Inflation and Housing: The worst is yet to come

Housing represents about a third of the basket of goods and services that the BLS uses to track inflation in the Consumer Price Index, the largest component. This is very bad.

Shelter inflation is generally slow to come up and slower to come down than other inflation components, posing a challenge for the Federal Reserve, said Douglas Holtz-Eakin, president of the American Action Forum and a former Congressional Budget Office director.

Because rent and housing prices are going up faster than most other items in the CPI, the inflation rate is almost certain to continue to accelerate in the coming months.

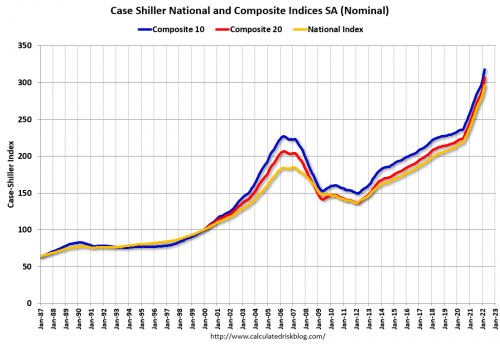

In fact, housing prices have never gone up faster.

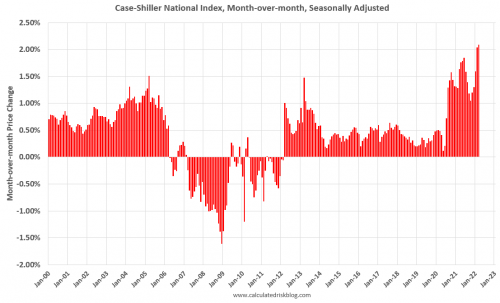

The MoM increase in Case-Shiller was at 2.09%. This is the largest MoM increase in the Case-Shiller index on record (since 1975), and stronger than any month during the housing bubble or during the late ‘70s with high inflation.

U.S. house prices rose 18.7 percent from the first quarter of 2021 to the first quarter of 2022 according to the Federal Housing Finance Agency House Price Index (FHFA HPI®).

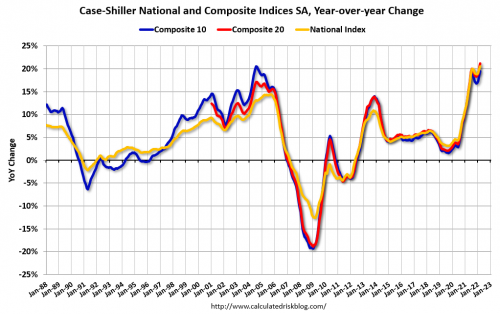

“Those of us who have been anticipating a deceleration in the growth rate of U.S. home prices will have to wait at least a month longer,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite Index recorded a gain of 20.6% for the 12 months ended March 2022; the 10- and 20-City Composites rose 19.5% and 21.2%, respectively. For both National and 20-City Composites, March’s reading was the highest year-over-year price change in more than 35 years of data, with the 10-City growth rate at the 99th percentile of its own history.

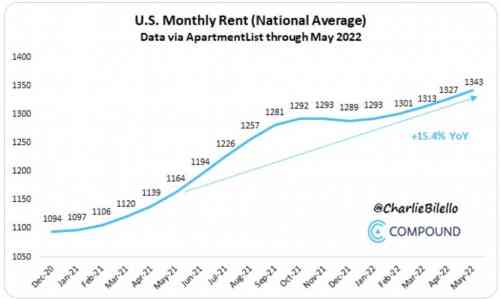

Industry data shows home prices rose a blistering 18.8 percent in 2021, and rent has climbed 17.6 percent nationwide over the last year, our Katy O’Donnell reported in March. But those prices haven’t fully shown up in inflation figures because leases are typically annual.

It seems mind-blowing that housing prices are going up so fast despite mortgage rates sitting at 13-year highs, and rates are almost certain to go higher still.

