Why the job market is stalling

The May jobs report was a huge disappointment. Only 38,000 jobs were added in May, the slowest rates in five years.

But was it an anomaly? An outlier? Maybe even a positive, like worker shortages?

There are plenty of people who will tell you not to worry, but almost all the evidence shows otherwise.

There are two issues to look at:

Is this part of a larger trend (i.e. not an outlier)?

Are there economic reasons for it (i.e. will it continue)?

No, it's not an anomaly.

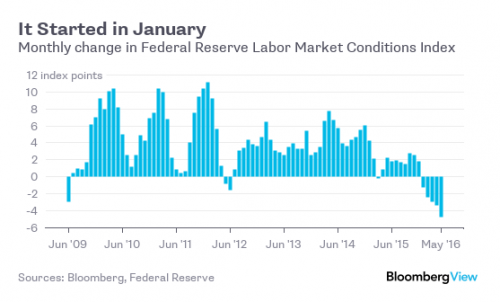

The sharp May hiring slowdown revealed in Friday’s employment report took a lot of people -- including me -- by surprise. It shouldn’t have. Things have actually been on the downswing for the U.S. labor market for months, according to the Federal Reserve’s Labor Market Conditions Index.

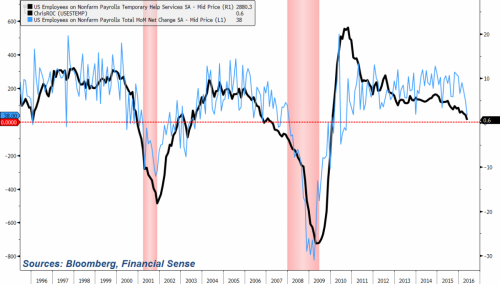

Temp jobs, normally considered a leading indicator of the labor market, has also been deteriorating.

Other forward looking trends are construction jobs and full-time jobs.

This now marks back-to-back months of job declines in the construction industry following revisions to April's report.

...The share of workers employed full time fell on an annual basis for the first time in three years. This comes as the number of people working part time for economic reasons experienced its largest one-month percentage gain since 2012.

So there is no shortage of weakening labor market trends, but why is it happening? There has to be reasons for something to happen, otherwise there's no reason for a trend to continue.

So does that reason exist?

Yes.

The report also showed that corporate profits dropped in 2015 by the most in seven years.

Friday’s report also offered a first look at corporate profits for the period. Pre-tax earnings declined 7.8 percent, the most since the first quarter of 2011, after a 1.6 percent decrease in the previous three months.

Profits in the U.S. dropped 3.1 percent in 2015, the most since 2008. Earnings are being weighed down by weak productivity, rising labor costs and the plunge in energy prices.

“If profits remain depressed, the prospects for capex and hiring will come under greater pressure,” Sam Bullard, a senior economist at Wells Fargo Securities LLC in Charlotte, North Carolina, wrote in a research note.

Corporate outlays for equipment declined at a 2.1 percent annualized pace, subtracting 0.12 percentage point, the Commerce Department said.

So that obviously sounds bad, but is it bad? Yes, it is bad.

history shows that when profits fall, the economy often follows them downwards. An earnings hit of the size that JPMorgan says is taking place has led to a recession within three years about 90 percent of the time.

And because corporate earnings have deteriorated so much, corporations have gone to great lengths to mask the bad news.

However, no matter how much book juggling they do, when the company is broke, it is broke.

