America's Lost Decade: Working class between the hammer and anvil

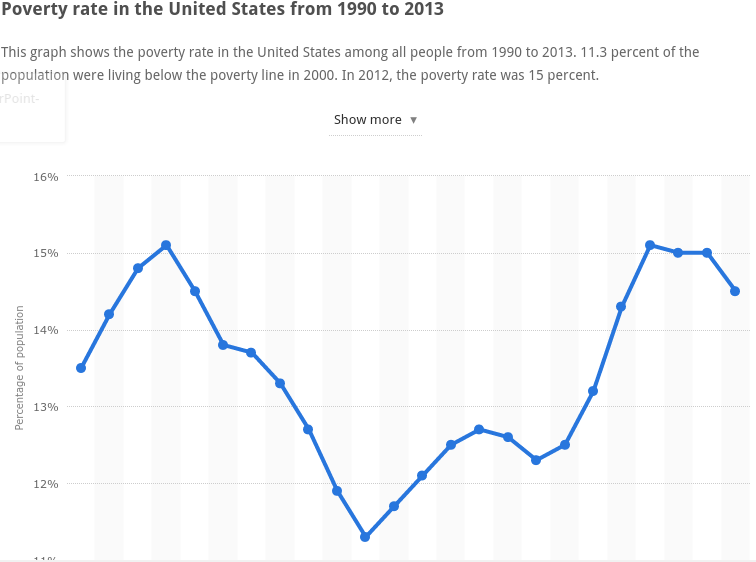

All the politicians and economists will tell you that the economy has recovered. While things aren't as bad as they were in 2008-2010, it certainly doesn't feel like we've ever gotten over the crash.

To better explore the situation, I'm going to approach this from the opposite direction that most economists do. They generally look at the economy from a top-down point of view based on ownership of capital.

I'm going to approach this from the condition of the working class and how they interact with the economy.

This essay is going to be very chart heavy.

The American working class family is barely keeping its head above water these days. Just one tiny wave and they will go under.

The most frightening finding in the Federal Reserve’s Report on the Economic Well-Being of U.S. Households in 2014 concerns a matter of $400. Four-hundred bucks. Twenty twenties. Four Benjamins.Or just enough to crush half of all American households.

“Forty-seven percent of respondents say they either could not cover an emergency expense costing $400, or would cover it by selling something or borrowing money,” reads this year’s annual report.

And those without any savings generally don't have good credit. So when the car needs to be repaired, or the kid gets sick, they turn to the predators.

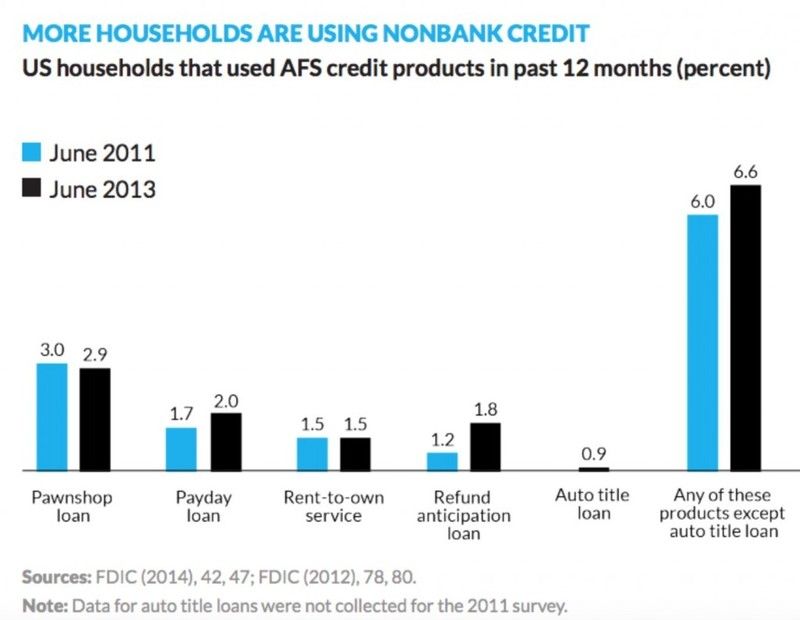

According to the Urban Institute report, the number of households that used alternative credit products increased 7 percent between 2011 and 2013. And the kind of household seeking alternative financing is changing, too.

