Another banking crisis approaches

The FDIC released it's first quarter report last week, and it had some interesting reveals.

Unrealized losses on available-for-sale and held-to-maturity securities increased by $39 billion to $517 billion in the first quarter. Higher unrealized losses on residential mortgage-backed securities, resulting from higher mortgage rates in the first quarter, drove the overall increase. This is the ninth straight quarter of unusually high unrealized losses since the Federal Reserve began to raise interest rates in first quarter 2022.

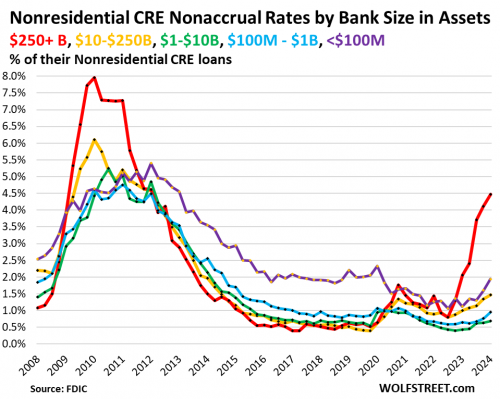

The $2.7 Trillion commercial real estate market is largely held by small, regional banks. The number of "problem banks" increased from 52 in fourth quarter 2023 to 63 in first quarter 2024.

So far the size of the CRE problem is still somewhat small, but then so was SLV last year. As we learned from the 2008 crash, banks are linked in ways that are not obvious beforehand.

This is exactly what happened to Silicon Valley Bank. The bank needed cash and the plan was to sell the longer-term, lower-interest-rate bonds and reinvest the money into shorter-duration bonds with a higher yield. Instead, the sale dented the bank’s balance sheet with a $1.8 billion loss driving worried depositors to pull funds out of the bank.The Fed papered over the problem with a bank bailout program (the Bank Term Funding Program or BTFP) that allowed troubled banks to borrow money against their devalued bonds at face value. It allowed banks to quickly raise capital against their bond portfolios without realizing big losses in an outright sale. It gave banks a way out, or at least the opportunity to kick the can down the road for a year.

Comments

I smell...

the waft of a bail out in the air.

What does it say, about myself and the current society...

...that I find these economic reports refreshing, even when I don't entirely grasp them?

I mean, I'm on record as convinced economics is pseudoscience, I ought to be suspicious of even the most credible forecasts.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

Economics is a science

However, economists get things wrong more often than the local weathermen.

So how can it still be a science? Because it is totally corrupted. It functions on several assumptions that are merely a defense of the status quo.

I'm sorry, I don't get what you're saying.

Are you being sarcastic?

Are you saying "none of this is REAL economics"?

Personally, I think it's enough that economics is a "social science", an umbrella which is pseudoscience through and through because it studies things that aren't objectively real (i.e. "society"), and to the extent it does study real things, it studies things that have free will, and free will is KRYPTONITE to science.

The only exception I'd make is psychology, which in practice is largely about Riverdancing on the edge of wherever it is that free will ends (and many of its demerits could be attributed to overeager proclamations that turned out to have been made on the wrong side of that divide).

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

An anti-empirical science is, I think, a whole new concept. n/t

That, in its essence, is fascism--ownership of government by an individual, by a group, or by any other controlling private power. -- Franklin D. Roosevelt --