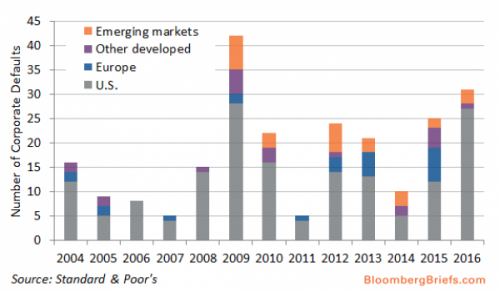

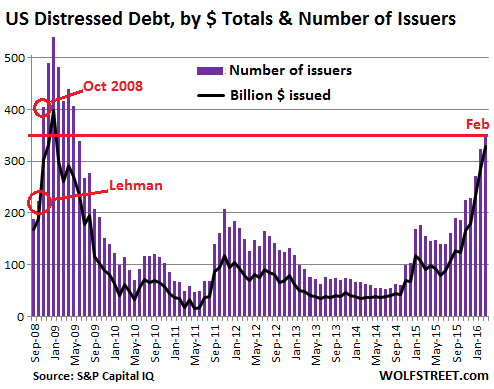

Standard & Poor's, via a report by S&P Capital IQ, just warned about US corporate borrowers' average credit rating, which at "BB," and thus in junk territory, hit a record low, even "below the average we recorded in the aftermath of the 2008-2009 credit crisis."

The one-year average default rate for US companies with a credit rating of B- is 9.8%, according to Standard & Poor's. That's a 1-in-10 chance that the company will default over the next 12 months. Companies getting downgraded deep into junk and issuing more low-grade bonds are precursors to soaring defaults.

A deterioration in the credit markets for marginal corporate borrowers has traditionally been one of the best predictors for the economy. Which is bad news.

The next thing to ask is "why are corporate earnings dropping so much?"

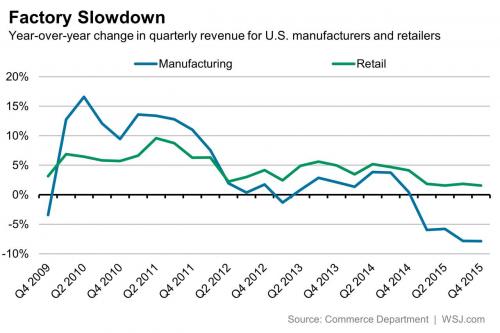

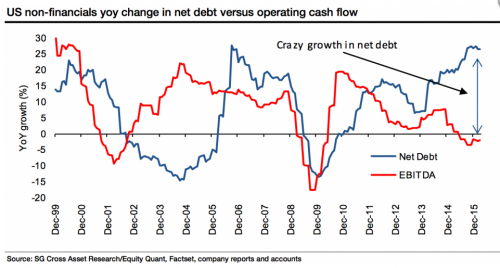

That can be answered in just two charts.

Sales are going down, and they can't unload what they are producing. Traditionally that means production cutbacks, which to workers means "layoffs".

Sales and profits might be down, but one thing is up - debt.

“Currently, the ratio of nonfinancial corporate debt to national income is nearly 45%, an elevated reading that suggests corporate balance sheets are not in particularly good shape,” LaVorgna said.

Obviously not all corporations are having profit problems, but it's important to acknowledge how they've retained their profits.

Summing all this up:

sales are down and inventories are up

corporate earnings are down and debt is up

hiring has stalled

You can still believe that hiring is about to bounce back, and it just might for some reason that no one could predict.

But the smart money says not to count on it.

Comments

Hillary will try the standard Hitler solution...

And pump lots and lots of money into the MIC through a war or two. Yes, it will stimulate the economy in the short term, but in the long term it will leave us right back where we started. (Worse this time, since the Rethugs will use the opportunity to cut social programs because we must PAY for the war... blah blah...)

Trump would also pump money into the MIC, and the PIC. While he may not be as quick to start a war in the middle east, he'll be more likely to start a domestic war against our own citizens. (But only the brown ones, so he'll get a lot of support from ignorant idiots.)

I guess it comes down to if you vote for the MSM's anointed choices, whether you want brown people to suffer here or overseas.

I do not pretend I know what I do not know.

I Don't Buy the Military Stimulating the Economy These Days...

We don't have anything like mass mobilization and a war footing.

We have a police action type mobilization and a war footing domestic and personal liberty crackdown, and that doesn't look to change much.

