HSBC, the World's Most Corrupt Bank, can be trusted again: DOJ

Back in 2012, HSBC had an embarrassing public relations problem.

A report compiled for the committee detailed how HSBC's subsidiaries transported billions of dollars of cash in armoured vehicles, cleared suspicious travellers' cheques worth billions, and allowed Mexican drug lords buy to planes with money laundered through Cayman Islands accounts.

Other subsidiaries moved money from Iran, Syria and other countries on US sanctions lists, and helped a Saudi bank linked to al-Qaida to shift money to the US.

The DOJ admitted that drug dealers would sometimes come to HSBC's Mexican branches and "deposit hundreds of thousands of dollars in cash, in a single day, into a single account, using boxes designed to fit the precise dimensions of the teller windows."

Talk about 'subtle'.

I say it was a PR problem, not a criminal problem, because the DOJ famously announced that HSBC was "Too Big To Jail".

As part of the deal, HSBC was put on a so-called deferred prosecution agreement. That agreement is now set to expire.

The deferred prosecution agreement was set to expire on Monday if HSBC stayed out of trouble. The bank, which is based in Britain but generates more than half of its profit in Asia, said the Justice Department was expected to file a motion to dismiss the case in federal court in Brooklyn after the agreement concluded.

“HSBC is able to combat financial crime much more effectively today as the result of the significant reforms we have implemented over the last five years,” Stuart Gulliver, the HSBC chief executive, said in a news release.

Well, I'm convinced!

After all, HSBC hasn't been in the news at all over the last five years.

At least not for anything resembling corruption. Amirite?

HSBC’s Swiss bank concealed large sums of money for people facing allegations of serious wrongdoing, including drug-running, corruption and money laundering, leaked files reveal.

Despite being legally obliged since 1998 to make special checks on high-risk customers, the bank provided accounts for clients implicated in six notorious scandals in Africa, including Kenya’s biggest corruption case, blood diamond trading and several corrupt military sales.

HSBC also held assets for bankers accused of looting funds from former Soviet states, while alleged crimes by other account holders include bribery at Malta’s state oil company, cocaine smuggling from the Dominican Republic and the doping of professional cyclists in Spain.

Described as "Syria's poster boy for corruption" in a January 2008 US State Department cable, Makhlouf was estimated to be worth $5bn before the outbreak of the uprising, presiding over a vast business empire and controlling some 60 percent of the Syrian economy.

...Thanks to lobbying by London-headquartered HSBC, Makhlouf was able to maintain Swiss bank accounts until May 2011 - despite existing US sanctions and growing interest around Makhlouf from financial investigators in the British Virgin Islands.

As The Guardian reported on Tuesday, leaked emails suggest that HSBC's compliance departments in Geneva and London argued against cutting ties with Makhlouf up until February 2011.

By 2014, campaigners claim, HSBC began arbitrarily closing dozens and dozens of bank accounts held by Syrian nationals living in the UK, doctors and students, refugees and activists - often with little or no explanation at all.

Spring 2017: Global Laundromat

HSBC, the Royal Bank of Scotland, Lloyds, Barclays and Coutts are among 17 banks based in the UK, or with branches here, that are facing questions over what they knew about the international scheme and why they did not turn away suspicious money transfers.

Documents seen by the Guardian show that at least $20bn appears to have been moved out of Russia during a four-year period between 2010 and 2014. The true figure could be $80bn, detectives believe.

One senior figure involved in the inquiry said the money from Russia was “obviously either stolen or with criminal origin”.

Investigators are still trying to identify some of the wealthy and politically influential Russians behind the operation, known as “the Global Laundromat”.

Last September: Forex manipulation

The U.S. Federal Reserve fined HSBC Holdings PLC (HSBA.L) $175 million on Friday for “unsafe and unsound practices” in its foreign exchange trading business, the latest in a series of fines for banks that fail to prevent market manipulation.

HSBC has been accused of “possible criminal complicity” in a money laundering scandal involving South Africa’s wealthy Gupta family.

Speaking in the House of Lords on Wednesday, two weeks after he first voiced concerns about UK links to the probe, Lord Hain said he had handed new evidence to the chancellor about the alleged involvement of a British bank in the “flagrant robbery” of South African taxpayers. Hain did not mention the name the bank in the Lords but did so in a letter to the Philip Hammond, in which he said the bank should be investigated over “possible criminal complicity” in corruption.

