The Recessionary Storm Warnings

There is a recession coming.

This isn't a controversial statement, because unless you believe that we've solved the problem of the business cycle in capitalism then another recession is inevitable.

A recession will happen sooner rather than later.

This also isn't very controversial because we've already had the third longest economic expansion in American history, so unless you believe that this time is different then history tells us that we are approaching the end of the expansion.

The question is 'when', not 'if'.

There are many ways to measure the probability of a recession in the coming year. Citicorp estimated a 65% chance of recession this year, but most other economists estimate the chances to be much, much lower.

Either way you slice it, economists can't be trusted. Most of them were denying the chances of a recession in 2008, months after the recession had already started.

As you can see, even in the third quarter of 2008, the best models we have missed the big recession entirely.

Economists didn’t just fail to see that monster recession; they routinely fail to see economic events coming.

While that is discouraging, it doesn't mean that there aren't useful and easily accessible items that we can use to see a recession coming. It's more of a case of giving it weight or not.

For instance, corporate earnings are a pretty good indicator. Less earnings generally mean less employment and investment. So how are corporate earnings doing?

The report also showed that corporate profits dropped in 2015 by the most in seven years.

Friday’s report also offered a first look at corporate profits for the period. Pre-tax earnings declined 7.8 percent, the most since the first quarter of 2011, after a 1.6 percent decrease in the previous three months.

Profits in the U.S. dropped 3.1 percent in 2015, the most since 2008. Earnings are being weighed down by weak productivity, rising labor costs and the plunge in energy prices.

“If profits remain depressed, the prospects for capex and hiring will come under greater pressure,” Sam Bullard, a senior economist at Wells Fargo Securities LLC in Charlotte, North Carolina, wrote in a research note.

Corporate outlays for equipment declined at a 2.1 percent annualized pace, subtracting 0.12 percentage point, the Commerce Department said.

So that obviously sounds bad, but is it bad? Yes, it is bad.

history shows that when profits fall, the economy often follows them downwards. An earnings hit of the size that JPMorgan says is taking place has led to a recession within three years about 90 percent of the time.

And because corporate earnings have deteriorated so much, corporations have gone to great lengths to mask the bad news.

However, no matter how much book juggling they do, when the company is broke, it is broke.

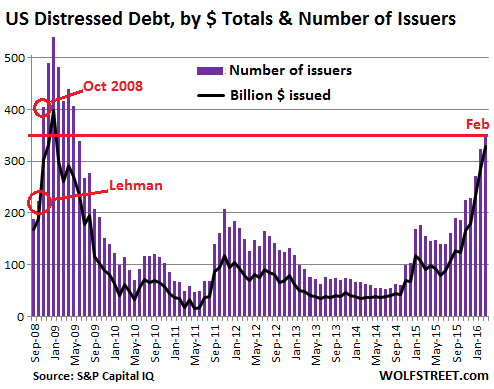

Standard & Poor's, via a report by S&P Capital IQ, just warned about US corporate borrowers' average credit rating, which at "BB," and thus in junk territory, hit a record low, even "below the average we recorded in the aftermath of the 2008-2009 credit crisis."

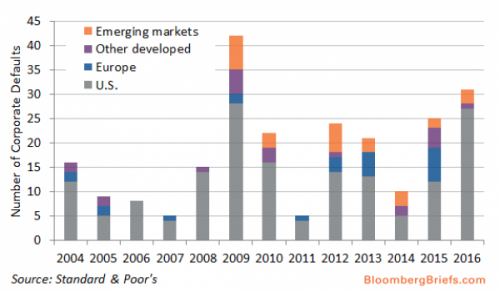

The one-year average default rate for US companies with a credit rating of B- is 9.8%, according to Standard & Poor's. That's a 1-in-10 chance that the company will default over the next 12 months. Companies getting downgraded deep into junk and issuing more low-grade bonds are precursors to soaring defaults.

A deterioration in the credit markets for marginal corporate borrowers has traditionally been one of the best predictors for the economy. Which is bad news.

It isn't just junk bonds. The collateralized loan obligation market has completely frozen up.

Once corporate income starts to fall across industries, "it’s rarely temporary".

The next thing to ask is "why are corporate earnings dropping so much?"

