News Dump Monday: Echo Bubble Economy edition

Oil prices have made a small bounce from sub-$30 to $40, despite a record glut of inventory. Good news for producers? Nope.

A dreaded scenario for U.S. oil bulls might just be becoming a reality.

Some U.S. shale oil producers, including Oasis Petroleum (OAS.N) and Pioneer Natural Resources Co (PXD.N), are activating drilled but uncompleted wells (DUCs) in a reversal in strategy that threatens to bring more crude to a saturated market and dampen any sustained rebound in prices.

Where have we heard this before?

After the financial crisis decimated the market for bundled home loans that weren't backed by the U.S. government, bankers and lenders seized upon a host of alternative assets that could be sliced and diced and served up to investors. Sales of commercial mortgage-backed securities (CMBS), along with collateralized loan obligations (CLOs) consisting of loans made to junk-rated companies, subsequently surged past their pre-crisis highs. Bonds backed by auto loans made to riskier borrowers also proved to be a sweet spot for yield-seeking investors and the companies and bankers that sold such debt to them. People might walk away from their homes, so the bull case went, but in the driving culture that is America, very few would ever willingly choose to fall behind on their car payments. [My Note: What?!?!?]

This state of affairs encouraged new lenders to pile into the subprime auto lending space, including Exeter Finance Corp. and Skopos Financial. Skopos hit the headlines last year for peddling two deep subprime bond deals featuring ultra-low credit scores and sometimes no credit scores at all. The concern has been that such upstarts, often backed by private equity firms, will lower their underwriting standards as they fight for market share in an effort to produce relatively quick returns.

Last week, it appeared the chickens had come home to roost for some subprime auto lenders and investors, with Fitch Ratings warning that delinquencies in subprime car loans had reached a high not seen since October 1996. The number of borrowers who were more than 60 days late on their car bills in February rose 11.6 percent from the same period a year ago, bringing the delinquency rate to a total 5.16 percent, according to the credit rating agency.

From the "Here we go again" playbook. Except its global.

In the past, the value of a commercial property was "the capitalized value of the stream of rents from that property." In this order of things, occupancy rates (content) mattered. Now, commercial properties are not selling content and value but merely value. Meaning, they are selling a "projected increase in price." Meaning, downtown Seattle has entered the phase of Ponzi financing.

"My speculation is that this has been caused by people looking to move their money into the US," Harvey explained. Where did he get this information? From a source within the CBRE Group, a "commercial real estate company based in Los Angeles." This source confirmed that global surplus capital is behind this transition. "It's much more lucrative to build or buy with the hope of selling at an inflated value rather than actual revenue."

See yesterday's News Dump for the reason behind this.

The world’s biggest bond dealers are getting saddled with Treasuries they can’t seem to easily get rid of, adding to evidence of cracks in the $13.3 trillion market for U.S. government debt.

The 22 primary dealers held more Treasuries last month than any time in the last two years, Federal Reserve Bank of New York data show. While at first glance that may suggest a bullish stance, the surge in holdings is more likely the result of investors including central banks dumping the debt on the firms, said JPMorgan Chase & Co. strategist Jay Barry.

Strategists say there are signs that the buildup of Treasuries held by dealers is having a ripple effect, mucking up the plumbing of the financial system. While the holdings show they did their job by soaking up the supply from central banks raising cash to support their currencies, it’s adding to questions about the resilience of the world’s most important market. The Treasury Department is already looking into whether the market isn’t operating as smoothly as it should.

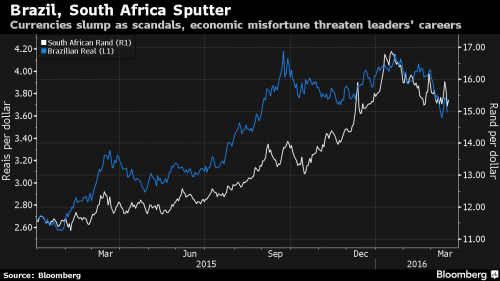

Brazil and South Africa are united by political scandals and economic misfortune. Gloom has descended as the presidents of each country fight off corruption allegations that threaten to end their political careers. For the leaders, Dilma Rousseff and Jacob Zuma, it’s a stunning fall from grace, a humiliation made worse by markets rallying on the prospects of their demise.