Also last month: enabling tax fraud

HSBC Private Bank, a Swiss unit of banking giant HSBC, has agreed to pay 300 million euros ($352 million) to avoid going to trial in France for enabling tax fraud, prosecutors said on Tuesday.

HSBC was accused last year of helping French clients to hide at least 1.67 billion euros from the tax authorities, according to a source close to the probe.

Three weeks ago: Selling Lehman products

HSBC Holdings Plc’s private-banking unit was fined a record HK$400 million ($51 million) over sales of structured products linked to Lehman Brothers Holdings Inc. in Hong Kong.

So like I was saying, HSBC has totally cleaned up its act and is a perfectly safe, responsible, law-abiding bank now, just like the DOJ tells you.

Comments

I have to laugh.

The banks won't deal with a state legal marijuana grower. After all, it's against federal law. /s

I think it has way much more to do with classification. Marijuana is a schedule 1 drug whereas the schedule 2 drugs are legal, money makin, govmint subsidized and include:

hydromorphone (Dilaudid®), methadone (Dolophine®), meperidine (Demerol®), oxycodone (OxyContin®, Percocet®), and fentanyl (Sublimaze®, Duragesic®). Other Schedule II narcotics include: morphine, opium, codeine, and hydrocodone.

Any of those show up in good news?

The drug war and the banks go good together and it's only possible by the money that can be made by controlling the government.

Regardless of the path in life I chose, I realize it's always forward, never straight.

America & the world could use less “Delaudid” and more “Delysid”

but of course I just say that as a veteran of the psychedelic 1960s-70s.

http://www.psymon.com/psychedelia/images/delysid.html

VP Pence needs more Delysid, that's for sure!

VP Pence needs more Delysid, that's for sure!

EDIT: I may need to take that back. From the article lotlizard linked:

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

It says something when . . .

. . . we feel we need to examine all the big banks to decide which one is the "most corrupt" in the world.

It's like exploratory surgery on a dying patient to see if the most aggressive tumors can be located and removed to save his life. Only the DOJ/surgeon in this instance decided he'd rather be playing golf and left the operating room to the anaestheticians, who are piping the gas to the observation gallery.

HSBC easily one of thee most stunning acts of Obama corruption

If this had all happened in a Latin American country, people would be accusing Holder and Obama of being paid off or controlled by drug cartels. When I read about the deal, not made very public was that HSBC was warned about their activities and told to stop. This wasn't some great unmasking worthy of a Hollywood thriller.

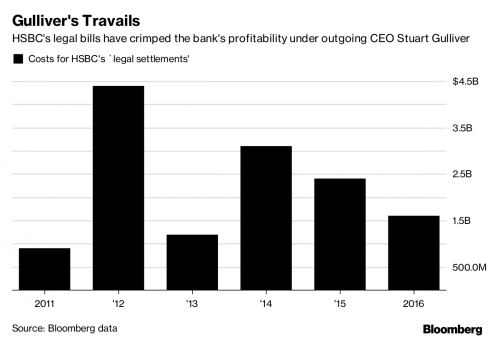

Also, pretty certain that the fine was tax deductible so HSBC had to pay more like $1.4 billion. They had a pretax profit for last three months as reported in October of this year of 4.6 billion. So the fine was basically one month of profits for supporting probably the most murderous gangs in the world.

I thought the fine was pretty much a signal to other banks that money laundering drug cartels would be met with a minor fine against their bottom line.

What about a change in what passes for regultory strategy?

Maybe if they tried to present the fines as a tax, the banks would go to great lengths to avoid them, rather then merely regarding fines for criminal behavior as a 'cost of doing business'?

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Am sure our SA friends will be happy

Happy to see this, thanks . Zuma and his PTB are in their in way, remind me of Trmpco.

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

To Trump’s DOJ they probably fo look

honest. Birds, feathers, etc.

I'm tired of this back-slapping "Isn't humanity neat?" bullshit. We're a virus with shoes, okay? That's all we are. - Bill Hicks

Politics is the entertainment branch of industry. - Frank Zappa

What a surprise

When banks, for profit colleges, military contractors and corporations commit fraud that's worth billions and only have to pay a couple million in fines while admitting no wrongdoing, that sends a message saying that it's okay to continue to commit fraud, but plan on handing over some money to the governments of whichever country there in.

One for profit college over billed the government and only had to pay a fine and since they didn't have to admit wrongdoing, the students who took out loans to pay for it still had to repay them.

