Recession 2020

There is a chance that the recession won't wait until next year to hit, but there is almost no chance that we won't be in a recession in 2020. A whole list of economic indicators are flashing red, starting with the most accurate recession forecaster of all - the yield curve.

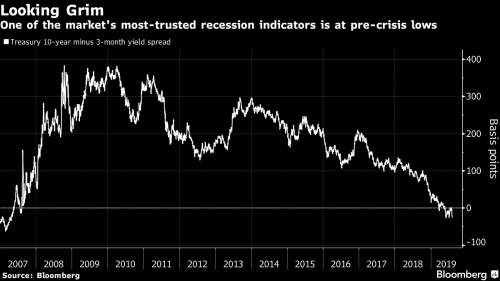

The latest eruption in the U.S.-China trade dispute pushed a widely watched Treasury-market recession indicator to the highest alert since 2007.

Morgan Stanley says Trump's trade war could cause a recession in 9 month's time, but there is a lot else going on than just a trade war.

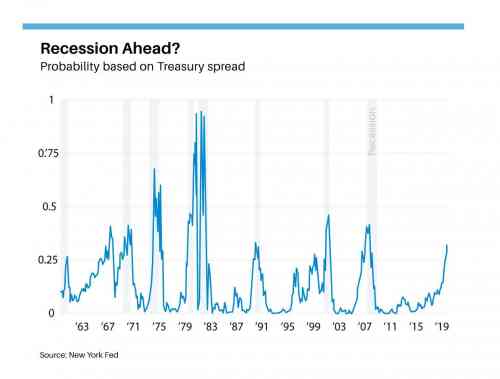

The yield curve is just one of four major recession indicators that are flashing red.

Since the 1960s, one indicator of a looming recession has been the New York Fed's recession probability index breaking 30%.The probability of a U.S. recession predicted by the treasury spread hit 32.9% in July—the highest since 2009, according to the New York Fed.

...

Although consumer confidence is still historically high, the most recent June consumer confidence index (released by The Conference Board every month) dropped to two-year lows, to 121.5.

...

For Morgan Stanley Wealth Management's Shalett, the most recent economic reports show "slowing that is far worse than the 2015-2016 minirecession," she writes—due in large part to "outright contractionary" PMI (an indicator surveying purchasing managers at businesses) data and global new orders.

...

According to a Reuters report in May, factory activity dropped to near 10-year lows, sparking fresh concern.

The U.S. has seen its longest economic expansion in the nation's history - 120 months.

The Fed had to know that it would eventually end. Yet the Fed never came even close to normalizing interest rates and that leaves them with few options.

The Fed’s main recession-fighting tool has long been lowering the benchmark federal funds rate, which governs short-term rates for things ranging from auto loans to credit card charges. In the past, the average reduction needed to fight a recession was a whopping 5.5 percentage points. Such a bold step is mathematically impossible now.

The Federal Open Market Committee, or FOMC, its policymaking arm, just decreased the rate a quarter-point to a 2.0% to 2.25% band, thus not a lot of room exists to cut much more. And if the Fed ends up decreasing the rate another half-point, as many suspect it will, then the central bank has even less to work with.

“They’re out of ammo,” said economist Gary Shilling, who owns his own eponymous firm. “Going from 2.25% to zero is not an awful lot.”

...

What happens if the Fed reverses course and starts purchasing bonds once more? There’s a school of thought that this too will be less effective than in the past. Reason: Banks have so much extra funding these days that they don’t know what to do with all the money. The previous rounds of QE, which finally ended in 2014, stuffed banks with trillions of new dollars, which they hold in reserve to buffer themselves against economic bad spells and also to make loans. Plus, loan demand is low, even now in an expansion. Demand will be a lot less in a recession.

The Fed is criminally unprepared for a recession, after making the fateful decision to rescue the banks and financial markets at the expense of the working class.

Washington is criminally unprepared for a recession, after making the fateful decision to invest everything in pointless wars at the expense of infrastructure and the working class.