According to Mills’s research, the share of households seeking non-bank credit with incomes above $30,000 increased from 42 to 48 percent between 2011 and 2013. And the share making more than $75,000 increased from 7 to 11 percent over the same span.

“People who are in these [non-bank] situations are not using these forms of credit to simply overcome an emergency, but are using them for basic living experiences,” Mills says.

That's a scary statement, because these sorts of loans have usury interest rates. They are supposed to bleed you dry.

It isn't just the very poor who are using them. It is the middle class too.

Why is that? For starters, we need to look at the job market and how that has changed.

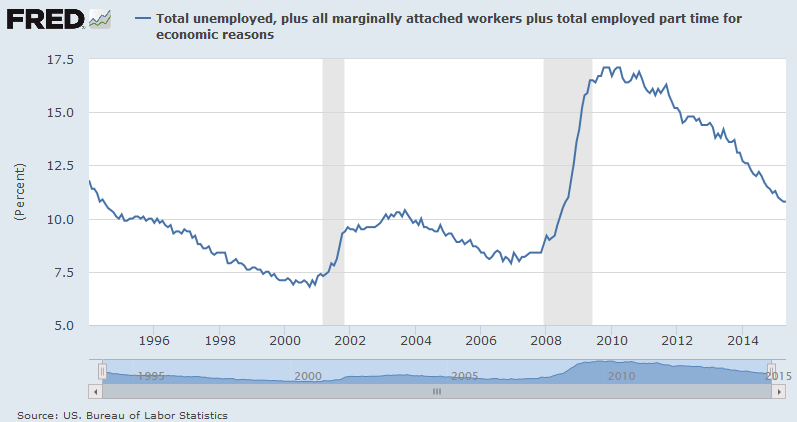

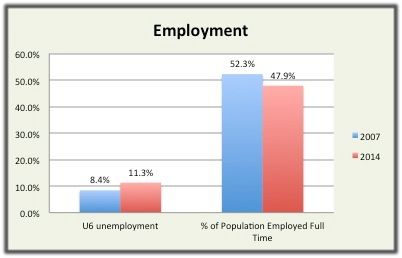

While the overall labor market has improved a great deal from the dark days of 2010, the broadest measure of unemployment remains still above the worst days of the post-2001 recession.

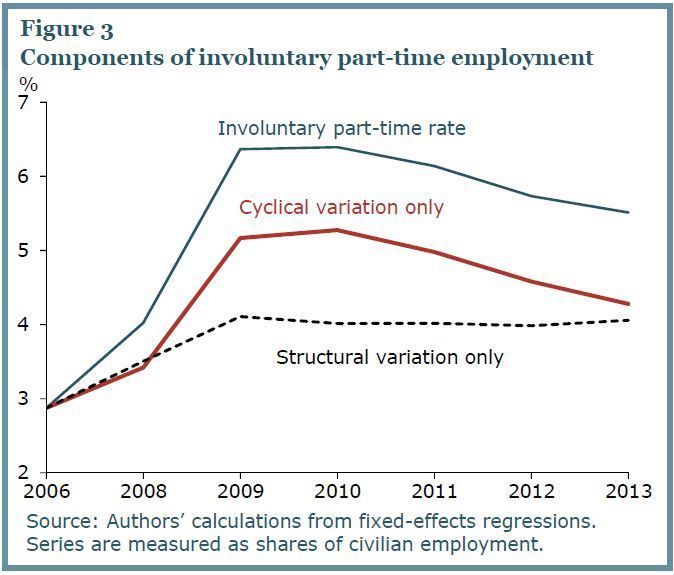

The reason for that is because many of the jobs being created are part-time positions, and economists are starting to wonder if that will ever change.

Fed policy makers see the still-elevated share of involuntary part-time work as evidence that labor-market slack persists. If the structure of the economy has changed so that a portion of those workers are just stuck, though, it means there's less room for improvement and more of a new job-market reality.

If you had a good paying job in 2007 with benefits and now you work two part-time jobs with no benefits, the headline unemployment number U-3 won't show a change, but the U-6 number will.

