What the bond market crash means

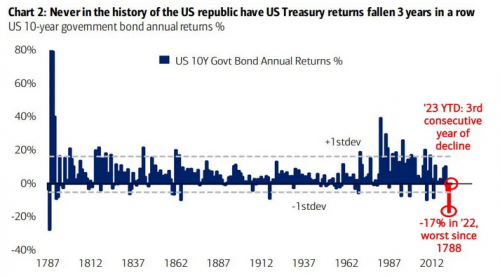

The current bond market crash (the one that no one is talking about) is the worst in American history, and one of the worst financial crashes in history.

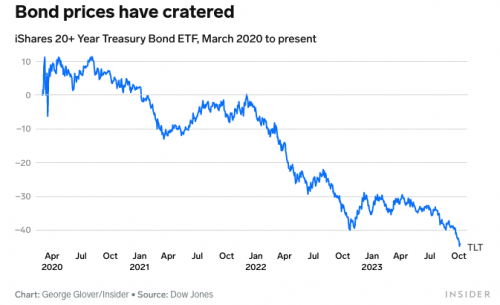

The bond-market sell-off that's sending yields soaring is starting to eclipse some of the most extreme market meltdowns of past eras.Bloomberg reported losses on Treasury bond with maturities of 10 years or more had notched 46% since March 2020, while the 30-year bond had plunged 53%.

Those losses are nearly in line with stock-market losses seen during the worst crashes of recent history — when equities slumped 49% after the dot-com bubble burst and 57% in the aftermath of 2008.

10-year Treasury yields have quadrupled.

Yet Blackrock says the bond market crash is far from over.

So what does it mean? Stock prices are often measures by a comparable price of debt.

In August this year, the S&P 500 climbed to levels last seen during the peak of dot-com boom, relative to an index that tracks the US corporate bond market, according to data from global analytics platform Koyfin. The gauge is still holding near those highs, despite the recent pullback in equities.The metric last surged this high in the spring of 2000 — and that was followed by a multi-year meltdown in stocks that saw the S&P 500 crash 50% between March 2000 and October 2002.

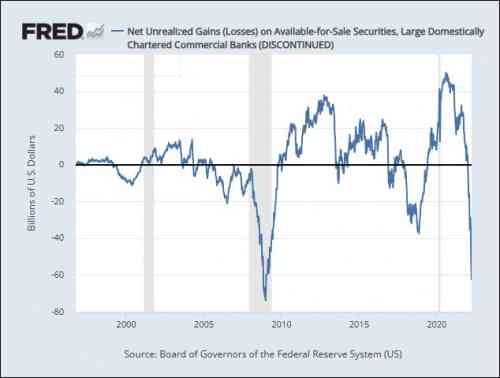

The biggest holders of bonds is banks.

The age of low interest rates and inflation has ended.

Comments

Does all this mean that Bidenomics is working? /S NT

I'd call it

Reaganomics and Clintonomics. The Bushes and Trump didn't deviate by much from the former. Obama and Biden modernized Clintonomics by accepting what GWB and Trump did.

I agree

I'm no fan of Biden, but this isn't Biden's doing. This is the Fed's doing, and it's been coming for a long time.

I've been saying for a while

I've been saying for a while it's going to get a lot worse before it gets better. Unfortunately I'm trying to sell a home since my husband got laid off after 12 years with his company. Economy sucks right now. House has had zero offers after 60+ days. Probably because interest rates are so high right now. Husband can barely even get an interview for employment in the tech sector right now. Brutal. Don't believe the hype!

If it was easy, everyone would do it.