News Dump Wednesday: More Recessionary Headwinds

Submitted by gjohnsit on Wed, 04/13/2016 - 11:01am

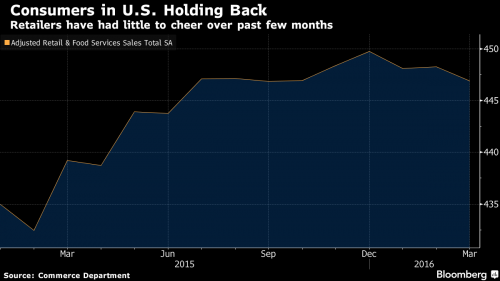

Sales at U.S. retailers unexpectedly fell in March, raising concern consumer spending is losing momentum.

The 0.3 percent drop in purchases followed little change the prior month, Commerce Department figures showed Wednesday in Washington. The median forecast of 81 economists surveyed by Bloomberg called for a 0.1 percent gain.

Sustained gains in consumer spending, the biggest part of the economy, are needed at a time exports are still depressed by cooling global markets and U.S. manufacturing is barely emerging from a slump.

U.S. coal giant Peabody Energy Corp. filed for bankruptcy on Wednesday, the most powerful convulsion yet in an industry that’s enduring the worst slump in decades.

The company filed Chapter 11 petitions for most of its U.S. entities in federal court in St. Louis, listing $10.1 billion in debt.

IMF warns about global economy

Global policy makers need to guard against a self-reinforcing “spiral” of weakening growth and rising debt that could require a coordinated response by the world’s major economies, according to the IMF’s top fiscal watchdog.

Most countries are on a higher debt path than they were a year ago, the International Monetary Fund said in its semi-annual Fiscal Monitor report released Wednesday. Fiscal deficits in 2015-2016 in emerging economies are projected to exceed levels during the global financial crisis, as countries struggle with low oil prices, cooling investor sentiment and intensifying geopolitical tensions...

Advanced economies, meantime, are facing the “triple threat” of low growth, low inflation, and high public debt, the fund said.

big banks living wills are rejected

JPMorgan Chase & Co., Bank of America Corp. and three other major U.S. banks failed to persuade regulators they could go bankrupt without disrupting the broader financial system and could now face a tighter leash from Washington after government agencies used one of the most significant post-crisis powers bestowed under the Dodd-Frank Act.

The banks -- also including Wells Fargo & Co., Bank of New York Mellon Corp. and State Street Corp. -- must scrap their resolution plans, or living wills, after the Federal Reserve and the Federal Deposit Insurance Corp. said versions submitted last year failed to satisfy their requirements. The lenders will have until Oct. 1 to rewrite the plans -- but under the pressure that another failure would give regulators power to subject them to more capital, liquidity or constraints on their businesses.

Obamacare not working as advertised

Well, the hammer has fallen: The largest health insurer in the U.S. has started pulling out of select Obamacare exchanges.

Five months ago UnitedHealth, which had been singing sunny songs to investors about its bright future on the exchanges, abruptly began crooning the blues. In an earnings call barely a month after executives assured investors that all was going swimmingly, they confessed that they were losing a ton of money on their Obamacare policies and described a pattern that sounded as if consumers were gaming the system -- signing up for a few months, using a ton of services, and then canceling their policies. If this continued, they said, they would have no choice but to pull out of the exchange business....

For example, Alaska’s exchange seems to be tumbling towards collapse, with essentially one and a half insurers. (Moda Health, the second insurer, has had financial troubles that leave its future uncertain.) Rates rose almost 40 percent last year, putting the benchmark silver plan at around $720 a month for a 40-year-old nonsmoker in Anchorage. Wyoming is down to a single insurer, and the uninsured rate has actually increased since 2013, presumably in part because the state has some of the highest premiums in the country. So does Vermont, which is now down to two insurers. Mapping a one-size-fits-all national policy onto low-population rural states seems to be a recipe for some problems.

CIA plasns to flood Syria with weapons

According to officials familiar with the situation, the CIA has been drawing up a “plan B” for the collapse of the peace talks, which will see a massive new influx of US weapons to “moderate” rebel factions, in another attempt to shift the war in favor of those groups.

If that sounds familiar, it’s because the CIA already had programs for arming “vetted” rebel factions earlier in the civil war, programs which ended with those groups no more powerful, and large amounts of US weapons winding up in the hands of ISIS and al-Qaeda’s Nusra Front.

“Plan B,” then, is really just America’s long-standing plan A, which has already failed, rebranded with a different letter, because nominally the US has to pretend it believes in the peace process it’s so eagerly planning for the collapse of.

The same plan, only moreso, as officials say the CIA is also planning to send even more powerful anti-aircraft weapons to the rebel factions, with an eye toward shooting down Syrian warplanes.

And Russian ones.

Comments

Shaun King: "I disagree with virtually every single word..."

[There's much, much more here and well worth reading]

Just a local anecdote............

My son has a retail business, his sales have been down, his regular customers just don't have a lot of money to spend. We usually get a lull after Christmas while people recoup from the orgy of holiday spending, then things pick up as people start getting tax returns, etc. Not happening, yet.

Housing in our area is extremely high, if available at all and has been getting worse, it is cutting deeper and deeper into the pockets of those who can least afford it.

We are subject to the vicisitudes of the oil patch and that sector of business has collapsed, most of those customers are either broke or have moved on.

Although employment figures for our area and the state are optimistic, jobs aren't paying that much, certainly not enough to keep up with the cost of housing.

