2008 crash lessons unlearned

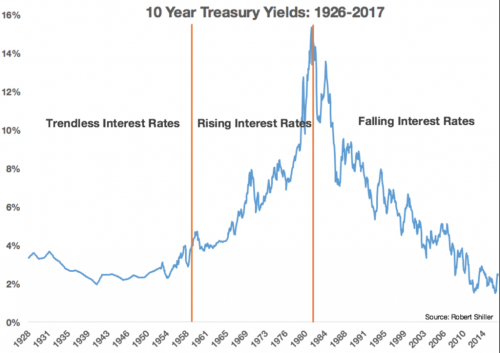

A glut in the supply of treasury bonds has pushed interest rates up to a seven year high. This has caused the end of a 35 year long bond bull market.

Ten-year yields also appear to have made a double bottom, dropping to 1.38 percent in 2012 and 1.31 percent in 2016, and have ceased forming the lower highs and lower lows that marked the declining yield trend.

So what does that mean?

It means the second longest bond bull market in recorded history, and the longest since the 16th century, has ended.

It means the lowest interest rates in 5,000 years of recorded civilization, have ended and you will never see those rates again.

It means that we have entered an extended bond bear market.

He said the rise in borrowing costs will not be uniform and will be “populated by periodic rallies”, but that generally speaking the market has entered a 10-year trend towards higher interest rates.

“I think we have lived in an era where central banks have distorted yields and they have done it for so long that there’s a group of people who are starting the business who don’t know anything other than distorted yields,” he added.

So why does that matter?

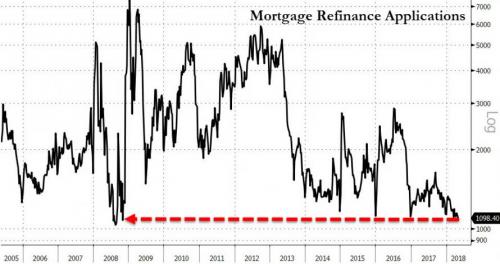

For starters, there's the immediate effect of declining consumer demand.

But the big item, the one that will cause everyone to suck wind, is that marginal borrowers will start to default.

Forget 2008.

It's going to look different this time.

For starters, the next crash won't start with consumers. The reason is because the working class has been on a strict austerity diet for the past decade. That was the cost for bailing out the wealthy in 2008.

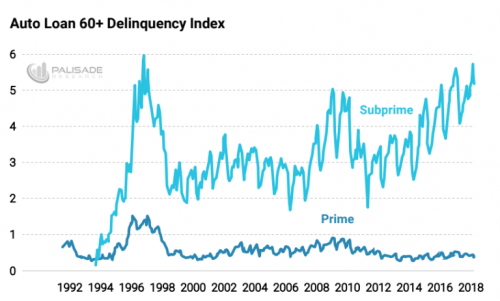

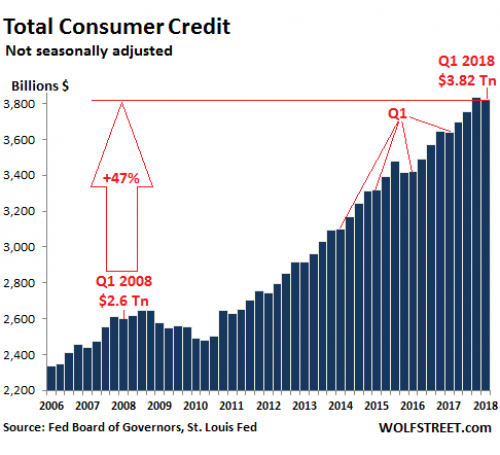

Therefore the only working class borrowing excess you'll find is in auto loans, student loans, and credit cards (all of those loans being adjustable). In other words, in the places where they had to borrow.

As for the wealthy? Well, unlike the poor, they took full advantage of the historically low rates.

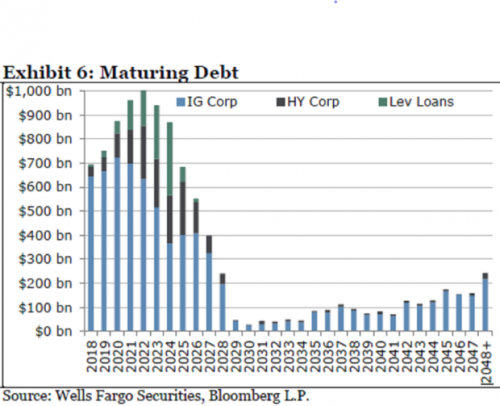

Corporate America partied like never before on cheap money over the past decade, and now comes the hangover.Companies will need to refinance an estimated $4 trillion of bonds over the next five years, about two-thirds of all their outstanding debt, according to Wells Fargo Securities. This has investors concerned because rising rates means it will cost more to pay for unprecedented amounts of borrowing, which could push balance sheets toward a tipping point. And on top of that, many see the economy slowing down at the same time the rollovers are peaking.

