Housing affordability crisis continues to get worse

The real estate industry celebrated another big year for home price appreciation - up 6.3% y-o-y.

Prices have almost returned to peak housing bubble levels, and the industry forecasts nothing but smooth sailing as far as the eye can see.

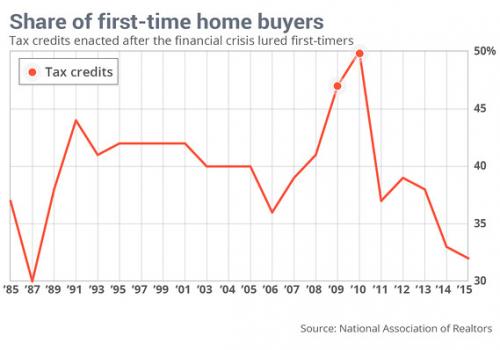

There is just one little problem with this scenario - who is going to buy these houses?

Meanwhile, average weekly wages in the second quarter of 2015, which was the most recent wage data available, were up an average of 2.6%from a year ago and median home prices were up an average of 5% in the third quarter of 2015 compared to a year ago across all 504 counties, RealtyTrac’s report stated.

“Renters in 2016 will be caught between a bit of a rock and a hard place, with rents becoming less affordable as they rise faster than wages, but home prices rising even faster than rents,” said Daren Blomquist, vice president at RealtyTrac.

“In markets where home prices are still relatively affordable, 2016 may be a good time for some renters to take the plunge into homeownership before rising prices and possibly rising interest rates make it increasingly tougher to afford to buy a home,” Blomquist added.

Hmmm. Now is the time to buy because if you wait you will be forever priced out of the market.

When have I heard that before? Oh, yeah. From friends, coworkers and the news media in 2004-2007.

Who is going to buy these increasingly unafforable homes?

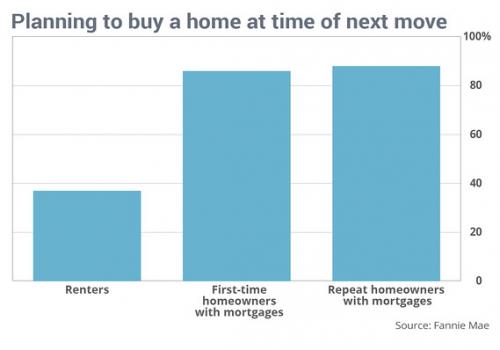

Current homeowners are the ones who most want to buy, but who are they going to sell their existing homes to at these prices?

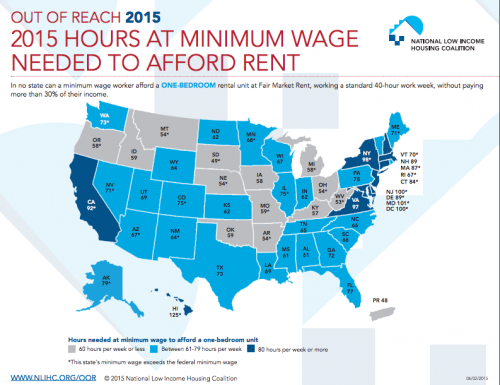

On the other end of the spectrum are the renters, who are being increasingly squeezed by the landlords.

There is not a single state in the U.S. where a minimum wage employee working full-time can reasonably afford a one-bedroom apartment at the fair market rent. While 29 states, plus the District of Columbia, have taken steps to raise the minimum wage above the federal rate of $7.25 per hour, affordable housing remains out of reach for the country's low-income workers.

A report from the National Low Income Housing Coalition reveals exactly how bad the problem has gotten over the past five years. At $7.25 per hour, a person would have to work 86 hours each week (more than double the standard full-time work week) in order to afford a one-bedroom apartment at the 2015 Fair Market Rent of $806.

With increasingly large mortgages and property taxes, both coming from high house prices, landlords have to charge an arm and a leg in rent to pay the bills. But that means that renters can't save any money to buy a house or their own.

Which brings us back to, who is going to buy these houses? Apparently it will be foreigners.

Most foreign investors expect to put more money into U.S. property this year than they did in 2015, with New York remaining the top target market worldwide, according to a survey by the Association of Foreign Investors in Real Estate.

Sixty-four percent of respondents said they intend to make modest or major increases to investments in U.S. real estate this year, while 31 percent expect to maintain their holdings or reinvest sales proceeds into other U.S. assets, according to the 24th annual survey by the group, known as AFIRE. None of the respondents plans a major decrease.

That's great for everyone except working class Americans. Capitalism wins!

Comments

Renter survey

Here we go again

It's like musical chairs. Quick grab a seat (house, apt, condo, broom closet) cause going fast and there is a intentional shortage of available seats. Of course none of the seats are affordable even if you already 'own' a dwelling. My 1914 house which we bought in 1993 for 74,000 because it was a filthy wreck and Portland had not yet been designated a yuppie hipsters or investor/developer's wet dream. We put a lot of both money and sweat equity into our home. We did not buy it to flip or as a first step on the ladder moving on up. We bought it after living for 10 years in San Fransisco where we could not even qualify for a loan on a broom closet even though we both had good corporate techie jobs. Our rent on a small house out on the Avenues with an crazy looking armed postman living in the basement and a furnace that was kaput was 1,250$ in 1988-92.

We we're amazed at the square footage we could actually buy in urban Portland that was affordable and offered us as a bonus a diverse vibrant neighborhood and community. No longer, now my neighborhood is 'desirable' to investors, developers, flippers and yuppies from hell. Now our humble dwelling is worth on paper 400,000$ something. Sounds great but wait. If we sell it and pay off our now mortgage of 150,000$ We now don't have the income or credit to qualify to buy another house inside metro Portland. Do we want to sell the house and move to rural Oregon and buy another house we could pay cash for yet not have enough to make it habitable and still afford a workspace to boot?

We could. We work from home and only need a wifi connection to stay in business. But this is our home, our community and our workspace office. We made it our home. I know this is a white privileged whiny complaint but not really. What good does it do to have an inflated home value if you can't afford to change your seat. Our mortgage, insurance and property taxes combined are cheaper these days then rent on a studio apt.would be. These rentals are new slapped up 4-8 story buildings that are slum of the future. The investors in this real estate development boom are proudly displayed in signage in front of the bulldozed new building sites that used to be mixed income beautiful old houses or apartments The signage features out of state corporations, suburban developers and investors from places like Shanghai.

How crazy is this? Who can afford this insanity as far as housing goes? Where do the hipster yuppies get enough money in this economy to rent 2,500$ one bedroom, prison cell like apts. Why do they want to live like this? I don't know but my story is not unique and while we are lucky as we still have income (much reduced) and a roof over our head (which half of blew off last winter and is now tarped until we can raise 16,000$) I can't understand how ordinary people who live and work in this economy are able to pay the vig. Don't even get me started on the cost of decent food.

I'm not going anywhere. I just hope that this insane economy crashes and burns. Sounds nasty I know but perhaps a good leveling of the playing field would take out the investor class and give ordinary people a chance to be able to afford to live. Every week I get letters from investor's, developers (a lot of them from corps in Phoenix AR ) telling me that a nice couple wants to buy my house because they love my desirable neighborhood. They offer cash, no closing costs and no credit hassles. They want to bulldoze my 'tired old house' and build tall house Mac Mansions. Infill and density are so environmental. Yeah right.

Gawd how I hate remakes and reruns.

"Our society is run by insane people for insane objectives. I think we're being run by maniacs for maniacal ends and I think I'm liable to be put away as insane for expressing that. That's what's insane about it."

-- John Lennon