Irrational Exuberance 2.0

Things have gotten so crazy in the markets that regulators have started mocking it.

Less than three weeks after shares of Long Island Iced Tea Corp. surged as much as 289 percent after announcing a name change to Long Blockchain Corp., the agency responsible for enforcing U.S securities law appears to want in on the action. The Fort Worth, Texas, branch of the SEC announced its new big idea on its Twitter account on Monday:

“We’re contemplating adding ‘Blockchain’ to our name so we’ll increase our followers by 70,000 percent,” @FortWorth_SEC said.

The cryptocurrency mania is far from the only example of an irrational frenzy. It's just the most obvious of examples.

For starters, it's not just the United States.

The new year isn’t even two weeks old, and already $2.1 trillion has been added to the market capitalization of global equities. The market is verging on such overbought levels that not even reliably bullish analysts can keep up with the new highs.

Optimism is upending the once-dour mood of a rally noted for the hate it inspired. The bull market, now in its ninth year, has finally reached the point of euphoria, said Morgan Stanley’s U.S. equity strategists.

“Now, we have seen a total reversal with people having a hard time even imagining how the market could decline,” they wrote in a report dated Monday.

More importantly, everyone is on the same side of the boat. Almost no one is betting against the market anywhere in the world.

Likewise, short interest on the largest exchange-traded fund tracking the S&P 500 is the lowest level on record, while shorts on the largest emerging-market fund are the lowest in over a year, IHS Markit data show.

And for those chart readers, stocks are extremely overbought.

Finally, the ultimate euphoric signal for chart watchers: the relative strength index, which tracks the magnitude and speed of price fluctuations.

The 14-day relative strength index for the S&P 500 Index, MSCI Asia Pacific Index, MSCI World Index, Nikkei 225 Index, and MSCI Emerging Markets Index are all in overbought territory. Together, the average of the gauges soared to a weekly record as of Jan. 5, according to data compiled by Bloomberg.

Amazon, for example, trading at 317 times forward earnings.

Jeff Hirsch of the Stock Trader's Almanac says there's now an 83.7% chance that equities will rise for the year. It's like free money!

Another things worth considering is who is buying.

I'll give you a hint: It's not savvy insiders.

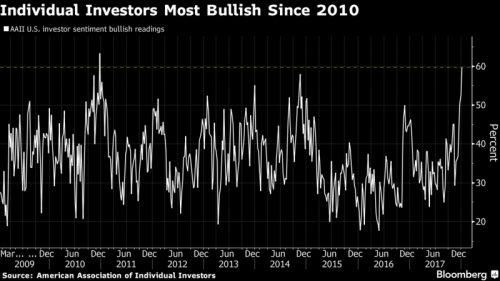

Retail investors in the U.S. are showing the most enthusiasm for stocks since the nine-year bull market began, another signal of growing optimism as financial markets hit new highs.

Clients at TD Ameritrade added to stock holdings for a 11th straight month in December, one of the longest buying streaks for retail investors ever recorded by the brokerage.

The only fear on Wall Street is the fear of missing out.

The Cboe Volatility Index (VIX.X) dipped below 9.0 on Thursday for the second consecutive day. The index, commonly regarded as Wall Street's "fear gauge," has never before read below 9.0 for two straight days since its inception 28 years ago.

The index reached as low as 8.92 early Thursday. It's only ever fallen lower than 9.0 on seven days since its creation. Six of those seven days have occurred in the last six months, with the other happening in December 1993.

Where is all this optimism coming from?

Partly from Republicans. They are absolutely giddy.

"2017 was the most remarkable year in the 45-year history of the NFIB Optimism Index,” said NFIB President and CEO Juanita Duggan. “With a massive tax cut this year, accompanied by significant regulatory relief, we expect very strong growth, millions more jobs, and higher pay for Americans.”

The Optimism Index for last month came in at 104.9, slightly lower than the near-record November report but still a historically exceptional performance. That makes 2017 the strongest year ever in the history of the survey. The average monthly Index for 2017 was 104.8. The previous record was 104.6, set in 2004.

"We’ve been doing this research for nearly half a century, longer than anyone else, and I’ve never seen anything like 2017,” said NFIB Chief Economist Bill Dunkelberg. “The 2016 election was like a dam breaking. Small business owners were waiting for better policies from Washington, suddenly they got them, and the engine of the economy roared back to life."

Uh, right. You would think that small business owners would be knowledgeable about economics, and not substitute politics for hard facts, but that doesn't seem to be the case.

However, there are savvy investors that aren't caught up in the mania. They are deal in bonds.