Guess who else is unprepared for a recession?

The brutal reality is that most Americans are not prepared for the next economic downturn or recession.

Comments

I've been busy

since 2008.

House is paid off. Credit card debt is 0. No outstanding loans. 2 freezers fully stocked and several hundred canned veggies and soups. Enough wood for 2 years of heat.

On average, I drive less than 10 miles a week and own my vehicle. No smartphone. No cable or satellite tv. If need be I'll go as far as cutting internet.

I'd like to know who the hell they're talking to about consumer confidence. Must be the credit card companies as everybody seems to think that credit is unlimited.

This next one will make 2008 look mild.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Warren has noticed

give the lady some credit

A 2020 recession, if it starts no later than summer, would doom Trump's reelection.

It would also boost progressives like Bernie and Liz because people would be less willing to accept incrementalism.

It's coming before the primaries start

in tit for tat action the moron in chief needs

to win....the currency war ameriKa can't win is upon

us.

Slight summary, tRumpolini put tariffs on China of 10%

on what was left to tariff, this happened yesterday.

Today China reciprocated by weakening it's currency

causing the stock markit to swan to the tune of 900

points. So thinking me(tRumpolini) lost, he doubles down

by doing this.

https://www.zerohedge.com/

For The First Time In 25 Years, US Treasury Just Designated China A Currency Manipulator

"This pattern of actions is also a violation of China’s G20 commitments to refrain from competitive devaluation."

416

Grab your

guns and Biblesmoney and buy some goods tokeep you comfy cuz inflation is coming bigtime, IMHO.

His ego is bigger than his hands and I wouldn't bet on him beating

China in this game even though he's gonna keep on trying

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Historically

We'll be in a recession for at least 4 months before they admit to being in a recession.

With Trump it'll be even longer.

Unless there is a massive crash.

I was thinking nine months

Puts us in the middle of the primaries (May) and another four puts us in the middle of the general (September). And I don’t think official statements (or the lack thereof) will confuse anyone on the receiving end of it.

Clench your buttocks it’s gonna be a bumpy ride...

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

Elisabeth Warren is progressive?

I somehow don't buy this. Dodd-Frank? What a joke. Both me and Eric never bought her political shtick. Man she's another ex-Republican. I just can't believe that this insane global economy will be reformed or resolved by our current, corrupt, fucked up political electoral system. There is no way for ordinary people who are not 'invested' to stop this insanity. What are our options when the Demorat's refuse to clean house or even regulate the disaster global cappies who own and run 'the place'? Free market, my ass. End days of run amok capitalism? I sure hope so for the sake of the planet and the people who are at the mercy of this nasty 'world we live in'.

So what's her solution?

She's good at "noticing" the big problems and asking the right questions, especially when she's given a platform. It's just that her answers have always amounted to wonkish technocratic incrementalism that doesn't match the alarmist nature of what she's saying. It takes a bit more than grandstanding with some populist sounding talk to be a progressive in my eyes.

Idolizing a politician is like believing the stripper really likes you.

A very small . . .

tax on financial transactions would have no effect on long-term investors, but would wreak havoc on high speed traders who manipulate the system. It is hardly incremental.

People have been forecasting recession since 2009

(when we refused to admit that we were actually in a depression) and so far it hasn't happened - officially. Maybe the only reason capitalism hasn't collapsed is that the rich and powerful refuse to admit that it has and we are all afraid to admit that they're liars.

On to Biden since 1973

I did predict a double-dip recession in 2010

but that was nine years ago.

Don't you think that after 10 years of record low interest rates things have changed?

Either way, the leading economic indicators are measurable facts.

Is Trump throwing gas on the fire?

People have been saying that a recession was coming before Trump started his tariff tiffs, but it seems that they are making it worse.

This financial stuff is not my forte so I'm not sure what questions to ask. But according to this article China did what they with their currency because Trump put even more tariffs on their products. How does this hurt us? And once China stopped buying so many of our soy beans awhile back they have found new markets to buy from and farmers are afraid that they won't get China's business back. Is this correct?

