Wall Street Ruling Elites Strike Back

If you've ever been in a Las Vegas casino when somebody is on a winning streak, you know that the casino won't just let them keep winning forever. Eventually large men in tailored suits will appear and escort the lucky gambler out of the casino. The casino will simply change the rules.

Gotta admit it’s really something to see Wall Streeters with a long history of treating our economy as a casino complain about a message board of posters also treating the market as a casino

— Alexandria Ocasio-Cortez (@AOC) January 27, 2021

This is what the powerful do. When Bernie Sanders was running in 2016 and suddenly appeared that he might win, the DNC, the media, and the political and financial establishment all came together to crush his campaign. They changed the rules.

When Julian Assange committed the unpardonable offense of journalism and exposed our war crimes, he was suddenly charged with espionage. They changed the rules.

#OccupyWallSt didn't have Robinhood accounts and their figurative drum circle has gotten a LOT bigger thanks to the open internet. pic.twitter.com/PE8241xOPa

— Alexis Ohanian Sr. (@alexisohanian) January 28, 2021

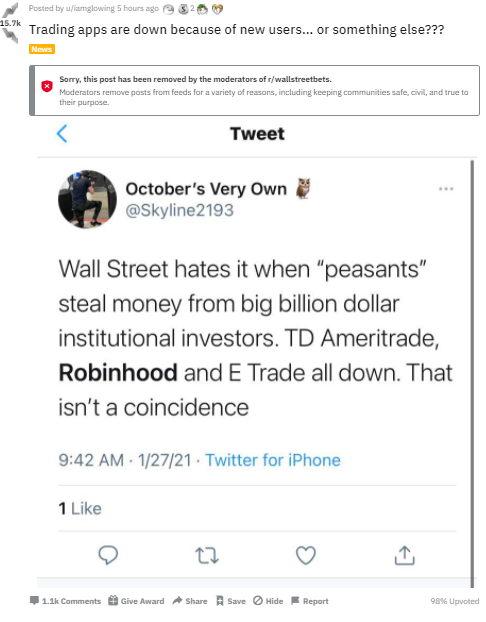

Today we have a bunch of retail investors beating billionaire hedge fund managers at their own game, and that can't be allowed. The ruling elites will sacrifice the thin fake veneer of earned meritocracy at the first sign of trouble.

The stock plummeted as much as 68% Thursday after Robinhood, Interactive Brokers and others took steps to curtail activity in several high-flying stocks, including GameStop and AMC Entertainment Holdings Inc...

The clampdown by brokerages extended beyond GameStop to other high flying stocks such as BlackBerry Ltd. that have surged this week, burning short sellers and hedge funds. The phenomenon attracted the attention of regulators Wednesday, with the Securities and Exchange Commission saying it was actively monitoring the situation.

Does this suit mention Robinhood's relationship with Citadel, who are deeply interested in the shorting of GME?

— Biden Removes Visa Restrictions on Kyrgyzstan (@Ayyyyten) January 28, 2021

The list of restricted stocks keeps growing.

In addition to GameStop, the wild trading affected other heavily shorted stocks, including AMC Entertainment, BlackBerry and Koss.“We continuously monitor the markets and make changes where necessary. In light of recent volatility, we are restricting transactions for certain securities to position closing only, including $AAL, $AMC, $BB, $BBBY, $CTRM, $EXPR, $GME, $KOSS, $NAKD, $NOK, $SNDL, $TR and $TRVG. We also raised margin requirements for certain securities,” Robinhood said in a statement.

Raising margin requirements increases how much money an investor using leverage and derivatives must have in their brokerage account after a stock purchase.

Interactive Brokers said: “As of midday yesterday, Interactive Brokers has put AMC, BB, EXPR, GME, and KOSS option trading into liquidation only due to the extraordinary volatility in the markets. In addition, long stock positions will require 100% margin and short stock positions will require 300% margin until further notice. We do not believe this situation will subside until the exchanges and regulators halt or put certain symbols into liquidation only. We will continue to monitor market conditions and may add or remove symbols as may be warranted.”

Stock trading app Webull stopped allowing clients to open new positions in GameStop, AMC Entertainment and Koss.

Comments

Robinhood now selling your GameStop stocks without asking

Robinhood must either think they're dead

or they didn't talk to their lawyers. Of course, who knows what the brokerage agreement says buried in the fine print. Anywhere else in the world this would be an admission of theft.

"Ah, but I was so much older then, I'm younger than that now..."