Unless, of course you are talking about a war footing with Russia or China, which would be a terribly disruptive event to global economics.

I just don't see the war machine doing anything but padding a few pockets and maintaining the subsidy of socially and ecologically undesirable commerce.

Peace~

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

Housekeeping: using color (alone) for charts is thoughtless

Some folks are unable to see all the colors in the normal visual spectrum. When trying to communicate to the general population, please understand that simple graphic coding devices should be added to color coding so that those of us with less than usual color perception can still understand the information you are presenting. For example, if you are using a double line graph coded in color, simply annotate which is which by adding a mark like an "x" along the graph line with one color and a "/" symbol along the graph line with the other color so that more of us will be able to comprehend what you are presenting.

Be a Friend of the Earth, cherish it and protect it.

I don't think they are his charts

But yes, legends are important, as is using colors with good perceptual separation (the green-blue one in the middle is especially egregious.)

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

good reminder

Thank you for this.

I used to post occasional YouTube music videos when I was on DKos that I felt were pertinent to the political topic of a thread, and usually did not post the lyrics (did not want to space hog). But on one occasion, the words were so mumbled that I included the lyrics in my post. A profoundly deaf Kos member thanked me and said she wished everyone would either include lyrics in their posts as I did, or try to find a YT video version that included lyrics on the screen or in the comments below the vid. I had to thank her, and to sadly admit I'd never considered that omitting the words really was a hassle for hearing impaired readers. Have followed her advice ever since. Typically, the lyrics-on-the-screen videos are painfully corny montages, but it is easy to post a better video and find the lyrics on AtoZ or other websites and copy/paste, for those I don't know by heart.

I think your request to use symbols as well as color in graphs is excellent, but is a bit more complicated than the music video solution. I remember doing paste-ups for scientific journals as an art student in the 60s, when most were litho printed in b&w only. It can always be accomplished, but sometimes to make the graphs readable, we'd have to break images down into many charts rather than keep all the data in a multi-layered image. Also, there were tons of cross-hatch templates available back in the day and I'm sure those are all online in font archives somewhere.

Shaylors Provence

I know of whom you speak.

I would love to see her posting here. She was a tireless activist for single payer health insurance. Yes, I post the lyrics for her and anyone with hearing impairments.

Look up at the stars and not down at your feet. Try to make sense of what you see, and wonder about what makes the universe exist. Be curious. Stephen Hawking

What about small businesses?

and independent contractors. Single payer healthcare would promote that part of the economy.

Beware the bullshit factories.

Those are elements of the Main Street economy and as such

are not of any concern to the people that matter. Small businesses compete with Big Business and they can only rarely afford to buy an election. 1099s are the way it is now and that's exactly why we got this insurance mandate in place of the health care we wanted.

You think you're fucked now? Wait until 100% of the liabilities and expenses are dumped into your lap while the "contributer's" cut just gets bigger every year.

Medicare for all

If the health insurance companies didn't make such a self-serving obstacle of themselves.

Beware the bullshit factories.

Bet the corps

Will still fine millions to pay their CEOs.

Of course some big corporations will loot their shareholders

It seems obvious that when a corporation loses huge amounts, but rewards its executives with mega-millions, shareholder interest is not #1. If you are a shareholder, you would be best served to consider your options.

Be a Friend of the Earth, cherish it and protect it.

The holders of common stock will be hit, hard.

The people that matter won't even notice it.

Getting very tired of

bending over and taking it for these incompetent morons. Of course we can't buy anything to keep everyone going - you've stolen all the new income and left nothing for us poor dumb consumers. It's time to share the wealth.

Enough is enough.

I'd rather learn from one bird how to sing than teach ten thousand stars how not to dance. - e.e.cummings

Wafer starts dropped in January

That is an industry term for computer chips. Even in very stable markets like the ones my foundry creates things are grim and getting worse.