Instead of driving down home sales and prices, it's actually driving home sales and prices higher.

A large reason for this dynamic is simple - FOMO - fear of missing out.

FOMO has traditionally been something you see at or near the top of a bubble.

Only in the last couple months has housing inventory been rising and listings been falling.

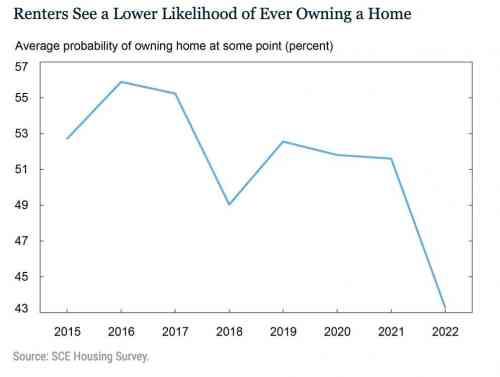

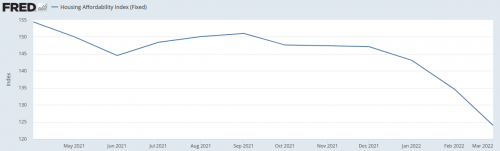

All of that adds up to housing affordability declining at an "American Dream Destroying" rate.

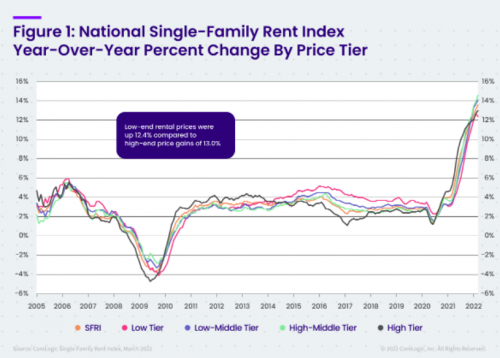

Rental prices aren't going up as quickly as housing prices, but it's pretty darn close.

Over the first five months of 2022, rents have increased by a total of 3.9 percent, compared to an increase of 6.1 percent over the same months of 2021. Year-over-year rent growth currently stands at a staggering 15.3 percent, but is down slightly from a peak of 17.8 percent at the start of the year.

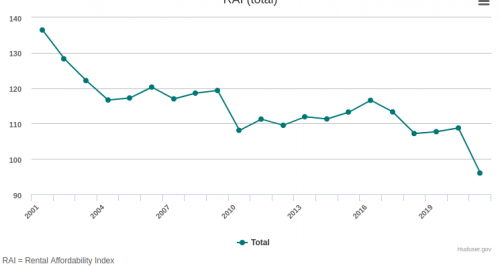

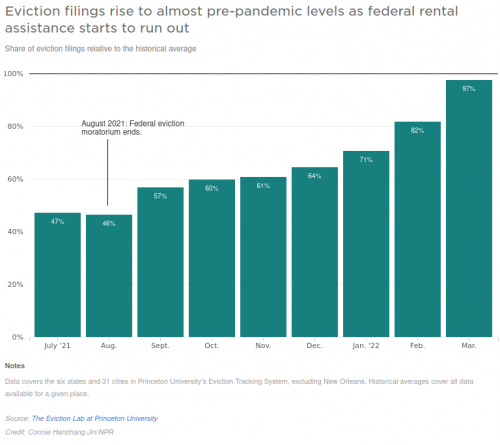

This massive increase in rental prices is hitting just as emergency rental aid allocated during the pandemic is finally running out.

Emergency rental aid has helped keep millions of people in their homes during the pandemic. But that federal program will start winding down this summer, when it expects to have allocated all of the $46 billion from Congress.About half of that has been spent so far, and in some places programs are now running out of their share of the money and shutting down. That's sending eviction filings up sharply, even as rents spike and inflation cuts deeper into household budgets.

"The longer we go past the time the eviction protections or resources are gone," she says, "the more we're seeing in some of these cities, eviction filing rates reach 150%, 200% of pre-pandemic averages."