The labor market isn't the only reason that the working class is struggling.

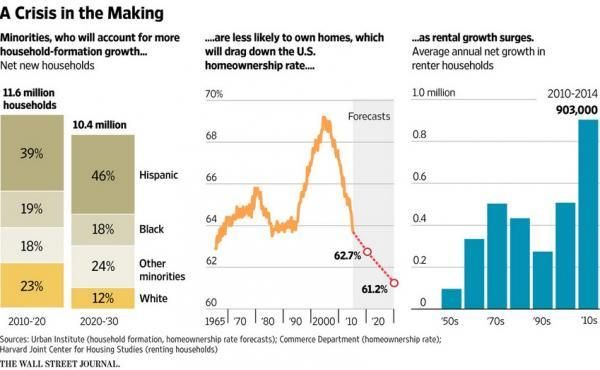

Another reason is the housing market.

The Housing market is often portrayed in the financial media from the capitalist point of view (higher prices are good), not from a working class point of view (low prices are good for consumers).

An unprecedented concentration of homeownership mean the benefits of rising prices are increasingly in the hands of wealthier people.

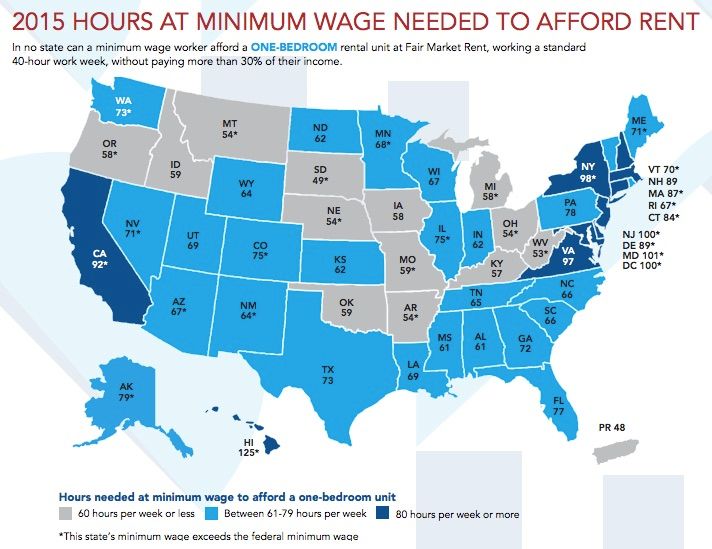

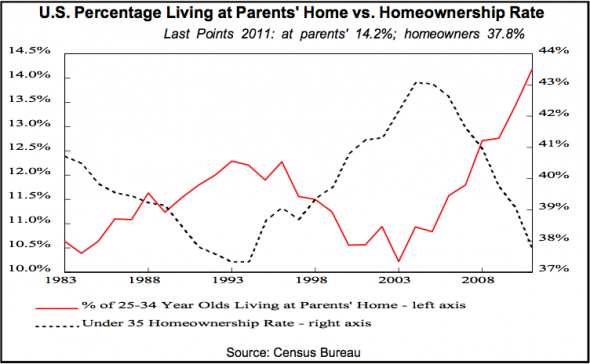

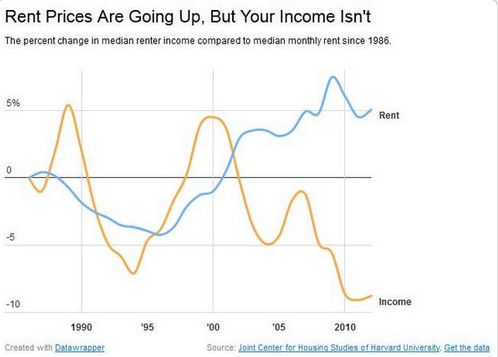

Getting priced out of homes means the working class will be renting, and that's becoming an even bigger burden. Housing is generally the largest expense of the working family.

This is falling especially hard on the younger generation, who are unable to move out due to expensive rents and low wages.

The working class is being crushed between the hammer and the anvil of rising mortgages/rent and falling wages.