I have been in this industry through three presidents now. Here is how it goes. The grim place we are in is a predictor of the direction of the general economy. The lead is 6 months to a year. I suspect it will hold off until after the election then crash. It's not going to be pretty, our worst year 2008 was at its lowest 10% higher in starts than our current. Our projection is currently a drop of another 8% of capacity in the next 3 months. Watch the chip industry it will give you an indication of what is to come.

Thanks!

This is good info. Something new to add to my monitoring.

I've followed http://thehousingbubbleblog.com/index.html for about 10 yrs ish (used to be on blogspot). That market feels like late '05 right now.

"Politics is not evil; politics is the human race's most magnificent achievement." Senator Tom Fries, 'Podkayne of Mars,' Robert Heinlein

What if a new recession started

when no one noticed the old one had ended?

gjohnsit? Is the US going to hit the recession metric

…before the election? Will there be two quarters in a row?

Profound economic events, of course, generally occur independently of that trend, and such possibilities are very much in play. With good reason.

Does it really matter, Pluto?

Given the ever-declining US voter

participation rate, seems to me

people, if they haven't already,

are figuring out that voting in the

US doesn't matter. The System

trundles on as systems tend to do

while people pay little attention,

because what happens in RL is

much more important than what

happens on screens.

Lotlizard pointed out a classic

2008 Silber article about this

very thing wrt to both "elections"

and the so-called "economy":

http://caucus99percent.com/comment/111187#comment-111187

Only connect. - E.M. Forster

Does "what" really matter?

Does it matter if the US economy enters an official recession before the election?

Or, does it matter if the 2016 elections are sidetracked by an unexpected economic event?

Based on the Arthur Silber essay you linked, among other things, none of it really matters. People's lives won't rapidly change. They can safely ignore politics for another decade. We're looking at 16 years of gridlock, total. The military murder and mayhem will continue on autopilot. The message from Our Overlords is clear: "We win whether you vote or not." and this one: "Love the way you fell for our phony outrage over Trump. Now we are again your moral superiors. This is just too easy."

Speaking of Silber, his website suggest that he and his cat may have died of starvation within the past few weeks.

His final words.

Chris Floyd has been calling for donations to Arthur Silber

for the last couple of years.

I gave something last fall in spite of always being close to the edge and having to rely on the kindness of friends myself.

One thing is for certain

it won't be declared before the election.

I'm expecting GDP to go negative late this year and unemployment to start rising before that.

I suggest

that we should not be asking why in economic terms, but in psychological. For example, the rise in corporate debt has been linked to corporate stock buybacks - are the big investors cashing out - cannibalizing - the companies? Are the investor class creating a recession in the summer for political reasons?

Actually, contrary to what I suggest above, I also suggest that this trend may be a good thing - people need to consume less for not only economic, but ecological and social reasons. The societal trend is - must be - less consumption, less production, more automation, That does not mean more unemployment, it could mean less wage slavery. We don't need more burger flippers, we need more softball teams. We don't need more highway construction so that we can get to our jobs, we need more highway maintenance so that we can get to the park.

We should not think of how we can prop up the present system, we should adapt to and create its replacement.

On to Biden since 1973

Disagree about consumers needs

In the real world, people need reliable transportation to get to their jobs, access health care and become educated. A mother with children to feed needs a reliable car or quality public transportation to get to a job so she can earn money to feed her family, get food, take them to the doctor when they're sick. She can't sit at home, walk in the park and still take care of her children. She can't move to a new house or apartment every time she changes jobs so she can walk to work.

We can't all stay at home and never travel farther than walking or biking distance and still have a successful, healthy society.

We need to repair our infrastructure in order to have a functioning society and economy. We need to fix things in the present to be able to plan for the future.

We need to focus on the needs of people now, in the present. We don't have the luxury of postponing those remedies while we plan Utopia.

If I sound like your mother, it's probably because I've had this discussion with my own son. He eventually figured it out.

"If you can't eat their food, drink their booze, take their money and then vote against them you've got no business being in Congress."