You need to explain that to me if you can

RH is closing people's accounts for no reason and without their input? Is that what they are doing and is that legal if you know? Seems that if there is a contract, but I don't do stocks so I don't understand how that would work.

Heh..

Was Humpty Dumpty pushed?

I can see it being legal...depending on the circumstance

...and the contract.

I just don't see THIS being a legal circumstance.

Apparently, it is legal

I found this video from earlier this afternoon, it's 30 minutes long (sorry) but he explains well why Robinhood (and others) are doing this today, and why it's legal for them to do so.

Terms of service are part of it, but not really the whole story. Worth the time for those who want to know more about the nuts and bolts.

[video:https://youtu.be/B8y1H3IMt6I]

He does touch upon the risk position of those buying at this price, who are going to be left holding the bag when this bubble bursts, as well as the risk position of the brokerage. It may be more detailed than most want to sit through, which is totally understandable.

Long story short, he says they are well within their legal rights to stop trading, sell shares without your permission, and so on, if they determine there is too much "volatility" in the market. And the SEC can also direct such actions.

They do have this game very well rigged indeed.

That's total BS about the volatility making it ok for them to

sell what you own!

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Hum, no it isn't "ok" if by that you mean cool or good

But the question was, is it legal.

To that specific question, I searched for answers, and I wanted to know the facts of it, rather than going by what I personally think should be true. Or what is or isn't "ok" -- whatever that means to you or me.

First there's the TOS/contract, which makes it crystal clear (if you speak legalese and read all 35 pages of it) that all users of the app agreed to these conditions, even if they didn't know it because they didn't read it or understand it.

And then there's the SEC and their regulations, which allow for them to take various actions to stop whatever they deem to be excessive volatility.

Watching the whole video I posted above will give you a much better understanding of it than my summary can. I recommend watching it if you wish to be informed of the law and facts related to this. If not, then carry on! It is definitely not "ok" in any other sense of that word. I am with you on that.

If their clients who were supposedly long the stock

the volatility would be for those short the stock. Therefore the story being told is pure BS They have no clue as to what "volatility" is. Volatility doesn't happen when markets go up.

And selling their positions cuz say they say naughty words is beyond belief!

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

property rights are pretty clear that NO, you can't sell

what someone else OWNS without the owners permission.

Watch the video, between the 5:00 and 10:00 minutes marks

if that is all you can spare.

He shows a copy of the Robinhood user agreement with bright color highlights showing exactly where a user of the app gives them permission to liquidate your shares, restrict your access, and even close your account, at their sole discretion.

Sigh... I really wish people here would stop reacting as if what I share in terms of information I find is my own personal opinion of things. That is not the case. Please stop attacking the messenger. I don't think this is right. At all. Many people -- including me -- where wondering whether or not what they did is legal. That is not a matter of opinion, it is something that has an answer, which one can find out. I thought it was a contribution to the discussion to share a relatively concise and thorough explanation of the answer.

It is really disappointing and distressing, to be honest, that there is such a resistance to looking at the truth of a matter rather than going off of purely emotional reactionary thinking.

For one

I appreciate your sharing the fine print.

Best not take it personal.

Some in these shook-up times

are lashing out at any out-crop

that mars a clean scale

to understanding

cheers

@CS in AZ Fine print

Fine print didn't protect Robinhood before

against a $65 million fine and its incredibly unlikely it will protect them from this event. If fine print really worked that well every user agreement would include a we own your first child clause.

Since America does not currently have a functioning government I can understand thinking that Robinhood might get away with this - because they might. But by the same token no functioning government can be a double edged sword that turns against them.

Okay. Thanks.

I just saw a tweet about the first lawsuit against Robinhood for doing this. Pelosi has weighed in as has Warren and lots of people who are upset about the rich being targeted. I’ll post it in the EBs soon.

Was Humpty Dumpty pushed?

Here is the class action lawsuit

Was Humpty Dumpty pushed?

The basic tenet of corporate law is to act in the shareholder's

interests. This was acting against the corporations self interest in order to help others who were not customers of the corporation. It is an indefensible act by corporate law. Anyone remember that movie The Corporation? That legal imperative built into corporate law is the reason corporations are psychopaths.

No

I don’t remember it. And can you expand on your comment more? It’s interesting.

Was Humpty Dumpty pushed?

Actually it did make sense

after rereading it this am. But who are the shareholders that RH is supposed to be looking out for? It is not the people who use their app, but the hedge funds and Citadel comes into play there too. Saagar tells more about that.

