Santa Claus isn't coming to Wall Street this year

Every year since 2009, Santa Claus came to lower Manhattan and showered presents on all the good and bad, little boys and girls.

No trade was a bigger winner than to go long in December...until this year.

Stocks plunged again on Friday, bringing the Dow Jones Industrial Average’s losses for the week to nearly 7 percent and ending its worst week since the financial crisis in 2008. The Nasdaq Composite Index fell into a bear market and the S&P 500 was on the brink of one itself, down nearly 18 percent from its record earlier this year.

Barron's titled their article The Stock Market Crash That Almost No One Heard.

That's a good headline, but an even better one is this:

Shades of 1987 and 2008 in Current Level of Stocks Getting Crushed

It can be seen in the percentage of stocks making new 52-week lows. Currently 38 percent of equities on the Nasdaq and New York Stock Exchange are trading below that level. Since 1984, there were only eight days when a bigger proportion of shares did so, according to Sundial Capital Research.Two of them were in 1987 -- during the famous Black Monday crash, when the Dow Jones Industrial Average lost 23 percent in one day, and then again during the following session. The rest were in the aftermath of the collapse of Lehman Brothers in October and November 2008.

“There are more than hints of panic in the air today,” Jason Goepfert, president of Sundial Capital Research, wrote in a note Thursday. “There is clear evidence of wholesale selling on a level we rarely see.”

You probably didn't notice because The Richest 10% of Americans Now Own 84% of All Stocks.

That should be enough to catch your attention, but this month the damage spread to the risky side of the bond market, starting with junk bonds.

A gauge of high-yield bond performance was trading close to its lowest since early 2016 on Friday, a day after the riskiest U.S. corporate bonds suffered their biggest daily drop in nearly three years and in sync with a broad pullback from stocks and other risky assets.

The iShares Iboxx High Yield ETF was down around half a percent in early afternoon trading and has fallen 7.2 percent so far this quarter, putting it on pace for its poorest quarterly performance since 2011.

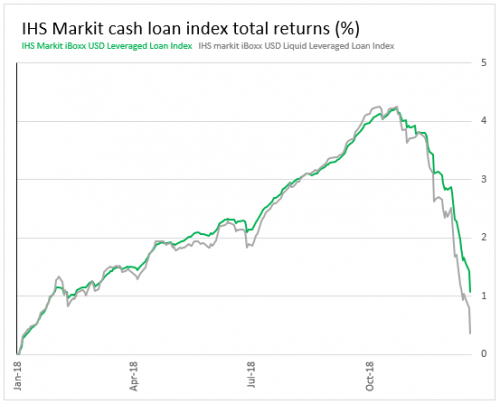

The $1.3 Trillion leveraged loan market has also taken a beating.

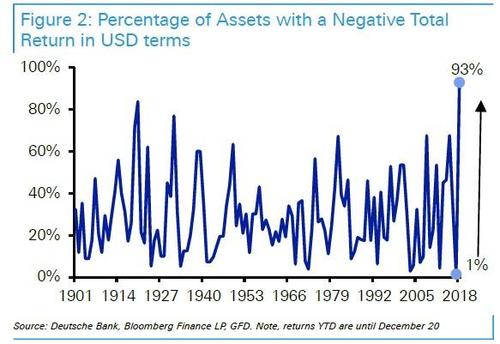

All in all, this adds up to, not just a bad year for financial assets, but a record bad year for financial assets.

Comments

Something else he didn't really mean

" In the beginning, the universe was created. This has made a lot of people very angry, and is generally considered to have been a bad move. -- Douglas Adams, The Hitch Hiker's Guide to the Galaxy "

@boriscleto It's The Trump Slump

It's The Trump Slump

NYCVG

It's really the MIC

brokers having a meltdown since news came out about the withdrawal of troops from Syria. The Prison "Industrial" complex and the MIC drive the goons at Wall St. Even the slightest movement of military pull-back is seen as a threat and skittish brokers run for the hills and stocks take a nose-dive. It is said that the stock-market is just an elaborate Ponzi scheme anyway. Stocks based on conning others to buy worthless sht.

Well done is better than well said-Ben Franklin

Yes, unfortunately

, my pension is invested in that Ponzi scheme. No I really don't have a choice.