U.S. equities responded to the Trump presidency with euphoria. The Dow Jones Industrial Average rose 25 percent in 2017, becoming one of the best-performing global asset classes. It was a different story with U.S. Treasuries: The yield on 10-year notes fell slightly from 2.44 percent at the end of 2016 to close 2017 at 2.41 percent. And the spread in yield between two-year and 10-year notes, often a signal of slowing growth or forthcoming recession, plunged from 125 basis points to 51.8 basis points at year-end 2017.

As they receive different messages from equities and Treasuries, investors should pay particular heed to the bond market in making asset-allocation decisions for 2018. Treasuries have been a better predictor of the two recessions in the 21st century -- the first lasted from March to November 2001, and the second from December 2007 to June 2009. In the case of the latter, yields plunged during the months before the recession whereas equities remained strong well into the first half of 2008 when the economy was already in a downturn.

There is good reason to believe Treasuries are sending a warning now.

Comments

The game is rigged...

wanna guess what corporations will do with any tax savings? That's right, buy their own stock. When will it crash? Now that's a difficult question. Does your crystal ball show a likely time frame? I've read somewhere people were talking June '18. Their guess is just a guess no matter the timing, I guess. So I hypothesize - it's a guessing game.

Thanks for the update gjohnsit!

Put 'em all in stocks!

...and bonds too!

“Until justice rolls down like water and righteousness like a mighty stream.”

Couldn't agree more. n/t

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

Oprah will save us

she has lady parts, and she's black. Does a Democratic politician need more than that? Dems don't need policies. Policies is what Republicans do, and we hates Republicans. Oh, yeah. Has she come out as gay yet?

Lord above us, please protect us...

cause we'll all need whiskey before breakfast (3 min)

[video:https://www.youtube.com/watch?v=vQ0tinuSqPI]

from a little festival near Rome, GA

“Until justice rolls down like water and righteousness like a mighty stream.”

And

she's a BILLIONAIRE!!!!

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

So Oprah would run as a Dem

I thought the dems already have a couple candidates that fit the description Kamala and Michelle.

Yeah, but Oprah’s richer.

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

Coming out would put

her over the top, . Speaking of ToP, they wouldn't be able to contain themselves! A black gay Hillary?? Priceless.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

Pump & Dump

Sell! Sell! Sell!

https://www.sec.gov/fast-answers/answerspumpdumphtm.html

A common mistake average investors make is buying high and selling low. They buy on hype and sell into fear when the stock plummets. By the time most investors hear about a hyped up opportunity it is near the top and they sell into their fear when the insiders start dumping the stock.

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

The rest of them rode the market all the way to the bottom.

@Meteor Man

Has the insider selling of stock occurred yet? Who are these retail investors buying all this stock from?

Psychopathy is not a political position, whether labeled 'conservatism', 'centrism' or 'left'.

A tin labeled 'coffee' may be a can of worms or pathology identified by a lack of empathy/willingness to harm others to achieve personal desires.

Question.

Is this the time to get out of stocks and into treasuries and bonds?

Assuming one wants to sell high and buy low, this would seem to be the way to go. If stocks crash will bonds and t-bills go up?

Anyone know?

P.S. Yes I know, financial advise is not garanteed to perform bla bla bla take your chances bla bla.

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

we lost half of some of our investments

the last time the wall street gamblers decided to fold their crooked hands. It's like a poker game. The bigger the pot, the more you want to stay in. We now minimize our exposure to risk. Staying even with inflation is better than a losing hand, hence short / intermediate term CD's with local banks and credit unions. Won't get rich in a rich man's game.

Zionism is a social disease

Thanks for the tip on CDs

I guess I should have been more specific.

My 401 plan has 5 levels of risk.

I can move my funds between levels at will. I can spread them out across the levels, should I choose. I am currently at level 3, or mid risk.

Level five, the highest risk, is heavily invested in stocks. With stocks currently overpriced and/or in a bubble, would it be prudent to move everthing into level 1, consisting of bonds and T-bills?

Is there an upside to this move?

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

wish I could help you more

I'm no financial guru. It was a hassle, but we escaped the company sponsored plans and went straight to the local banks' CD's. Were getting whacked by the money managers % take whenever funds were shifted. No more.

Zionism is a social disease

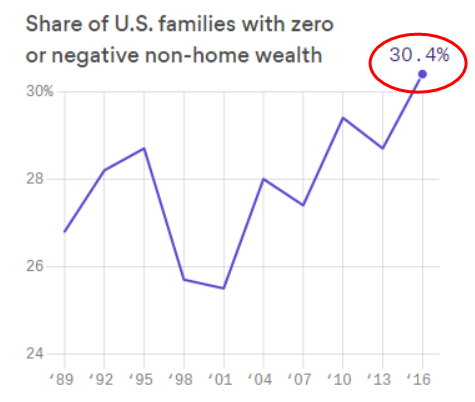

This is the part where they take the throwaway people

...by the ankles, turn them upside down, and shake all the rest of the money out of their pockets.