I just don't see how this ends up in anything but a disaster.

Comments

I agree.

Huge, imminent, widespread, and it will happen everywhere at the same time. A sudden shock.

It wasn't easy, took decades for me to be out of debt with 3 pieces of real estate, including my home, office, and future retirement home, all vehicles, all everything is paid for, no debt other than monthly bills. I expect my properties will eventually be worth almost nothing, but doubt my ad valorum taxes or insurance will reflect that. I kid.

Thanks for the essay.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

How much of this is being driven by hedge funds

buying homes and whole neighborhoods? If they can afford to pay cash for houses then they don’t give a rat’s ass about interest rates.

The message echoes from Gaza back to the US. “Starving people is fine.”

No Housing

People here are renting RV's in the woods because there is no where they can afford to live. Now the county is throwing a fit over it. They are supposed to have a special meeting about it. People wouldn't be living that way if there was decent housing.

So, if this is the dire future we are facing,

the hardships of the ‘undeveloped’ world will also suffer. Is capitalism capable of even addressing such a massive social welfare upheaval, no less meeting such a challenge?

I think not. In the land of ‘property rights’ there is little concern for basic human rights. Capitalism is designed for making fortunes, and then making them even bigger. Alms for the needy are only provided to the extent that revolution is forestalled. Equality of ‘opportunity’ is advertised, but is a lie. Those who fail to make their fortune deserve their lives of poverty.

Capitalism is a fantastic economic system if you want to increase consumption, deplete resources, and concentrate wealth for the very few. It is in no way egalitarian, it is exceptional. With natural resources dwindling and the planet warming, capitalism, if it is to continue at all, will be compelled to jettison great numbers of “useless eaters” and subjugate it’s trans-human worker class. Sound familiar?

I’d rather try something else, before it’s too late.

“The story around the world gives a silent testimony:

— The Beresovka mammoth, frozen in mud, with buttercups in his mouth…..”

The Adam and Eve Story, Chan Thomas 1963

One answer is high-IQ engineering innovation.

This is how the housing crisis could be bridged/solved in the immediate future (if there is one). Until people get their excess reproduction levels under control. With automation, we don't need excess humans wasting their lives competing for labor jobs. One person trained in automation can do the work of five people, and still have plenty of time for recreation and family. This will take some time, but it is the clear path into a sustainable future,

Meanwhile, high-quality housing units can be constructed very rapidly, with existing technologies that are used intelligently. Well designed, sound-proof, energy efficient, and sustainable homes of various sizes can be made available right now — likely at more affordable prices due to economies of scale. If this is a state-owned project, the housing could be exceptionally affordable, since greedy corporate profit-taking, instant millionaire insiders, and political influence payola are removed from the cost equation. And, this government expenditure is fully reimbursed shortly after completion, instead of disappearing down a black hole, like military spending on Empire fantasies and power-lust.

This example is a 15-storey hotel, but it could easily be configured into a condominium complex for home ownership, with businesses and shops on the ground floor. It's a very small footprint for housing a moderate-sized community — which leaves ample land for a community park and individual plots for produce gardens for each resident.

CHINA DAILY

WHOLESOME CIVILIZED GLOBAL NEWS. GIVE IT A TRY.

That is truly amazing, Pluto

Even at that speed no builders were injured. It would be great if America (and NZ) could build with the same efficiency providing affordable rents, or with government subsidies for those in need.

People need food, love (or care) and shelter.

House prices don't count and the Fed no longer uses them

because they don't reflect reality. I don't buy a house every month. The fed bases inflation estimates on Personal Consumption Expenditures PCE. Rents, and what a homeowner would need to pay if they rented the house they own.

Prices here rose 30%, no one put that money in my bank account and I didn't have to pay anything because the mortgage is gone.

Tucker Carlson is only a pundit, he knows no more than anyone else who can read a paper.