The bond market is crashing

A lot of people seem to be unaware that the bond market is twice as big as the stock market.

Which is why the recent bond market crash is so scary.

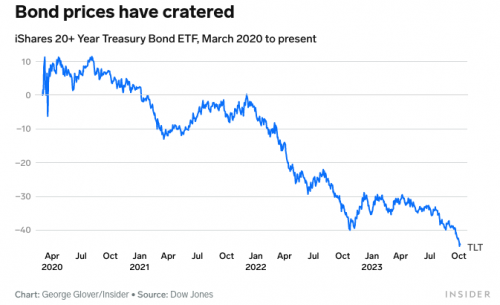

Longer-term bond prices have cratered in recent weeks, turning an already-rough period for the asset class into a rout that rivals some of the worst-ever US financial-market crashes.Ten-year Treasury notes have plummeted 46% since March 2020, according to data from Bloomberg, while 30-year Treasurys are down 53% over the same period.

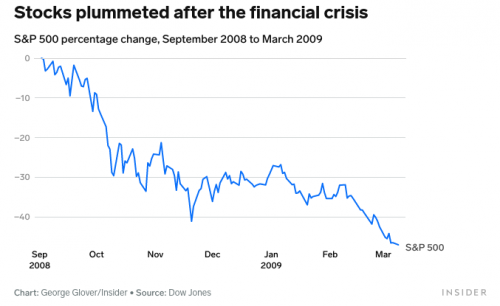

Stocks last suffered losses of that magnitude 15 years ago, when the collapse of Lehman Brothers and the 2008 financial crisis led to the benchmark S&P 500 index plunging 48% in the space of six months.

To put this into perspective, this is even worse than the last bond bear market.

Compared with previous bond-market meltdowns, long-term Treasurys are seeing one of the most extreme undoings in history. The losses are over twice as big as those seen in 1981 when 10-year yields neared 16%.

Comments

Bonds haven't crashed, they've been on a downward

trend for quite sometime though. A crash would occur if this

happened say over a period of 1-3 months.

So while this is true to say it's a crash isn't.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

The stock market 2008 crash

started in December 2007.

I know little with regards to the bond market but your post made

me curious to get a understanding. After a quick search I came across this which seems to explain (somewhat) what is happening with regards to long term bonds.

https://www.cnn.com/2023/10/05/investing/premarket-stocks-trading-bonds-...

Not sure if this is accurate but it perhaps gave me a better understanding of the situation.

As long as...

the Federal Reserve keeps raising interest rates the bond yield will go down.

Bonds that were bought at low interest rates are now coming due at much higher rates. The banks have to eat the difference.