Debt Default Tuesday: It's not just a Greek Tragedy

All eyes are on Greece this weekend.

When Greek prime minister, Alexis Tsipras, announced that he was calling for a popular referendum on July 5 to decide the austerity measures, the "door closed" on the negotiations. The European Central Bank responded by announcing it would cut off liquidity to Greek banks, and now Greece has no choice but to resort to capital controls.

A debt default by Greece on Tuesday is virtually assured.

However, Greece better take a number because they aren't the first in line for default. Ukraine is ahead of them.

Ukraine could suspend its debt payments almost immediately if an important meeting with creditors on Tuesday ends in stalemate, the country's chief debt envoy Vitaly Lisovenko said.

Ravaged by conflict and on International Monetary Fund life support, Ukraine is asking its foreign bondholders to accept a 40 percent writedown or "haircut" on the $23 billion of debt they own, but so far they have not agreed...

But Lisovenko, who will be leading the negotiations for Ukraine at Tuesday's meeting, said those risks mattered little considering the country's precarious situation.

Asked whether creditors could move to seize the country's assets, he replied: "There are no assets, unfortunately."

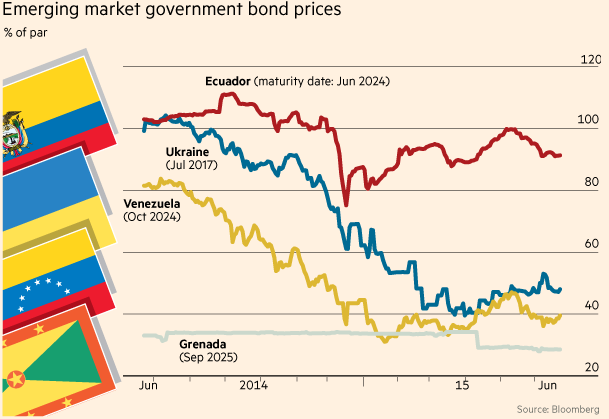

Whether Ukraine and its creditors can reach an agreement or not, a "credit event" has already been declared, which triggers the credit default swaps. Ukraine debt is trading below 50 cents on the dollar, which is the implied default level.

Much like Greece's predicament, Ukraine's debt situation is bad now, but gets much worse in the near future. Which is why both of them are playing hard-ball in their negotiations now, instead of waiting until things deteriorate further.

So Ukraine is first in line on the default train, with Greece right behind them. Unnoticed by almost everyone is who comes in third - Puerto Rico.

As legislators struggle to pass a budget in San Juan, the power utility is set to talk with creditors in New York Thursday about restructuring $9 billion of debt. It faces a July 1 bond payment and has insufficient reserves. Meanwhile, lawmakers are considering a bill that would allow the government to suspend monthly cash deposits for repayment of general-obligation debt.

“The fiscal and economic situation in Puerto Rico has reached a tipping point,” Cesar R. Miranda Rodriguez, the commonwealth’s attorney general, said in prepared testimony to a U.S. House committee Wednesday in Washington. “The situation is truly dire.”

Gov. Alejandro Padilla has appealed to Congress for the ability to declare bankruptcy, but he is unlikely to get his wish.

Puerto Rico is trying to manage $73 Billion in debt, most of it held in the United States, and the Wednesday debt payment is nearly equal to every dollar it currently holds in reserve.

So Greece, Ukraine and Puerto Rico. All in just one week. Sounds like a bad week for the bond market.

And yet, that isn't the whole story.

All told, 11 countries, including Greece, are currently at serious risk of defaulting according to global credit rating agency Moody’s.

The default train wreck doesn't end there. The oil price crash is starting to show up in the corporate bond market.

Despite the improving the economy, the number of companies at risk of going bust is rising faster than at any time since the Great Recession.

According to credit rating agency Standard & Poor’s, 52 companies have defaulted on their debt in the first six months of this year. That’s more than double the number of companies that missed interest payments in the first half of 2014, and it’s close to eclipsing the 60 companies that defaulted in all of 2014. It is also the highest pace of defaults since 2009.

The shale oil boom was always built on cheap credit. That makes them vulnerable to any sort of shock to the credit system, which could dry up liquidity.

Considering what is likely to happen this week, the frackers should be terrified.

Continental Resources Inc.(NYSE:CLR), the company credited with making North Dakota’s Bakken Shale spent almost as much as Exxon Mobil Corp.(NYSE:XOM), a company 20X its size.The burden is becoming heavier after Crude Oil prices fell 43% in the past year.

Interest payments are eating up more than 10% of revenue for 27 of the 62 drillers in the North America Independent Exploration and Production Index. Drillers’ debt ballooned to $235-B at the end of Q-1, a 16% increase in the past year as revenue shrank.

S&P downgraded the credit ratings for nearly half of the frackers this year. Why? Because their business model resembles a social media company in the way that it burns through cash faster that it can raise it.

Energy companies accounted for a third of the corporate defaults this year.

The problem for shale drillers is that they have spent money faster than they have made it, even when Crude Oil was 100 bbl. The companies in the index spent $4.15 for each Dollar earned selling Oil and Gas in Q-1, up from $2.25 a year earlier, at the same time driving production to the highest marks in more than 30 yrs.

Almost $20-B in bonds issued by the 62 companies are trading at distressed levels, with yields more than 10 percentage points above US Treasuries, as investors demand much higher rates to compensate for the risk that obligations will not be repaid.

There are also other dangers in the global financial market that could also effect the situation. For instance, China's epic stock market bubble is finally bursting.

Plus, there is also growing evidence that the 35-year bull market in bonds is ending. Since almost no one is still working on Wall Street that remembers a bond bear market, it is likely that most will not know how to trade it.

Comments

I have to admit I can't even understand

the basics of many comments.

What did you think about the diary today by kmoorh. I liked the diary a lot, but get always confused when people start commenting and can't figure out where they stand. I see some hype on both sides, but then that's "verboten".

https://www.euronews.com/live

For the first time, ever

…since I've been trading Forex, my broker won't allow trades today (it's Monday morning in Asia). They'll allow open trades to close. But that's it.

It's the Twilight Zone.

That's interesting

A partial shutdown of Forex trading is a big deal.

On my DKos diary, Draxinum assured me that none of this is a big deal and I was "full of shit" for bringing it up.

What's their game plan? Or goal

I never understood why we had to bailout the banks in the first place. They were the ones that committed the crimes and over extended themselves, so besides the fact that they own our government, why was it necessary for us to bail out the banks? Especially the foreign banks. Why did our taxes have to bailout them?

Country by country is either being destroyed by our military and nato, or destroyed by the imf and other banks.

So, what's the goal?

The message echoes from Gaza back to the US. “Starving people is fine.”