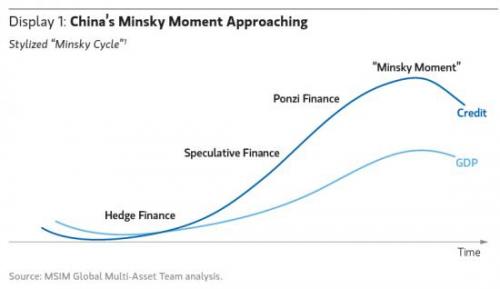

News Dump Tuesday: China's Minsky Moment Edition (updated)

Financial markets are starting to worry

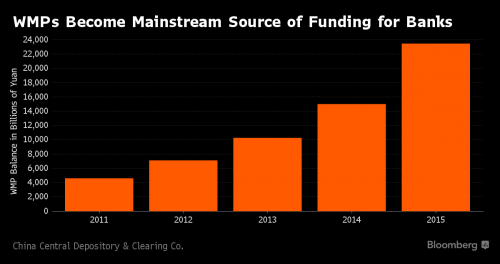

The risk of a default chain reaction is looming over the $3.6 trillion market for wealth management products in China.

WMPs, which traditionally funneled money from Chinese individuals into assets from corporate bonds to stocks and derivatives, are now increasingly investing in each other. Such holdings may have swelled to as much as 2.6 trillion yuan ($396 billion) last year, based on estimates from Autonomous Research this month.

The trend has China watchers worried. For starters, it means that bad investments by one WMP could infect others, causing a loss of confidence in products that play an important role in bank funding. It also suggests WMPs are struggling to find enough good assets to meet their return targets. In the event of widespread losses, cross-ownership will create more uncertainty over who’s vulnerable -- a key source of panic in 2008 when soured U.S. mortgage securities triggered a global financial crisis.

“There’s abundant liquidity in the financial system, but a scarcity of high-yielding assets to invest in,” said Harrison Hu, the chief Greater China economist at Royal Bank of Scotland Plc in Singapore. “All the risks are accumulating in an overcrowded financial system.”

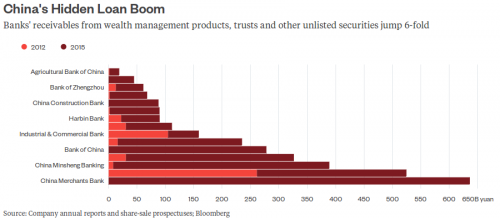

Exploding non-traditional credit

As many as 15 publicly traded Chinese lenders, large and small, report roughly $500 billion of such debt between them, which they hold not as loans but as receivables from shadow banking products. While the traditional credit business of these banks is 16 times bigger, receivables have jumped sixfold in three years. Explosive growth of this type usually ends badly. It's hard to see why it'll be different for the People's Republic.

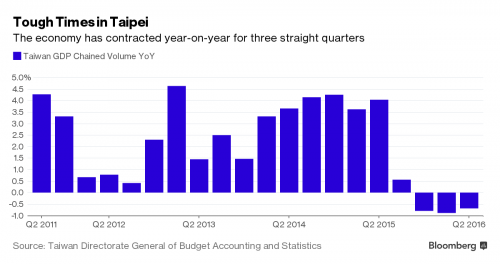

Those nearest to China are among the hardest hit as growth in the world's second-largest economy grinds to the slowest pace in a quarter century.

Hong Kong, Macau, and Taiwan all saw their economies shrink in the first quarter, while Mongolia's commodities-fueled boom has faltered. And the bad news doesn't stop there.

"The ripples are likely to spread further out," said Frederic Neumann, co-head of Asian economic research at HSBC Holdings Plc in Hong Kong. "As China's economy continues to cool, it will provide an ongoing drag on global output, curtailing inflation pressures in the process and anchoring interest rates in the process. The economic malaise currently experienced by China's immediate neighbors, therefore, is only a portend of a milder version to afflict economies elsewhere as China comes off the boil."

Brazil's Transparency Minister Fabiano Silveira resigned on Monday after leaked recordings suggested he tried to derail a sprawling corruption probe, the latest cabinet casualty impacting interim President Michel Temer's administration.

Silveira, the man Temer tasked with fighting corruption since he took office on May 12, announced his plans to step down in a letter, according to the presidential palace's media office. No replacement for Silveira has yet been named.

Silveira and Senate President Renan Calheiros became the latest officials ensnared by leaked recordings secretly made by a former oil industry executive as part of a plea bargain. The same tapes led to the resignation last week of Romero Jucá, whom Temer had named as planning minister.

But how effective are those “decapitations” in the long run? The verdict is far from clear and, to an extent, depends on the size and cohesion of the targeted group.

Both the 2011 raid on Osama bin Laden’s compound in Pakistan and the targeting of Mullah Mansour on a Pakistani road were major successes for U.S. intelligence and the Pentagon.

Al Qaeda’s central command, a relatively tight international terror network now led by Ayman al-Zawahiri, has been in decline since bin Laden’s death. It has been unable to fully recover from the blow or to mount major attacks against the West.

But the experience is less encouraging for wide-scale insurgencies such as the Afghan Taliban. While such decapitations can provide a short-term gain, they rarely change the course of the conflict—and frequently backfire if not accompanied by a much broader, resource-intensive involvement of a kind the White House has been loath to pursue.

During her first year, she faced tuition and expenses that ran nearly $50,000, even after a scholarship. So she decided to check out a dating website that connected women looking for financial help with men willing to provide it, in exchange for companionship and sex — a "sugar daddy" relationship as they are known.

Now, almost three years and several sugar daddies later, Kashani is set to graduate from Villanova University free and clear, while some of her peers are burdened with six-digit debts.