Any new thoughts this am? I will admit that I am lost on a lot of the minute details with stocks and such, but I find this fascinating. They have cost companies their businesses for years while they shorted their stock and drove the prices down. If that isn't manipulation then what is?

Was Humpty Dumpty pushed?

How is that even remotely legal?

let me guess, there’s something buried deep in the terms you have to agree to for using the platform.

Idolizing a politician is like believing the stripper really likes you.

Some are asking congress to look at arbitration

and get it cleaned up once and for all. It’s so funny watching the reaction to this saga. Sides are being chosen and it’ll be interesting to see who’s on which side. I’m lol at the rich people attacking Reddit-ers.

Was Humpty Dumpty pushed?

Soooo...not so much "Robin Hood" as "Dennis Moore"

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

Dear (redacted) is getting a check for $535,185

I guess he can now pay the rent on his corner store. Maybe he can even buy some new tires for his 7 year old Toyota. A big win for the little guy!

On to Biden since 1973

I've been watching this guy

MeetKevin who has been live streaming this play out in real time.

[video:https://youtu.be/Dd0025SOSro]

C99, my refuge from an insane world. #ForceTheVote

Protest and resistance

don't have to be physical or violent. This is superb! Go people!

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Payback will be a bitch

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Hedge fund managers are petitioning congress

to raise the minimum wage to $50,000/hour and for sending out $2 million relief checks.

Was Humpty Dumpty pushed?

Relief checks retroactive to last March

Lol watch how fast congress reacts to this if they need a bailout.

Meanwhile our $2k checks still haven’t gone out to us. But look at how fast they can get the new cabinet seated. Lickity split.

Was Humpty Dumpty pushed?

Ah, well

The Empire Strikes Back. It always does. If it's any consolation, I will make a pee tape, if it's Nancy Pelosi that I pee on. I will stay hydrated anticipating the opportunity.

Can someone read this

And let me know where the guy is coming from? He’s saying that a lot of people that bought the stock yesterday will lose their shirts when the price falls. Which he says will because it’s over valued. It’s worth $29 billion, yet Best Buy is $23 billion so that makes sense.

https://www.businessinsider.com/the-gamestop-wallstreetbets-reddit-thing...

It sounds like now would be good to buy short stock, but I’m not doing it cuz I don’t understand the risks of investing, but I do need to learn.

Was Humpty Dumpty pushed?

Reno ain't that far from you

it's a gamblers game

Ha

I actually went to Bendover (Wendover) Thursday and passed all the big casinos and didn’t even think about going in. Probably thinking more about Covid than losing money. I’m trying Evanston next week. Prettier drive and not so far. But actually the Utah desert is very beautiful. I got quite a show driving home with the sun playing on the mountains and shining on the lake. There are sticks in the water that are very blurred.

Was Humpty Dumpty pushed?

In after hours trading

Gamestop has breached 340 a share...as of a few minutes ago

C99, my refuge from an insane world. #ForceTheVote

That's good news, but....

you're asking to take a loss at this point.

Any money someone uses to buy GME at this point is money they can kiss goodbye.

I just hope that they can kill a couple more hedgies in the process.

Oh, I wasn't advocating,

just making a note. I really like this MeetKevin live stream. He's at it again. Waiting on this guys who is supposed to d a twitch live stream with AOC. The CEO of Robinhood was on bloomberg channel he subscribes too, and the CEO guy at Robinhood, can't, or won't, answer direct questions... about why they stopped buy trading on these securities.

[video:https://youtu.be/w_YEa4XfAG4]

C99, my refuge from an insane world. #ForceTheVote

It’s down below 300 now

This seems like a good article, but what do I know?

https://lawandcrime.com/high-profile/law-prof-who-wrote-textbook-on-secu...

It’s the financial French Revolution...I hope. But powerful people are talking and taking action. Where’s the IRS in this saga?

Was Humpty Dumpty pushed?

It was at 17+

when this all started.

The shorts are gone for a moment. It's naked and likely to streak again.

I'm hoping that many thought the run was over and shorted it once again. They had the power of the wall backing them up by shutting things down for a day or two.

Now it's possible they're about to shit their portfolios again.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Okay most of that went over my head

I just read that after Robinhood let people buy/sell again the stock went up again to a higher amount. So if this company is that over valued then what happens? People have to sell to make money right? So they can all be millionaires, but only on paper. Right? But what happens when they do sell? Won’t people have shorted it?