Then the throwaway people bail out Wall Street.

One prudent move for investors is to take half out of the stock market. Cash is king for the short term, handy for buying distressed assets or tangibles.

i remember mocking commercials during the dotcom boom bragging about how much money their tech company lost. I can't remember what the advertisers were selling, though.

Exactly what I'm afraid of, Pluto

I have set aside greenbacks (under the proverbial mattress) as anything in or from the bank or CU is digital and can disappear in a keystroke.

I also have some funds invested in ammo, a potential new currency. The same with about 50 bottles of hard alcohol (whiskey, brandy, tequila, etc.) and since I only drink beer should be a safe bet.

I'm currently shopping for bare farmland to convert some of my 401 into something more tangible than a digital ledger at Bear-Sterns.

Other than that, the usual foodstuffs (bags of rice, beans, flour, and dehydrated potato flakes, veggies, and refrieds. And Spam. Lots of Spam.

I'm also looking for a way to buy veggie seed in bigger quantities than the little Home Depot seed packs. A lot of money for such a small amount of seeds in those packs.

I'm considering investing in some foreign currency such as Renminbi or Ruble, if its legal. No way on cryptocurrency, just another digital risk.

I don't know how else to prepare for another collapse. But I'm almost certain one is coming.

Suggestions are always welcome.

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

I've been trying to have a prepper conversation

...about this for months. Stay tuned. I'm going to post something later tonight about the scope of the crisis, because it's key that we understand that. And, the information is not out there in the US.

It's legal to hold foreign currency. I hold Renminbi in the US as well as currencies from various oil-producing countries.

Holding US Dollars is okay for awhile, especially if you could pickup some income-producing property on the cheap. I don't like the idea of rural land. Those people are the most vulnerable, IMO. You can grow food in your yard. Food is a good thing to buy and store at anytime.

Anyway, I don't think it's going to be that kind of crisis.

Look forward to what

you have to say re: prepping.

Read some lit. that it takes roughly 1 acre for a family of 4 to subsistence farm and survive. Plus or minus depending on soil, water supply and climate. Chickens, rabbits, and small game for occasional protein.

Of the people I talk to, most favor double ought shotgun shells to hold and trade with. I will go with small game loads as the big game will be the first to disappear and small game will be around a lot longer.

Since I already have an all electric Nissan, I should probaby invest in some solar panels.

Arable land (paid for in full) and reliable water supply I think will be ideal to just have in the bag. If not for me, then my heirs.

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

I like your idea of diversification

Rural, undeveloped acreage should hold it's own. Check the local tax rates first. I'd rather look at wood lots near a water source, if you don't plan to till. Also, careful of seeds. Many have a shelf life now (thanks monsanto) and lose fertility over time. I'm curious to see how well the Argentine and Sino-Russo currencies fare. They have been forced by the IMF, World Bank and related crooks to start their own financial trade systems. If independent currencies have enough backing, US$ and EU$ fail will only increase their strength.

Personally, I'm investing in local alternate energy sources and tools. My scope is small, so am working toward subsistence level survival skills and materials.

Zionism is a social disease

You couldn't be more right

re; the tax rate. It varies widely. I've seen 25 acres with annual tax of $110. And 2 acres @ $3300 a year. Keeping the tax rate low is key to holding on to bare acreage.

I'm already investing in pre-1964 silver dimes, quarters, and fifty cent coins, just a hedge.

Will need to find out where to buy foreign currency though.

Maybe you could suggest someplace? Thanks.

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

I buy mine thru the local bank

They get it fedex from Utah. A small % or flat rate fee is taken from each handler. Shop around for the better rates. It varies over time. But the trend seems the $US is losing value against other currencies. Last summer the Euro was 5 cents better than the dollar, now it's 20 cents. They are blaming the Chinese for buying fewer US treasury bonds. Ha!

Zionism is a social disease

Here's the foreign currency scoop

I've banked at Everbank for many years. It's a regular FDIC bank.

I currently hold foreign currencies there, both in CDs and a regular deposit account. It's easy to switch currencies or exchange some back into Dollars for local spending. Exchange rates are lower than commercial exchanges. I've also held unallocated precious metals there. It's simple to move in and out of them.

They talk about the same things at the world desk that we do at c99, which is tilted toward geopolitics rather than business. I notice in his latest market advisory, Chris Gafney is hinting at fragility. Bankers always see the world in a balance that exists from moment to moment. He's saying that if nothing else changes, everything will move smoothly toward improvement. Bankers never commit beyond the moment and never talk politics. I've listened to him for years, however, and I sense he's got his eye on the black swans circling overhead. See what you think.

I agree it's always handy to have dimes and quarters on hand, (so called junk silver). That will be very easy to spend, anywhere you go.