“If more of your cash flow is spent into servicing your debt and not trying to grow your company, that could, over time, if enough companies are doing that, lead to economic contraction,” said Zachary Chavis, a portfolio manager at Sage Advisory Services Ltd. in Austin, Texas. “A lot of people are worried that could happen in the next two years."

The high-grade bond market in the U.S. has the lowest credit-quality mix since the 1980s, according to New York-based research firm CreditSights Inc.

“Most companies in this universe really need to refinance,” said George Bory, the head of credit strategy at Wells Fargo Securities.

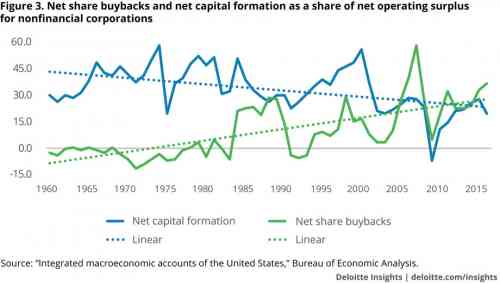

Corporate America has had record profits for years by starving their workers, but instead of spending it on R&D or just building up a rainy-day fund, they've borrowed up to their chins.

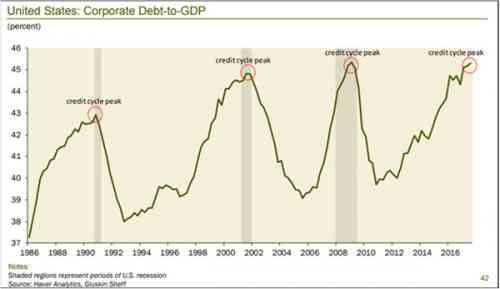

“Interest rates are already doing damage, people just haven’t noticed,” Andrew Lapthorne, the firm’s global head of quantitative strategy, said in an interview Tuesday. “Leverage in the U.S. is grotesque for this stage of the cycle. At the moment you’ve got peak leverage at peak prices. It’s not like you have to dig deep to find a problem.”

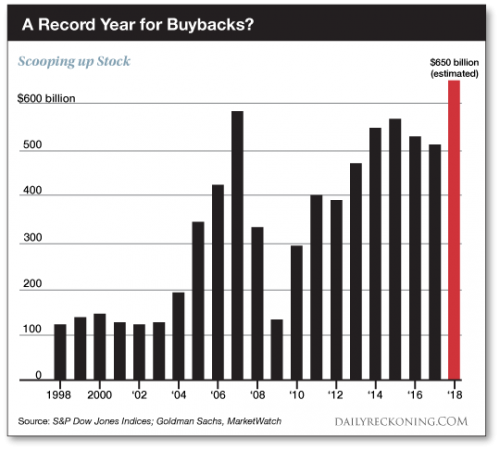

So what did corporations spend their money on, if not on R&D or workers? Stock buybacks. And boy is business booming!

J.P. Morgan’s Dubravko Lakos-Bujas projects that the S&P 500 companies could buy back over $800 billion in stock this year. This would exceed the previous 2007 record buybacks of about $650 billion and would be substantially higher than last year’s $530 billion. The $800 billion would be about 3.5% of the $23 trillion of the S&P 500’s market capitalization.

Buying stocks with borrowed money is still just margin speculation, whether it's done by individuals or companies.

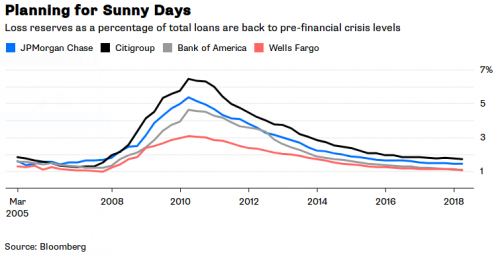

Speaking of rainy day funds, guess who's been cutting back on them? Wall Street banks.

