News Dump Wednesday: Bond Defaults Cometh

Submitted by gjohnsit on Wed, 04/06/2016 - 10:28am

The next spike in corporate defaults will be a doozy.

When the next corporate default wave comes, it could hurt investors more than they expect.

Losses on bonds from defaulted companies are likely to be higher than in previous cycles, because U.S. issuers have more debt relative to their assets, according to Bank of America Corp. strategists. Those high levels of borrowings mean that if a company liquidates, the proceeds have to cover more liabilities.

In bad times, corporate bond investors on average lose about 70 cents on the dollar when a borrower goes bust. In this cycle, that figure could be closer to the mid-80s, the strategists said.

"A lot of the troubled companies that had become overleveraged were able to find more temporary solutions in the last credit cycle," Holtz said. "Those Band-Aids are no longer available now, and a lot of companies are going to have to face distress," he said.

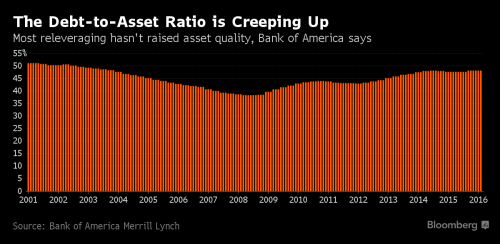

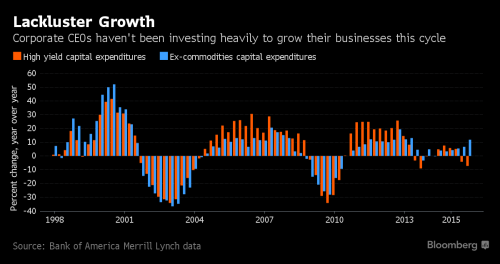

Leverage levels have been rising as more companies use borrowings to refinance existing liabilities, buy back shares and take other steps that do not increase asset values, Holtz said. Capital expenditure, which does boost assets, has been relatively low during this cycle.

Junk-rated companies have debt equal to about 48 percent of their assets now, up 7.5 percentage points in the last 7 years, according to Bank of America Merrill Lynch data. The ratio of debt to assets is one of the main factors in how big losses will be when a borrower defaults.

Another factor is the rate of default, because when more companies are defaulting, more are looking to sell assets or otherwise restructure, leaving investors with lower recoveries. Default rates currently stand around 4 percent, according to Moody’s Investors Service. The ratings company forecasts that the measure will rise to 5.05 percent by the end of the year in the best-case scenario, and could jump as high as 14.9 percent under the most pessimistic projection.

Puerto Rico's Development Bank on the brink

Puerto Rico’s Government Development Bank, which was set up after the Great Depression to chart a course out of poverty, is on the verge of a collapse that would deepen the Caribbean island’s $70 billion debt crisis.

The lender was designed to promote business investment with a long-term horizon, but in recent years politicians turned it into a piggy-bank that lent to the government and its agencies, helping keep them afloat as the island’s economy shrunk. Now it’s rapidly running out of cash and likely to default on a $422 million debt payment due in May -- raising the risk that it may be pushed into receivership or broken up.

The bank’s failure would undermine one of the last sources of cash that Puerto Rican authorities are counting on to pay teachers, firefighters and other employees, in a territory where almost half the population lives in poverty. Hedge funds are also laying claim to the money, filing a lawsuit against the lender this week, while in Washington lawmakers are mulling steps to put the island government under federal oversight and give it legal powers to restructure its debt.

Puerto Rico took steps on Tuesday toward a unilateral moratorium on all government debt payments, rejecting efforts in Washington to allow it to restructure only under close federal supervision.

The Puerto Rican Senate authorized a declaration of emergency and a debt moratorium at around 3 a.m., after hours of debate. The island’s House of Representatives was debating such a measure late Tuesday but had not yet voted. Any bill would need to be signed by the governor, Alejandro García Padilla.

The sudden moves seemed likely to complicate efforts in Washington to enact a rescue package for Puerto Rico. The House Natural Resources Committee, which has been drafting the rescue in consultation with Democrats in Congress and the Treasury Department, said it still planned to issue an updated version on Wednesday, despite Puerto Rico’s action.

The rescue involves sensitive constitutional issues, and the drafters have been trying to strike a balance between Democratic and Republican Party priorities. So far, the lawmakers in Congress have called for sending a federal oversight board to Puerto Rico, auditing all major branches of government there, promoting fiscal reforms and eventually providing certain restructuring tools that are normally available only in bankruptcy.

NIRP destroys Japan's debt market

Two months after the BOJ said it would start charging interest on some lenders’ reserves, the outstanding balance in the interbank call market tumbled to a record low 2.97 trillion yen ($27 billion) on March 31, according to Tanshi Kyokai data going back to 1988. While the brokers association and the Japan Securities Depository Center said two weeks ago they had upgraded systems to settle transactions at sub-zero yields, traders say more than technical issues are preventing a revival.

“Among central banks, the BOJ is the one that destroys functioning markets the most,” said Izuru Kato, the president of Totan Research Co. in Tokyo. “Companies will slash staff and scale back operations where activity is grinding to a halt, exposing markets to spikes in rates when the time comes for normalization.”

The disruption to Japan’s ground zero for bank funding coincides with a collapse in bond-market trading over the past year, even as the BOJ’s hoarding of notes has left it nowhere near achieving its 2 percent inflation target three years after Haruhiko Kuroda became governor. When questioned by a lawmaker in parliament last month, Kuroda agreed that it would be theoretically possible to lower rates to minus 0.5 percent, from the current minus 0.1 percent.

