You are suffering from inflation because of rich people

Inflation is becoming the top political/economic issue in the country.

Like any issue that actually matters, there's more misinformation than anything else. Republicans want to blame poor people and Biden for the inflation.

Republicans argue that "exorbitant handouts" from the federal government, including a $300 weekly federal pandemic unemployment benefit, also have contributed to the labor shortage and rise in inflation.

But Biden's BBB plan was never passed and inflation began to pick up before he ever took office. As for blaming poor people, well, let's look at the raw numbers.

The M2 money supply is the broadest measure of the amount of money in the economy. The large and unnatural spike in the M2 during 2020 is hard to miss. Anyone familiar with supply and demand could tell you that if you massively increase the amount of money in an economy that prices will rise.

So did that come from giving poor people money? Hardly. First of all, the spike is much larger than the $260 Billion spent on extra unemployment benefits in the CARES Act. More significantly, just look at what happened to money velocity in the economy.

[According to Wikipedia: The velocity of money is a measure of the number of times that the average unit of currency is used to purchase goods and services within a given time period.]

Money velocity dropped off a cliff even while a mountain of money was shoved into the economy.

That may seem like a contradiction, but it isn't. It's a clue to who got all that money.

According to the Congressional Budget Office, each dollar of UI benefits raises aggregate economic activity by $1.10. In other words, when you give poor people money they spend it. Every dollar spent on SNAP benefits (i.e. food stamps) generates $1.67 in economic activity.

The poorer the people getting the money the more likely they will spend it. Wealthy people are more likely to save or invest it. This isn't a controversial statement.

It may have occurred some of you that it is exceedingly rare to have inflation with a collapsing money velocity. After all, why hang onto money if it's falling in value?

This is happening because we are seeing price inflation driven by massive asset inflation.

Put another way, what actually happened since 2020 is a case of massive wealth extraction from the poor to the rich. The instrument of that wealth extraction was the Federal Reserve.

The massive Federal Reserve asset buying spike happened almost exactly at the same time as the M2 spike and the M2 velocity drop. This is not a coincidence.

Still that $4 Trillion spike in Fed assets doesn't tell the whole story.

The Fed has no business buying $2.7+ TRILLION RESIDENTIAL Mortgage-Backed Securities (RMBS). The Fed recklessly pumped the housing bubble for Wall St's benefit. Result?

Out-of-control housing inflation - for both home prices AND rent. It's like they WANT a homelessness crisis! pic.twitter.com/dNiVfP6dAn

— Occupy The Fed Movement (@OccupytheFeds) March 25, 2022

The Fed has done something never before seen in economic history: they re-inflated an asset bubble. Two asset bubbles in this case: housing and the stock market.

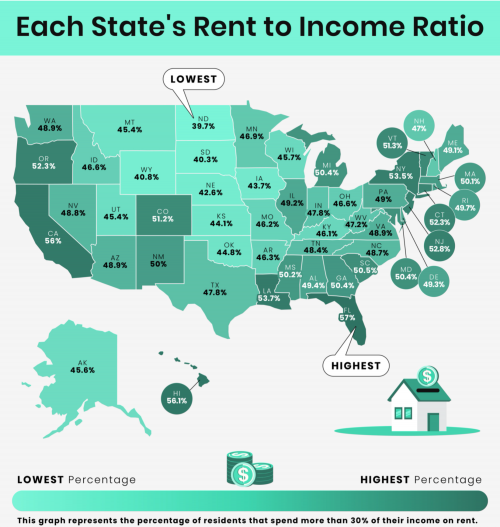

In normal times, housing is one of the largest expenses of the working class. In 2022, it's a black hole of expenses.

It's no secret that institutional investors from Wall Street are loving this housing crisis.

Now guess where those big investors suddenly acquired that mountain of cash that they are using to buy up all of the homes?

