"There will be no interruption of our permanent prosperity."

The quote above is by Myron E. Forbes, President, Pierce Arrow Motor Car Co. (January 12, 1928).

However, the same could be said by forecasters today.

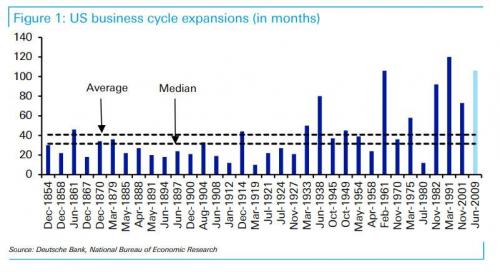

With the calendar’s turn from April to May, the U.S. economic expansion has become the nation’s second-longest on record.

That milestone was reached as the Federal Reserve prepared to begin a two-day meeting in Washington on Tuesday. After a slow-but-steady slog over the past eight years and 10 months, most parts of the economy still look resilient... if everything stays on track, the U.S. expansion would become the longest on record in July 2019, based on National Bureau of Economic Research figures that go back to the 1850s.

Even though inflation is edging higher, the overall cost of living remains contained. That, together with lower taxes and robust hiring, is why economists forecast a decent runway for household spending, the biggest part of the economy.

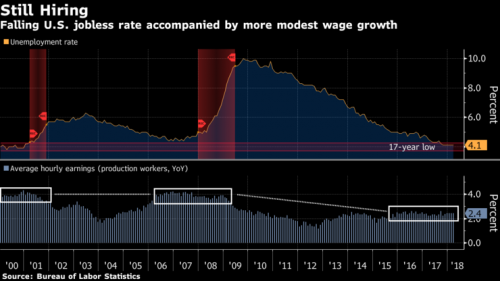

Jobs data due Friday are expected to confirm employment picked up in April after cooling in March. The 4.1 percent unemployment rate, already below what’s generally considered consistent with full employment, is projected to keep falling. Businesses frequently complain about a shortage of qualified workers, and the hope is that a tight job market may finally spur an acceleration in wage growth, whose tepidity has been a disappointing feature of the expansion.

For some reason economists haven't figured out that the unemployment rate could drop to zero and it won't have much effect on wage growth.

Why? because the unemployment rate only measures within a country, while workers are competing with wages of the entire world.

The only things that could change this is an end to globalization or a revival of labor unions, and the ruling elite won't stand for that.

Thus the "decent runway for household spending" will only be used by the top 10%.

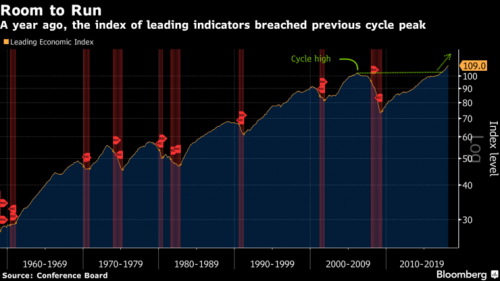

On the other hand, the Conference Board’s leading economic index, a broad measure of the U.S. outlook, shows growth is on course for another decent run, according to Ed Yardeni, founder of Yardeni Research Inc.

“This expansion has a shot at the record books,” he wrote in a note to clients.

"There is no cause to worry. The high tide of prosperity will continue."

- Andrew W. Mellon, Secretary of the Treasury. (September 1929)

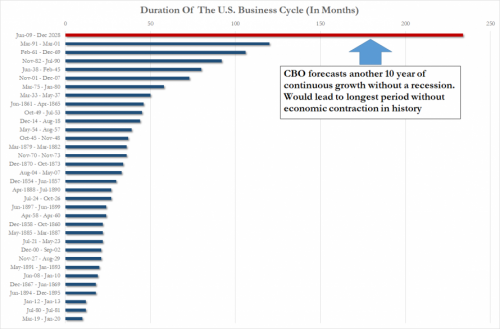

10 more years of uninterrupted growth, according to the CBO.

That sound perfectly reasonable, amirite?

Comments

These bastards and their Kulak lackeys need to hang.

As someone who has been struggling to find steady work for six damn years, there's no way I'm the only one in this position. The tech industry is either outsourced, Visa'd, or automated. We are fucked no matter what we do.