“What many thought would be locomotives of growth have become risks,” said Mario Blejer, Argentina’s former central bank governor and a vice-chairman at Banco Hipotecario SA. “They gave the appearance that lots of progress was taking place. Suddenly we saw it was really just a lie.”

The challenge now is whether South Africa and Brazil -- which only became fully fledged democracies over the past 30 years -- can prove they have the ability to clean house as their economies sputter. Failure to do so threatens to undo the gains of the past decade and send markets into a tailspin. It could also fuel social unrest.

Their heydey with investors has long passed. Goldman Sachs closed its BRIC fund last year after it lost 88 percent of its assets since the 2010 peak. South African bonds are the worst performers across emerging markets over the past six months, with the yield on 10-year notes rising to 9.18 percent. Brazil’s real is down 12 percent in the past year despite a rally this year fueled by traders’ optimism that Rousseff will soon be gone.

Of the 40 million people who climbed into Brazil’s middle class during the boom years, almost one in 10 has already slid back down. Across the Atlantic, South Africa’s jobless rate of 24.5 percent is even worse than it was at the start of Zuma’s term and the highest among the 85 countries tracked by Bloomberg.

In systems beset by corruption, Rousseff and Zuma may just have had the misfortune of being in power when the music stopped, according to Mark Blyth, a professor of political science at Brown University in the U.S. In periods of sustained growth, “you don’t notice the corruption,” he said.

In the wake of the death of a US Marine in northwestern Iraq in an ISIS rocket attack on Saturday, the Pentagon has announced they are in the process of deploying an undisclosed number of additional Marines to Iraq to take part in ground combat against ISIS....

The number of troops deployed, and how big a force this will have the US up to in Iraq, remains unknown, but the US was already confirmed to have more troops in Iraq than their diplomatic deal with the Abadi government permitted, and has only increased the number of troops since.

Also, on March 24, 1999, the NATO alliance, led by the United States, began bombing the former Yugoslavia, a conflict that resulted in the creation of Kosovo, a gangster state run by criminals who have been credibly charged with trafficking in human organs and whose leadership is essentially the Albanian Mafia. (That war, by the way, can also be laid at Hillary’s doorstep.)

As I warned my readers at the time, the US alliance with the “Kosovo Liberation Army” has resulted in the unleashing of Albanian ultra-nationalism — and today we see that the Kosovo government is being violently challenged by a movement that seeks to create a “Greater Albania.”

The stock market rally since early February is unloved.

And yet for all the positive signals being sent by stocks, buyers aren’t storming back. In fact, going by one measure of U.S. outflows, investors just yanked more money from American equities that any time since September. Enthusiasm remains bridled as a logjam of investor concerns, from China growth to ineffective central-bank policy and weakening profits, shows no signs of dissipating.

Investors of virtually all types have sold more stock than they’ve purchased, according to Bank of America Corp. In the week ended March 11, the bank’s hedge fund, institutional and private clients sold $3.7 billion, the most since September and the seventh consecutive week of withdrawals, the company said in a note last week. Net sales by institutions were the second-biggest since the bank began recording the data.

The other issue is earnings. As economists lowered projections for this year’s global growth to 3 percent from 3.6 percent in August, analysts cut profit estimates. They now expect a 2.9 percent increase in net income for U.S. companies in 2016, down from 7.1 percent in December, and profit declines in Europe. Worldwide, there have never been as many earnings downgrades versus upgrades as there are now, according to the annual averages of a Citigroup Inc. index tracking the changes.

“I’m not buying anything; I’m sitting on my hands and waiting,” said Michael Woischneck, an equities fund manager who oversees the equivalent of $166 million at Lampe Asset Management in Dusseldorf, Germany. “I would definitely sell this rally because it’s totally central-bank driven and has nothing or very little to do with fundamentals.”

Comments

Sanders Earns Big Win In Primary Of Democrats Living Abroad

Sanders Earns Big Win In Primary Of Democrats Living Abroad

"We've done the impossible, and that makes us mighty."

good news

I've been waiting for this. Bernie gains 5 delegates over Hillary. And the worm turns.

