Paul Krugman says inflation is over

Columnist Paul Krugman says that you can relax now. The inflation problem is over.

What these numbers and a growing accumulation of other data, from rents to shipping costs, suggest is that the risk of stagflation is receding....Obviously we’ve had serious inflation problems over the past year and a half. Much, probably most, of this inflation reflected presumably temporary disruptions of supply ranging from supply-chain problems to Russia’s invasion of Ukraine. But part of the inflation surge also surely reflected an overheated domestic economy.

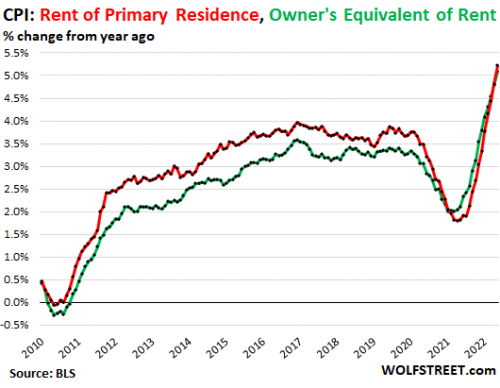

Ah yes, anyone can look at the CPI chart above and see that the inflation problem has passed.

Well, you can if you are a Nobel-Prize Winning Economist like Paul Krugman. It's not like Krugman has ever been wrong.

Incidentally, the Nobel committee doesn't give out prizes for economics.

This isn’t a foolish concern in principle. Over the course of the 1970s just about everyone came to expect persistent high inflation, and this expectation got built into wage- and price-setting — for example, employers were willing to lock in 10-percent-a-year wage increases because they expected all their competitors to be doing the same. Purging the economy of those entrenched expectations required an extended period of very high unemployment — stagflation.

Wages for workers are going up so fast right now. Right.

Why is it that inflation can ONLY be stopped by the working class taking 100% of the hit? The working class got practically no benefit in creating that inflation. It's almost as if the Working class have no part in inflation, except being used as a bailout for incompetence by the wealthy.

Let's not get ahead of ourselves. After all, inflation is no longer a problem.

Less than a month ago, traders were pricing in a cycle that took the benchmark federal funds rate target to more than 4% -- a level last seen in early 2008 -- up from the current range of 1.5% to 1.75%.But traders have rapidly unwound those expectations, and now foresee a peak around 3.3% in the first quarter of 2023....By contrast, the latest median projections from Fed officials, released last month, show the key policy rate climbing into 2023, reaching 3.75%.

Wait a second. Inflation is running at 8.6% in the United States, and is even higher in much of the rest of the world, but interest rates are going to top out at 3.3%?

Only a month ago everyone was talking about 1970's-style stagflation, but before inflation could even start to fall the markets have already started to price in disinflation.

What appears to be going on in the markets is FOMO (Fear Of Missing Out). Which makes sense, since the Fed has trained Wall Street to think that it will bail them out at the first hint of trouble.

This extreme bearishness would suggest investors are reducing their exposure to equity risk. However, the reality is quite different. As shown below, the A.A.I.I. investor allocation to stocks, bonds, and cash tells the story. Despite A.A.I.I. sentiment at very bearish levels, the allocation to equities remains very high while bonds and cash remain low.

Interestingly, seemingly terrified investors are still unwilling to sell for the “fear of missing out.“ It is worth noting that during previous bear markets, equity allocations fell as investors fled to cash. Such has not been the case in 2022.Investors seem more afraid of missing the bottom should the Federal Reserve suddenly reverse course on monetary policy. Much like Pavlov’s dogs, after years of being trained to “buy the dip,” investors are awaiting the Fed to “ring the bell.“

Comments

That is so nice of him

So energy costs will not increase?

Food costs will not increase?

Glad to hear that. I want to move to whatever planet he is living on.

@Mickt Calling it not the nobel

Calling it not the nobel in economics is a little much. Is calling it the Nobel Memorial Prize in Economic Sciences ok? https://en.wikipedia.org/wiki/Nobel_Memorial_Prize_in_Economic_Sciences

I'm not buying the dip nor waiting for any bells to ring, I simply know that eventually the market goes back to where it was and improves. Looking back not many years I can see where I'm still way ahead of where I was despite a 25% dip.

I've read Krugman for years but never been a big fan. I like how he writes but his bid ideas were about geographic economics and how some places are great at making some things, and others at other things, so we should just accept it. Computer stuff from Silicon Valley and manufacturing from China and the hell with our manufacturing. On politics he's worse.

I follow Claudia Sahm who used to work for the Fed and the white house. She's into inequality.

Locally, there is very strong demand in the employment sector. My kid is working at the supermarket as I write. $18 to start and the imported cheese counter as well as the bakery section are both closed as they don't have enough people to work. He works the deli where there are supposed to be 5. They often have to close early, short staffed. It's the busiest supermarket amongst a sea of 3/4 million tract homes as far as the eye can see. They are very busy, not enough workers.

My daughter applied at McDonalds but each interview was cancelled as the manager had quit that day, presumably for more pay elsewhere. Many fast food is take out only. Costco had no AC today, triple digit temps, no HVAC on a Saturday I guess. Nurses and Doctors? ha ha

I'm laboring rather than hire people who don't exist, and I'm charging up the ying yang. Probably making more per month than I have in most years. I think low wage labor wages here are far outpacing inflation.

Landscape Contractor told me he interviewed an AMerican (all illegal workers mostly). The American had one year's experience and wanted $30, and I sure can't blame him, I'll bet they kick themselves for not hiring him.

One real good way to curb inflation is to tax the bejesus out of upper middle class and wealthy, maybe corporate taxes. Never happen.

investors are awaiting the Fed to “ring the bell“

apparently pundits of this ilk consider a market awash in levered equity is

a good thing. If the wealthy can ride out this wave, all is good with

the investor class. The rest of us, not so much. Devaluation of the dollar is gaining

momentum. Go figure.

Zionism is a social disease

Krugman pays others

to fuel up and buy groceries for him while he thinks deep thoughts.

He is deep into theory, not daily life.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

Sorry gjohn

but I quit at "paul krugman".

Just another multi millionaire who believes everybody should listen to him.

Another ego inflated false prophet.

Regardless of the path in life I chose, I realize it's always forward, never straight.

I think gjohnsit

just outed Krugman as a dick head for us.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

heads

Or maybe a fish head:

[video: https://youtu.be/JKDtUzRIG6I]

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

The Great Pretender

I quit paying any attention to Paul Krugman after he supported Hillary Clinton over Bernie Sanders. He's a centrist Democrat who masquerades as a progressive.

Krugman thinks deficits are great

He likes to uses the example of the Second World War. We had a record national debt but never had to pay it off because of growth and inflation. His theory is that deficit spending is not a problem if it stimulates growth. Problem is that this is not 1945. I don't think that there is any mathematical model that can demonstrate that printing and borrowing money at the current rate leads to anything but disaster. Yet he still clings to his theory. He's fully invested in the current US economic model. No wonder he claims that inflation is over. He fits in well with the current staff of the NYT, neoliberal, woke, elite and disconnected from reality.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.