Worse than a stock market crash

Submitted by gjohnsit on Thu, 04/10/2025 - 12:02amWhile the stock market gets the headlines, people in the know are watching the bond market.

While the stock market gets the headlines, people in the know are watching the bond market.

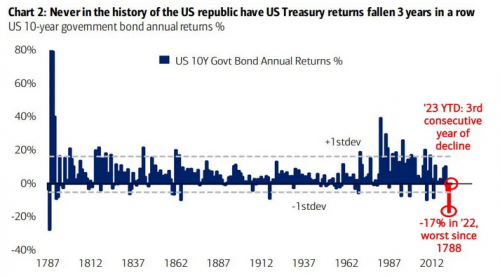

The current bond market crash (the one that no one is talking about) is the worst in American history, and one of the worst financial crashes in history.

I posted this chart earlier this week, but a lot of people were confused what it meant, so I'm going to expand on this.

Some people thinks this is no big deal. This is a huge mistake. To give you some idea, consider this chart.

A lot of people seem to be unaware that the bond market is twice as big as the stock market.

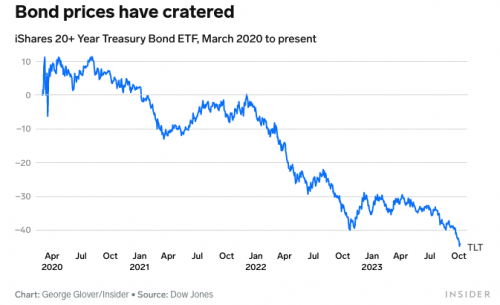

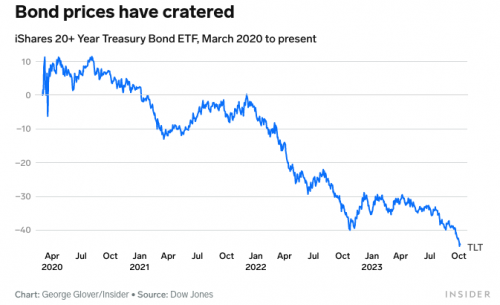

Which is why the recent bond market crash is so scary.

Longer-term bond prices have cratered in recent weeks, turning an already-rough period for the asset class into a rout that rivals some of the worst-ever US financial-market crashes.Ten-year Treasury notes have plummeted 46% since March 2020, according to data from Bloomberg, while 30-year Treasurys are down 53% over the same period.

Stocks last suffered losses of that magnitude 15 years ago, when the collapse of Lehman Brothers and the 2008 financial crisis led to the benchmark S&P 500 index plunging 48% in the space of six months.

To put this into perspective, this is even worse than the last bond bear market.