What Indicators I Watch

At the moment, my region is just beginning to recover from the Bush-Cheney Oil War Recession. For the first time in several years, there are actually visible help wanted signs around the neighborhood, and they stay up longer than a day.

The turnover of empty store fronts has increased. What I mean by this is that when a small business doesn't make it, the space doesn't sit idle with "For Lease" signs for months or years. Another business moves in and opens rather quickly.

The bottom line for me is how many phone interviews my unemployed collegiates get when they apply for jobs. For several years now, the monthly average for the three of them hovered between zero and one per month combined. Total. This last week broke that record with two since last Monday. This doesn't guarantee an office interview, but does indicate more interest by employers right now, at least locally.

BUT . . .

I have been around the block a few times in my years. Every time the work force begins to see advances, as the unemployed are again desired by employers, you can count on a deep recession coming within six months. Considering that the American economy has yet to truly recover from 2008, this next "dip" will be worse. What gives this away to me is the large number of new construction sites which go empty, and when there is a glut in the inventory of new construction, expansion of the economy has ended. No new capacity is needed or desired.

I am glad I'm old. I won't be around that much longer to see the greedy destroy what was once a great nation.

Vowing To Oppose Everything Trump Attempts.

It's Pretty Simple...

We needed Bernie's Economic Ideas to be put in place...

We needed to put people to work rebuilding our infrastructure, and modernizing our energy production...

We're Phucked...

[video:https://www.youtube.com/watch?v=C7plYn2qDN0]

[video:https://www.youtube.com/watch?v=brKJbCFSs48]

I'm the only person standing between Richard Nixon and the White House."

~John F. Kennedy~

Economic: -9.13, Social: -7.28,

A few people got low paying

A few people got low paying or temp jobs and unemployment went down. However, employers will not raise wages and their customers, most of whom are someone's employees, still have little purchasing power, so the trend will continue.

Beat Trump with Bernie!

Consumers out of disposable income?

I suspect that for most Americans at the end of the month there is not much cash left over for anything but necessities? Don't consumers drive the economy?

The UnAffordable Care Act has taken a wad out of my pocket -- it increased 37% in the past two years and my premium is now more than my mortgage. There goes several hundred a month that I could have spent on local restaurants, music, trips.

Single Payer would help the economy -- it's perplexing why the business community doesn't get that.

Fears realized about ACA

Though I campaigned for it, the changes from the original plan were worrisome at the time. Despite reassurances from my Dem senator and congresscritter, there was a real concern that the out of pocket and premium costs would rise and eat up disposable income. The unspoken fear among health care activists at the time was that these increases would end up stifling economic recovery for the middle and lower classes.

Yeah, it looks like it's happening. It reinforces earlier concerns that ACA will eventually self-destruct as premiums and health care costs rise (most good cost-controls were stripped from the original ACA bill). Insurance companies and providers are strip mining the program for all available cash, and will eventually force it deep into the red right about the time it's supposed to become self-sustaining.

"If you can't eat their food, drink their booze, take their money and then vote against them you've got no business being in Congress."

My gut says your right.

With GDP averaging about 2.2% since 2010 or 2011, there's been no significant capital movement, no increase in Government infrastructure spending, there has been NOTHING to indicate demand has increased.

SO yeah if the ACA sucks up an increasing share of a families income, it will lower demand.

The GDP trend since 2nd FQ 2014 (4.6%) has been down, with 2 quarters going negative in 1st FQ 2011 and 1st FQ in 2014, there is not enough activity to keep GDP consistantly in the plus area. With demand dropping, we will likely see another FQ go negative.

2.2% average growth is like living on a razors edge, there is very little to keep things from sliding off the cliff. Ask yourselves, are we in a bubble, if we are, can the bubble burst. I think the answer is yes it will burst.

FDR 9-23-33, "If we cannot do this one way, we will do it another way. But do it we will.