"I’m a human being, first and foremost, and as such I’m for whoever and whatever benefits humanity as a whole.” —Malcolm X

Yeah, same boat here

So if I get my way, then I'll be financially ruined. I can live with that.

Let's remember that any real fix to this problem cannot stop at the US borders. We can't try to fix inequality here and ignore the entire rest of the world because leaving it continue for the rest of the world would mean leaving the system in place that made it occur.

Any possible "win" that I can think of involved quite a long fall for myself and probably a lot of other Americans... at least for a while.

A lot of wanderers in the U.S. political desert recognize that all the duopoly has to offer is a choice of mirages. Come, let us trudge towards empty expanse of sand #1, littered with the bleached bones of Deaniacs and Hope and Changers.

-- lotlizard

It couldn't happen to a more deserving bunch.

-Greed is not a virtue.

-Socialism: the radical idea of sharing.

-Those who make peaceful revolution impossible will make violent revolution inevitable.

John F. Kennedy, In a speech at the White House, 1962

So, Trump is accomplishing what Occupy Wall Street couldn’t! n/t

I hadn't thought of it that way.

But you're right. It wasn't his goal, but then so little that Trump does looks planned or sensible. Our corporate masters are leading us to extinction so I'm in favor of anything that causes them sleepless nights or worse.

-Greed is not a virtue.

-Socialism: the radical idea of sharing.

-Those who make peaceful revolution impossible will make violent revolution inevitable.

John F. Kennedy, In a speech at the White House, 1962

Except for Morgan Stanley's Hedge Fund Group

The Hedge Fund Group performed the worst at Morgan Stanley, but they are not subject to the same ethics as the the other divisions of the banking group.

If I'm reading that right, that is. That sort of institutional, counter-intuitive evil got normalized in 2009, however, so there's no surprise here.

Abolish the stock market. Now.

Modern education is little more than toeing the line for the capitalist pigs.

Guerrilla Liberalism won't liberate the US or the world from the iron fist of capital.

That Last Chart is Kind of Scary. nt

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

The market is still grotesquely overvalued.

Could drop another 40 percent before equity prices begin to match real earnings by listed American conpanies. This whole recovery has been an illusion driven by negative real interest rates and QE. Now that's not there, the bottom will surely drop out and nobody in thw world will care to rescue us. It had to happen, eventually.

Again massive wealth re-distribution from workers to the rich

Every time a market seriously crashes some economist does the post mortem. It's always the same, the net result is a massive wealth re-distribution from the middle class retirement accounts to the oligarchs. Why is that? Well, you have to look at the cash-in cash-out model. The cash-in has been the retirement funds, 401K etc. The cash out has been the wealthiest Americans who own vast amounts of stock, and sell it on a regular basis to fund their life style. The markets really are a Ponzi scheme coupled with a gambling casino. The total market wealth as measured by shares multiplied by stock price is a fantasy. There is no way that some persons could ever step up to the plate and buy those stocks so that existing owners can cash out, now or in the future. It is all speculation, essentially investing in derivatives. People around town tell me that they have lost all their gains for the year. Yeah, right, they actually have zero real gains unless they sell their stock. This is speculation based on the next greater fool principle. The stock price is based not on the value of the company, or its P/E, but on how it's perceived by others trading in the market. I won't even get into market manipulation by the big banks, but suffice it to say that they have been unburdened and they can now trade their money, their depositor's money and they have infinite short term credit with the government. Sounds like some sort of pact with the devil for bailing them out in 2007-2010. That might work in a rising market or even a flat market, but it's a disaster in a falling market. How's your balance sheet?

The other important point to make is that buying stock is not an "investment " in anything. Investment implies that it is being used to develop new technology, a new extraction business, a new business infrastructure, something that creates a fundamental increase in efficiency in the economy to deliver goods and services, and therefore an earned profit. Again, it's speculation. Your giving some previous owner of the stock your cash in the belief that someone else in the future will buy that stock for more money. I do agree that stocks should not be traded publicly.

I think that it would be nice if those in the upper 0.1% would thank the suckers from the working middle class and let them know that they have enjoyed spending their retirement savings.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.