Panic selling on Wall Street again

It's not as big as Monday's crash, but it more than wipes out Tuesday's dead-cat bounce.

The losses are starting to add up.

According to FactSet data, 58 of the S&P 500’s components are in a bear market, meaning they are trading at least 20% below their 52-week high. More than a dozen of those components crossed the 20% threshold with their Thursday drops.

The financial media finally noticed that the bond market matters.

The 10-year Treasury yield briefly hit a four-year high of 2.88%, renewing concerns about inflation and higher interest rates.

"The bond market has definitely got the stock market's attention," said Ryan Detrick, senior market strategist at LPL Financial. "Is the bond market telling us something we don't know? Is there more inflation down the road than we're expecting?"

That's what they want to believe/sell you.

What is actually going on is what I explained on Monday: The Fed is shrinking it's balance sheet, while at the same time China has started selling it's dollar-based debt... Plus, the ECB tapering means less buying from Europe and a falling dollar.

They don't want to acknowledge this because it would call into question the validity of the nine year bull market, because it means it was engineered by the central banks.

It get's even worse if you take into account that the second longest bond bull market in recorded history, and the longest since the 16th century, just came to an end. That leaves us entering a long bear market in both stocks and bonds.

Comments

This morning's WashPost headline, before 1,000 point drop

If you’re not investing, you should be. There’s a sale in the stock market right now

This morning's Motley Fool headline:

5 Stocks That Could Double Your Money in 2018

And then an honest NY Times headline: We All Have a Stake in the Stock Market, Right? Guess Again

It might not be panic selling.

It only took ten years or so to repeat the thrills of a deeply plummeting stock market. Perhaps hindsight will show that today's sellers were wise to vacate the premises before the floor completely collapsed. If I had had any stocks to sell I would have dumped them months before the peak. It isn't over yet, IMHO.

“The story around the world gives a silent testimony:

— The Beresovka mammoth, frozen in mud, with buttercups in his mouth…..”

The Adam and Eve Story, Chan Thomas 1963

Keep an eye on Deutsche Bank

article from yesterday

And then today happened.

stake in the stock market

Oh, we all do have a stake in the stock market.

It's the one we're impaled on!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Sign of the times

breaking out the pom-poms

I caught a little of NPR's "Marketplace"

this afternoon. The host was careful to reassure his audience that "the fundamentals are strong." I'm pretty sure that the target audience for "Marketplace" is the upper middle-class retail investor.

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

Hmm...

Where have I heard that phrase "The fundamentals are strong"?

/sarc

Why is China selling its dollar based debt?

What would have happened if the Fed hadn't bailed out the banks? Would have nationalizing them have been better for the country?

Scientists are concerned that conspiracy theories may die out if they keep coming true at the current alarming rate.

How soon people forget

only a few weeks ago

And two months ago

aw, man...

My suggestion is that all of us might forget about a subject we are not as educated or interested in as you. You can hurt feelings easily about memory about a subject we look to you for education.

Snoopydawg is a treasure, as you are.

This OT, an opportunity to say that I am in my 6th week of flu and the aftermath, and I cannot go and do and need to just be still, sit, sleep, and what has kept me from going bonkers is you, snoopydawg, Lookout, and the cherished EB.

I am at the point if I am not dead, I should be happy.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

I'm sorry

I meant no offense.

My comment was a general statement, not anyone specific.

Can I refer to you as Handsome man?

I cannot thank you enough for educating me and the other c99ers.

This is a great place where truth is written.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

LOL,

gjohnsit should have never posted a picture of himself.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

as to your OT

As of this week, I am just recovered from the flu. Four weeks for me. You have my deepest sympathy. Get well soon.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

As long as Americans are willing to buy Chinese products

China will keep their Treasury holdings. They currently are holding 127.3 billion MORE than last year.

http://ticdata.treasury.gov/Publish/mfh.txt

Keep in mind this money is really American dollars due to negative balance of trade. The U.S. trade deficit with China was $347 billion in 2016. The trade deficit exists because U.S. exports to China were only $116 billion while imports from China were $463 billion.

As long as Americans are willing to buy Chinese goods, China will give them credit. Kinda like the company store. We will see the Chinese treasury holdings drop like a stone when American consumers can't afford to buy stuff from China. There is a similar dynamic at work with Russia.

BTW, Chinese consumers will surpass American consumers this year. China has millions of new consumers coming on line as the American consumers are getting tapped out and up to their ears in debt. So does Russia.

Mattis saying the US is preparing for conflict with China

and Russia probably contributes to China wanting to roll back some of their purchasing of US debt. His pronouncements are remarkably stupid given how much we owe China how reliant we are upon them for electronics, etc.