So much junk insurance, too

The most popular (read "affordable") plans have annual deductions of $5000, meaning most are paying a few hundred dollars a month for a product they can't use unless they spend another $5,000. So most are just paying the premiums and still paying out of pocket for health care or not going to the doctor. SMH. Imagine how much economic stimulus and job creation could come from diverting that $5,000 towards consumer spending? Buying that much needed new car, fixing up the house, buying a new tv or refrigerator or a new winter coat...

On the downside, consumer spending has less impact than before as so many consumer products are no longer made in the US. The whole thing is so easy to fix, if our leaders wanted it.

"If you can't eat their food, drink their booze, take their money and then vote against them you've got no business being in Congress."

In a global economy

consumer spending does come back and benefit us here in the US.

An increase in US spending on flat screens, laptops tablets, all require someone to provide the service, whether the sale is made online, or made in a brick and mortar location. IT means jobs.

Buying a car made in Asia from a salesperson in Hartford, means a sales job in Hartford.

FDR 9-23-33, "If we cannot do this one way, we will do it another way. But do it we will.

But ...

Our current trade imbalance is about $120 billion per quarter. That represents a 2.8% drag on GDP. There is no way that the slight increase in services created by foreign good imports erases that drag.

[Edited to remove the word "growth" which was confusing.]

2.8% on GDP growth of 2.2%......

is 0.06. Can that signal rise above the noise?

We've had quarterly trade deficits since 1965, annual trade deficits since 1975. The 4 major components of GDP growth are Population growth, Productivity growth, resources and energy. Trade deficit drag is statistically nonexistant in those terms.

GDP revisions released by the BEA are exponentially larger in scale than trade deficit drag. First FQ 2016 GDP estimate was .5%, revised to .8%, thats a 30% difference........

FDR 9-23-33, "If we cannot do this one way, we will do it another way. But do it we will.

Sorry about the confusion.

I edited my comment to remove the word "growth" since it was confusing. The 2.8% drag I'm referencing is the drag on GDP. In other words, if reported GDP is 2.2%, trade drag reduced it from 5% (2.2 + 2.8). Your 0.06 is incorrect.

You seem to be suffering a fundamental misunderstanding. Definitionally, "GDP includes all private and public consumption, government outlays, investments and exports minus imports."

A $400 to $500 billion annual trade deficit is a devastating outflow of US funds. And cheaper imported goods have a downward ripple effect, as service prices are based on the cost of the underlying good and therefore decrease as the price of goods decrease.

Ah, i see. 2.2% plus 2.8% =5%

In the overall, when we have significantly less than full employment and low interest rates, yes trade deficits are a drag on the economy. But the reason we're looking at a period of low growth economically speaking is because the 3 of the 4 major components of economic or GDP growth are in the negative. Energy costs, are up over 30 years, resources are in short supply, US hematite iron ore basically ran out in the early 1970's, we've hit peak fish. Mineral and metal mining is required to go deeper into the earth tripling and quadrupling costs to get the same amount of material. Workforce growth is declining, from 1960 to 1990 workforce growth was better than 1.6%, now at 1.1% or 1%. Yes oil costs are down right now.

The only major component of GDP, productivity increases, are in a position to support high growth rates. by high i mean 6% to 12%. i would think that most economists would say over the last 8 years and looking forward another 10 years would agree the best we can expect to see is 3-4% GDP growth.

This where the current low cost of (energy) oil helps the potential of GDP growth, it puts 2 of the 4 major components of GDP in a growth phase. But we're not seeing more than 2.2% growth because there is no demand to support more, while we're in a liquidity trap.

So lets do the Keynesian thing, we create 20 million jobs in infrastructure, we'll see more demand for domestic production. Sunrise industries like GE'e wind turbine division is going to make out like bandits, with an increase in domestic content reaching 60%, its been making more sense for large turbine towers to made locally. For example the Atlantic Wind Connection will support 1700 4mw turbines by completion. With a possible local manufacturing site in NJ, with delivery of major components to the Port of Newark for loading.