Spring forward and march on!

Thanks for the good news.

“Until justice rolls down like water and righteousness like a mighty stream.”

The global surplus of capital is invading real estate markets

in perceived desirable areas and paying cash. Often they are going for the short term, furnished airb&b model which is more lucrative than long term rentals, thus driving up rental prices in many cities. I think the last statistic I saw was that 36% of the US real estate market is all cash buyers. Or, even more frustrating, some of these properties are vacant, waiting for the increase in value in order to flip. It is a bubble all over again.

" “Human kindness has never weakened the stamina or softened the fiber of a free people. A nation does not have to be cruel to be tough.” FDR "

Yes 36% is what I saw too

but that was at least a year ago.

I know in my little rural area of Ohio, I did some looking a couple years back and there was a ton of house sales in a relatively short amount of time. That's unheard of around here where houses usually sit on the market for a year or more. Then I noticed the buyers - IIRC at least 50% of them were from out of town. And by that I really mean from out of state. I'm betting every one was a cash sale.

At the time we had the added bonus of "enjoying" a fracking boom... or at least the preparations for a fracking boom. So with all those drillers and pipeliners, who would only be here for maybe a year or two, the place was ripe for rentals. Rents skyrocketed. Places were going for $1000 per bedroom per month. The locals who have lived here for generations - and didn't happen to work on a frack pad - were hurting pretty bad. A friend of mine lost her house in the foreclosure debacle and spent a year and a half looking for something she could even marginally afford.

The weird thing is, the oil glut pretty much shut fracking down completely, but rents are still sky high compared to past times. I'm waiting for the day when these places start sitting empty for long stretches, and the "owners" just walk away from them. Most of them made their purchase price back and then some a long time ago. It will happen. It's only a matter of time.

Meddle not in the affairs of Dragons - For thou art crunchy and good with ketchup

With respect to shale oil and tar sands...

They are so f*d.

And the holders of their paper (junk bonds) are too.

Long term why? In the UAE the bids for the SHAMS II solar plant came back at the equivalent of $10 a barrel.

https://www.nbad.com/content/dam/NBAD/documents/Business/FOE_Full_Report...

Quote: For solar PV and on-shore wind

technologies, there is already a track

record of successful deployment.

Prices have fallen dramatically in the

past few years: solar PV falling by 80

per cent in six years, and on-shore

wind by 40 per cent. The speed of

this shift towards grid parity with

fossil fuels means that, in many

instances, perceptions of the role of

renewables in the energy mix have

not caught up with reality. At the end

of 2014, the 200 MW Dubai Electricity

and Water Authority (DEWA) bid in

Dubai set a new world benchmark for

utility scale solar PV costs, showing

that photovoltaic technologies are

competitive today with oil at US$10/

barrel and gas at US$5/MMBtu.

Always loving your diaries gjohnsit.

I want a Pony!

More threats from our allies in Iraq

They've threatened us before. Is this different?

Tea-GOP forced to do damage control to keep House majority

Politico may be overstating with this headline: Trump puts GOP House majority in jeopardy.

The possibility of a "wave" election to flip the House of Representatives to the Dems depends on some factors in addition to Trump. Certainly the Democratic Party nominee will have to be Bernie, because Hillary has such high negatives and very little support from independent voters. And the Dems will have to recruit some good congressional candidates in key districts.

At the very least, the Dems ought to gain 12-15 House districts.

"We've done the impossible, and that makes us mighty."

Hey, gjohnsit! Got a comment/question for you.

I'm limited to using a @#%! spy-phone,

which has its ... limitations.

Many of your blockquotes, although not

all, appear on my screen running all the

way across the width of the page, which

makes them very hard to read.

In this piece, all of your quotes except the

sixth (the one beginning "Their heyday")

do that. The sixth quote appears as

properly formatted to align with the width

of the text of your article.

Could you maybe look into this and see

why so many of your blockquotes do

that, and make some adjustment to your

formating for those of using phones?

I'd really appreciate it. Thanks!

Only connect. - E.M. Forster