The publication follows a high-profile leak by Greenpeace earlier this month of a trove of chapters of the proposed Transatlantic Trade and Investment Partnership (TTIP) between the United States and Europe. Given that congressional approval of the Trans-Pacific Partnership (TPP) is on the rocks, as the EU-Canada Comprehensive Economic and Trade Agreement (CETA) is in those countries, and given that public opposition to the TTIP is on the rise, negotiators had hoped that the TISA could slide by under the public radar. This leak makes that possibility even more remote.The New Provisions annex would restrict the job-stimulating localization requirements that governments can place on foreign services providers. These proposals, which are more extreme than existing free trade/investment agreements, would make it harder for all TISA countries to effectively regulate these companies — including potentially in the finance sector. And they would restrict developing countries’ ability to regulate foreign investment to promote development the way the industrialized TISA countries did when they were developing, according to an extensive analysis by Sanya Reid Smith, legal adviser to the Third World Network in Geneva.

The U.S. Treasury Department and the Office of the U.S. Trade Representative yesterday revealed a plan to go beyond the TPP in terms of localization requirements on financial services in the proposed TISA, to appease major banking industry corporations and the members of Congress who represent them.

This HuffPo article was taken down

James Comey and The FBI will present a recommendation to Loretta Lynch, Attorney General of the Department of Justice, that includes a cogent argument that the Clinton Foundation is an ongoing criminal enterprise engaged in money laundering and soliciting bribes in exchange for political, policy and legislative favors to individuals, corporations and even governments both foreign and domestic.

...

Here’s what we do know. Tens of millions of dollars donated to the Clinton Foundation was funneled to the organization through a Canadian shell company which has made tracing the donors nearly impossible. Less than 10% of donations to the Foundation has actually been released to charitable organizations and $2M that has been traced back to long time Bill Clinton friend Julie McMahon (aka The Energizer). When the official investigation into Hillary’s email server began, she instructed her IT professional to delete over 30,000 emails and cloud backups of her emails older than 30 days at both Platte River Networks and Datto, Inc. The FBI has subsequently recovered the majority, if not all, of Hillary’s deleted emails and are putting together a strong case against her for attempting to cover up her illegal and illicit activities.

Brexit about to become reality?

Public opinion has shifted towards the UK leaving the EU, two Guardian/ICM polls suggest as the referendum campaign picks up pace – with voters split 52% -48% in favour of Brexit, whether surveyed online or by phone.

Previous polls have tended to show voters surveyed online to be more in favour of Britain leaving the EU. But in the latest ICM research, carried out for the Guardian, both methodologies yielded the same result – a majority in favour of leaving.

Comments

The only question that remains is...

...will the crash of 2016 happen before or after the election. Given the fact that the Fed seems hellbent on raising interest rates in the face in a world where inflation is either near zero or negative, my guess is before...

I want my two dollars!

The Fed raising rates

by the small amount being suggested would be like a mosquito bite to a person with advanced pancreatic cancer. Don't get me wrong, the pain to the 99% would be real especially those struggling to get by day to day. We are the grass that always gets trampled when the elephants go on a rampage.

I think the Fed is wiggling hard to avoid being forced to follow much of the developed world in adopting a negative interest rate program. They've moved off of zero and hope they are able to continue increasing rates without shocking the system into recession. It looks like a last ditch effort to move towards "normal". I don't know if it will work. I think it's doubtful at best. The past eight years have been an exercise in avoiding pain in the financial industry without actually doing anything that fixes a broken, incredibly corrupt though highly profitable if you're on the inside, system. The Fed doesn't have the tools to fix the system. They can only prop it up and hope for divine intervention. Congress could provide the tools to the government to fix it but won't. The administration doesn't want the tools either. They'd have to use them at their own peril. All three know that actual remedies would cut off the flow of money to their benefactors and themselves from a corrupt system.

My mildly informed opinion is that they will continue to apply Bandaids and take a little pain medicine from time to time to seem to be improving the health of our economy. Nothing of importance will be done until the financial system really crashes. Hard. The Fed is unlikely to precipitate it but China sure looks like they could set off the bomb our financial masters have been feverishly building under all of us. The scary thought that comes to me is whether this is a bug or a feature. Truly huge fortunes and immense power could arise from a world of wrecked economies if you have the resources to take advantage of the chaos. What better way to get rid of that pesky thing called democracy. Am I being paranoid?

"Ah, but I was so much older then, I'm younger than that now..."

Heh.

Guards, take this person away. S/he knows too much.

There are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns – the ones we don't know we don't know.

The Fed is going alone.

Congress should be doling out stimulus money. Buyback of student loans, Social Security increases, even if temporary, the treasury buying state bonds to avoid default. Instead Congress keeps fussing about the debt (a meaningless number to a fiat currency) and cutting spending, which is driving the economy down.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

IT appears that Britain's fishing fleet is solidly pro

Brexit, and lobbying hard for it.

That, in its essence, is fascism--ownership of government by an individual, by a group, or by any other controlling private power. -- Franklin D. Roosevelt --

Huh. Well, I tend to agree

Huh. Well, I tend to agree with you that Clinton will never be indicted under Obama, if the FBI makes a case for indictment and that gets leaked she's in a world of hurt.

Holder on Snowden

a public service

Brazil has problems

Big time. I have a friend there and the stories he tells me and

whatnot make it sound like things are getting pretty crazy down there, but still in a civil way for the most part.

We chat on Skype all the time so he can work on his conversational English and we frequently end up talking politics, long story short he makes it sound like they are literally on the brink of overthrowing the whole government.

There is the caveat though that he is my sole source of info on what's going on down there, but he went from encouraging me to come visit to suggesting I wait a bit till things quite down.

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

Your cell phone is a personal tracking device

link

Something changed with Iraq

First the Saudis

Then the Russians