Was Humpty Dumpty pushed?

The whole reason for this

was to fuck over the shorts. Some made a lot of money but most were in the game to show how ridiculous the market is. It was mainly a protest. And it was very successful.

When it was shut down, many rich ass wipes thought it was under control and again shorted the stocks that are being targeted. Unfortunately for them, the shutdown was a highly visible collusion amongst the ptb. Now an army of low volume traders have awakened to the game. For them making a fortune isn't a thought. Ruining fortunes is their play.

As I said before, I'm happy to be out of the game because there will be blood.

Hedge funds need to die.

They're immoral. They don't give a shit about anybody. They are our current government.

Hope that helps a little.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Crystal clear!

Thanks. I just read about what you said here. I think.

https://www.zerohedge.com/markets/7087-billion-reasons-why-exchanges-bet...

This explains why they took the action they did by restricting the stocks.

Was Humpty Dumpty pushed?

What do you think about this from the article

.near the end.

So that was highly illegal right? That those people called the brokers to tell them what to do. That is rigging the market. Right? And very, very naughty.

And I didn’t see the answer to this question:

Was Humpty Dumpty pushed?

Now is when we point out to our new libertarian allies

who love guns and interview with Jimmy Dore that "hey, these hedge fund managers have destroyed the free market system and are the money behind the bought out Dems and Repugs. If there's going to be a civil war, wouldn't they be your primary target?"

Just sayin'

You must not have read the part where GME had a new CEO

who was expected to buoy shares. He was turning to e-commerce. So Gamestop might not fold. The holders will keep holding because stocks ultimately go up so one day they will be worth selling. Even if you get caught holding them. You just can't let them go.

20 years from now, we'll be laughing at the gif of an old dude waving his hands saying "diamond hands! diamond hands!"

No I did read that

hence my question about what happens next. Will people need to hold the stock now that the short bets have most probably been replaced? Which you answered nicely. Thanks.

The article I excerpted says the same thing that Saagar did. RB exists to cover for the elite. There should be public hearings on what happened with this saga and new rules put in place to keep hedge funds from sinking businesses. The SEC knew damn well that people were coloring outside the lines and should have stopped that long ago, but of course they haven't.

What the GameStop saga and the capital riots have shown is that America is a banana republic where the ruling elite are above the law and the job of congress is to keep it that way. Pelosi loves to say that "No one is above the law INCLUDING the president" and that the press doesn't fall to the floor laughing their asses off just shows how captured they are. Of course presidents are above the law. So are governors that poison and kill their citizens and countless others. Including thos on the stock market boards.

Was Humpty Dumpty pushed?

Matt Taibbi weighs in on this:

Suck It, Wall Street

Wall Street periodically goes through gambling frenzies and tosses out market fundamentals because in the short run they profit handsomely. Then sectors of or the total market collapses. Wall St is now as hooked on bailouts as DC is hooked on borrowing and spending (for the benefit of Wall St).

Spot on

That is why the CEOs going on TV to whine about this is so damn hypocritical. They have been rigging the market for probably ever and when someone catches them at their game, they whine to the authorities to shut them down. But not one company, including Delta Airlines had to sell their stock or find other ways to stay in business after the epidemic hit. Oh no instead they got the guv to bail them out bigly in just a few days. Meanwhile we got $100 a month from them and told to get back to work. And do not spend that money rigging the stock market. That is what the owner's job is. Leave it alone.

Was Humpty Dumpty pushed?

Not quite:

Trying to rig the markets is very old (South Sea Company -- circa 1715 - a political/private joint venture), but they tend to collapse relatively quickly. What finally put hard to take off handcuffs on the financial crooks were the New Deal financial regulations (a few solid ones predated that) combined with a steep progressive income tax. For over forty years (a relatively long time in bank/financial markets), there were few collapses. Then came the "Reagan Revolution," a bipartisan and so far four decade project to prove the New Dealers wrong (and increase the wealth of the wealthy). What a shame voters never bothered to take note of the diminishing purchasing power of their income/savings and link it to all the deregulation and tax cuts. Also a shame that those voters that participated in the ripoffs aren't the same as those that will pay the largest price for an economic collapse.

I have noticed

the dollar I gave to the SSA in the sixties

is worth about a dime now, maybe a nickel

tax cuts and wars mean nothing when your

govt. guaranteed retirement is practically worthless