$48 TRILLION, more than twice the size of the GDP of the United States, was created out of thin air by the Federal Reserve, and shoved into the banking system, without a vote by Congress, or even an article about it in the NY Times. A large part of this bank bailout wasn't even to banks in the United States. Yet you, the American taxpayer, are still back-stopping all of those loans.

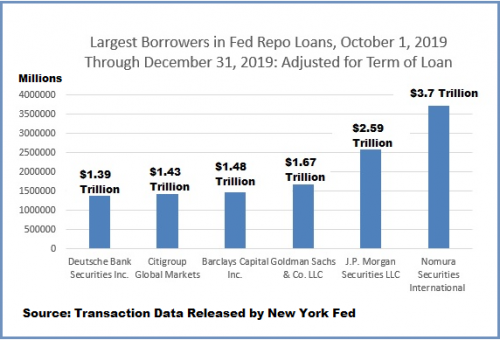

Wall Street on Parade sifted through all of the boring, Federal Reserve financial reports and pulled out a gem like this.

As thousands of businesses were forced to close in the U.S. as a result of the coronavirus outbreak in March of 2020, and millions of Americans were financially struggling, the Federal Reserve was pumping what would become a cumulative $3.84 trillion in secret repo loans into the U.S. trading unit of the giant French global bank, BNP Paribas, in the first quarter of 2020.

The repo loan market is where banks, brokerage firms, mutual funds and others make loans to each other against safe collateral, typically Treasury securities. Repo stands for “repurchase agreement.” The Fed only comes to the rescue of this market when there is a liquidity crisis and Wall Street firms are backing away from lending to each other. September 17, 2019 was the first time the Fed had to intervene in the repo market since the financial crisis of 2008 and it was months before the first case of COVID-19 was discovered anywhere in the world.

BNP Paribas is not just any ole global bank. It’s the bank that the U.S. Department of Justice fined $8.8 billion in 2015 for flouting U.S. sanctions, covering its tracks, and pleading guilty to a criminal charge.

What may have led to the scramble for money by BNP Paribas Securities is – wait for it – risky derivatives, the same financial weapons of mass destruction that blew up the U.S. financial system and economy in 2008 and led to the biggest bailout of Wall Street in history by the Fed.

The BNP Paribas information comes from a repo loan data dump by the New York Fed this morning – the regional Fed bank that handled all of these secret repo loans from their inception on September 17, 2019 to July 2, 2020.

The Fed has withheld the release of the names of the banks that got these massive loans for two years but is now forced to release them under the provisions of the Dodd-Frank financial reform legislation of 2010.

The raw Fed data can be seen here.

We shouldn't overlook the fact that the largest bank in America, and five-time criminal felon, JBMorgan Chase, took an oversized amount of that bailout money.

According to the quarterly data releases by the Fed for its repo loans, the trading unit of JPMorgan (J.P. Morgan Securities) borrowed $2.59 trillion in term-adjusted cumulative repo loans in the fourth quarter of 2019 and another $3.6 trillion in the first quarter of 2020.

Wall Street on Parade has also noted the total news media blackout on this enormous bailout.

So there you have it. A direct line from point A to point B. A map showing how we are being ripped off by every important player in the financial system. However, since the news media didn't report it, will anyone believe me?

Comments

Not so much dumbed-down

as told from a different perspective, with more attention to detail and less assumptions on what you knew.

[edit] Posted this up to reddit and it is getting zero attention as well. I'm guessing the reason is because it doesn't come in a bite-sized meme. People can't focus anymore.

It looks like everyone here is getting it. I'm glad that I redid the essay.

The question is: how do you get this info out to the general public?

I really appreciate your efforts

This is a difficult topic to get a grasp on, and the media blackout reinforces confirmation bias against any smoke=fire implications. I wish I could offer suggestions for gaining traction on this, but I’ve given up trying to influence even my circle of “friends” for being seen as a contrarian and a fool.

Not that they ever show me why I’m wrong…

I remember years ago

at least 15 years ago that I understood what the main difference between the German Federal Reserve (Deutsche Bundesbank) and the US Federal Reserve bank was. I have all but forgotten, (heh, senile age group here approaching).