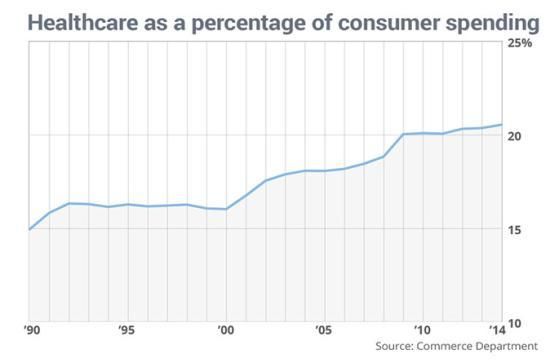

There is also the issue of expenses on health care spending that is outpacing the economy, but that's an issue for another day.

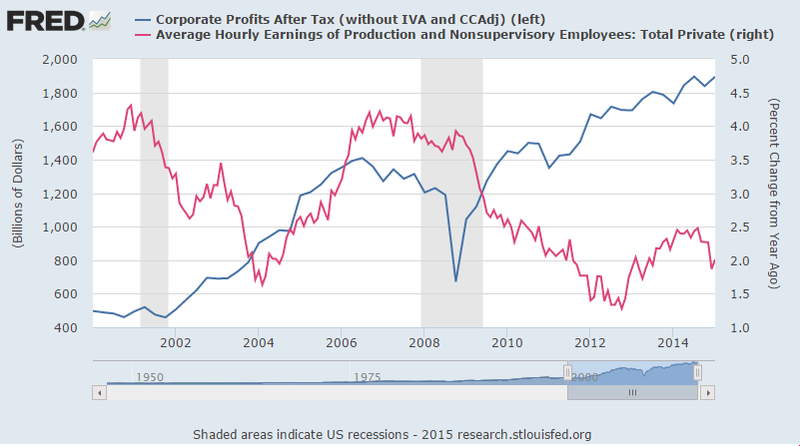

Going back to wages, its not like worker productivity or falling corporate profits are the cause of wages falling.

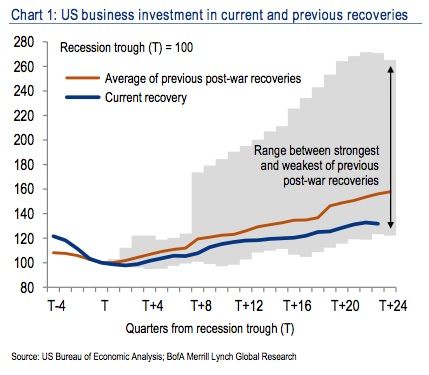

So if companies are making bigger profits but not giving any of the money to their workers, where are they spending that money? Investing in the company? Nope.

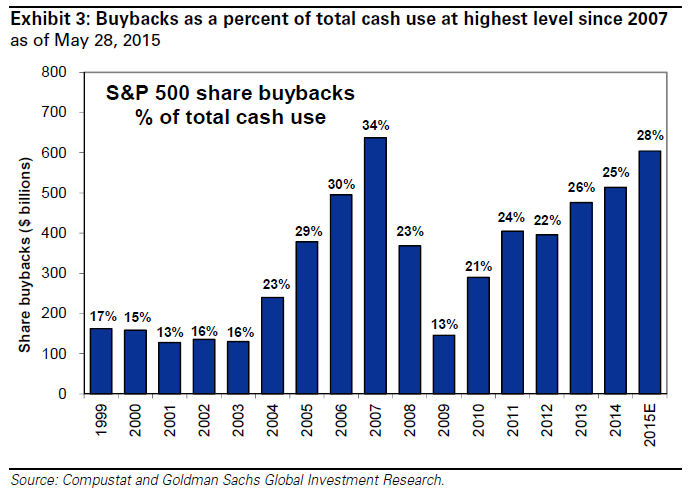

Are companies using those profits to buyback shares so they can drive up stock profits for bigger executive bonuses? Yep.

And that is the biggest reason why the economy is so sluggish.