Modern education is little more than toeing the line for the capitalist pigs.

Guerrilla Liberalism won't liberate the US or the world from the iron fist of capital.

Kulak lackeys ?

How romantic.

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

alliteration

I think he was going for the alliteration.

The kulak lackeys who cause all our lack.

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Oh ...

I thought it was nostalgia for the VKP(b).

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

Service sector jobs

Low unemployment may put some upward pressure on service sector wages that, in substantial part, can not be sent abroad, but your point about globalization and wage depression seems glaringly obvious and yet absent from the conversation in the MSM.

Fightfor15

As is any discussion of the said upward pressure, such as the "Fightfor15" movement.....

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Actually

if you had a Pierce Arrow today, you would have to be "permanently prosperous".

1933 Pierce-Arrow sells for $2 million

Just sayin'

Prof: Nancy! I’m going to Greece!

Nancy: And swim the English Channel?

Prof: No. No. To ancient Greece where burning Sapho stood beside the wine dark sea. Wa de do da! Nancy, I’ve invented a time machine!

Firesign Theater

Stop the War!

permanently prosperous

And, by definition, you would be!

From the Wikipedia article:

So much for permanent prosperity!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

The bottom 50% don't

have much breathing room for "discretionary spending," so they can rave all they want, "Economic Expansion" ain't going anywhere. The only thing that expands The Economy™ is money in consumers pockets. And the 1% PTB aren't gonna have any of that, so... so much for uninterrupted expansion.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

To be fair

the top 20% are doing pretty good, and they vote.

So there is a significant percentage of the population that will defend the status quo.

I suppose the 1%

can get by on

the Buying Power of the Top 30% even, but this isn't going to be anywhere near The Economy™ they apparently dream about when most of America broke or close to it. The Economy™ they want requires that $15 an hour minimum wage they fight tooth and nail. What they don't seem to get is, pay people an extry $3, $4, $5 an hour and they get it right back with that extry spending money going right back into Their Economy. Which raises all boats.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

Wall Street can't wait that long

Wall Street can't wait that long. It seems incapable of exercising delayed gratification, or even of seeing further than the end of its nose.

To the financial markets, wage growth is a very bad thing. Under toxic capitalism, the sole objective, which has been codified into law, is not simply to make a profit. The goal is to maximize profits, to make as much money as possible. Anything that reduces profits - such as paying employees higher wages - threatens share values in the market.

The recent "mini-crash" of the stock markets this past February has been attributed, in large part, to investors' fears about increases in minimum wages.

It's an odd thing: Wall Street sees humans only as consumers, yet they don"t seem to actually comprehend what that means. We can't consume if we can't afford to consume.

"Don't go back to sleep ... Don't go back to sleep ... Don't go back to sleep."

~Rumi

"If you want revolution, be it."

~Caitlin Johnstone

We're set for another market crash.

Crashes are part of the billionaire business-model. After a crash, they can buy up the 'distressed assets' for pennies on the dollar.

Mike Taylor

Heh!

“Stock prices have reached what looks like a permanently high plateau,”

For some reason economists

Well also, our calculations for unemployment rates are skewed and also misleadingly used.

People working low-pay part-time work? Employed! Congrats all is good.

You stopped looking for work? Don't care, fudge them out of the calculations.

It is frighteningly easy to give people bullshit statistics and then they gobble it up.

Take a good look at the DJIA over the last 12 months

The Dow had a good clean Trump bubble run-up until the end of January this year at 26,500, and then suddenly went unstable. The big banks are trying to establish a bridgehead at each 500 point threshold, but it's not holding. You can see the thrashing as nervous investors unload and the big banks try to hold up the Dow. The difference in the shape of the curve is really profound. The problem for the banks is that their market manipulation is dependent on using relatively small, timed buys to manipulate. The problem then is that they are getting into bigger and bigger debt to the Fed. Unless the market levels off at some support level they will not be able to recover and pay back the short term loans. At some point it crashes catastrophically as the extreme hazard of these manipulations is that a systemic failure results in the potential energy of an extreme bubble being turned into kinetic energy as it undershoots and falls out the bottom.

Of course I'm just speculating about this.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.