In these conditions of 3-5% GDP growth it is more than possible, it is expected that trade deficit drag will become a moot point, especially of our trading partners use less currency manipulation. So isn't the question: can we create an environment where trade deficits don't grow as quickly? And the answer is clearly yes. But it won't happen until many fundamentals are altered.

FDR 9-23-33, "If we cannot do this one way, we will do it another way. But do it we will.

The average household (two earners) earns about $52,000

per year, less than needed for a family of four, http://www.cheatsheet.com/personal-finance/how-do-you-know-when-youre-ma...

That's $26,000 per person or $13/hour. Less than a modest living wage (let's not fool ourselves, even $15/hour isn't exactly living the high life, even if it's all tax-free, which of course it's not). And of course averages are skewed upward by a few extremely high-earning households.

So now that Americans have no disposable income, businesses are suffering because sales are down. Quelle surprise.

Please check out Pet Vet Help, consider joining us to help pets, and follow me @ElenaCarlena on Twitter! Thank you.

Neo-liberal capitalism is unsustainable. Quelle surprise indeed!

Krugman's support of the Clinton philosophy has done nothing to improve my opinion of economics in general.

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

Globalization makes production more vulnerable to climate change

Globalization made economic production more vulnerable to climate change

The environment is the most important player in politics.

The oligarchs don't care.

They are scrambling to elect Hillary.

But even that won't stop the changes that have already started

Velocity of money

and why Asher Edelman, a hedge fund investor, supports Bernie as having the best plan for the economy for the rich as well as for "the rest of us."

http://www.businessinsider.com/asher-edelman-endorses-bernie-sanders-2016-3

That's another good topic

But I wanted to focus on just jobs for now, instead of looking at the more fundamental problems in the economy.

I would like to read what you have to say about velocity.

Sparhawk is at your diary @TOP pushing Fix the debt crap:

Total Goober.

FDR 9-23-33, "If we cannot do this one way, we will do it another way. But do it we will.

I hadn't thought about that. The Free Marketeers have almost

no reality intruding on their circle jerks any more.

What a waste.

Zackly The Problem!

In the bailouts in 2008 everyone got bailed out except the 99%...

Now all the money is sitting in Scrooge McDuck's Money Room and it isn't moving....

While we lose additional money on our Mandated ACA Insurance, making less at the jobs we have now in this new economy, attempting to sell items or services to customers that don't have the money to buy them...

No velocity is the problem...

I'm the only person standing between Richard Nixon and the White House."

~John F. Kennedy~

Economic: -9.13, Social: -7.28,

Hi. One of the 94 Million here.

Guess it was my choice to "drop out of the job market". Don't remember making that decision.

Been "looking for work for 5 years now. Was once a high tech sales executive. Now, 61 years old and no one will hire me.

But my sons, both who have degrees -- one chose to become a Mountain Man in CO, the other starting up his own jewelry business in VT. College? Economy? They're happy/satisfied, which is good. Unfortunately I still have $60K in debt that I can't pay for.

I cannot begin to tell you how insanely angry I become when Potus, the Vpotus, the Admin, the MSM -- AND HRC -- tells me after so long with this Admins "efforts" that I'm doing so well.

Prof: Nancy! I’m going to Greece!

Nancy: And swim the English Channel?

Prof: No. No. To ancient Greece where burning Sapho stood beside the wine dark sea. Wa de do da! Nancy, I’ve invented a time machine!

Firesign Theater

Stop the War!

I am 63 and in the same boat. Don't let it leak more.

Out of work for more than 5 years. From a fast-moving field. Overqualified (like you) for mind-numbing work that would suck my soul dry. $40K debt (that I can pay down until 2030??), another $200K in limbo. My benefits to me do not kick in until 65. If there is still an economy then. What happens to money parked in an annuity in another recession?

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

This is all completely ... unsurprising to me

When are these bozos in charge going to get it through their thick skulls that POOR PEOPLE CAN'T BUY STUFF.