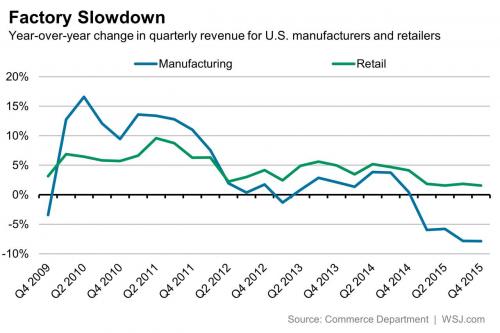

That can be answered in just two charts.

Sales are going down, and they can't unload what they are producing. Traditionally that means production cutbacks, which to workers means "layoffs".

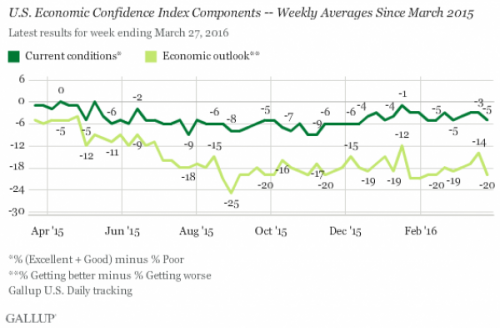

So why can't they sell the product?

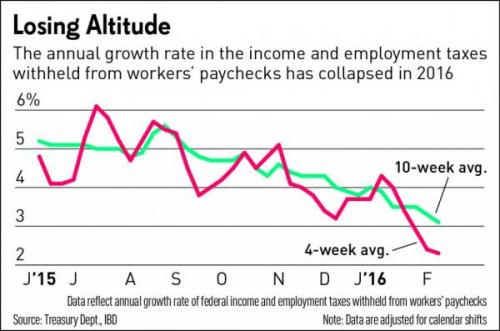

I refer that question to this chart.

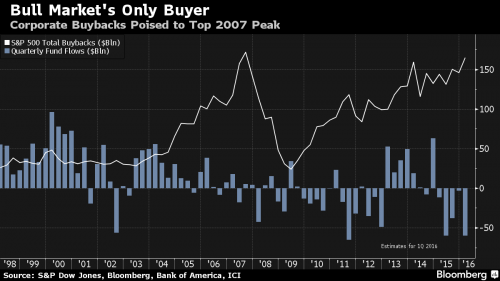

Now some will dismiss all this and point to the stock market as the great historical predictor. I would challenge that assertion in a normal market, but this is far from being a normal market.

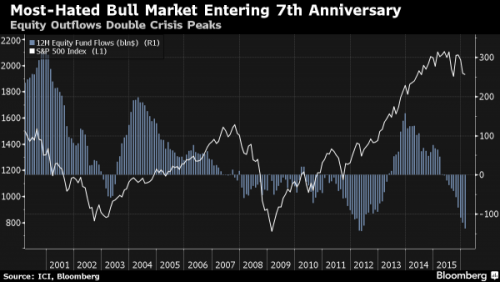

Is the stock market going up because regular people are buying stocks? No. Regular people are selling stocks. A lot of stocks.

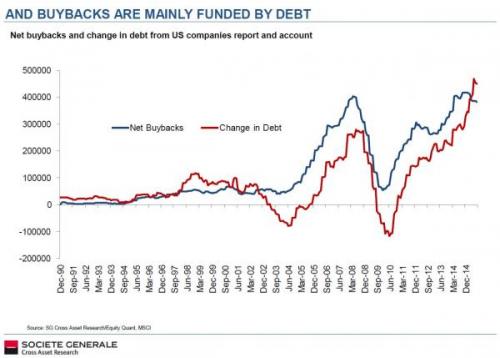

Then who is buying stocks? Companies are buying their own stocks, and going into debt to do so.

“Anytime when you’re relying solely on one thing to happen to keep the market going is a dangerous situation,” said Andrew Hopkins, director of equity research at Wilmington Trust Co., which oversees about $70 billion. “Over time, you come to the realization, ‘Look, these companies can’t grow. Borrowing money to buy back stocks is going to come to an end.”’

So are stock buybacks a good investment? No. Stock buybacks are not a good investment

The companies losing money on these bets are down a collective $126 billion over the past three years, a decline of 15 percent.

Many corporations would have been better off investing that cash in an index fund instead of their own stock. The overall market rose 39 percent over the same period.

No matter how you cut it, it appears that corporate health is deteriorating and that layoffs are inevitable unless things turn around immediately.

