Recession and the global economy

The next recession won't be like the last recession.

Just like the old saying about generals prepare to fight the last war, this is why most people will be caught off-guard.

The last recession originated in the subprime housing market in the United States. The next recession will likely not originate in the United States at all.

Five big economies are at risk of recession. It won't take much to push them over the edge.

The British economy shrunk in the second quarter, and growth flat lined in Italy. Data published Wednesday show Germany's economy, the world's fourth largest, contracted in the three months to June.

"The bottom line is that the German economy is teetering on the edge of recession," said Andrew Kenningham, chief Europe economist at Capital Economics.

Mexico just dodged a recession— usually defined as two consecutive quarters of contraction — and its economy is expected to remain weak this year. And data suggest that Brazil slipped into recession in the second quarter.Germany, Britain, Italy, Brazil and Mexico each rank among the world's largest 20 economies. Singapore and Hong Kong, which are smaller but still serve as vital hubs for finance and trade, are also suffering.

Notably Brexit and Italy's debt crisis is happening exactly at the wrong time for Europe, while the European Central Bank is out of ammo.

Singapore is in recession, South Korea's economy has stalled, while China is slowing.

Brazil narrowly avoided a recession, but Argentina is in full-fledged meltdown and looking to default again.

So what's that got to do with the U.S. economy? A lot.

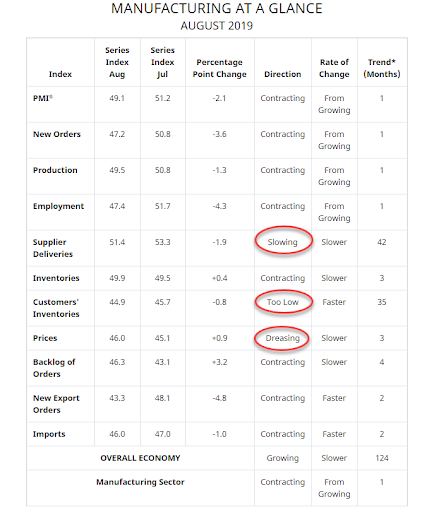

Notice the collapse in export orders.

That alone has pitched the U.S. manufacturing sector into recession.

U.S. manufacturing activity contracted for the first time in three years in August, with new orders and hiring declining as trade tensions weighed on business confidence, which could renew fears of a sharp economic slowdown.

You've probably heard about the inverted yield curve, but there is a whole list of other indicators that are flashing.

More telling, the wealthy have stopped spending.

Because there are so many geopolitical factors, plus an unprecedented global bond bubble, it's extremely difficult to predict how this is going to play out.

The only things I can say for certain is a) it's coming, and b) it'll be different.

Comments

meanwhile, gold is extending it's run

and now it's pressing on a long-term resistance level from 2013

The amazing part is that gold is rallying in the face of a stronger US Dollar.

Normally gold moves opposite the dollar.

Dean Baker says no recession for 2020 -- Contrarian View

http://cepr.net/blogs/beat-the-press/no-recession-for-2020

Dean goes on to say that the non-cyclical type of economy predominates our economy now, when it hasn't in the past, and thus our economy will not be affected this time as much as in the past -- hence no recession -- or not much of one. But he does say that unemployment will rise some, and lay offs will affect those who are the first to be laid off in a downturn. It will definitely suck for them.

Just a contrarian point of view.

If Dean is right

It will only prove that our definition of "recession" is useless.

If people can't afford rent, food, and medical care then "recession" has become the same as "depression".

When you are unable to work

It is always a depression for you even if times are great for nearly everyone else.

Not saying you're wrong - you're right - but

China's finally started to admit that their economy's been a Potempkin village for 20 years. Saying that Argentina is melting down is like saying that today's Tuesday. Italy? They haven't grown since they joined the EU. For every economic claim that "Trump's a Nero" there's a government stat that says he's a genius - for every chicken little there's a liar. Brexit won't be half as bad as the neocons and the neolibs and the globalists and the chicken little leftists claim, even though they will try their damnedest.

Germany is serious, but it's also self inflicted. It's a banking crisis caused by corrupt men having too much money to play "how many countries can we bring down" with.

The ultimate problem is that without a counterbalance capitalism is nothing but corruption and stupidity. The fall of the USSR took away that counterbalance. 2000 was stupidity, 2007 was corruption. We were warned.

On to Biden since 1973

Yes this time it will be different

Not sure why even tptb think it won't?

theburningplatform.com

No one blinks an eye at $22 trillion in debt, trillion dollar annual deficits, 0% interest rates for ten years, $17 trillion of negative interest debt in the world, retro-active adjustments to GDP and savings rate calculations to make them more positive, 40% of the working age population not working – but unemployment reported as 3.7%, inflation reported at less than 2% when the average person experiences inflation in excess of 5%, corporations using their billions in tax cuts to buy back stock to boost their stock price, a military waging undeclared wars across the globe, an out of control surveillance state monitoring our communications, media companies using propaganda and censorship to push their new world order agenda, and $200 trillion of unfunded liabilities that cannot be honored.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley