Bernie is about to get blamed for crashing the stock market

We are starting to see headlines like these.

Bond investor Gundlach said that the biggest risk to the market in 2020 was the possibility of Sanders becoming president.

Longtime hedge fund manager Stanley Druckenmiller said something similar last summer, warning that stocks could plummet if Sanders is elected president.

“If Bernie Sanders became president, I think stock prices should be 30% to 40% lower than they are now,” he said in June.

The thing is that this is very likely to be true.

I don't say this lightly.

However, something is missing from this analysis. The most important thing.

That something is that the stock market is massively overvalued.

Right now the stock market is a bubble in search of a pin.

Using the price-to-earnings metric — which measures a company’s current share price relative to its per-share earnings — shows the S&P 500 is trading 24.37 times forward earnings.To put that in perspective, the average ratio in the last five years was 16.7, and just under 15 in the last decade.

...

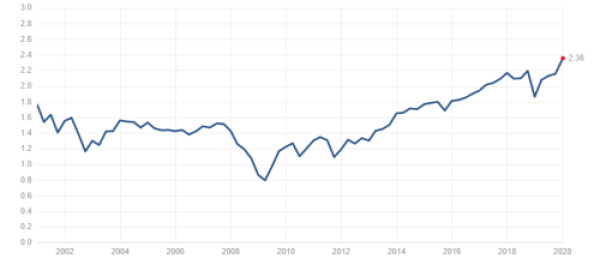

The price-to-sales ratio looks at a company’s market capitalization and divides it by the company’s revenue in the last 12 months. A lower P/S ratio usually leads to a stronger investment.And this is where the overvalued picture really begins to get clear.

In short, Davis sees market prices falling.

Davis added the S&P 500 “could be overstating earnings due to buybacks and other financial engineering of profits.” Over the last five years, S&P 500 earnings have topped corporate profits.

“P/E ratios are some 80% above the long-term norm,” Davis said.

If you take a long-term Post-WWII look at the stock market, the average P/E ratio is closer to 12. Which means stocks are priced to absolute perfection right now.

So guess what happens when perfection doesn't happen?

Bernie is not the real danger to the stock market.

Corporate America has two critical problems that has nothing to do with elections.

1) Losing money

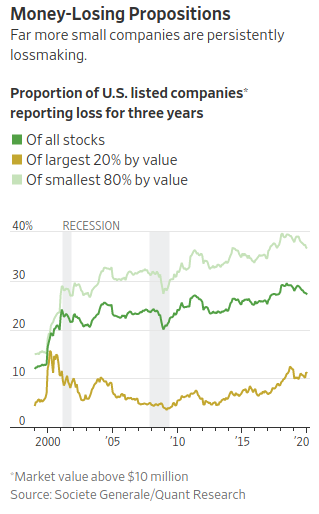

The combination of forces has pushed the percentage of listed companies in the U.S. losing money over 12 months to close to 40%, its highest level since the late 1990s outside of postrecession periods.

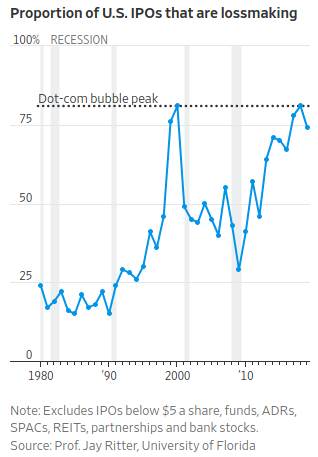

...Investor tolerance of losses shows up most obviously in new issues, where about three-quarters of IPOs were made by loss-making companies last year, according to University of Florida finance professor Jay Ritter.

It doesn't take a genius to know that investors will eventually sell companies that can't make a profit (i.e. Uber, Tesla, Netflix).

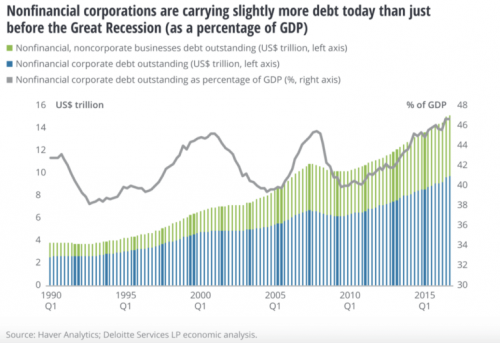

According to the Fed’s meeting summary, some from the bank are worried that its own policies will continue fueling the corporate debt bubble and make the next US recession even more severe.