Finally..can't anyone stop Trump from doing what he is or is that what the PTB want him to do? Tank the economy and let the banks do their thing?

The message echoes from Gaza back to the US. “Starving people is fine.”

Tariffs replace the graduated income tax.

Moving from taxing the rich to taxing the proletariat (the poor have no money of their own to buy goods and hence pay tariffs). since the rich invest most of their wealth and workers spend most (or more!) the tax burden shifts downward (by design!)

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Trumps tiffs

are so fake. A deliberate distraction which enables the neoliberal/pigs from both parties to continue with their raping and pillaging the earth and the humans who live here. For what? Somebody tell me why a fascistic insane demagogue is still in office? Because he serves their agenda, all of them R's and D's. Yes they could stop Trump but why would they? He's getting it done and the Dems. can put the blame on Trump and Co. The Demorat's can then focus on fake social issues and rile up the populace with mayhem and social unrest. If this is not the case why have they once again taken off the table the legal remedy for lunatics, unfit for office demagogues of the worst order. What can ordinary people do to prepare for their crashes? Nothing. We're all dependent on this fucked up economy one way or another.

Pelosi is a senile tool.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Just theater

Yes, a tool all right. Remember when the House Democrats were considering who would be the Speaker of the House, Trump actually supported her. Some were perplexed by this. I commented at the time that this didn't surprise me in the least, as if Trump didn't have someone like Pelosi as Speaker, they would have to invent someone identical. They would have, too.

Trump needs a foil in the House, and Pelosi is perfect for the role. It's part of what allows Mega-party team A and Mega-party team B to achieve the goals their owners have tasked them with.

Our MSM screams and raises hell over it all, but that's part of the act, too. Meanwhile We the People continue to get the shaft.

Yep pretty much

I read an article about how Trump was selected just so he could be blamed when the economy crashes again. I didn't know how reliable the site was, but it does seem like he is doing things to deliberately make things worse. Another article said that the Feds cut interest rates to keep a recession at bay, but that Trump put it back on course by doing his tariffs. But...guess who is being blamed?

Yeah Vlad wants the global economy to crash because reasons.

The message echoes from Gaza back to the US. “Starving people is fine.”

China weakening their currency makes all

imports more expensive.

Also tRumpolini twiited he wants to give the greatest

bestest farmers another bailout from the damage the

tariffs have done to them i.e. China not buying ameriKan

farm products.

Now ask me where they get the money for that, same way

they get the money for the MIC. In todays world only the

sheeple don't get anything but BOHICA

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Should make them cheaper, not more expensive.

That's the whole point of currency manipulation. If a nation is a net buyer, it wants its currency strong. If a net seller, it wants it's currency weak.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

China is a net seller

they export all the corporate made shit

all over the world

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

I find it difficult to believe

....that Trump would try to throw the economy into a recession at this time. In fact, he has been dogging the Fed Reserve for that interest cut just to push the possibility of a recession back and further boost the stock market.

I believe it is common knowledge that the incumbent party almost always wins a second term if the economy does not fail catastrophically. And Trump is poised to win according to historian Allan Lichtman, whose system has never failed to accurately predict the outcome of the past nine Presidential elections. Lichtman tracks the 13 variables that determine the outcomes of Presidential elections going back to the Civil war — the health of the short-term and long-term economy being two of them.

Lichtman, a Democrat himself, says there is only one way to trick the situation at this point. Can you guess what it is?

You are assuming Trump is smart

Near as I can tell he is a marketing genius with no morals or any interest in anything else.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

LOL!

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Trump's risky move

link

that's cheating, amigo!

impeachment? from may 2019? guess lichtman had thunk the mueller investigation would show more than continued innuendo? ; )

for the room: investopedia says a recession is technically two quarters of negative growth/gdp (didn't it used to be three or four?), but one question i have is this: does the funny money extend and pretend banks loan (creating profits for the banks) factor into GDP?

and of course mr. market is no fair test of anything, given the fact that cheap interest allows buy-backs of stocks, etc. no? but it was kinda fun to see that mr. market reacted so negatively (pun intended) to his MAGA tariffs and china's'currency manipulation'.

the worst part of the trump's trade wars with china are (imo) that the administration now equates economic wars with china as casus belli for nuclear war. so let's ring china with more nukes and a US space command!

Wendy, every point you made was right on.

Every statement true. In interviews, Lichtman indicates that it does not matter how the impeachment plays out. His point is that it would flip one of his 13 keys against Trump's re-election. The same thing happened with Hillary just months before the election. He saw that and announced in the Washington Post that she would lose. He was one of the few that got that right.

Clearly, the trade war is merely a cover for the economic war that the US Coup Government is waging against China from the State Department. There is simply no way that China will be allowed to continue with their Belt and Road project, which paves the Eastern Hemisphere with a modern, penetrating infrastructure for trade, which supersedes US hegemony and US military blockades in that part of the world.

The US intends to force a global boycott against China — physical, intellectual, and cultural — that will lay its economy and people to waste. Within a year, Americans will believe that they have always been at war with China. Trump seems only marginally in the loop on this, while running interference and creating distractions. He is being operated.

thanks for the additions on lichtman,

but in the end, i was just horsin' around due to the date. and yes, i agree that obomba's 'pivot to asia' (was that it?) was a recognition of eurasia heartland theory geopolitics in search of maintaining command-and-control of unipolar world at all costs. but now new sec-def esper and his sidekicks (esp. pompeo) are seriously promoting what you'd clipped from my comment.

but yes, you know and intuit china policy like no other here, imo, and i believe you. which also reminds me, i had cause on my new thrills and chills diary to suss out john pilger's documentary: 'The Coming War on China' now available to watch free online', 26 June 2018 clicking to watch introduces it, provides date time-capsules, and so on. you might like to watch, i'd think, if you haven't already.

best to you, amigo,

wd

Thanks.

I'll check that out. China is being derailed into developing and producing advanced weapons of war now. This is a steep overhead that they did not have before. China used to be adept at ignoring the American menace. But, I guess things are getting real.

Spot on, Snoop

There is simply no way that China will be allowed to continue with their Belt and Road project, which paves the Eastern Hemisphere with a modern, penetrating infrastructure for trade, which supersedes US hegemony and US military blockades in that part of the world.

OBOR will render the US Navy obsolete and impotant.

Witness what is happening with the oil tankers being seized and carrier task forces being used to threaten blockades now.

All that will be mitigated with continent wide high speed rail, impervious to seaborn attack.

The American regime must stop OBOR to remain hegemon.

Eurasia must complete OBOR to survive.

This is the defining battle of and for the 21st. century.

IMHO

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

Yes it is:

The US has done everything it can to subvert China's plan to develop the Eastern Hemisphere with a 21st century trade infrastructure, beginning with the AIIB development bank that all US allies joined along with 100 other nations. China gets a vision and just keeps plowing forward, making things better, opening new inland markets and making trade faster and and more streamlined.

I wonder how the US will turn these nations against China.

The Stock Market

is the biggest lie in all of this. As an average person, if I had investments, I'd be scared as hell right now. The correction is coming and all the suckers (regular small investors) are about to see their 401ks vanish again.

Additionally, as Florida resident and someone who's profession is directly tied to the housing market, let me warn all here. Stay away from a home purchase right now!! The market is way overvalued and when this recession hits there's going to be metric fuck ton of bad paper on $350k homes that are only worth about $150k.

Look after yourselves and good luck to all. I'm afraid this will make 2008 seem like a minor setback.

Or take the chance and

sell your house now and buy another later after the crash.

Ed. Sp. "take" was "tale"

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Time your tale carefully

as the difference between losing and winning is extremely minor.

And taking a chance is nothing but gambling.

The owner of the casino usually wins.

Regardless of the path in life I chose, I realize it's always forward, never straight.