Bank of America Corp.’s loan loss reserve, the rainy day fund that banks set aside to cover potential defaults, shrunk at the end of the first quarter to just 1.08 percent of its overall loan portfolio. That’s lower than its lowest point in the run-up to the financial crisis — 1.19 percent in mid-2007. Wells Fargo & Co. currently has the lowest ratio of reserves to total loans of its rivals, at 1.07 percent, though its still slightly higher than the less than 1 percent it was in late 2007. Increasingly, those rainy day funds have become a source not of protection but profits.In the first three months of the year, the nation’s four biggest lenders, which includes JPMorgan Chase & Co. and Citigroup Inc., drained a collective $993 million from their their loan loss reserves, boosting bottom lines. Wells Fargo accounted for nearly two-thirds of that, lowering its loan loss reserves by $631 million in the first quarter. Wells Fargo also booked a provision for loan losses in the quarter of just $191 million, another way to boost profits. That was by far the smallest of all the big banks. Citi’s loan provision in the quarter was nearly 10 times larger at $1.8 billion, but that, too, was down from the $2 billion in the prior three months.

The famous saying by Warren Buffett is "You don't know who's swimming naked until the tide goes out."

Rising interest rates in a debt-saturated economy is the same as the tide going out.

Those rising interest rates have translated into the flattest yield curve since August 2007, the moment that the credit crunch first struck.

Comments

They didn't learn their lesson

or they ignored what happened instead? I'm going with the latter. I bet that there were many things that they could have done to decrease the risk of another economic crisis, but the money flowing in was too good to pass up.

Do you have a time frame for when the next crash comes? I've heard that it's just around the corner.

The message echoes from Gaza back to the US. “Starving people is fine.”

Schooled well

The fact is they learned their lesson quite well. They learned it so well that they know they can do it again -- and that they have nothing to fear. This time, it's even worse than the government (our taxes) bailing their butts out. Now they can go after the depositor's funds.

Thanks, Obama.

How far will they push it?

That's a good way to have angry mobs rioting in the streets.

The politicians are captured by Big Finance, but even they will hesitate at voting for something that might risk the lives of their families.

River City woes

Yes, and part of me says "Bring it on!" due to John and Jayne Deaux now directly exposed (even though very few know it at this time). I hesitate to push that sentiment however, understanding the misery which will follow. Nevertheless, once the average American realizes just how completely they've been put in harms way - as they lose it all, there's going to be trouble as we've not seen in a very long time.

I can't time a rigged market

This has already gone on longer than I expected.

There is so much central bank manipulation now that economic fundamentals only show up in revisions.

@gjohnsitI can't time a rigged

That's the thing though: everyone thinks they can.

It's basically a painful game of musical chairs. Buy a stock, wait for it to jump up, sell it to the next guy and take a seat.

Or perhaps a game of hot potato fits better here.

Point is, folks want to squeeze everything they can out while they can, while leaving some other guy holding an empty bag.

These numbers are breathtaking.

Literally breathtaking. I've been out of the finance world for years now, but ... these numbers are frightening.

Only connect. - E.M. Forster

The coming collapse of the capitalist economy

will make 2007-8 look like a weekend holiday. Right now, this economy is firing on all cylinders: low inflation, low interest, low unemployment....this is good as it gets. It's not very good for the working folk.

Hopefully, the nut job older white male population will die off and socialism will blossom from their graves. If everyone has a stake in the economy, you will likely have better outcomes.

Why does it gotta be white males dying?

Seriously, does identity politics do anything but divide and put us against each other?

You could have just went with "Nut jobs" but that's not forceful enough so we gotta toss a little bigotry in there? (And a touch of ageism too! Now I get why people use identity politics, its easy!)

Those controlling things couldn't ask for a better tool of division and we happily grab and run with it.

One thing I really like about this place is that people get to the root causes of problems and don't just rely on, "Grrr! White guys bad!" As an argument in favor of their position.

There's been a recent upsurge in it here lately though and let's just say I'm not a fan.

I'd rather work together to face the real problems with real solutions because at the end of the day those that are creating them only care about one color...

Green.

Avarice and greed isn't picky, it happily goes with any race, age or gender.

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

@Alphalop Sorry I generalized.

Sorry I generalized. FWIW, I am a baby boomer white male. The fact is, the largest cohort of Trump voters are:

Ekins’s analysis identified Staunch Conservatives as the largest cluster of Trump supporters at 31 percent. They are loyal Republicans, solid fiscal conservatives, have traditional values, and are politically aware. They worry about legal and illegal immigration. They are a little older, more likely to be male than female, and have higher socio-economic status than some of the other groups. They are the group most likely to be NRA members.