Some students were able to get them discharged, but DeVos has halted it. Now those students are having to pay for the interests they racked up during the time they were told not to repay them.

A military contractor in the Iraq war was found guilty of fraud and after they paid a fine they got new contracts.

Bush the Greater sent people to prison after the savings and loan scandal. How long after that did financial institutions color inside the lines until Clinton did his thing?

The message echoes from Gaza back to the US. “Starving people is fine.”

An under-reported aspect of right-wing populism in ex-E. Germany

is the enormous disillusionment with German and European elites’ — supposedly superior — value system and “rule of law,” experienced by people who were badly damaged during the transition by various kinds of shady but legal business dealings.

Now living in what was formerly East Germany, I see some big similarities to what “locals” in Hawaii went through after Hawaii became a state.

Basically, it’s the result of (1) having seen everything potentially profitable that wasn’t nailed down bought up by outsiders from far away, and (2) having every form of shysterism invade to take advantage of a huge new market of rubes inexperienced in the outrageous amount of leeway Western, “Free World” law affords to people and business entities who know how to work the system.

HSBC used to be Hong Kong and

HSBC used to be Hong Kong and Shanghai Bank Co. -- the Hong Shang -- and is one of the leading British institutions that directed the opium trade which destroyed and subjugated India and China. It has always been a key part of imperial rule, along with dirty money and dirty ops. Note the direct ties at the highest level of British intelligence, and to the Bank of England, in the profiles of the directors, below.

Since its beginning in the 1860s HSBC been one of the dirtiest banks on the planet. During the Viet Nam war, Lucien Conein and Ed Lansdale of the CIA used HSBC to launder heroin money.

The first time Ghandi was jailed by the British was when he wrote about the role of the Hong Kong and Shanghai Bank in the opium trade.

I looked at the HSBC Board of Directors about a year ago. Here's about half of them:

Jonathan Evans, Lord Evans of Weardale, former Director-General of the British Security Service, the United Kingdom's domestic security and counter-intelligence service. You really think this guy does not know what HSBC is doing while he's a director?

Joachim Faber, CEO of Allianz Global Investors from 2000 to 2012, and is chairman of the German Stock Exchange Group since May 2012. Allianz is the world's largest insurance company. In April 2001, Allianz bought 80 per cent of Dresdner Bank, the largest bank in Germany.

Sir Simon Robertson, former Chairman of Kleinwort Benson, which has historically been used by top British elites, particularly for off shore banking. Kleinwort Benson was a pioneer in privatisation: it was the lead adviser on the privatisation of British Telecom which, at the time in 1981, was the largest public offering ever. In 1995, Kleinwort Benson was bought by Dresdner Bank. Sir Robertson was also President of Goldman Sachs Europe.

Jonathan Symonds, CBE, former Chief Financial Officer of Novartis AG, the Swiss company which is the largest pharmaceutical company based on sales. Symonds was was a Partner and Managing Director of Goldman Sachs in 2007-2009.

Janis Rachel Lomax was Deputy Governor of the Bank of England from 2003 to 2008.

Philip D. Ameen, Senior Vice President, Principal Accounting Officer and Controller of General Electric Capital Corporation and General Electric Capital Services, Inc; Vice President and Principal Accounting Officer of General Electric Company until March 15, 2008 and served as its Comptroller from April 1994 to March 15, 2008. According to his HSBC blurb, Ameen "has extensive experience in accounting standards setting and reporting." What standards, exactly, is he setting? According to the Bloomburg bio on Ameen, he "is a Member of the Advisory Board of University Business School's Center for Excellence in Accounting and Security Analysis. He serves on the International Financial Interpretations Committee of the International Accounting Standards Board. He was the longest-serving member of the Financial Accounting Standards Board Emerging Issues Task Force."

- Tony Wikrent

Nation Builder Books(nbbooks)

Mebane, NC 27302

2nbbooks@gmail.com

How can you make this stuff funny?

In all seriousness, you have a gift for writing.

That being said, I'd already pretty much figured out that none of the large banks (and most of the small banks) are trustworthy. It seems pretty obvious that banking is the career of the criminal class.

A lot of wanderers in the U.S. political desert recognize that all the duopoly has to offer is a choice of mirages. Come, let us trudge towards empty expanse of sand #1, littered with the bleached bones of Deaniacs and Hope and Changers.

-- lotlizard