I wished you could say something to the differences of both. If you like. One day. Before I am gone.

'They' just want their slaves back and they don't even care if they are white or black. Bingo. They are even not racists, nor Nazis. See?

Shite I am going bananas. Sorry. I will try to read through it several times, after I changed all inot big black bold letters. Thank you so much for your reporting and work here. Kudos.

https://www.euronews.com/live

It's not my wheelhouse, but

...I do know that German Federal Reserve (Deutsche Bundesbank) was set up to copy the Federal Reserve.

However, once the ECB was created, that comparison gets thrown out the window.

Theoretically the Bundesbank should be subordinate. Yet the Bundesbank and ECB are both based in Frankfurt.

The first two graphs are descriptive

of your point. Thanks for clarifying otherwise obscure financial wonders.

I agree that people on my level are grumbling loudly of the price hikes.

I've watched the value of the dollar tumble gradually over the past 50

years, but not quite like recently. It is almost beginning to seem that regular

folks can no longer afford to live, let alone in comfort. Panic selling-off of

assets as a reaction is a scary proposition. This reminds me of the way the

already rich bought-up goods and properties in the 30's for pennies on the

dollar. Asset stripping may be the term for it. Leaving most desperate.

Damn greedy monsters. We need a new financial system.

Remember that after Obama gave the banks trillions

they went on a foreclosed homes buying spree and took 5 million homes off the market which drove up prices for both buying homes and rents. At the start of the epidemic congress gave companies lots more money for buying back more of their stocks, but they also went shopping for homes again. One fcking hedge fund bought a neighborhood of 116 homes that they will then rent out. And cities across the world are building those gawd awful apartment complexes which they only rent out. The bowling alley I haunted as a kid went under during the shutdown and lo and behold there is one of the gawd awful apartment complex being built. The mountain road between here and Salt Lake City used to be orchards as far as the eye could see and now they have been turned into those gawd awful apartment complexes.

Rents have gone up close to 50% in many states and of course wages haven’t kept up. But the parasite class is blaming rising wages as the reasons for inflation. And still congress fiddles whilst more and more Americans suffer. Big pharma keeps raising prices on drugs and instead of congress stepping in they are blowing smoke up people’s buttocks about reining in debt collectors. They recently told insurance companies that they can only charge people for insulin $35, but people who don’t have health insurance still have to pay whatever big pharma tells them to. People are dying, becoming homeless and suffering from gawd only knows because the class war has been super charged. But don’t forget to vote for the party of your choice and think that either one will do anything that hurts their donors.

But then it’s all Putin’s fault isn’t it?

A leftist is someone with morally correct politics. A liberal is someone who wants to feel morally correct w/o ever putting themselves at odds with power or costing themselves opportunities or experiencing the uncomfortable emotions that truth causes.

MMT for me...

... but not for thee! It seems like the Fed can move mountains to protect their own. It looks like the limit to MMT without pushing inflation is more than 2X the GDP. I guess it could be who's given the money as well. In the hands of people who need it asset bubbles probably wouldn't be inflated

This ain't inflation, it's Malthus, it's genocide

When we reached the limit of stress we could put on our world our parasitic elites said, "don't worry, we can tech our way out of this" and when we reached the limit of our tech abilities we just boosted the tech, again and again until there was no more tech left. When there wasn't anything of the forests and oceans and earth left to eat we started to eat the poor and week.

I used to say that inflation follows available money, but now the Fed has found a workaround - it just prints the money. Run out of money buying up houses and demanding impossible rents? Well here's more money, go buy more houses. And when this runs out there'll be more. Always remember, after a point capitalism is about how much you can destroy.