This is true of my experience here in Vermont as well.

Mea culpa for offending many of you with my identity politics. Reading the news can trigger emotional responses and one is my anger at people who are Tea Party/Trump supporters.

I agree there's a clique of White Males...

who run the show, are assholes, and think that they're better than everyone else.

Yes, it is a bit like high school.

Unfortunately, you go to the next town over, and if you look like the clique, you're going to be associated with it. Also, the clique sets the standards, clothing that is available, entertainment you watch, money you use, etc... Then they tell you that the only way to succeed is to become part of the clique.

Honestly, I'm starting to look at the business suit as a gang symbol. Yeah, it looks good, but It's absolutely a caste/class marker as blatant as a Burka.

[video:https://www.youtube.com/watch?v=jrxI_euTX4A]

I do not pretend I know what I do not know.

@detroitmechworks That's why I turn a

That's why I turn a Jacobson's eye on folks who think that voting for one of their group has to be a step forward. All those guys who are similar to me, at least superficially have been selling is out for years. A look at Clarence Thomas, Ben Carson, Michelle Bachman, Hillary Clinton, etc., shows that there are plenty of opportunistic sellouts available in any identity you could possibly want.

@Blueslide totally not offended,

totally not offended, more frustrated because I see these arguments daily that divide us, get us no closer to a solution and in fact hinder any solution from being found or pursued.

Nothing else we have done has fragmented the left more and in my opinion it's exacerbated the situation of those that it claims it wants to help the most.

Money stands together where as we seem intent on dividing each other into ever smaller identity groups.

So my rant wasn't directed at you particularly but at identity politics in general and I also intended no individual offense.

Peace!

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

Could you make up some

"Not A Nut Job" stickers for us non nut jobbers. I'd like a couple of more years. Then again, maybe I am a nut job.

@Snode I was gonna say put me

I was gonna say put me down for one but I too am A nutjob, just not THAT nutjob...

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

It's times like these....

....that I wish the Democrats would actually fulfill the Repigs' end-times nightmares and nationalize all means of production, but unfortunately the Democrats are just pig workers. They serve the same masters and wouldn't want to upset them in any way.

Modern education is little more than toeing the line for the capitalist pigs.

Guerrilla Liberalism won't liberate the US or the world from the iron fist of capital.

Obama could have nationalized the banks but,

— as was quickly made evident by his service to the 1% as an ideal projection screen to catch the 99%’s hopes and make sure they came to nothing — the fix in favor of the bankers was in from the very beginning.

The throw away economy...

Is not going to do the rich any favors when they run out of cash. Everything they have is transitory, good for a couple years, at BEST.

The Chinese have already started the process of devaluing their IOUs.

Skills are gonna be back in style soon. REAL skills. Not "I can manipulate Statistics to fool investors into giving me money that I can use to manipulate more statistics and play more games."

I do not pretend I know what I do not know.

I think you are spot on...

I've become a jack of all trades over my life, not necessarily because of many different jobs, more hobbies, but I think they would have prepared me well for it when it happens if I wasn't already getting long in the tooth, lol.

Between being able to brew excellent beer, distill alcohol and grow dank weed I figure I'd have a place in any survivalist community in the event of a collapse because I can make people feel good.

Oh, I can make stuff out of wood, some chemistry and could rig up a power array with salvaged alternators, batteries and a creek, but really, who needs all that when you got beer, liquor and weed?

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

I can maintain/build computers...

But I can't do a damn thing with the Solid State ones. And without parts, I'm stuck. I'm well aware of the usefulness of this skill in a survival situation. (Minimal)

So, I'm working out, trying to get back into shape, and working on my Judo. Worst case scenario, I can do grunt labor and defend folks. (Nobody says what you do for a living has to reflect your inner life.)

I do not pretend I know what I do not know.

@detroitmechworksSolid State

Like SSD? There isn't really anything to worry on those though. Unless you mean something else with Solid State.

I built my own computer but I'm by no means an expert on computer parts.

@Alphalop @Alphalopgrow dank weed

Feel like that should be a new thing on modern resumes:

Skills:

Dank weed grower.

Is there any way to look at

what will happen to us in the next crash. I assume we will bear the brunt of it. Consumers have already pulled back a lot of spending (but read credit card debt is maxed). If we bail out Wall St. again it seems the only place they can get bailout money is raising taxes on lower income workers, gutting the safety net completely and dismantling SS. What other things am I not seeing? How will this affect the world economy? I figure they benefited from the bailout of their investments too, and just put their money on black like they always did.

