Why inflation is likely to accelerate after the election

The markets celebrated last week when energy prices fell, and this allowed the inflation rate to decline slightly.

What most people don't realize is that a large part of that decline in energy prices came from the U.S. federal government and it's about to run out.

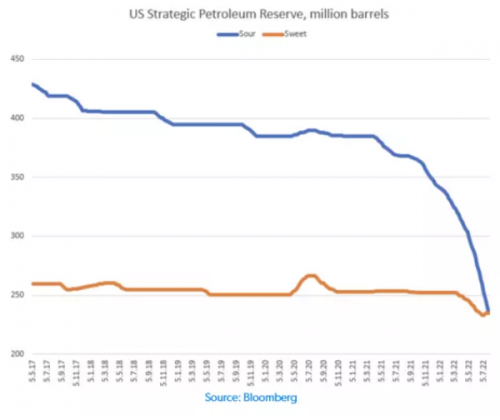

As of 26 August, the SPR’s holdings, at 450 million barrels, are at their lowest since 1985! It’s declined by 171 million barrels in the last 12 months alone, and it’s going lower in the months ahead.

‘Over the next six months, around 240 million barrels of emergency oil stocks, the equivalent of well over 1 million barrels a day, will be made available to the global market.’

The 31 March announcement called for a release of reserves for six months. That would put the end date for September. But another announcement in July said the releases would continue until the end of October.

By the end of October, it’s estimated that stockpiles of medium sour crude will be just 179 million barrels. To put that into perspective, from June 2021 to October 2022, the US will have likely sold down 180–190 million barrels of medium sour.

In other words, there’s very little firepower left, short of draining the reserve completely.

And guess what happens when you (literally) get to the bottom of the barrel? You need to start filling it up again for when a real emergency occurs.

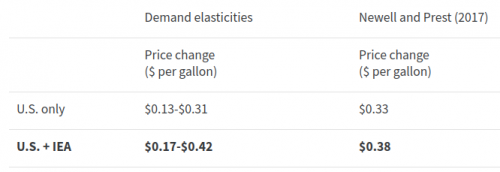

The Treasury did a study estimating how much impact that had on energy prices.

It is unclear how much of these changes in oil prices were passed through to retail gasoline and diesel prices. In general, we would expect one-for-one passthrough: a $1 per barrel decrease in crude would lower the price of gasoline by $1 per barrel, equal to $0.024 per gallon, since there are 42 gallons of gasoline per barrel. However, recently refining markets have been very tight, and it’s possible that a $1 change in crude oil would not lead to an equal decline in the retail price of gasoline.

This program ends in eight weeks. When that happens energy prices will rise around 35-38 cents a gallon. In addition the federal government will need to buy oil to replace what it had sold, so that should push the price of gas up around roughly 40-45 cents a gallon. Energy prices affect almost everything else.

In related news, natural gas prices in Europe just spiked 30%. This will spill around the world.

Comments

Chickens coming home to roost

That video was informative. I wonder if Canada will increase the price of oil they export to the USA? They certainly are sitting in a better position now that sanctions have been imposed on Russia. Maybe our neighbor to the north won't be quite as accommodating as it has been for decades.

Not sure if these two are related but it could have an impact.

https://www.economist.com/europe/2022/09/03/the-g7-plans-to-cap-russian-...

https://www.cnbc.com/2022/09/05/oil-opec-surprises-energy-markets-with-a...

Putin turning up the pain dial

Can you say uncle?

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

End oil sanction threats

End inflation

Seems basic to me.

Everything else is a temporary market fluctuation.

All threads lead to no good.

I am not an economics surgeon but my take is demand for oil will remain the same, but the supply will go down. According to market stuff, that means the price of oil will go up. And trying to cap the oil price of Russian exports, nobody with economic surgeon degrees thinks it will work. Only hope is for India and China to get their discounts from Russia, and then resell the oil with a huge market up which means, darn it, higher prices.

This is why we should be

This is why we should be working in good faith with all the counties of the world to alleviate the energy crisis. Instead we are provoking a major energy exporter an making it hurt for literally everyone. I thought our dear leaders were supposed to be smarter than this.

They are either complete idiots or they want people to suffer on purpose. I'll let you decide.

If it was easy, everyone would do it.