...The Fed isn’t the only one to sound the alarm on the worrying amount of debt US businesses have racked up while interest rates were low.Corporate debt has risen by 50% since the financial crisis, bringing the grand total to just under $10 trillion.

Over the next five or six years, about half of that debt is going to mature, the result of which could be catastrophic. Many US corporations that used cheap debt to finance buybacks and acquisitions will likely have to refinance at higher rates, putting a strain on corporate earnings and, in turn, share prices.

Let's add all of this up.

a) Corporations are swimming in debt, and

b) have trouble making profits, while

c) stock market prices are ridiculously expensive.

Yet, when stocks finally begin falling back to Earth, it'll all be because Bernie won a couple primaries. So that's why you must vote for a corporate centrist.

Mark my words. You WILL hear this bullsh*t spewing from the mouths of "very serious people" on cable news.

Comments

Funny thing....

Despite the fact that the Social Democrats have dominated Swedish politics for the last century or so, the Swedish stock exchange still exists.....

Just call me Puzzled.

Gëzuar!!

from a reasonably stable genius.

Neoliberal: "but it's not the saaaaame!"

and here are some arguments:

10. Clinton won the popular vote.

9. It just wouldn't work.

8. Capitalism is better than socialism.

7. Shut up.

6. If you want to make as much as Bill Gates, work as hard as he does.

5. The number of millionaires in Sweden is indicative of failure.

4. Donald Trump REEEEEEEEEEEE!!!

3. Now is the time to talk about party unity.

2. Bernie bros.

1. Russia.

ThEn BeRnIe ShOuLd DrOp OuT

How dare he and his army of poors, communists, and other residue do this to shareholders, the true victims of all of this movement building! Where is my butler with the smelling salts?! How am I supposed to sleep at night when Bloomberg might not make it to his next billion?

I just read a headline in passing

that said Bloomberg is going to raise taxes and get $11 trillion for we the people. Isn't that what his BFFs are mad about Bernie doing?

The message echoes from Gaza back to the US. “Starving people is fine.”

It's only a problem when Bernie does it

and Mr. Stop and Frisk probably would give himself most of that money in the form of an "administrative adjustment" for being the best CEO America could have.

Trump, yes, but first....

I think you might be right, gjohnsit.

At first, I was thinking it would be Trump who will use this argument, but it'll be the corporate Democrats who use it first. Not that Trump won't use it. In fact, it's a sort of insurance policy for Trump if the market heads south before the election. Any market crash gets painted on whichever Democrat happens to be running against him ... but especially if it happens to be Sanders.

Hell, even if the market doesn't flatline before the election, Trump can still use it. I would think it would be an effective tactic to use on Boomers especially. Millennials have got nothing to lose, so they're immune.

But, with the exception of Tulsi, I'm guessing the other Democrats will attempt to slander Sanders with it before Trump even gets out of bed. Hard to say who might drag it up first. My money would be on Warren or Bloomberg, but if The Empty Suit or Her did it I wouldn't be surprised.

Not sure if you noticed but China

which is either the second or first largest economy depending on how you measure (PPP?) is kind of shutting down. I think the Shanghai is down something like 2.75 Friday, Hong Kong not doing well either down 6.5% for the month and they were struggling as it was. Much of our supply chain is China based.

There is a lot of churn in our markets, always was. Peloton exercise bikes are worthless, so is Wework space. A 100 dollar used bike off Craig's list works, as does a corner of your apartment with a desk. At the same time Amazon has been jumping. People hate Amazon and Bezos but he does something better than big box stores. Pays better wages than Walmart too.

CNBC is warning of Sanders gaming the Iowa caucus results

It's almost as reliable as Forbes publishing an article bashing Apple.

" In the beginning, the universe was created. This has made a lot of people very angry, and is generally considered to have been a bad move. -- Douglas Adams, The Hitch Hiker's Guide to the Galaxy "