@Snode That's a really good

That's a really good question. I have always worried that when the baby boomers reach their senior years, the "safety net" will be completely torn to shreds.

I'd hate to see that happen, I really would...

But there is a small, petty part of me that I'm not particularly proud of is shouting, "Good! Fuck 'em! They partied like there was no tomorrow and trashed our house and now we gotta clean up the mess!"

Do I blame them all? No.

But it can't be argued that their acceptance of the situation largely allowed it to develop.

After all, they still had paper ballots and largely honest, legality conducted elections at their disposal but still supported Nixon, Reagan, etc.

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

No internet, just the media = propaganda victims

Same as now, only now that's because most of the the once-trusted internet alternatives have become/revealed as subverted, not that everyone realizes that - but now that we know what a difference an exposure to more factual information makes, how are they going to keep us down on the farm once we've seen the bright lights shone on their peculations? Oh, right, by using militarized, Israeli-'anti-terrorist'-trained police/mercenaries with military weaponry... drat, forgot to think positive.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

My crystal ball is busted

The only things we know for certain are:

1) There will be another financial crash

2) It will be bad

3) The politicians will want to save the banks again, but

3a) The Fed will have a lot less ammo

3b) The government will have a lot less funds

3c) The people will tolerate a lot less screwing

Everything else is a guess.

Bank bailouts are a thing of the past, next time it's a bail-IN

Bail-in as in the banks have permission to keep your money that you have in their banks and yes that would be legal. Congress passed legislation making it so. I have posted some links to this in the past and will try to find them later today if you're interested.

Greece got to be the the test case for this a few years ago when one day people woke up and went to the bank to get their pension funds and found that they couldn't. Older men and women were devastated the most.

A quick search for this will bring up nightmare scenarios and images. The fix is in. Even though we worked hard for our money, in the end they get to decide whether we get to keep it.

The message echoes from Gaza back to the US. “Starving people is fine.”

@snoopydawg Hmmmm....Pelosi and

Hmmmm....Pelosi and Schumer are prob. kinda stringy, and taste like kaka. Who else is there that won't leave a bad taste in your mouth? Jared looks tender.

Seriously, I didn't know this. So the FDIC is just a fig leaf now? This has got to get out there. I suppose stocks and bonds are fine. "All your cash are belong to us".

Bank Bail-in

If You Have Money in a US Bank Account Be Aware!

I don't understand how it could possibly be legal for the banks to just keep people's money, but it is because of how congress has let them write their own legislation.

People are wondering if they put their money into credit unions or local banks if it won't happen to them. I haven't been able to find anything about the answer to this question. Especially when it was the banks that ignored the risks or just took them anyway.

The message echoes from Gaza back to the US. “Starving people is fine.”

Are there other sources that say similar?

Because from what I gathered that site was a gold investment site so it wouldn't be unsurprising that they would want to push that notion.

Not that I'd put it past the fuckers, I didn't even question it until I went to copy the link to share the story, but I'd feel better (or not?) If I had it from a known reputable source.

You can't trust anyone these days.

It's only paranoia if they're not out to get ya...

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

If you mean this, lots of other sources! Here's one.

If you read this in full at source, which I would strongly recommend, allow space for the emission of heavy steam from both ears.

https://www.truthdig.com/articles/president-obama-and-congress-just-gave...

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

I read your link carefully.

It said that banks can now use depositors' money to speculate. But I didn't read anything that did away with the obligations of the FDIC. It sounds as though this time the banks speculate with our savings. When the bubble bursts instead of the Fed bailing out the banks, the FDIC gives us our money. It should be a much more popular form of bailout.

I understand why you said that

I have no problem with people questioning the sites used here if they have some concerns. I did a search for them and found numerous websites that are reporting this.

The Bail-In: How You and Your Money Will Be Parted During the Next Banking Crisis

This addresses the FDIC that supportably protects our deposits.

When this happens how long do you think it's going to take for the FDIC to run out of money if millions of accounts are involved? Not long enough that's for sure.

Now is a good time to take your money out of banks such as Bank of America, JPMorgan Chase and Citibank and deposit it in smaller banks or credit unions. Otherwise, $1 trillion of depositors’ funds could go bye-bye, and that’s not small change.

This makes it seem that the credit unions and little local banks might not do this. Please read the rest of the article and also do some research yourself to make sure that you are protected.

This legislation was signed during the Empty Suit's tenure. Still waiting for anyone to tell me one thing that Barry did during his tenure that helped us little people. You know of any? And no Lily Ledbetter doesn't count.

