The Summer Of The Unicorn Massacre

Unicorn: a term used in the venture capital industry to describe a startup company with a value of over $1 billion.

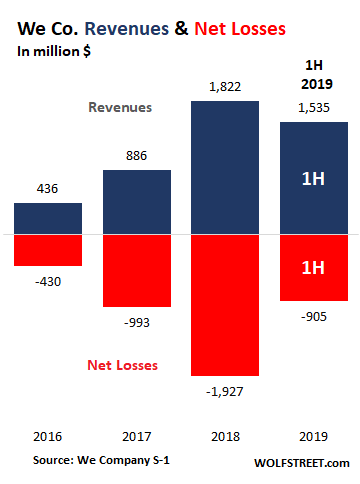

WeWork is the latest tech startup to file for IPO, and even the financial media couldn't take it seriously.

There are so many bizarre things about this company (such as "WeWork founder Adam Neumann and his wife Rebekah will give $1 billion to charity. If they don’t, their voting rights in the company will be diluted") that the fact of the company losing money hand-over-fist almost gets forgotten.

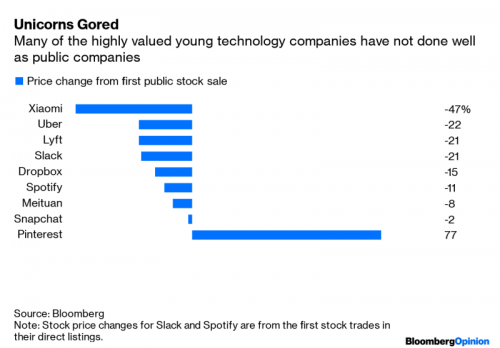

WeWork isn't some isolated case. It's just the latest and most extreme.

A good example is Uber. In May it was the largest IPO in history.

Last week Uber reported that it lost $5.24bn in the last three months, its largest-ever quarterly loss. That's more than the yearly GDP of Fiji.

Yet no one seems to be phased by such staggering losses.

I'm not going to talk about Uber’s losses here, even though the amount of money the company loses (its operating cash flow was -$1.6 billion in Q2) is astonishing. Everyone knows Uber loses money. At this point, the amount of money you’re able to lose seems to be a point of pride in Silicon Valley.

How is that anything but a flashing warning light?

“As we aim to reduce Driver incentives to improve our financial performance, we expect Driver dissatisfaction will generally increase.”

- Uber’s latest 10-Q, page 63

Wall Street and Silicon Valley tell us not to worry about the short-term losses, but the fact is that most unicorn companies are still losing money five years after their IPO.

It makes me wonder, how is this not a massive misallocation of resources, and a mismanagement of the economy?

Money that could be used to make the lives of millions of workers better through being rewarded in wages, is being flushed down the drain in money-losing gambling.

Isn't this just proof of a major flaw in capitalism?

Comments

It was twenty years ago today...

Well, almost.

Do you hear what I hear? What I hear is an echo. It's the echo of the Dot Com Bubble Burst. I keep wondering what will precipitate the next tumble. Maybe they won't start it, but if nothing else, these unicorns will burn nicely in the coming fire.

One thing that amazes me as much as anything is the Dow. I can remember when it went over $1000. It wasn't all that long ago, and it took 76 years for it to get there. Look at it now. Can we all say "overvalued?" Or perhaps it's that the dollar is that worthless now. Dunno. Maybe both.

Being as cynical as I am

It sure looks like that is exactly what is happening, but I wonder if it's not being done intentionally for some nefarious reasons we don't understand?

As for Adam and Rebekah giving a billion to charity, is that anything like what

Gates, Soros and others are doing? Except that they aren't actually supporting charitable organizations they are parking the money in their private foundations. This is a great way to get away with having the money taxed.

The ideal subject of totalitarian rule is not the convinced Nazi or the dedicated communist, but people for whom the distinction between fact and fiction, true and false, no longer exists.

~Hannah Arendt

pardonnez-moi

Pardon me, snoop, but don't you mean "This is a great way to get away with having the money not be taxed"? Or am I misunderstanding you?

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Yeah

Poor sentence structure. This happens on bad hair days. I knew what I meant though...

The ideal subject of totalitarian rule is not the convinced Nazi or the dedicated communist, but people for whom the distinction between fact and fiction, true and false, no longer exists.

~Hannah Arendt

Shudder...

Made me think of an oft spoken barb from my ex-wife: "You're not supposed to listen to what I say! You're supposed to know what I mean!"

I did mention "ex," right?

lol

Sorry to have brought up bad memories for you. I wish I could blame my mistakes on auto correct, but it corrects words not sentences. So yeah just read what I intended to say and not what I did.

The ideal subject of totalitarian rule is not the convinced Nazi or the dedicated communist, but people for whom the distinction between fact and fiction, true and false, no longer exists.

~Hannah Arendt

All good.

No worries. I've been married for 14 years to a wonderful woman who makes me forget about the past. Effortlessly, naturally.

psychO

My response to that kind of thing runs something like this: "Goatdammit, I'm not psychic, I'm psychO!"

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

I could see an over-charge kick-back scheme

Hey supplier, sez CEO, we ain't in the black anyway, so go ahead and over-charge us by 20%, keep 5% for your troubles and kick-back to me the other 15points. In a billion dollar outflow, ain't nobody gonna notice.

Compensated Spokes Model for Big Poor.

free enterprise vs. capitalism

Sure is.

And it also accentuates the difference between capitalism and free enterprise. (Capitalism is what free enterprise deteriorates into.) Under free enterprise, better wages mean more goods and services get purchased, which rewards wage payers through higher profits; rinse and repeat. (Henry Ford, among others, grokked this.) Under late-stage capitalism, the Casino is everything, resulting in money being, well, "flushed down the drain in money-losing gambling".

Guess which one we have now!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

The unlinking of executives' pay from their performance

translates into huge short term rewards for a handful of parasites at the top. They don't care if they kill the host company as long as they each get their pint of blood first.

These charts reflect the company finances, but I am pretty certain that the personal finance charts of the top decision-makers look quite different. That's messed up.

Pay is linked to performance, but it's STOCK performance

So, juice the stock, misrepresent facts, get that huge bonus and maybe a golden parachute on the way out.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Yep. Exactly.

If a company makes too much, Wall St. hammers it

as "mismanaged." Those are funds that should be going to increase shareholder value through stock buybacks, according to the current business model. That's SOP for most listed companies these days.

In 2018, buybacks amounted to more than a Trillion dollars in stock trades - all of which went to increase share prices, broker commissions and stock option bonuses for company execs. That came out of operating profits that, as you said, might have otherwise gone to improve and increase production, wages and jobs creation.

Perverse, unless you're a shareholder, broker, or executive who gets most of his compensation in stock options that aren't even immediately taxable.

Buybacks were illegal as a form of stock price manipulation until the Reagan Administration deregulated them.

Self-delete. Dupe.