When does the recession hit? We may might already be in it. Or it may hit soon. Or it may wait until next year to hit.

But it is very unlikely that the recession can be pushed out past 2017.

If I was to make a guess, I would say that the recession hits this year, but they don't declare it until we are past the election.

Comments

Let's see if people can take their eyes off the horserace

long enough to see something big coming their way.

I have my doubts.

I dropped this on GOS

I'm curious if anyone will even care about a diary that doesn't talk about Trump, Hillary, or Bernie.

I think the politicians know that the word "Bailout"

is political poison this time.

But you know it will be coming in fact if not in word. The question is can they keep the people quiet about it this time?

There's a finite number of euphemisms that you can use before they're just freaking obvious.

I do not pretend I know what I do not know.

There won't be a government bailout the next time

It's going to be a bail in just like what happened in Greece.

It was written in to the last omnibus bill that the banks will be able to take depositer's money.

And since the banks know that people won't want their money used to bail out the banks, many wil withdraw their money and keep it at their homes. The banks don't like that and neither does the irs because they can't keep track of people's money and can't be sure if they are reporting their money accurately.

So to get around this, they want to go to a cashless society. There are a few countries in Europe that are trying this out now.

Do a search for 'cashless society' and read up on the topic.

The message echoes from Gaza back to the US. “Starving people is fine.”

Credit unions!

Would credit unions be safe at least?

This shit is bananas.

I am not sure

But I do know that all of the big banks are on board with taking your money. Hell, they wrote the damned bill for congress to pass.

But I do think that CUs are a safer bet.

Do a search for the bail in and see what it says and if CUs are included.

The message echoes from Gaza back to the US. “Starving people is fine.”

you mean the one we are in will deepen

because things have been fucked for some time now.

and really, tell me how i could have fallen for Paul Krugman's bull??? it was funny, as Krugman continually praised Obama's economy and I thought, wait, what?

oh well.

“There are moments which are not calculable, and cannot be assessed in words; they live on in the solution of memory… ”

― Lawrence Durrell, "Justine"

Think 1937

It's a recession within a depression

Conceptually yes.

I would argue that by 1936 a number of metrics indicated the Depression was over. Today, Mortgage backed Credit Default Swaps, the contagion of 2008 are still around. The fundamentals of collapse are still with us.

The fundamentals of a more stable economy have been torn down, From 1938 to 1988 recessions were shorter and shallower, none longer than 11 months, none more than -2% GDP.

Remember, prior to 1930 recessions occurred something like every 4.7 years, 28 of 31 downturns saw unemployment and GDP peak to trough of 15% to 33%. None lasted less than 12 months.

FDR 9-23-33, "If we cannot do this one way, we will do it another way. But do it we will.

Another problem is going to be

The high interest car loans that are being bundled and sold.

gj did a diary on this IIRC, a few weeks ago or I read it on another site.

I will see if I can find the article

Then there's the trillions in student loans that are going to come in to play.

The message echoes from Gaza back to the US. “Starving people is fine.”

It's not like I've been stalking

Krugman but he was highly critical of Obama during the bailout and stimulus "debates". Krugman was right and the administration dreadfully wrong. Well, unless your plan's purpose is to protect banks, banksters, and the extremely wealthy. The pod people seem to have dragged Krugman off for re-education or replacement the past couple of years as he's suddenly becomealmost pleased with the Obama economy. Not one fucking thing has actually changed, of course, except a slightly larger segment of the population has less economic suckitude in their lives. More people are employed but still can barely survive much less help drive a service economy with their spending.

I don't see as many people buying the BS of '08-'09 when it all goes to shit this time. The casualties will be higher up the food chain. Earnings of the highly educated/skilled are already falling in this economy. The elites will lose their Praetorian Guard's loyalty if that segment starts to hurt too much. Regrettably, more suffering higher up the food change, with accompanying really bad juju down in steerage, may be the only way to break out of the cycle. CEOs and upper management jumping out of high rises would be a good indicator we're ready for a revolution.

"Ah, but I was so much older then, I'm younger than that now..."

If you are looking

at the stock market for economic predictions you are looking in the wrong place. Buybacks and dividends are being funded out of debt in part to avoid repatriation and the tax hit that would result. See Apple - which I don't think has a cash flow problem

New Deal Democrat (whose record since 2006 is damn near perfect) is close to being on a recession watch for Q4 this year and 2017.

