Why can't Wall Street see what is so obvious to the rest of us?

Stocks were moving higher and looking strong this morning, and then the CPI inflation report came out, and stocks got monkey-hammered.

Stocks fell sharply on Tuesday after a key August inflation report came in hotter than expected, hurting investor optimism for cooling prices and a less aggressive Federal Reserve.

...The August consumer price index report showed a higher-than-expected reading for inflation. Headline inflation rose 0.1% month over month, even with falling gas prices. Core inflation rose 0.6% month over month. On a year-over-year basis, inflation was 8.3%.

Wall Street has consistently underestimated price inflation. In fact, they've been wrong consistently on the same side for about a year now. Why is that?

I'll let Cardi B explain the problem to you, because it appears that she's more in touch with reality than Wall Street is.

No seriously…I want to know how people are surviving… https://t.co/sodp7YdJTY

— Cardi B (@iamcardib) September 10, 2022

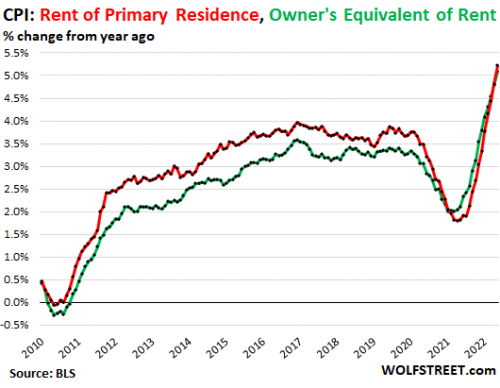

U.S. rental inflation accelerated in August as shelter costs rose 0.7%, marking the biggest monthly increase since 1991, and keeping overall inflation elevated.

...Rental prices surged last year, and although they have since moderated, long-term tenants still haven’t experienced the biggest hikes in asking prices.

Shelter costs are the largest component of the consumer price index, comprising about a third of it.

The problem here is class. Those wealthy predators on Wall Street own their homes. They don't pay rent. They don't hang out with people that do pay rent. If they know someone that does pay rent, it's because that person is renting from them.

Two months ago I explained in detail why inflation wasn't going to moderate anytime soon, and it was because of rents. I also pointed out how the official rent inflation number was understating the real rent price inflation.

Coincidently, Paul Krugman reassured us all just yesterday that rent price inflation was no longer a problem.

Paul Krugman said a cooldown in the cost of rent suggests US inflation is starting to flatten, speaking as investors count down to a key price data release.

At this point I'd like to remind you that Paul Krugman has never been wrong about anything, and that two months ago he declared that inflation, rent price inflation in particular, was no longer a problem.

What these numbers and a growing accumulation of other data, from rents to shipping costs, suggest is that the risk of stagflation is receding....Obviously we’ve had serious inflation problems over the past year and a half. Much, probably most, of this inflation reflected presumably temporary disruptions of supply ranging from supply-chain problems to Russia’s invasion of Ukraine. But part of the inflation surge also surely reflected an overheated domestic economy.

Why is it that inflation can ONLY be stopped by the working class taking 100% of the hit? The working class got practically no benefit in creating that inflation. It's almost as if the Working class have no part in inflation, except being used as a bailout for incompetence by the wealthy.

Let's not get ahead of ourselves. After all, inflation is no longer a problem.

Less than a month ago, traders were pricing in a cycle that took the benchmark federal funds rate target to more than 4% -- a level last seen in early 2008 -- up from the current range of 1.5% to 1.75%.But traders have rapidly unwound those expectations, and now foresee a peak around 3.3% in the first quarter of 2023....By contrast, the latest median projections from Fed officials, released last month, show the key policy rate climbing into 2023, reaching 3.75%.

Wait a second. Inflation is running at 8.6% in the United States, and is even higher in much of the rest of the world, but interest rates are going to top out at 3.3%?

Only a month ago everyone was talking about 1970's-style stagflation, but before inflation could even start to fall the markets have already started to price in disinflation.

It doesn't stop there. I explained last week how energy prices are going to spike higher in about 6 weeks.

Can we just stop pretending that Wall Street isn't inefficient and incompetent?

Comments

A conversation with Michael Hudson and Ben Norton

Excerpt from A short history of inflation in modern times

Well, what happened with private capital is they said, well, we can borrow from the banks at a very low price and we can buy the houses as absentee owners. And we can make much more money in rent than the low interest rates we have to pay.

So the low interest rates helped finance large real estate private capital companies to come in and begin to become absentee owners of a rising amount of housing in the United States, which is what has turned the home ownership rates way down.

At the point Obama took office, about 59% of Americans were homeowners. Now it’s under 50%. It’s fallen by about 10 percentage points as a result of the Obama evictions and the rules that Obama put in, the anti-Black rules, the anti-Hispanic rules, the anti-minority rules, and the anti-consumer rules that Obama put in.

[These] have essentially transformed the real estate market away from a home-ownership economy into a rental economy, where you’re recreating a landlord class financed by the banking class, and merging between the finance, insurance, and real estate sector, the FIRE sector.

https://michael-hudson.com/2022/09/a-short-history-of-inflation-in-moder...

Zionism is a social disease

Wall Street operates on Faith

When their Faith leads them astray, they get monkey-hammered by reality.

Housing costs have gone on a tear ever since Citibank-owned Obama reinflated the housing bubble. It started out slowly--you could still buy a house in 2014--but it compounded over time, especially after the orange, Off-Brand Orban cut trillions of taxes for the rich. And I don't see much that Biden has done about it yet.

All bets are off in a few years when we start to see the sea levels rise, if the Twaites Glacier in Antarctica breaks away.

At least half of Wall Street

makes money when things go to shit- so why would they care? The professional shorts are licking their chops. Those with microsecond-precise programmed trading mechanisms can pump and dump faster than the human eye can see.

The only people who lose are those who still believe in the concept of long-term value. All the money is being made in the noise margins of the daily ebb and flow- the more noise, the more that gets made. And you thought Bitcoin was weird...

That's why I've always been in favor of a trading tax. Those bastards are now the only ones who have any money, anyway. Tax them for a change.

Twice bitten, permanently shy.

I disagree

Don't tax them; they'll just find a way around it.

Kill them. Seriously.

I'll bet the legal case for justifiable homicide could write itself by this point - their actions clearly do immense direct harm to countless others.

As I keep asking, why was it just "Occupy Wall Street" and not "Columbine Wall Street"?

If Wall Street were somewhere else in the empire, I'm willing to consider it might've been (again, Colin Woodard's work on the different Americas deserves center-stage in political discussion, yet instead is a no-show). There's a huge difference between being civilized and being domesticated, and sometimes I wonder whether New Yorkers aren't among those cultures too far to the wrong side of that divide.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!