I imagine the same scenario across the country and the globe, unless the public has money to spend, we will continue this spiral. Instead of pumping more money into big banks that are not lending we should be putting it into local banks that do lend, we need a national minimum wage hike that includes all the "hospitality industry" people who are trapped at $2+ dollars an hour in wages, most of all, we need to address our infrastructure problems and put people back to work doing the work that Congress has refused to address for years.

I agree with you that we need to pay more. But I also think

we need a guaranteed national income rather than worry too much about creating jobs. Imagine life's necessities covered, so that no one had to "prove disability" or document their job-seeking efforts or otherwise jump through hoops to beg for government assistance again. Then work would be for the extras, so each employee would have some power in deciding whether the wages, benefits, and treatment merited them spending their time in that job or not. Meanwhile, regardless of whether we lose jobs to overseas production or automation, it doesn't matter, jobs aren't essential to survival. And since everyone has money, a certain amount of commerce will always be present because everyone will be able to buy products and services.

Please check out Pet Vet Help, consider joining us to help pets, and follow me @ElenaCarlena on Twitter! Thank you.

The scary part is that people on Social Security,

even if it isn't a lot, still get a check every month. That is more than most people under 65 can say. In some rural locations, social security accounts for 25% of the local business. If people UNDER 65 had a base income they could count on, that would be spent. It would stimulate the hell out of local business and create jobs-as long as it is spent with LOCAL businesses. It isn't just retail, we have a lot of local micro-breweries who are partnering with LOCAL restaurants to create a local "club" scene. This is where discretionary money makes a huge difference in the lives of the "hospitality" workers - they live on their tips and spend every cent they make. It is a sad commentary - one that needs to change.

A lot of news from Bloomberg! I don't quite trust them;

isn't Bloomberg one of the 0.1%?

From my headline news:

New York unions endorse Clinton and Sanders.

Trial for accused Charleston church shooter delayed until January.

About 40,000 unionized Verizon workers walk off the job.

Please check out Pet Vet Help, consider joining us to help pets, and follow me @ElenaCarlena on Twitter! Thank you.

All news sources you have to filter

Especially financial news.

I use Bloomberg a lot because a) their editorial page can sometimes be really good, and b) it's one of the first web sites I open every morning to keep track of the markets.

Yahoo Finance and CNBC I consider to be less reliable and more biased toward bullishness.

Financial Times is the best, but behind a pay wall.

Transit workers union endorses Bernie: true

Verizon workers strike; Bernie joins them on the picket line: true.

Diaries up on TOP.

Where my Mom and Step-Dad live,

(SW Ohio) a lot of golf courses are closing. When I was visiting, I was very proud to hear them saying what I had said to them six months ago - "Golf is a luxury. People do not have the discretionary income to play it." There was a time when the average Joe that worked at one of the local factories could afford to go play. Those days, and factories, are gone.

We are not embracing a politics of envy if we reverse a politics of greed. - Joseph Stiglitz

When we are to the point where negative interest

rates are even being seriously discussed, you can't help but think that they are merely trying to juice up their profits before the whole damned thing comes crashing down. And the real solution stares us all in the face - employment at a fair wage. But that would be a real solution that would actually work for real prosperity and we just cannot have that. I recently pulled what savings I have out of the stock market. Now it's in a money market type account and while I like to think that is a bit safer, I know damned well it is not. They want that last dime out of the strapped and unemployed "consumer" and they'll by God work hard to get it.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

Oil tanker off the coast of Singapore

Something is not right here

Are they full or empty?

If full, demand has dropped and they are floating fuel tanks. If empty, there is no demand for more supply? It certainly looks ominous, yellow haze and all.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Bernie Sanders Joins Strikers in New York

Will we see this tonight on MSNBC?

Watch: Bernie Sanders Joins Strikers in New York, Slams Verizon's Unfair Labor Practices

This is why Bernie is my guy in this election:

"We've done the impossible, and that makes us mighty."

BREAKING: NY Transport Union Feels The Bern!

Bernie Sanders Announces New York TWU Endorsement - Full Press Conference (4-13-16)

The Transport Workers Union Local 100, representing 42,000 workers in the New York region

Please help the Resilience Resource Library grow by adding your links.

First Nations News

Hear Hillary Clinton

Defend Her Role in Honduras C

Please help the Resilience Resource Library grow by adding your links.

First Nations News

"She's Baldly Lying"

Dana Frank Responds to Hillary Clinton's Defense of Her Role in Honduras Coup

Please help the Resilience Resource Library grow by adding your links.

First Nations News

Political Center is shifting left

center-left can not hold

oh gosh ty again

Guess I'm addicted.

Stop Climate Change Silence - Start the Conversation

Hot Air Website, Twitter, Facebook

Given that the crude benchmarks are once again on the rise

(apparently the result of taking Saudi and Russian pronouncements about a production freeze seriously), and should that rise continue, I would expect consumer spending to drop even further. Couple this with the worrisome trend of an expanding "gig" economy, and throw in the failure of Obamacare (as you noted) and the prospects of a collapsing financial bubble, and, well, things ain't lookin' to rosy.

"Our society is run by insane people for insane objectives. I think we're being run by maniacs for maniacal ends and I think I'm liable to be put away as insane for expressing that. That's what's insane about it."

-- John Lennon

btw, Here's an excellent short essay on the evolution of

the word "gig" and its relation to the "gig" economy.

"Our society is run by insane people for insane objectives. I think we're being run by maniacs for maniacal ends and I think I'm liable to be put away as insane for expressing that. That's what's insane about it."

-- John Lennon