@Roy Blakeley We don't owe China

We don't owe China anything. They sold us stuff and and we paid them in dollars. Those dollars go into their account at the Fed and they either spend it on stuff that is for sale in dollars, borrow against their accounts at the Fed, or buy Treasuries, which are in effect savings accounts.

T-Bills are debt obligations

eom

TOP gets 10% of it right

warning TOP link

They figured out Trump's fault in this, but nothing else.

Daily Kos diary on the subject

To the Commenters' credit, as soon as some fiend started spouting Austrian economics, the same was thoroughly lambasted.

-- Daily Kos user tossthedice

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Just don't bet on a stable market. The Volatility Index blew up

taking the VIX market-makers and those who were heavily invested in nice, steady upward climb along with it. Kinda reminds me of all those trillions in CDS that were triggered in Q3 2008, taking Lehman down with it. Anyone know who's been underwriting the upside of the VIX? Those "institutions" probably aren't answering their phones and texts this evening.

https://www.marketwatch.com/story/risky-short-volatility-bets-to-get-gre...

Ex-regulator says warnings for risky volatility bets should be in ‘big, bold 24-point font and in red letters’

Don't forget derivatives

from my previous rant

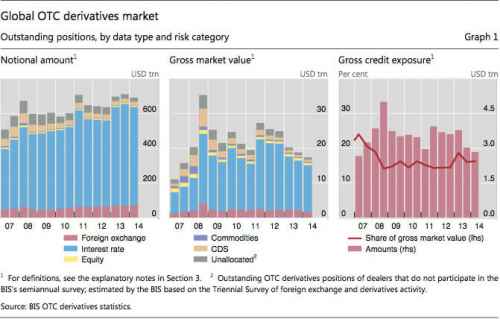

Finally, there is something I've ranted about before - interest rate swaps.

What most people don't realize is that the interest rate swap market is far larger than the credit default swap market that scared so many people in 2008.

The global notional market for interest rate swaps was about $560 Trillion in 2014.

While using notional values dramatically overstates the actual amount of money at risk (unless there are systemic defaults), even a small fraction of that mountain of money dwarfs of the GDP's of the world.

What this means is that if interest rates were to rise, and rise quickly, it would trigger these interest rate swap contracts (i.e. someone would have to pay).

I wish I COULD forget derivatives!

Speak not to me of such things, for it frighens me!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Or we could say

That interest rate derivatives are "about half a quadrillion dollars."

In case anyone needs to use 'quadrillion' in a sentence.

OK, so add in the various other derivatives ... can we get to some part of a quintillion dollars?

Why not just define every grain of sand as being a Dollar?

True, all these dollars are notional, and not as scary as it sounds. But someone having to pay off losses is real as rocks. If that someone goes bust, that starts off a chain of busts. Smells like 2008 … or 1929…or worse is cooking.

Orwell: Where's the omelette?

A trillion here, a trillion there

pretty soon it adds up to some real cash.

Here's what a quadrillion looks like in pennies:

pound/sand equivalency

(minor spoiler alert, if you haven't seen Local Hero yet DON'T WATCH THIS CLIP, go watch the movie.)

[video:https://www.youtube.com/watch?v=nSMOQKNXbV8]

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Well the overall derivatives market

$1.2 quadrillion

no?

"The Democratic Party has been focused too much on pleasing people who matter too little in this society." -- Chris Cuomo

Tax Cuts

I am wondering if the big tax cut package recently passed isn't also contributing to the problem. Wouldn't big deficits require the U.S. government to pay more in interest? It seems like a perfect storm resulting in a future deep recession.

Will bailins' be a real possibility

Now?

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

Gotta be in the game plan.

Orwell: Where's the omelette?

I'm thinking yes they will be coming soon enough

I hope most people are out of the bigger banks and in credit unions and hoping they will be safe from it. I just don't see how the Hell keeping people's money from them is even legal. Especially when we aren't the ones who screwed up. This has to go against our pursuit of happiness clause somehow.

Scientists are concerned that conspiracy theories may die out if they keep coming true at the current alarming rate.

Stockmarket?

Could be worse...could be Bitcoin!

I want a Pony!

A little off-topic, but I think it needs said.

I've never bought into the idea of the Fed raising interest rates to 'curb inflation'. Raising interest rates adds to the costs of doing business and puts upward pressure on costs/prices of all products and services. 'Curbing inflation' is not the real rationale.

Inflation IS involved in their motivation to raise rates, but the real reason is to protect the rich (and profit margins of lenders) FROM inflation.

For example, if someone has $100 million in savings, then we see a 5% annual rate of inflation, that person just lost $5 million in buying power over the course of that year.

Also, if we see inflation rates outrunning the profit margins for banks (on loans, mortgages etc.), banks would have actual losses instead of returns after inflation is figured in.

So it's not about 'curbing inflation' as much as it is protecting the rich (and the profit margins of banks) FROM inflation.

Mike Taylor