What Greece's debt crisis has taught us

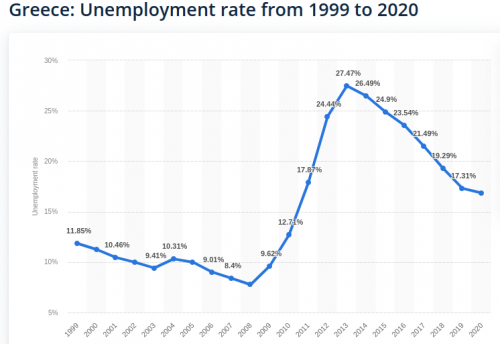

12 years ago Greece went into a debt crisis. Greece wasn't allowed to default on the debt. Instead they were forced into severe austerity.

On the other, the long-term effects of the austerity programmes over the past eight years are so deep-rooted that poverty as a way of life (“queueing for a living”) is the real prospect for a huge percentage of the population.

...

A basic fact of life is that the lowest-income groups cannot pay their taxes, and 14 per cent of the population are at risk of “food poverty” – you either eat or you pay your utility bills. You certainly don’t pay your property tax or income tax, so the national exchequer is depleted.

Studies indicate a sharp rise in the child mortality rate since 2010, and also in the mortality rate for the elderly. There are three times as many suicides as before.

No matter what, the lenders could not be allowed to take a loss. And so the working class were impoverished so that the debts could be serviced.

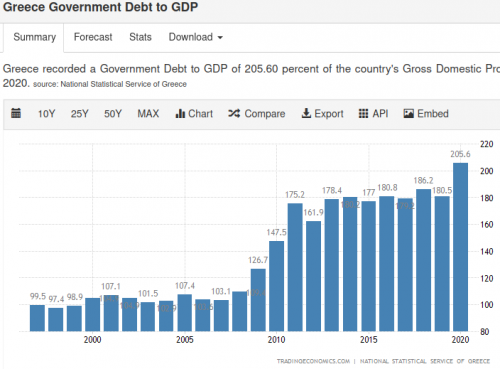

But at least the debts were paid down, amirite?

After all, Greece emerged from the bailout in 2018, so that must have meant that Greece's debts are now manageable.

Mario Centeno, board chairman of the European Stability Mechanism (ESM), said in a statement: “For the first time since early 2010 Greece can stand on its own feet. This was possible thanks to the extraordinary effort of the Greek people, the good cooperation with the current Greek government and the support of European partners through loans and debt relief.

“It took much longer than expected but I believe we are there.”

...

Pierre Moscovici, the EU’s economic affairs commissioner, said at the weekend: “The reality on the ground remains difficult. The time for austerity is over, but the end of the programme is not the end of the road for reform.”

I mean, if the debts haven't been paid down then what was all of that suffering for?

Greece will never ever emerge from austerity and crushing debt. Because unpayable debts remain unpayable.

The country might have achieved budget surpluses – excluding debt repayments – of about 4% in 2016 and 2017, but its hands remain tied on social welfare spending. Greece has already legislated for new reforms for 2019 and 2020 and will remain under supervision for several years.

The improving economic indicators are not yet translating into tangible improvements in the day-to-day lives of Greeks. “The bailout is over, but the shackles and the asphyxiation are still on,” the opposition-friendly To Vima newspaper wrote on Sunday.

Economics professor Nikos Vettas believes it is “imperative” to generate “very strong growth” in the coming years. Otherwise, “households that are in a very weak position due to 10 years of cumulative recession will continue to suffer”.

Even the IMF has admitted that Greece will never get out from under this debt mountain unless creditors take a haircut. So the objective was never to fix Greece's debt problem.

Greece was only the first First-World Nation to get the 3rd World Treatment.

More nations will get it, and eventually it'll be the United States' turn. Although the U.S. is already on austerity, so it might not actually change that much.

Comments

I don't know much about this guy, but he speaks facts

"Greece wasn't allowed to default on the debt."

What does this mean, exactly?

I don't know much about debt; my father once remarked that my credit's probably better than his.

I think I do know one thing, though...

...hence, the ultimate origin of what is now called: Slavery.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

It means that the creditors didn't have to take a loss

The idea is that there is no risk with lending.

Didn't TPTB take private depositor's funds

from their bank accounts to pay the national foreign debt to banks such as Morgan Stanley?

Excellent question

[edit]

I know they did that in Argentina in 2001, and Cyprus in 2011.

I believed that in Greece they simply got locked out of their bank accounts for several weeks. (something to keep in mind for future reference)

...but I was wrong.

Thanks for making me look it up

"Bad outcome" was used as a talisman

against the possibility that the SYRIZA government might do something to alleviate the debt situation, like, for instance, bringing back the drachma and detaching Greece from the Euro.

Of course, bad outcome occurred anyway. The working class of the rest of Europe was a bunch of damn fools to let Greece go down the tubes.

"It hasn't been okay to be smart in the United States for centuries" -- Frank Zappa