News Dump Friday: China Bubble Edition

Submitted by gjohnsit on Fri, 03/25/2016 - 10:19am

China's debt is going parabolic: the typical stage of a bubble right before it pops

Total credit to the Chinese private non-financial sector stood at $21.5 trillion at the end of September 2015, accounting for 205% of the country's gross domestic product, according to the Bank for International Settlements.

In Japan, the figure accounted for more than 200% of the nation's GDP at the end of September 1989, when the country was in the late stage of its economic bubble.

In the U.S., the boom in subprime housing loans for low-income borrowers evolved into a global financial crisis in 2008. At the end of September that year, total credit to the U.S. private sector reached its peak, accounting for 169% of the country's GDP. It took U.S. banks about four years to overcome their bad loan problems.

And now in China, the outstanding amount of total credit to the private sector has surged 300% from the end of December 2008.

Not since 1999 have China’s companies had so much trouble getting customers to actually pay for what they’ve bought.

It now takes about 83 days for the typical Chinese firm to collect cash for completed sales, almost twice as long as emerging-market peers. As payment delays spread from the industrial sector to technology and consumer companies, accounts receivable at the nation’s public firms have swelled by 23 percent over the past two years to about $590 billion, exceeding the annual economic output of Taiwan.

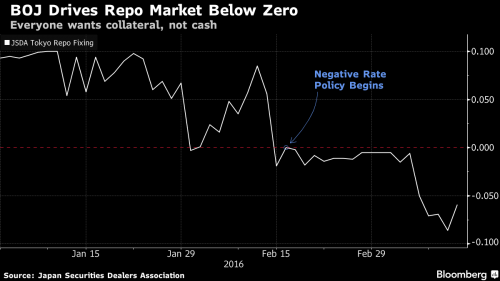

Japan's bond market is breaking

Signs of stress are multiplying in Japan’s government bond market, which is crumbling under pressure from the central bank’s unprecedented asset-purchase program and negative interest rates.

Bank of Japan Governor Haruhiko Kuroda has repeatedly said his policies are having the desired effect on markets, including suppressing JGB yields. His success is driving frenzied demand for longer-dated notes as investors avoid the negative yields offered on maturities up to 10 years. And as buyers hang on to debt offering interest returns, the BOJ is finding it harder to press on with bond purchases of as much as 12 trillion yen ($106 billion) a month, sparking sudden price swings leading to yield curve inversions that have nothing to do with economic fundamentals....

Yields on 40-year JGBs dipped below those on 30-year securities Tuesday, and a BOJ operation to buy long-term notes last week met the lowest investor participation on record.

“It wouldn’t be surprising to see some BOJ operations fail,” said Yusuke Ikawa, a salesperson at UBS Group AG’s Knowledge Network in Tokyo. “The biggest risk of that is in superlong bonds.”

A dearth of liquidity has driven a measure of bond-market fluctuations to levels unseen since 1999.

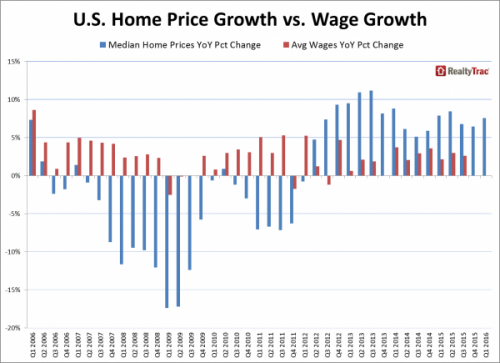

The NAR are perma-bulls on housing, so this statement should raise a few eyebrows.

"The overall demand for buying is still solid entering the busy spring season, but home prices and rents outpacing wages and anxiety about the health of the economy are holding back a segment of would-be buyers."

Just a month ago he said this: "Home prices ascending near or above double-digit appreciation aren't healthy – especially considering the fact that household income and wages are barely rising."

That much honesty from the NAR is unusual.

The report also showed that corporate profits dropped in 2015 by the most in seven years.

Friday’s report also offered a first look at corporate profits for the period. Pre-tax earnings declined 7.8 percent, the most since the first quarter of 2011, after a 1.6 percent decrease in the previous three months.

Profits in the U.S. dropped 3.1 percent in 2015, the most since 2008. Earnings are being weighed down by weak productivity, rising labor costs and the plunge in energy prices.

“If profits remain depressed, the prospects for capex and hiring will come under greater pressure,” Sam Bullard, a senior economist at Wells Fargo Securities LLC in Charlotte, North Carolina, wrote in a research note.

Corporate outlays for equipment declined at a 2.1 percent annualized pace, subtracting 0.12 percentage point, the Commerce Department said.

Comments

Deja Vu Redux

I was one of the "bubble heads" that were openly mocked during the run-up to the real-estate bubble between '05 and '08. At one point someone got me to call a mortgage broker "just so you can see what you could buy". I already knew my absolute ceiling in the SF Bay area was an already unrealistic (in late '05) 550K, because I'm a researching fool whenever I did my toes into the (relatively) unknown to me.

The mortgage broker unwittingly pushed me into the "OMG there IS a bubble" camp by telling me, with a straight face, that I could afford a home up to 1.1 million dollars.

Seriously, the woman tried to convince me to basically bankrupt myself with what was likely an "interest only" loan with a killer bubble payment.

When I heard about the real estate rush by the Chinese, all I could do was shake my head.

Just another refugee from the Daily Chaos.

gjohnsit, please check.out

my comment to your Monday News Dump.

Thanks.

Only connect. - E.M. Forster

IF it pops before 11/08

...things will get *really* interesting.

******************************

Muerte al fascismo. Muerte a la tiranía. colapso total de los que promueven tampoco. A la pared con el unico porciento%