Via e-mail he writes: "The data is extremely close. Only 2 of 8 indicators -- the yield curve and real money supply -- are unambiguously positive now. The rest are slightly, or firmly, negative."

I generally don't agree with gjonsit about economic predictions. But if he and NDD begin to see the same thing I would pay attention (NDD is not there yet)

I respect NDD's chart reading

Both NDD and I predicted the 2008 crash.

Where we parted company was shortly after. I expected a double-dip recession. NDD didn't. He was right. I was wrong.

But the story doesn't end there.

We were looking at two different things. I was looking at the economic fundamentals. NDD was looking at the indicators.

My mistake was underestimating the size and effect of the Fed. A mistake I've learned from.

NDD also made the mistake of not looking past the traditional indicators. That's why he expected a V-shaped recovery, and it took him years to recognize the fact that wages simply weren't coming back.

I could be wrong, but I still don't believe that NDD has recognized the significance of the Fed's manipulation.

In fact, I don't believe that most people even recognize that global central bank policy is still in DefCon1 status, eight years later.

In 2014 I predicted a 2016 recession. About four months ago NDD said that a recession was not on his radar.

NDD can read a chart with the best of them. But as far as I can tell he isn't all that interested in economic theory.

Normally econ theory wouldn't be important, but in these days of massive global QE and NIRP we are no longer in normal times. The markets no longer reflect real prices.

For example, the unemployment rate is under 5%. In a pre-2008 world that should translate into strong wage inflation. But that isn't happening.

Some time after the next recession hits, things are going to start breaking in unexpected places. Chart reading is going to become less dependable and more difficult.

I wish I could be more specific, but I don't have a crystal ball.

Worse

and out of tools. Interest rate manipulation has run its course by bumping up against the lower bound, 0%. Practically the only way out is a massive infrastructure rebuilding program driven with printed money and financed with low interest rate debt, all of which is beyond the Fed's power. It's the same stimulus that Obama rejected in '08-'09. Somehow the party of no and the candidate of nope would gladly watch the country burn down first.

"Ah, but I was so much older then, I'm younger than that now..."

It is worse

You've got that right.

I've seen them starting to talk about helicopter money, as if its a real possibility.

The central bankers have gone mad.

Helicopter Money???

Could you explain what that means for us econ knuckle-draggers out here?

And while you're at it, what about this bail-in thing mentioned up thread? That sounds mighty illegal to me. Not to mention scaring the crap out of me.

Meddle not in the affairs of Dragons - For thou art crunchy and good with ketchup

A Socialist in the White House

would at least push for infrastructure spending to jump-start the national economy. It's what we needed, but didn't get, with the original stimulus -- one-third tax cuts didn't have a strong stimulative effect. Of course, we need a left-leaning Congress to actually send the bill to the President in the first place.

If Hillary get in, her advisers will take one look at the size of the national debt (18 trillion!) and start screaming for austerity, regardless of what the economy actually requires. While we won't become Greece, because the dollar is, for right now, the currency of record, it won't be pretty.

littlevoice

who is NDD? gjohnsit provide a link

Is NDD another name for bondad?

The Bonddad Blog

If if is bondad, that was another person who got their start on dailykos

thanks

New Deal Democrat

a close friend of Bonddad (or sock-puppet, who knows?).

my hunch it is bonddad

I followed some of the links on the web site

http://bonddad.blogspot.com/

That site mentions a book that he wrote.

I went back to dailykos and searched for user bonddad

He posted a diary on dailykos June 13, 2013

Shadow Insurance Explained

And in that diary he says

I followed the link to his website and get the company

HS Captive Management WHERE FINANCE, ECONOMICS AND LAW MEET

and this goes around the circle another time

this, Bonddad on dailykos is the same person with The Bonddad blog and is the head of a company that provides info on "captive management" kind of insurance

Well thanks, but no thanks. He has made an argument.

With support.

You have not. 'NDD something something' does not cut it.

I will stick with ghonsit on this.

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.

Mosler: January spending revised downward, February anemic.

Warren Mosler has this post up today.

Paraphrasing here:

Sales drive capitalism, but January's rosy spending report of +0.5% M/M, just got revised down to +0.1%. February came in at +0.1% too. That's pretty weak.