On to Biden since 1973

Imagine

how many other sectors of the economy your analysis could apply to. The wealthy are so powerful they don't need to produce anything, they just dominate whatever segment they choose to. Having control of healthcare, Wall St., education, food, housing and any damn thing they set their sights on they control the economy. They can steer recessions and depressions to transfer wealth to themselves. 2008 recession ended in what? 6 months while for the rest of us it took most of a decade. Hoarding all that cash is like controlling the air supply to a space suit, just enough to barely keep the occupant alive and doing their bidding. I don't see how this is accepted because it weakens the country and shifts all goals to protecting their wealth. This is pure, refined corruption.

I can only surmise that when the U.S. collapses the Richie Riches will escape to whatever paradise they created, taking the cash with them, without hesitation or remorse. Pledging allegiance to the flag is for little people, us dupes. The wealthy have their own alter they pledge on, it's mobile and made of gold.

Yep!

They are traitors to we the people. We send them to congress to do our bidding, but they sell us out and do the bidding of their donors. Has it ALWAYS been this way and maybe hidden a little? Dunno, but now it’s full blown corruption. Did you know that congress doesn’t actually write bills anymore? Lobbyists now write them and send them to congress to vote for them. And they rarely have enough time to read what is in the bills before they do. 21,000 pages get sent to congress and they have less than a day to read what they are voting on.

As I mentioned democrats passed legislation to rein in how much people have to pay for insulin. Insurance companies still can charge whatever they want, but people with insurance only have to pay $35. But there are hundreds of other drugs that have no price caps on them and people have to pay whatever they are told to. Or die. Medicare should be able to set the amount that it will pay for drugs except congress won’t let it just so already rich people can become more richer. Money is a made up concept is it not?

A leftist is someone with morally correct politics. A liberal is someone who wants to feel morally correct w/o ever putting themselves at odds with power or costing themselves opportunities or experiencing the uncomfortable emotions that truth causes.

My own take is

there was one time it wasn't like this. The Great Depression and the controls the government put on the economy was the first time the US gov. managed the whole economy. The tax system put in place as we slid into WW2 to finance the war levelled the playing field a lot. After the WW2 we slipped into the Cold War, still keeping the tax system and controls in effect.

JFK started to loosen the tax rates, and Johnson and RFK advocated for anti poverty programs. Of course this was obviously communism. After Viet Nam when the bill for the war came due, the economy stalled. For many, esp union workers this was disaster. Decent paying jobs were gone through layoffs, then off shoring. They were pissed about democrats pushing for antipoverty programs when they were hurting. Carter was the anti-Nixon like Biden is the anti-Trump, even though Carter started the anti regulatory ball rolling, the republicans hated him. With the rise of Reagan and Reagan Democrats the rest is history. The greed heads looked at the middle class the way Mitt Romney looked at an undervalued company. We leveraged our own buyout.

I left out the oil embargo, the shifting of job to the south, then to Mexico, then to china and a lot of limited wars that we seem to need to exist. All opportunities to grab more power during crisis. Now economic crisis seems built into the economy as means to transfer assets, power, and wealth to the 1%. I despair because we the people lost this war to keep our country, and I don't see it coming back. Our most important citizens are like the Bezos, Musks, Murdocks and Kardasians. We exist to serve them because our political class feel they need to be served.

Thanks for the economic lesson

I've been wondering how long the Federal Reserve can continue with this quantitative easing? It's just debt piled onto more debt for the U.S. taxpayer. It's scary to think our economic well-being is in the hands of a bunch of irresponsible bankers who seem to have about as much power as the U.S. Supreme Court when it comes to economic policy.

I heard about this years ago

I heard that the industry that committees are supposed to be overseeing got to choose who the chairman was so I think this is quite true. It’s just more congressional corruption.

A leftist is someone with morally correct politics. A liberal is someone who wants to feel morally correct w/o ever putting themselves at odds with power or costing themselves opportunities or experiencing the uncomfortable emotions that truth causes.

Secret Recipe for High Inflation

Really good essay gjohnsit

I hear you saying that the recipe calls for large amounts of

Rich people, federal reserve, and corporate media serfs

Housing affordability

It would be interesting also

to graph rent costs within the same time frame, or is that included in the housing affordability one?

thanks