The message echoes from Gaza back to the US. “Starving people is fine.”

@snoopydawg thanks for all

thanks for all the links guys!

This is something that's gonna require some reading and I still may not fully grasp it.

In a lot of ways I guess it doesn't really matter because I have been certain for some time that we are due for a new fleecing since we just started to start catching up, maybe this will finally be the one that brings out the pitchforks.

Can't give us too long with the rug under us or we might balk when they yank it out...

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

How right you are to be concerned

There is a reason why Obama signed the included provision in the 2012 NDAA where it gives the military the authority to arrest anyone for any reason, (but they will probably be accused of terrorism) and hold them indefinitely without charges or access to a lawyer. In case of a natural emergency, a terrorist attack or an economic crisis the president could declare martial law and that provision goes into effect. This sounds like a great conspiracy theory doesn't it? But for what reason would that provision be made?

This is also why the police have been militarized and why Bush created a separate group of national guard that is allowed to operate independently of their state governors.

Have a good laugh at this, but if any of this happens one day then remember that you heard it from me first, mkay?

The message echoes from Gaza back to the US. “Starving people is fine.”

@snoopydawg after doing

after doing some reading I'm trying to find the silver lining...

The only one I can think of is that if they do crash out again maybe it'll be the crash that puts the economic engine of unfettered capitalism in the junk yard where it belongs.

They have gotten too greedy, they at least waited a couple generations between major fleecings in the past but now the greedsters can't even go a decade..

The only silver lining I can grasp at is maybe, just maybe, the people will finally grasp their metaphorical balls in one hand and pitchforks in the other and I'll get to see at least a few of these life wrecking scumbags dangling from a tree like putrescent fruit...

Damn, you were right, there's so much steam coming out my head people thought I was vaping!

"I used to vote Republican & Democrat, I also used to shit my pants. Eventually I got smart enough to stop doing both things." -Me

And the irony is that...

my social worker tells me I'm paranoid and not trying to get better when I repeatedly refuse to convert my paper check to electronic, and pay cash for my utilities.

I get the feeling that the Vets are the canary in the coal mine for what the politicians will do. Nearly every austerity measure they pull was test fired on the troops or the vets at some point.

Hell, I sometimes think the reason they pay us disability is just compensation for all the crap they KNOW they pulled. And now they're trying to fucking weasel out of admitting they did anything wrong by extending it to the society at large.

I do not pretend I know what I do not know.

Well for now you are being smart

And this is why they are trying to move us to a cashless society. No money in the bank? No soup for you. There are some countries that are doing this willingly in Europe and they love the convenience of just waving their phones over the button and walking on. Bezos is playing with this with his Whole Foods stores. People put their stuff into their bags and when they walk out the machines tally up the price and they are charged through their phones or credit card on record.

The message echoes from Gaza back to the US. “Starving people is fine.”

Worse than 2008?

emerging markets in bad shape

Don't they bankrupt poor areas, effectively boot elected reps

And install 'Emergency Managers' to sell off the public assets cheaply, with unmanageable repayments to financial institutions the only important criteria?

And, with Greece as a test case, haven't they advanced to bankrupting countries, placing banksters in charge over superseded government, to sell off the public assets cheaply, with unmanageable repayments to financial institutions the only important criteria?

Isn't this starting to look as though the US may be 're'-possessed by ruthless international financial interests, once crashed to a final crush for the last bit of public money and individual bank accounts by ruthless criminal financial interests?

Perhaps while China takes over on trade monopolies? Please note that while Russia - trying to make life better for citizens - is still presented as scary-scary-Commie to some Russiagate propagandists decades after the Soviet Union fell into capitalist Russia, following their electoral tripping by US self-interests, China is the non-scary 'Communist', since absolutely not remotely socialist/left-ish and run by ruthless US-friendly oligarchs rather regarding their people and all other Poors as disposable cogs in a self-consuming grinder.

The Psychopaths That Be not only follow the money more assiduously than anyone else but are determined to scoop up the lot.

https://www.youtube.com/watch?v=yFQhVAwbB6o

Hmmmmm... Wasn't there a Chinese curse about living in interesting times?

Edit: the/their & of/by.

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Greece could be bankrupted . . .

because its debt is denominated in Euros. A Republican temper tantrum (refusal to increase the debt limit) aside this wouldn't happen to the United States. Our debt is denominated in dollars and the government can print as many as it wants. Of course the value of the dollar in international trade might shrink a tad.