February Personal Income was up 0.2% M/M, but that was due to transfers (more poors getting assistance) and rents (the rich getting richer). Salaries and wages were down 0.1%.

Whether or not we call it a recession, it's still a pretty crappy economy for all but the top Quintile.

If you plant ice, you're gonna harvest wind. -R. Hunter/J. Garcia

What worries me,

is the Citi Group amendment that was added in Dec. of 2014, which gutted the Dodd Frank Bill, that Mrs. Clinton loves so much.

From Wall Street on Parade:

Snip

From ThinkProgress:

2 million a day lobbying congress. Let that sink in. That is fucking sick. Now, think about this. Who has received lots, and lots, and lots and LOTS of campaign contributions over her career, from employees, top employees of Citi Group? Hey, who would thought, but Citi Group is the #2 contributor to Hillary Clinton's Senatorial career.

When the shit hits the fan, as this essay indicates it's not a matter of if, but when, (which I agree) what we experienced in 2008 will be nothing compared to what's coming down the road. The Citi Group amendment is the very mechanism by which the banks will get their bail out money.

I fear another bailout because social order might just break under the pressure. Millions have already been devastated by the 08-crash and have not recovered, nowhere near previous levels. It would be like pouring gasoline on a fire to the radical right, Tea Party militia types. They hate democrats, libatards and especially Obama. If a democrat is in office, I think we can count on a few disturbances here and there. If Trump or Cruz is in office, I expect social order to collapse at the state and federal levels.

I could just be a cynical pessimist, pissed off at the world for being so fucked up and I can't snap my fingers and fix it! (lol)

GO #BIRDIESANDERS, #BERNIESANDERS

C99, my refuge from an insane world. #ForceTheVote

By coincidence

I found this article today in my travels that has a similar prediction: HARRY DENT: Civil unrest is coming to America He seems to believe that the bubble will burst mid-2016 and last for a very long time.

I did not bookmark the article particularly for that information but because of his information about the middle class and angry people. I think I will go watch Mad Max or similar to see if I can pick up some survival skills.

We are what we repeatedly do. Excellence, then, is not an act, but a habit.--Aristotle

If there is no struggle there is no progress.--Frederick Douglass

Third longest economic expansion? For whom??

You couldn't prove this under my roof! I support four adult relatives who hold 3.5 bachelor degrees and 1 masters degree. Two of these have part-time jobs while the other two can't get interviewed. If I wasn't bringing home a good union wage, we'd be in terrible shape economically no matter how high the Dow goes.

I'm coming around to the idea that those on the inside of the markets use recessions and other economic reverses as a means of running out their competition, much like the Saudis have been doing to the frackers for the past year. Once your competition is broke and out of business, you swoop in and take the good stuff for a pittance. Thomas Edison was a master at this, until JP Morgan showed him how the game is really played!

It's clear that the vast majority of human life on this planet is deemed surplus by such folk, and they aren't shy about wanting to rid the world of the rest of us if they can manage it. Manipulating wealth toward this end is but the beginning of a very ugly era in world history.

Vowing To Oppose Everything Trump Attempts.

Edison and J.P. Morgan

....... fucked Edison over the same way Edison fucked Tesla, Westinghouse, and the rest of us over!

Thank Cat for Teddy Roosevelt and the Trust-Busters!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

grooooaaaannnnnn!!

another dupe reply, apologies!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Disaster Capitalism

Naomi Klein. Get a copy and read it if you haven't. A version of this has been around a very, very long time. The "industries", trading posts chartered by the US government, of early 19th century America are a form of it. The basic ingredients were:

1. Sell essential goods unobtainable from anywhere else.

2. Easy credit

3. Demand payment with land when Native Americans could repay loans.

4. Call in the army if they refuse.

5. Rinse & repeat.

This is what fueled the great US expansion west. More has been stolen from people by businesses and lawyers taking advantage of disasters, intentional and bad luck, than all the armies that ever existed could have every plundered.

"Ah, but I was so much older then, I'm younger than that now..."

The top 10% are doing fine

The working class, not so much.

If we separate the fossil fuel industry

out from the rest of the economy, are we still in negative territory? How much of the defaults, corporate bankruptcies, layoffs, etc., are concentrated in the Global Warming Industry, which has been hit hard by low oil and natural gas prices?

The marriage between capitalism and democracy is over. –Slavoj Zizek