After years of lambasting other countries for helping rich Americans hide their money offshore, the U.S. is emerging as a leading tax and secrecy haven for rich foreigners. By resisting new global disclosure standards, the U.S. is creating a hot new market, becoming the go-to place to stash foreign wealth. Everyone from London lawyers to Swiss trust companies is getting in on the act, helping the world’s rich move accounts from places like the Bahamas and the British Virgin Islands to Nevada, Wyoming, and South Dakota.

“How ironic—no, how perverse—that the USA, which has been so sanctimonious in its condemnation of Swiss banks, has become the banking secrecy jurisdiction du jour,” wrote Peter A. Cotorceanu, a lawyer at Anaford AG, a Zurich law firm, in a recent legal journal. “That ‘giant sucking sound’ you hear? It is the sound of money rushing to the USA.”

Comments

Wow.

Are the investors going to absorb their losses or pass them on to us?

"Private profits, social losses."

Life is strong. I'm weak, but Life is strong.

TYT via Alternet: Much Bigger Than Just a Protest Vote

The Young Turks: Bernie's Success Is Much Bigger Than Just a Protest Vote (Video)

Bernie has gotten it right for 40 years. He was right about the illegal invasion and occupation of Iraq, he has been right about equal rights for his entire career, and he predicted the adverse consequences of so-called "free trade" agreements that working Americans never agreed to.

"We've done the impossible, and that makes us mighty."

If we don't break up the big banks, they will break the world

And Reich has a great comment on his FB page about Bernie's acumen r/t that:

Robert Reich:

In an exchange with the New York Daily News editorial board a few days ago, Bernie said he didn’t know if the Fed had authority to break up the big banks but the President does have such authority under the Dodd-Frank Act.

This drew an onslaught of criticism from the media: "Bernie Sanders Admits He Isn't Sure How to Break Up Big Banks," read Vanity Fair's headline. "This New York Daily News interview was pretty close to a disaster for Bernie Sanders," said The Washington Post. "How Much Does Bernie Sanders Know About Policy?" asked The Atlantic. The Clinton campaign even said in a fundraising email "on his signature issue of breaking up the banks, he's unable to answer basic questions about how he'd go about doing it, and even seems uncertain whether a president does or doesn't already have that authority under existing law."

The criticism is bonkers. Bernie was absolutely correct when he said the President has the authority to break up the big banks under Dodd-Frank. He's repeatedly specified exactly how he'd use that Dodd-Frank authority to do so. His critics are confusing the Dodd-Frank Act with the Federal Reserve. Whether the Fed has the authority on its own to break up the biggest banks is irrelevant.

Clearly, Bernie has the Democratic establishment worried enough to try to twist his words into pretzels.

Dodd-Frank protects TBTF banks

Bernie probably knows that the Dodd-Frank procedure for breaking up TBTF banks is designed to be unworkable. This is the kind of thing that's hard to explain to voters.

Matthew Yglesias: Bernie Sanders's plan to break up the banks, explained

"We've done the impossible, and that makes us mighty."

Whatever happened to

good old fashioned trust busting. Aren't there old anti-trust laws starting with the Sherman Act still on the books? The too big's are not only too big they seem to be horizontally and hostilely eating each other. Like Bozo of Amazon buying the WaPo. Surely there are still some laws left that are applicable to bust up these behemoths. They certainly seem to have no problem with reinterpreting old law to make new so why not dust off the anti-monopoly and trust busting laws of yore. 'That is not going to happen' heard over and over from the establishment Democratic apparatchiks and their mouth pieces is getting old. Saying this does not make it so, take a good look at the assholes who keep repeating this mantra of No. They need to go. Politics are not static that's what Bernie's revolution movement is talking about.

Mud slinging

Here it comes both barrels..misdirecting and misleading. What has surprised me is how obvious the MSM blackout and smear job has become. Enough that there are protest at CNN (the Clinton news network). Even public broadcasting seems to be in the tank pushing the corporate meme. Bernie still has a path. Let's make that happen.

“Until justice rolls down like water and righteousness like a mighty stream.”

Jumping Jehoshaphat!

A bit OT, but... Every time I see a diary from you, gjohnsit, I internally say Jumping Jehoshaphat. It is a chicken/egg thing. Do I say it because my mind is trying to find a way to pronounce gjohnsit, or because I inevitably say JJ after I read your essays? Who knows.

If possible, have a happy afternoon everyone.

"Intelligence is the ability to adapt to change." Stephen Hawking

NEW: http://www.twitter.com/trueblueinwdc

The first to go...

High yeald bonds in the oil sector ( tarsands shale oil).

Those producers need like $80 a barrel just to stay afloat.

Recently WTI. stalled at $40 and has been trending back to

$35.

Not enough to pay high priced debt.

I want a Pony!

(Need a way to deletecduplicate coments

I tried 'edit' then 'cancel' need a 'delete' in comment editing.

I want a Pony!

Wind and Solar are crushing it

everyone is investing

Thanks for the is information

Thanks for the is information! Reading the information above cannot wonder what is going to happen next.

Life is what you make it, so make it something worthwhile.

This ain't no dress rehearsal!

State Department fighting Hillary email investigation

Surprise, surprise

Where have I heard this before?

Oh yeah. 2007

What could possibly go wrong!

What could possibly go wrong!

Life is what you make it, so make it something worthwhile.

This ain't no dress rehearsal!

Dutch reject EU-Ukraine deal

that's interesting

Puerto Rico goes insolvent

it happened