- got that. Bad news -- got that. But in what way? Stock market crashes? Prices go up (or down) for consumer?

thanks!

So what is a plebe to do?

So what is a plebe to do? Seriously. In general.

Hearing this kind of stuff is un-settling.

Buy silver? Pay off mortgage? Take $$ out of stocks?

Refinance the mortgage now.

Rates will never be this low again. Even shaving 1% off your mortgage rate will mean big savings over the long haul. IMO.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

Did the calculations

I'm at the point that accelerating mortgage pay off is the way to go.. So aggressively trying to have it paid off in next few years..

Figure it's 4.5% return on my money (rate of mortgage). Safer than market...

Plebes should recognize we are prey /nt

Be a Friend of the Earth, cherish it and protect it.