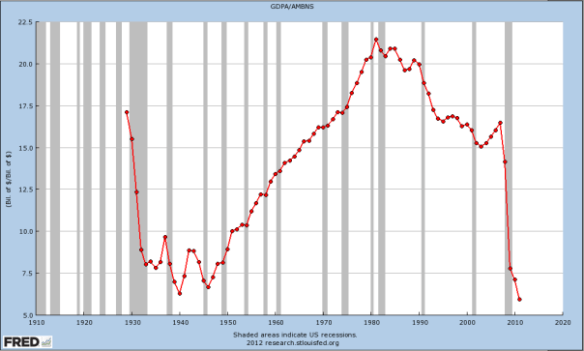

With the working class lacking disposable income, the velocity of money has slowed down to a level even below the level of the depths of the Great Depression.

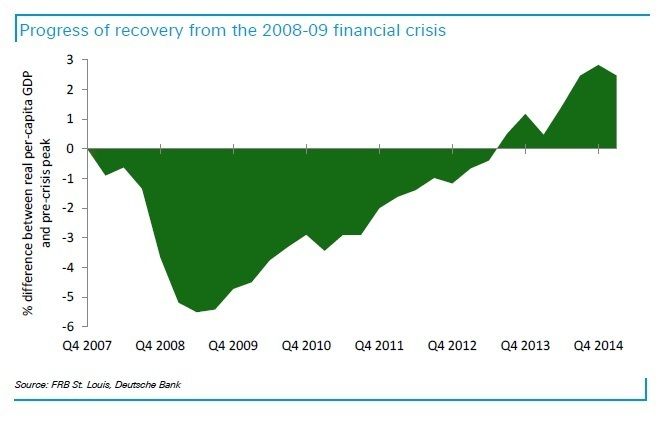

Deutsche Bank also took a crack at explaining why the economy is so sluggish, but looked at it from an entirely different perspective.

By our definition, the US economy has taken on average 10.8 years to recover from past systemic banking crises. Moreover, the present recovery is not yet complete and will not be complete in the near future. As shown in the next chart, real output per capita returned to its Q4 2007 pre-crisis peak 23 quarters later, in Q3 2013. In the 8 subsequent quarters, only 19% of the lost output has been recovered. If real GDP per capita continues to grow at its post-crisis rate of 1.4%, the output lost due to the crisis will only be fully recovered in Q4 2017, exactly ten years after the recession began. This projection is not very sensitive to plausible alternative growth scenarios – it appears that the financial crisis has resulted in a “lost decade”.

Comments

It always burns me to hear

the economy framed in terms of gross domestic product, Dow Jones averages, and corporate profits. None of these factors are helping the average family survive. I think the most telling factors are how the American people are faring. It has been barely surviving mode for too many families and I see no signs of that improving, particularly in light of the TPP and other similar trade agreements that have already bled the middle class dry. The only way I can see a real recovery for working people is for a massive government jobs program and no one in Congress seems willing to touch that.

Excellent diary! This one is so valuable with all of the charts and graphs you have included.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

The truly scary thing

is that the economic expansion is already the 6th longest in history.

The stock bull market is already the 3rd longest in history.

And the bond bull market is the longest in American history.

Thus just going by historical averages, all will soon end in a horrible crunch. And without the working class ever making it back to "normal".

Things are bad, and they could get a lot worse.

I really don't want to say this, but my statement is based on historical averages and likelihood.

When your up to your ass in alligators,

it is had to remember the goal is to drain the swamp. Poor people make bad decisions because they don't have any good options to choose from.

I hope people are really fed up and ready for Bernie's revolution.

"Religion is what keeps the poor from murdering the rich."--Napoleon

I love this, dk

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

Good diary. It's pretty easy to see if people look

particularly when you add the graphs of the rich and see how fast their "arrows" are going up. It's pretty simple,

the more that goes to the top, the less that can make it to the bottom.

Capitalism as currently practiced has got to go.

looks like the rentier class is doing a great job of driving...

increasingly large segments of the middle class into economic situations where they are rendered unto the usurers for harvesting.

great diary

aside from the last four charts I didn't need the others. I have felt all of it in my personal life.

https://www.euronews.com/live

Seconded! Excellent diary--thanks! N/T

Mollie

"Every time I lose a dog, he takes a piece of my heart. Every new dog gifts me with a piece of his. Someday, my heart will be total dog, and maybe then I will be just as generous, loving, and forgiving."--Author Unknown

Visit Us At Caucus99Percent.Com

Everyone thinks they have the best dog, and none of them are wrong.