China is "financially out of control"

Submitted by gjohnsit on Fri, 09/11/2015 - 2:58pm

Willem Buiter, Citigroup chief economist, is concerned. He sees a 55% chance of a global recession in the near future because of China.

The cause of his consternation is the immense debt that Chinese non-financial companies have racked up in a short period of time. Over the past decade, the indebtedness of China's private sector has exploded and exceeded that of the U.S., which Buiter pointed out has a much more advanced economy and sophisticated financial system:

"I think things are financially out of control in China and we are waiting for the regulators and supervisors to bring things back under control and to do for the financial system the kind of things - recapitalizing banks and other systemically important financial institutions - that would give you the underpinning for continued growth," he said.

China's problems are being manifested is several ways.

The most obvious way is the immense amount of money that China is spending trying to keep their stock market bubble inflated and protecting their currency.

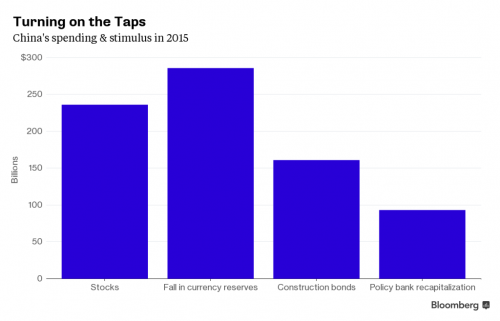

The economists at Bloomberg tallied the spending to help the economy; the total so far is roughly $800 billion. The sheer levels are not just astounding but a reminder that China is not on a path toward economic liberalization, no matter the comments from its leaders.

That's $800 billion just since this summer. That money has to come from somewhere, and that somewhere is in China enormous currency reserves, which dropped by nearly $100 Billion in August.. The lion's share of that selling was U.S. Treasuries.

Comments

China's Mind-Boggling Consumption Of The World's Raw materials

Here is most of the article

this is a huge issue for the global economy

Visualizing China's Mind-Boggling Consumption Of The World's Raw Materials

Citicorp dip-squid is bugged because it isn't banksters

...

Like banksters and Wallstreeters do such a good job.

That, in its essence, is fascism--ownership of government by an individual, by a group, or by any other controlling private power. -- Franklin D. Roosevelt --